From the Tommeliten A Field production approval to a decommissioning project at Dunlin Alpha, below is a compilation of the latest headlines in the E&P space.

Activity headlines

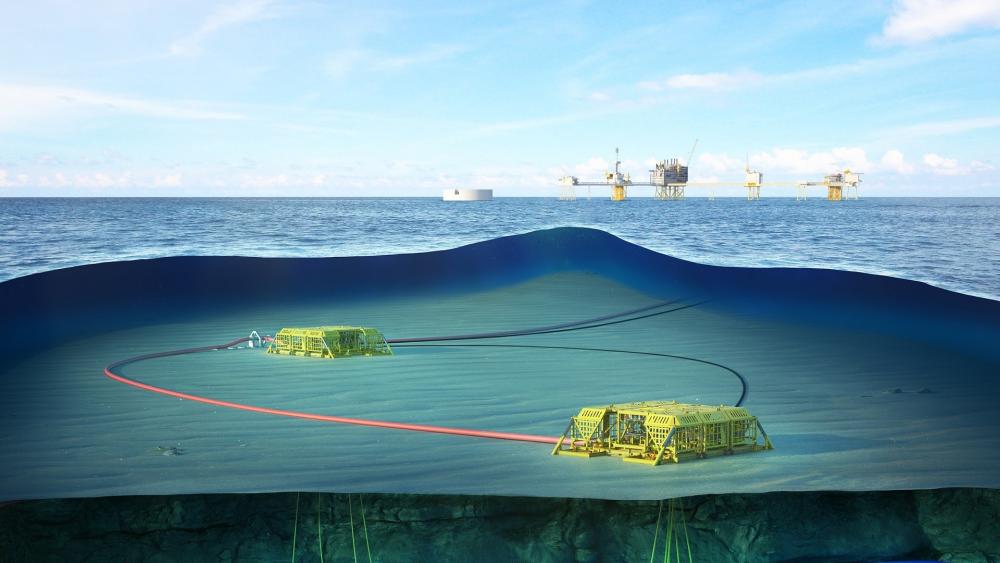

Tommeliten A Ready to Start

ConocoPhillips has received consent to begin production at the Tommeliten A Field in the North Sea, the Norwegian Petroleum Directorate announced on Oct. 5.

Operator ConocoPhillips estimates recoverables in the field at around 150 MMboe. The field in PL044 was discovered in 1977 and the $1.2 billion subsea development plan was approved in 2022.

The Tommeliten A development includes two subsea templates with enough space to accommodate 12 wells. The wellstream routes to the Ekofisk Field for further processing and export. Gas will export to Emden, Germany, while oil and wet gas will be routed via pipeline to Teesside in the U.K. Tommeliten A will include 11 development wells, seven of which completed as of start-up. The operator expects to complete the four remaining wells during the first quarter of 2024.

The 12th slot is reserved as a potential future replacement well.

DeepOcean Completes Dunlin Alpha Decom Project

DeepOcean has completed a significant decommissioning project on Fairfield Energy’s Dunlin Alpha platform on the U.K. Continental Shelf, DeepOcean announced Oct. 3.

The Dunlin Alpha installation, located below 151 m of water, produced its first oil in 1978. In subsequent 37 years, more than 522 MMbbl of oil were recovered from the Greater Dunlin Area, comprising the Dunlin, Dunlin S/W, Osprey and Merlin fields. Fairfield Energy acquired the assets in 2008 and took over full operatorship in 2014.

DeepOcean removed six subsea conductors and four vertical supports at varying water depths and removed the upper conductor guide frames together with the design and installation of bespoke clamps.

DeepOcean’s Aberdeen office was responsible for engineering and project management, with support from the company’s Haugesund and Stavanger offices in Norway. The offshore work was conducted from the hybrid battery-powered construction support vessel (CSV), Edda Freya.

Key subcontractors who assisted in delivering the scope of work include Claxton, Machtech and Global Energy Group.

