Expand Energy landed a 5.6-mile lateral in northern West Virginia’s dry-gas Utica in five days with just one bit run. (Source: Shutterstock)

(Editor's note: This article has been updated to reflect Expand's clarification that the 5.6 mile-well includes the vertical depth of the well; the lateral was 4.7 miles and was landed in the Marcellus.)

Expand Energy landed a 5.6-mile hole in northern West Virginia’s Marcellus—and in five days with just one bit run, it reported.

The total hole was made in roughly 134 hours, "a new U.S. land record for a single bit/BHA run," a spokesman told Hart Energy.

The results are among the drilling and completions (D&C) and other operational improvements the E&P was expecting just a few months after the merger of Chesapeake Energy and Southwestern Energy to form Expand, said COO Josh Viets.

“That type of progress … clearly has an opportunity to lend itself to other areas that ultimately translates into incremental synergy,” Viets said in a recent earnings call.

The well, Shannon Fields OHI #3H, has a 29,687-ft vertical, heel and lateral beginning in Ohio County, West Virginia, according to Expand.

The lateral alone is 24,812 ft or 4.7 miles.

It was made from a pad due east of Wheeling and terminating on the West Virginia side of the Ohio River across from Tiltonsville, Ohio, according to WellDataBase.com.

Expand is planning more cost efficiencies, Viets said.

“We definitely see there's meat on the [post-merger] bone and are really, really excited about what we have in front of us.”

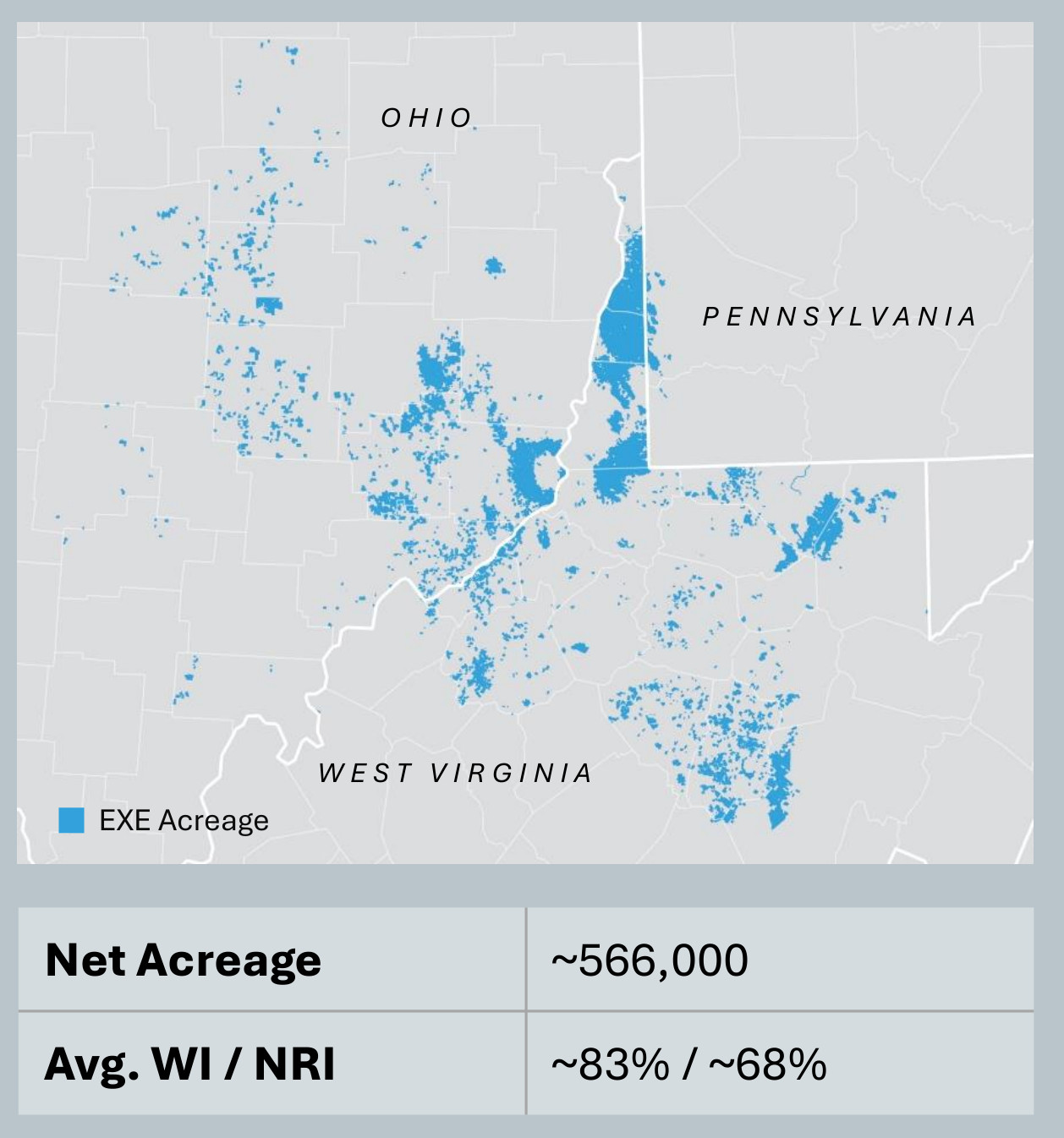

Post-closing on Oct. 1, Expand holds more than 650,000 net acres in the Haynesville Shale in northwestern Louisiana and 1.3 million net acres in the Marcellus and Utica shales in Ohio, West Virginia and Pennsylvania.

