Whether it is optimizing production enabled by AI-guided automated decision-making or controlling corrosion inhibitor injection at the edge, digital technology is transforming Vital Energy’s potential.

Vital Energy, formerly known as Laredo Petroleum, created a proof of concept in 2020 that would improve production from its wells by combining sensor data with AI and edge computing to automate electrical submersible pump (ESP) operations.

As the company implemented various phases of the Intelligent Well Program, it saw production increase by 400 bbl/month during the ESP optimization proof of concept, by 1,400 bbl/month with the addition of the gas lift optimization proof of concept, by 6,600 bbl/month through the inclusion of physics constraints and the addition of an ESP health monitoring solution and now by 45,000 bbl/month by automating ESP control at the edge.

David Benham, director of digital innovation at Vital Energy, told E&P that scaling the technology created an exponential production growth curve and helped extend the lives of ESPs as the program was applied to more and more Vital Energy wells.

At first, Vital Energy focused on maximizing oil flow while minimizing disruption events, such as ESP failure.

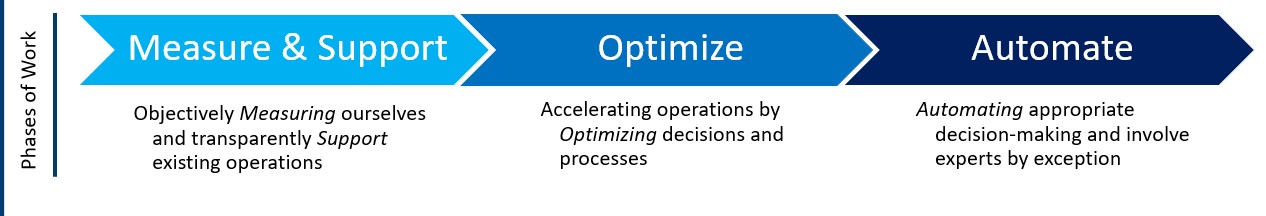

The initial phase focused on objective measurements and creating the AI solution to accelerate the speed of decision making.

“You can’t exploit any opportunity if you’re not looking at it in a timely fashion,” Benham said. “Things like outlier detection, multivariate alerting—those are the real beneficial items.”

