McKinsey & Co. dubbed 2023 generative AI’s breakout year, and rightfully so. There was seemingly no industry that wasn’t touched by this technology in some way. But as much as we’ve looked to AI to solve challenges at the personal, community and global levels, we’ve not yet fully tapped into the technology to solve one of the most pressing and important challenges of our time: the energy transition.

The International Energy Agency reported that global emissions hit an all-time high last year, and while we already have many of the necessary tools available to support a safe, secure and reliable energy source, the challenge lies in the implementation. We need energy providers’ processes to be more efficient and automated, which is where generative AI fits in.

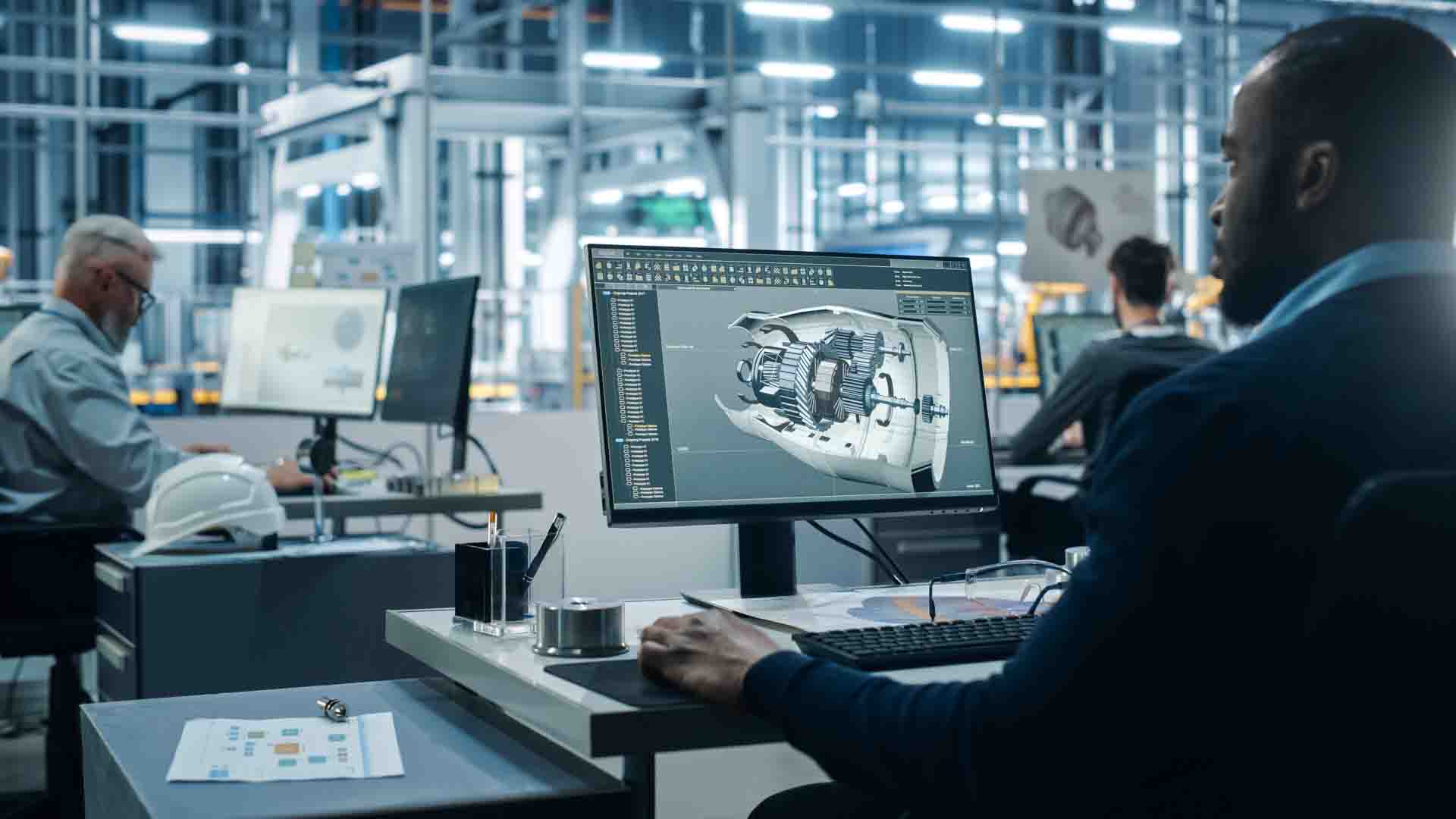

One of generative AI’s primary functions is analyzing vast amounts of complex data and turning it into new and original content. At its core, it’s a way to provide the right insights to the right people at the right time.

But to deliver on its full capabilities, organizations need to first liberate data that’s typically locked in different systems and applications, leaving it largely useless. Once the data is more easily accessible, it can be connected to create a meaningful and holistic view that accurately represents an organization’s industrial reality. This industrial knowledge graph is what then provides the necessary context to the large language model and operationalizes the data, arming the company with the information and context it needs to make better decisions.