Petrobras Wins License to Drill in Potiguar Basin

The Brazilian Institute of Environment and Renewable Natural Resources (IBAMA) awarded Petrobras an environmental license to drill two exploratory wells in the maritime block BM-POT-17, in deep waters of the Potiguar Basin, Petrobras said on Oct. 2.

Petrobras said it would begin drilling as soon as the rig arrives on location, which is expected to happen by mid-October.

Contracts and company news

Altera to Provide Baleine Phase 2 FPSO

Altera Infrastructure said in an Oct. 3 release, it has been awarded contracts to deploy the FPSO Voyageur Spirit and the Nordic Brasilia shuttle tanker for the Eni-operated Baleine Phase 2 project offshore Côte d'Ivoire.

Altera said the vessels have a firm 15-year contract. The Voyageur Spirit and Nordic Brasilia are undergoing life extension work and field-specific modifications at Drydocks World in Dubai before deployment. The shuttle tanker Nordic Brasilia will be converted into an FSO to provide additional storage capacity to the Voyageur FPSO. Altera will own and operate both vessels.

Production of phase 2 is expected to finish in the fourth quarter of 2024.

Core Lab, Halliburton Collaborate

Halliburton Co. and Core Laboratories Inc. announced on Oct. 9 a U.S.-focused collaboration to compress the delivery time of digital rock data solutions while petrophysical laboratory measurements are in progress.

This collaboration combines Core Lab's reservoir description and optimization technologies with Halliburton’s specialization in pore-scale digital rock analysis.

According to the companies, the collaboration will enable U.S. clients to run pore-scale simulations in parallel with physical laboratory experiments.

“Digital rock simulations empower petrophysicists, engineers and geologists to dynamically evaluate reservoir characterization models while they await the completion of traditional lab measurements, which often takes months,” Chris Tevis, Halliburton’s vice president for wireline and perforating, said in a press release.

ADNOC to Use Drones for Emissions Monitoring

ADNOC announced on Oct. 5 a partnership with EDGE Group PJSC to deploy UAE-made unmanned aerial vehicles (UAVs) across its onshore and offshore operations.

EDGE’s autonomous systems arm, ADASI, will repurpose its existing drones for ADNOC to use to minimize emissions, monitor operations and provide support in emergency response situations.

Repsol Sinopec Extends Petrofac Contract

Petrofac announced winning a three-year contract extension valued at over $100 million to provide operations and maintenance services for Repsol Sinopec Resources U.K.’s North Sea operations, according to an Oct. 4 release.

Vår Energi, Optimizing Portfolio, Sells Brage Assets

Vår Energi ASA announced on Oct. 5 its sale of 12.3% interest in the OKEA-operated Brage Field in the Central North Sea to Petrolia NOCO AS for an undisclosed sum.

The transaction is subject to normal regulatory approvals and is expected to close end of 2023.

Vår’s net production from the Brage Field was 1,000 boe/d in the first half of 2023.

“The transaction is part of Vår Energi’s ongoing portfolio optimisation process,” Stefano Pujatti, Vår Energi CFO, said in a press release.

Halliburton Launches New Multilateral System

Halliburton Co. introduced the FlexRite Selective Access multilateral completion system on Oct. 3.

The multilateral system is intended to address complex well scenarios and maximize reservoir contact to save costs and time while reducing the environmental footprint, Halliburton said.

Through a combination of stimulation capability and through-completion selective intervention, the FlexRite Selective Access system delivers life-of-well versatility to multilateral installations, according to the company

Nauticus Buying 3D Depth for LiDAR Capability

Nauticus Robotics Inc. will acquire 3D at Depth Inc. for $34 million in stock, before certain purchase price adjustments and the assumption of debt, Nauticus announced in an Oct. 3 release.

3D provides commercial subsea laser light detection and range (LiDAR) inspection and data services.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.