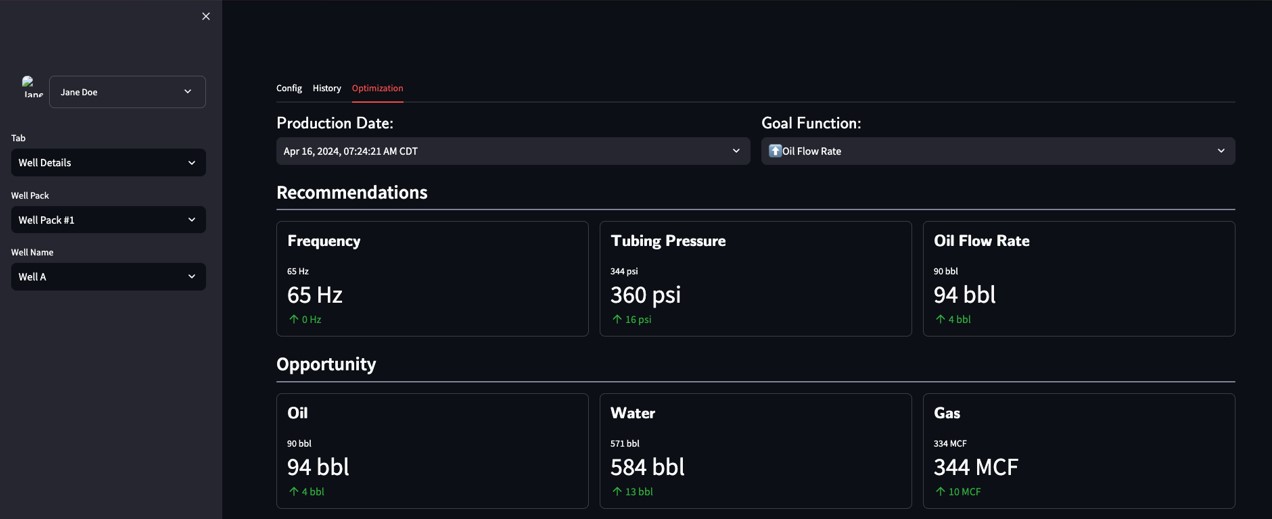

Vital Energy’s petrotechnical experts designated set point ranges for ESP pump frequency and tubing pressure and provided feedback about the decisions the system got right and wrong.

“Everything that we designed in this first phase is to capture subject matter expertise so that we can begin to create more sophisticated models in the optimized phase,” he said.

For Vital Energy, optimization means focusing on determining which operations are effective and profitable and which are not in terms of goals and the environment.

“We take what’s working, and we apply those to the opportunities where they’re not working. Sounds really simple, but this is really the transition from unsupervised or simple machine learning to more sophisticated supervised algorithms, where we can get a deeper, more precise answer,” Benham said.

And when the petrotechnical experts consistently accept the algorithm’s recommendations and the optimized answers are within the company’s risk tolerance, Vital Energy begins to automate those decisions through an automated routine, including a computer self-tuning at the edge, and scale by deploying the tech to more wells.

Beyond proof of concept

As Benham points out, it is not one and done. Instead, Vital Energy iterates the optimize and automate phases on other factors that could improve a well’s profitability. The first focus was on oil flow rate while minimizing disruptions, events and failures.

“We automated that, and now we’ve circled back to optimize the gas liquid ratio. Then we circled back for low-producing wells to maximize total fluids,” he said.

These three optimization capabilities, combined with commercial value, are available to all Vital Energy’s current assets, and the company is refining several other optimization factors for testing later this year.

The Intelligent Well Program relies on a lot of tech: AI, algorithms, machine learning, edge computing, the Internet of Things, sensors, the Amazon Web Services cloud and more. All of this comes together in a surveillance portal showing the performance of Vital Energy’s roughly 375 ESPs in the ground. A petrotechnical expert can tune a well’s ESP to a specific optimization function in the portal, and the program adjusts ESP operations automatically.

The program has been developed to accommodate 22 of the most common pump sensors.

From its 2020 launch, Benham said the program has behaved like a startup.

“We had to take prudent risks,” he added.

Each product would ultimately need to be able to sustain itself, and ideally serve as a building block to more advanced functionality. Eventually, the goal is for fully autonomous operations, he said.

Vital Energy did not create the project on its own—collaboration made the Intelligent Well Program’s success possible.

Vital Energy scaled its internal digital team with staffing from software development company SoftServe to create products such as the algorithms and portal.

ChampionX helped Vital Energy understand disruption events, Benham said, noting more than half of Vital Energy’s ESPs were manufactured by ChampionX.

Not only has the program generated more barrels for Vital Energy, it improved ESP uptime by about 4% in 2023 over 2022 levels, even though there was a 138% year-over-year increase in the number of ESP systems in use. In 2022, 42.7% of ESP units experienced a failure, compared to 29.6% in 2023, according to the company. The mean time to failure increased from 220 days in 2022 to 328 days in 2023.

Change management

Transforming ESP decision-making took buy-in from leadership as well as the departments affected by the change. For that reason, Benham said, goals had to be fully aligned.

The program’s algorithm also had to balance a physics-based approach with an AI-based approach.

“Oil and gas love their physics. It’s what people are taught in school, but there’s a lot of missed opportunity if you don’t augment that with AI and analytics,” he said.

But getting that buy-in was a bit harder than Vital Energy CTO Brandon Brown expected.

“You would think this would be really easy stuff to implement. Everybody would be excited for it. Well, they’re not necessarily excited for it,” he said.