One example of this is Cosmo Oil, the third-largest oil refiner in Japan. A few years ago, the company was struggling to hire qualified engineers. The team attributed this to the decline in the working-age population as the birth rate decreased in Japan, as well as the reputational challenge oil and gas was facing amid growing calls for emissions reduction that made it difficult to recruit.

As the team at Cosmo Oil searched for a way to operate a refinery with fewer engineers, its initial focus was on figuring out how engineers conducted their tasks to see where productivity could be maximized and how operations could be consolidated across multiple sites.

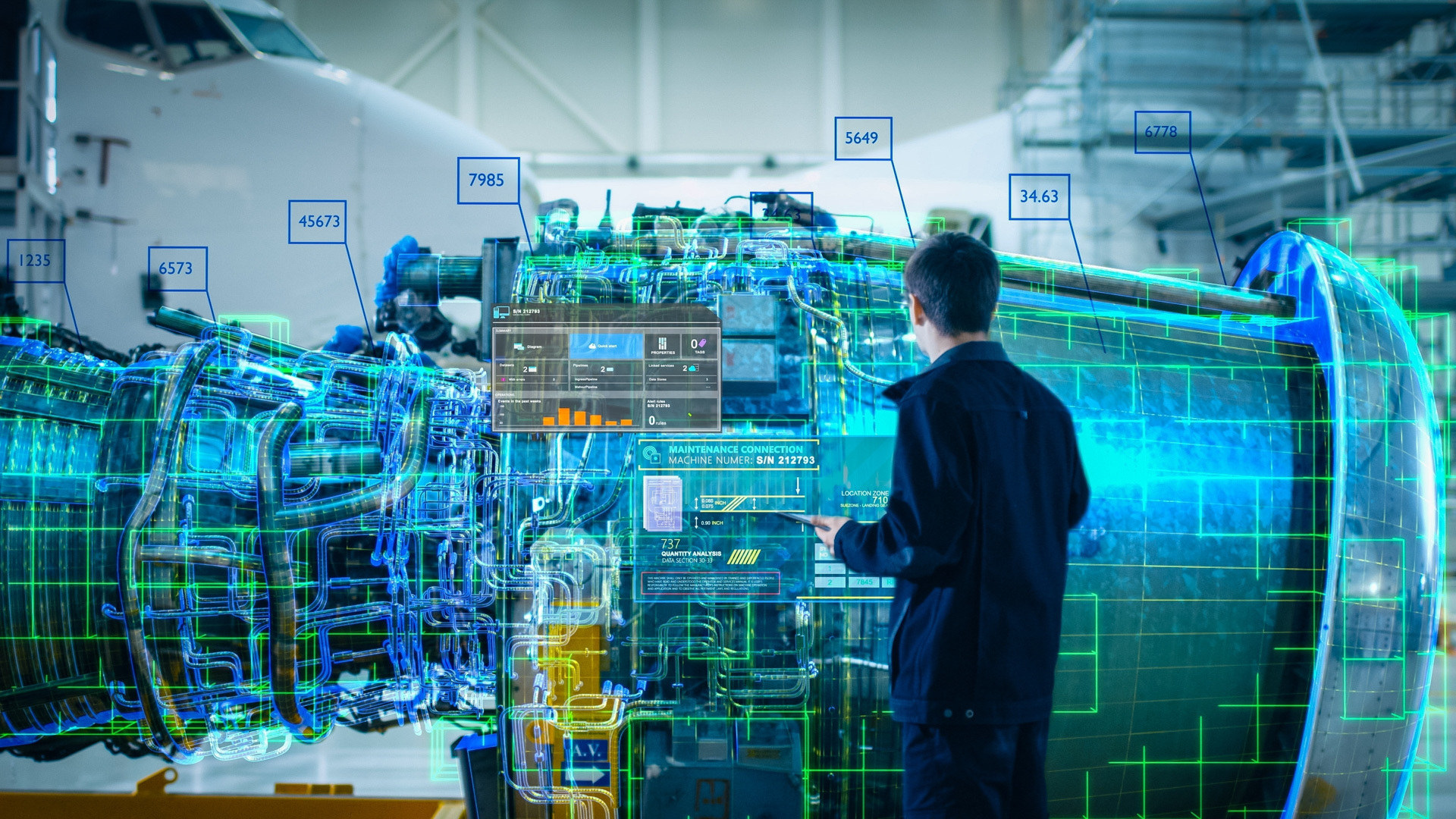

The research found that approximately 70%-80% of an engineer’s job involved data collection. This crucial data—which included operational data, maintenance data, equipment inspection records, asset performance management tool data, piping and instrumentation diagrams and data sheets for various components—was scattered across multiple sources and formats. The data was siloed, and the team was wasting time and resources trying to track it down.

