Expand Energy landed a 5.6-mile lateral in northern West Virginia’s dry-gas Utica in five days with just one bit run. (Source: Shutterstock)

Expand Energy landed a 5.6-mile lateral in northern West Virginia’s dry-gas Utica—and in five days with just one bit run, it reported.

The results are among the drilling and completions (D&C) and other operational improvements the E&P was expecting just a few months after the merger of Chesapeake Energy and Southwestern Energy to form Expand, said COO Josh Viets.

“That type of progress … clearly has an opportunity to lend itself to other areas that ultimately translates into incremental synergy,” Viets said in a recent earnings call.

The well, Shannon Fields OHI #3H, has a 29,687-ft lateral beginning in Ohio County, West Virginia, according to Expand.

It was made from a pad due east of Wheeling and terminating on the West Virginia side of the Ohio River across from Tiltonsville, Ohio, according to WellDataBase.com.

Expand is planning more cost efficiencies, Viet said.

“We definitely see there's meat on the [post-merger] bone and are really, really excited about what we have in front of us.”

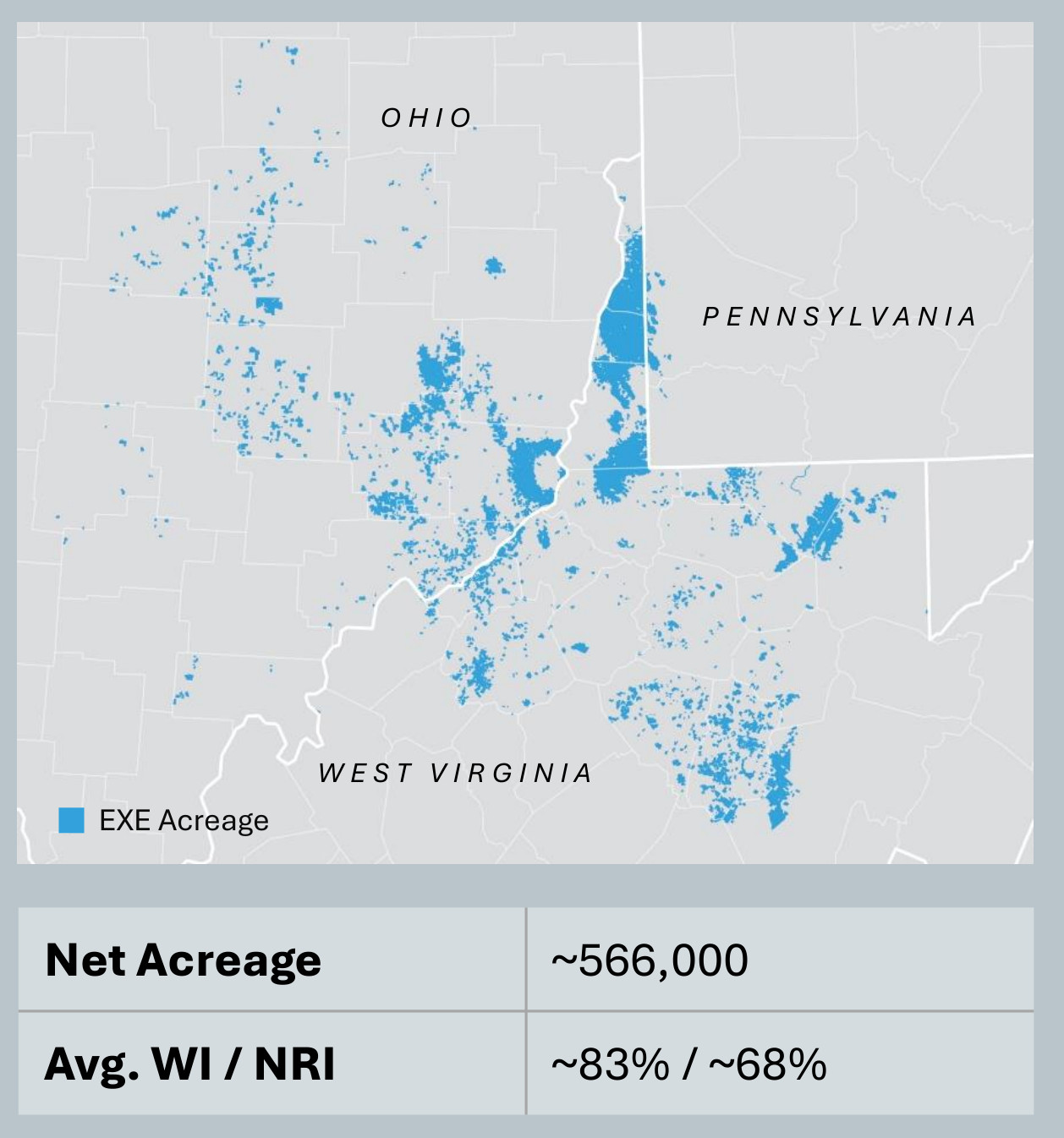

Post-closing on Oct. 1, Expand holds more than 650,000 net acres in the Haynesville Shale in northwestern Louisiana and 1.3 million net acres in the Marcellus and Utica shales in Ohio, West Virginia and Pennsylvania.