A rare 5.6-miler

An oilfield securities analyst told Hart Energy that onshore wells with laterals greater than 4.5 miles are rare.

Service firm Tenaris reported in 2023 that West Virginia hosted what was the longest lateral in North America at the time: 24,166 ft (4.57 miles) in Lewis County.

“But probably not for long,” Tenaris added in its report. “Every month, a new well is achieving record-breaking lengths for their lateral sections in the Appalachian region.”

The firm participated in the 2023 D&C job and noted in its report that the longer the lateral, the more challenging the torque.

“The trend of longer laterals has steadily grown in recent years, calling for extreme torque capabilities, quicker installation speeds and overall connection robustness,” Tenaris reported.

In 2022, Axis Energy Services performed the completions drill-out on what was the longest lateral in North America at the time: 23,700 ft. The job was for Utica Shale operator Ascent Resources in Ohio.

“A total of 136 plugs … were successfully drilled out in a single run with no down time,” Axis reported.

RELATED

Utica Oil Player Ascent Resources ‘Considering’ an IPO

Eclipse Resources’ tests

Earliest to test the limits on super-extended laterals in the Appalachian Basin was Eclipse Resources, which advanced length to 3.5 miles in 2016 with its Purple Hayes #1H in the Utica in Guernsey County, Ohio.

In 2017, it took a lateral as far as 20,800 ft (3.94 miles) in its Mercury #5H, also in the wet-gas Utica.

By October 2017, it had 11 extra-long lateral wells, according to a press release at the time.

Its longest Utica dry-gas well was Wiley D #8H with a 19,335-ft lateral (3.66 miles).

After Eclipse merged with another E&P and was renamed Montage Resources, it was purchased in 2020 by Southwestern Energy, which is now part of Expand.

Drilling costs, -23%/foot

Expand reported in its investor call that, in the Haynesville, feet drilled per day increased 22%—to 595 ft/day—on Southwestern’s acreage since closing the deal Oct. 1.

Cost per foot declined 23%, to $335/ft.

Overall, 8.8 days were trimmed per well, resulting in $1.4 million in savings per well, including rig-move days (2.8 days), spud (0.7), drilling the vertical (2.2) and making the lateral (3.1).

Viets said the months between announcing the merger and closing it were used to integrate the two companies’ well designs.

“We had a pretty clear understanding of what the gap was in terms of days and we utilized the time of our integration planning to break that down into well segments.”

$2/Mcfe

Combined, Expand reported its spend in the Haynesville averaged $2/Mcf on new wells brought online in 2020 through 2024, compared to peers’ costs of $2.16/Mcf to $3.35/Mcf.

Expand identified the peers as Aethon Energy, BPX Energy, Comstock Resources, Sabine Oil & Gas and TG Natural Resources.

In northeastern Pennsylvania, its cost per Mcfe averaged $1.84, compared with $2.12 to $4.80 among peers Coterra Energy, EQT Corp., National Fuel Gas Co.’s Seneca Resources and Repsol.

In West Virginia and Ohio, it averaged $1.72, compared with between $1.41 and $2.15 among peers EQT, Antero Resources, CNX Resources and Range Resources.

14 rigs, 6.5 frac crews

Expand’s 664,400 net Haynesville acres, entirely inside northwestern Louisiana, have a 92% average working interest (WI) and 73% average net revenue interest (NRI).

The E&P plans to run up to nine rigs and three frac crews there this year, it reported.

Its northeastern Pennsylvania leasehold consists of 700,000 net acres with 51% average WI and 42% average NRI. The company plans to run roughly 2.5 rigs and two frac crews there this year.

In West Virginia and Ohio, Expand holds 566,000 net acres with 83% average WI and 68% average NRI. It plans to run roughly 2.5 rigs and 1.5 frac crews there this year.

RELATED

Recommended Reading

Enbridge Appoints Steven Williams to Chair of the Board

2025-03-12 - Enbridge has appointed Steven Williams to lead the board of directors following Pamela Carter’s retirement as chair.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Baker Hughes to Supply Equipment for NextDecade’s Rio Grande LNG

2025-03-11 - Baker Hughes will provide turbine and compression for NextDecade’s trains at Rio Grande LNG.

Pearl Backs Haynesville Mineral and Royalties Firm Wild Basin

2025-03-10 - Equity commitments from Pearl Energy Investments and others have put $75 million of backing behind Haynesville Shale minerals and royalties company Wild Basin Energy.

Expand Energy Picked to Join S&P 500

2025-03-10 - Gas pureplay Expand Energy will be elevated on March 24 from its position in the S&P MidCap 400 index.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.