Senior leadership was keen on the opportunity to boost production but petrotechnical experts did not blindly accept the technology.

“There’s a necessary process to engage people and gain their support on this path. Unlike in their private lives, where they might unknowingly accept AI in various applications, here, they don’t just take it at face value,” he said.

Benham said he underestimated the amount of time and money the company would have to spend on change management.

He said the most successful projects were those with the digital team working directly with the people who would be affected by a change.

“We have data scientists that are out every other week in the field riding with lease operators, techs, foremen, supers, sitting in the office with engineers, going to training seminars to speak their speak, to learn the way that they walk every day of their day-to-day. And that’s the biggest difference between a successful project and an unsuccessful project,” he said.

Giving ownership also helped. For example, petrotechnical experts were able to set real-world parameters for ESP operations.

Looking back, Brown said he might change how the project team approached launching the Intelligent Well Program.

“We should have started better explaining the why,” he said. “And if I had to do it all over again, I would send every single production engineer we have to an AI or machine learning/AI course. The ones that have taken the time to educate themselves truly understand the benefit and fully embrace it.”

On the other hand, he said, now that the Intelligent Well Program and a couple other AI-based efforts have shown success, iterating on similar projects should reach productivity more quickly.

“The next project becomes a little bit easier because we have talked about it, we have seen results, and people start to understand it a little bit better,” Brown said.