A rare 5.6-miler

An oilfield securities analyst told Hart Energy that a 5.6-mile horizontal is rare.

Service firm Tenaris reported in 2023 that West Virginia hosted what was the longest lateral in North America at the time: 24,166 ft (4.57 miles) in Lewis County.

“But probably not for long,” Tenaris added in its report. “Every month, a new well is achieving record-breaking lengths for their lateral sections in the Appalachian region.”

The firm participated in the 2023 D&C job and noted in its report that the longer the lateral, the more challenging the torque.

“The trend of longer laterals has steadily grown in recent years, calling for extreme torque capabilities, quicker installation speeds and overall connection robustness,” Tenaris reported.

In 2022, Axis Energy Services performed the completions drill-out on what was the longest lateral in North America at the time: 23,700 ft. The job was for Utica Shale operator Ascent Resources in Ohio.

“A total of 136 plugs … were successfully drilled out in a single run with no down time,” Axis reported.

RELATED

Utica Oil Player Ascent Resources ‘Considering’ an IPO

Eclipse Resources’ tests

Earliest to test the limits on super-extended laterals in the Appalachian Basin was Eclipse Resources, which advanced length to 3.5 miles in 2016 with its Purple Hayes #1H in the Utica in Guernsey County, Ohio.

In 2017, it took a lateral as far as 20,800 ft (3.94 miles) in its Mercury #5H, also in the wet-gas Utica.

By October 2017, it had 11 extra-long lateral wells, according to a press release at the time.

Its longest Utica dry-gas well was Wiley D #8H with a 19,335-ft lateral (3.66 miles).

After Eclipse merged with another E&P and was renamed Montage Resources, it was purchased in 2020 by Southwestern Energy, which is now part of Expand.

Drilling costs, -23%/foot

Expand reported in its investor call that, in the Haynesville, feet drilled per day increased 22%—to 595 ft/day—on Southwestern’s acreage since closing the deal Oct. 1.

Cost per foot declined 23%, to $335/ft.

Overall, 8.8 days were trimmed per well, resulting in $1.4 million in savings per well, including rig-move days (2.8 days), spud (0.7), drilling the vertical (2.2) and making the lateral (3.1).

Viets said the months between announcing the merger and closing it were used to integrate the two companies’ well designs.

“We had a pretty clear understanding of what the gap was in terms of days and we utilized the time of our integration planning to break that down into well segments.”

$2/Mcfe

Combined, Expand reported its spend in the Haynesville averaged $2/Mcf on new wells brought online in 2020 through 2024, compared to peers’ costs of $2.16/Mcf to $3.35/Mcf.

Expand identified the peers as Aethon Energy, BPX Energy, Comstock Resources, Sabine Oil & Gas and TG Natural Resources.

In northeastern Pennsylvania, its cost per Mcfe averaged $1.84, compared with $2.12 to $4.80 among peers Coterra Energy, EQT Corp., National Fuel Gas Co.’s Seneca Resources and Repsol.

In West Virginia and Ohio, it averaged $1.72, compared with between $1.41 and $2.15 among peers EQT, Antero Resources, CNX Resources and Range Resources.

14 rigs, 6.5 frac crews

Expand’s 664,400 net Haynesville acres, entirely inside northwestern Louisiana, have a 92% average working interest (WI) and 73% average net revenue interest (NRI).

The E&P plans to run up to nine rigs and three frac crews there this year, it reported.

Its northeastern Pennsylvania leasehold consists of 700,000 net acres with 51% average WI and 42% average NRI. The company plans to run roughly 2.5 rigs and two frac crews there this year.

In West Virginia and Ohio, Expand holds 566,000 net acres with 83% average WI and 68% average NRI. It plans to run roughly 2.5 rigs and 1.5 frac crews there this year.

RELATED

Recommended Reading

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

E&P Highlights: Jan. 13, 2025

2025-01-13 - Here’s a roundup of the latest E&P headlines, including Chevron starting production from a platform in the Gulf of Mexico and several new products for pipelines.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.