Data-driven decisions

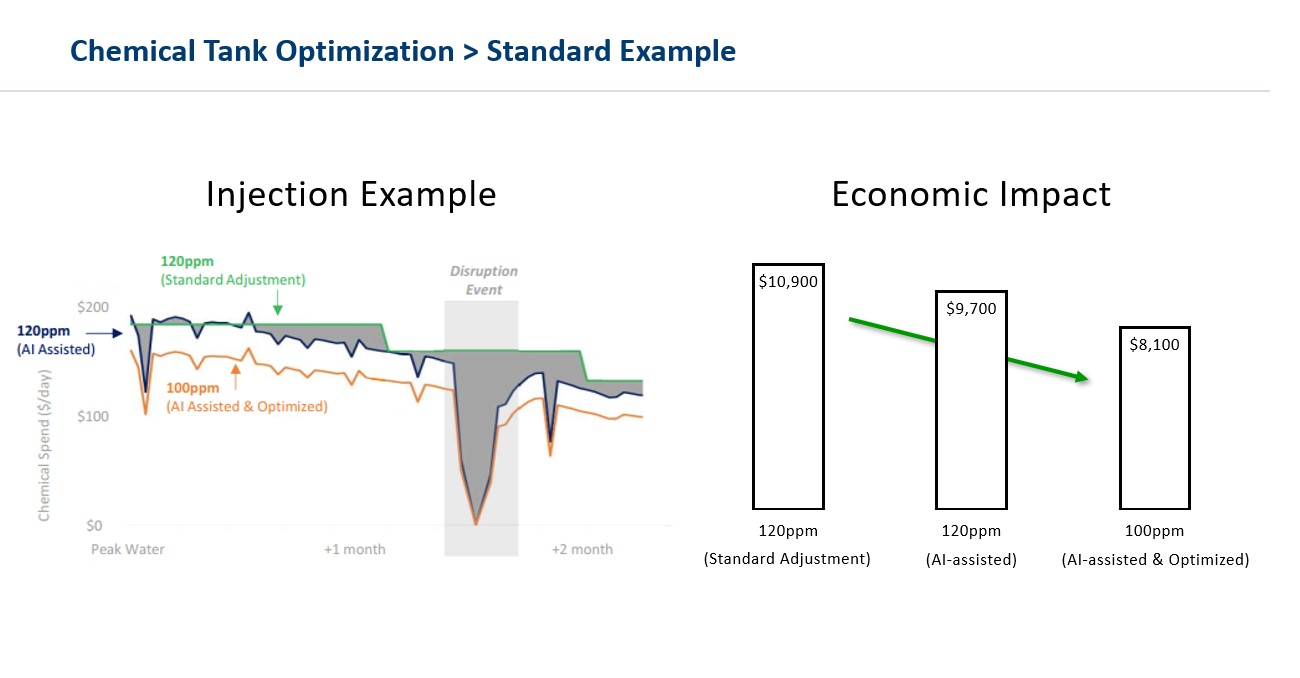

Vital Energy’s Chemical Tank Optimization Program was the company’s first AI solution to become fully autonomous with an edge control device, and it is saving the company money every month on corrosion inhibition.

According to Benham, as of March 2021, every new Vital Energy well is equipped with a fully autonomous corrosion inhibitor solution. From the very outset, it has paid dividends, he said.

“One of the most neglected areas in the upstream industry is dispensing chemicals, particularly as a well comes off of peak production,” Benham said.

Traditionally, the amount of corrosion inhibitor a well will receive is set for “the worst day of the month,” or the most the well will need in a month, and that rate is revisited and adjusted every 30 days, he explained.

“If the well goes down or if the water fluctuates for some reason, people are not auto adjusting those chemical injection rates,” which results in over-injection of those chemicals, he said. “We built a solution that adjusts as water adjusts.”

The AI solution at the edge automatically regulates the amount of corrosion inhibitor dispensed into each well based on the current water flow and whether the well is actually producing. In the past, Benham said, if a well went offline for any reason, it was common to continue dispensing chemicals, but the edge controller automatically drops the injection rate to zero when a well is offline to prevent unnecessary injection of chemicals.

According to Benham, average savings amounted to about 11% initially per month per well in the well’s first two years due to real-time injection adjustments. The savings increased even more, he said, as Vital Energy tuned the amount of chemicals injected in each well. In total, each month the AI-automated chemical injection optimization solution is saving Vital Energy about 18% on continuously dispensed chemicals per well in the first two years of the well’s life, he said. The savings does decrease as the production decreases, he added.

“From a change management cycle, everybody knows it’s expensive, everybody knows it’s neglected, and they can see how it works. They feel good about it,” Benham said.

Brown said the corrosion inhibitor program was like a gateway project that made later AI-related efforts go a bit more smoothly.

“This is the one that got them to open up a little bit to how AI could possibly help them with their jobs,” he said.

Digital wellspring

Generative AI figures into Vital Energy’s 2024 tech roadmap.

“What does that mean for us? It’s access to knowledge, faster,” Benham said, from documentation access to procedures and automation.

Brown said, “As a technologist, what I’ve been using in my personal life for years is now actually being asked for at work. And oh, it’s so much fun.”

AI opportunities in oil and gas are “almost limitless,” he added. “Vital plans to take advantage of those opportunities that are yet to be discovered.” And one of the biggest opportunities an oil and gas producer faces comes from digital transformation or revamping the business’ business operations using digital technologies. Digital transformation starts with good data.

“You’ve got to have some data that you’re confident about, and it’s accurate, and that confidence needs to span multiple departments, not just one department,” Brown said, explaining that people often have data that works in their silo but not in another department’s silo.

Given the importance of quality data, Benham said Vital Energy considers data at the outset of every project.

Brown said, “In a perfect world, it would’ve been great to go get all your data fixed and then go do these projects, but that’s never going to happen anywhere.”

Vital Energy knew it had solid production data, which made a project like the Intelligent Well Program a logical starting spot.

“From a production standpoint, the data lift was relatively mild. The overall data lift for the entire company is huge, and that’s a multi-year journey,” he said.

The goal is to be a fully data-driven company, he said, noting many companies that say they are data driven are in actuality only working off of a small percentage of the data available.

“How do you become a data-driven company with all of your data? That’s the transformation that has to take place. And one of the most effective ways to do that is by leveraging cloud technologies and machine learning,” Brown said.

Recommended Reading

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.