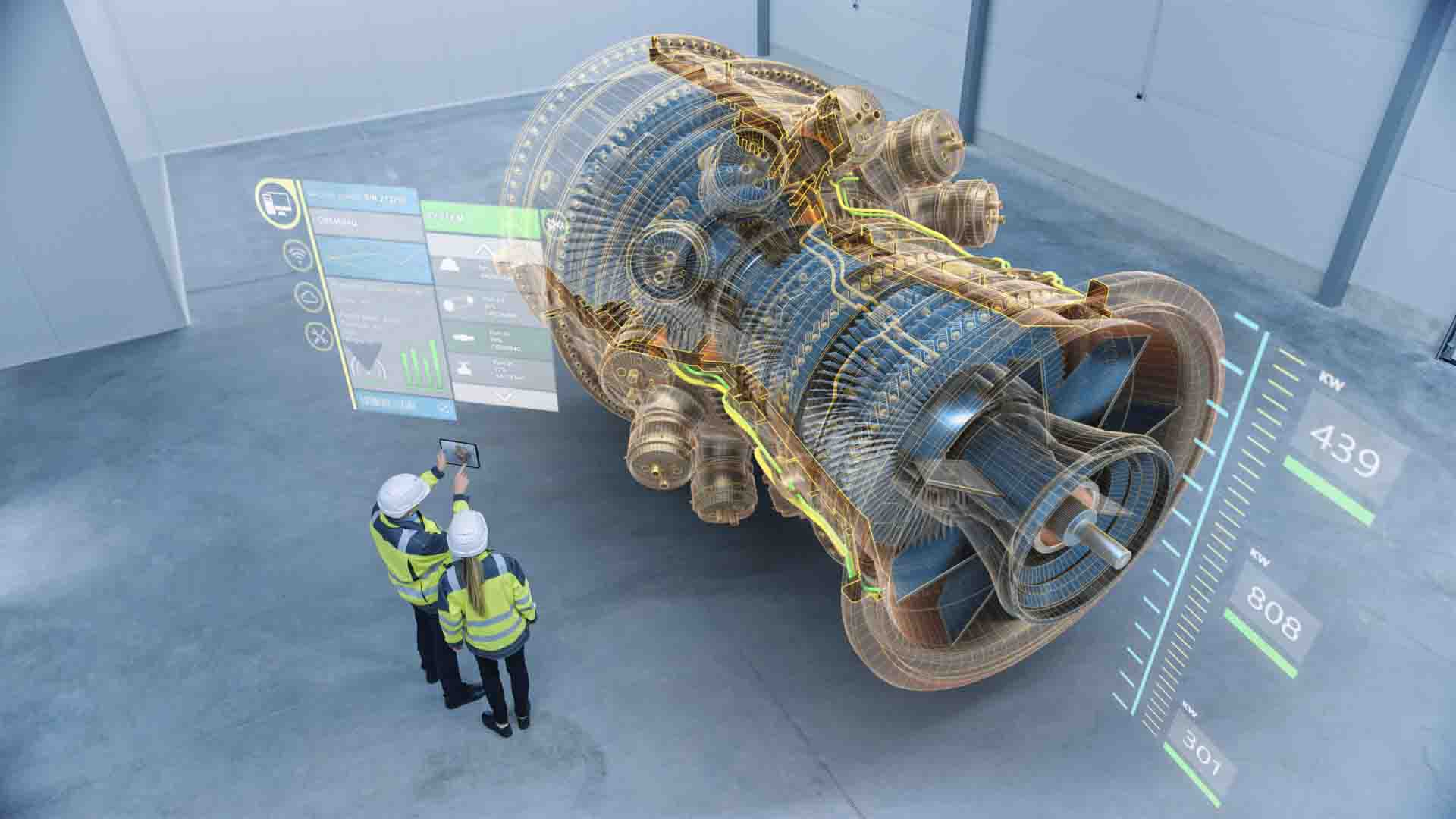

To address this, Cosmo Oil turned to Cognite Data Fusion, an Industrial DataOps platform that could take all the previously unusable data, including unstructured data, and consolidate and connect it using AI for automated data contextualization. From there, the technology extracted data patterns in a flexible knowledge graph that represented the organization’s operations digitally. This allowed Cosmo Oil’s engineers to access data on all refineries quickly and easily, simplifying data-driven plant operations and increasing their overall efficiencies.

Aker BP, one of Europe’s largest independent oil and gas operators, and Siemens, a technology company, faced a similar data problem. Aker BP had granted Siemens access to the field data of its Ivar Aasen onshore team and was looking to improve condition monitoring of the Ivar Aasen asset. But the Siemens team often found the data it needed to address the problem was locked in inaccessible systems, hindering their visibility into important information like work orders, work permits and document systems.

Rather than continuing to operate with fragmented and limited insight, Siemens turned to Cognite Data Fusion, which was already in operation across Aker BP’s assets. The ability to read data through a single platform and access live and historical data, regardless of original source or format, via a single point of entry, saved hundreds of hours and enabled Aker BP to increase efficiency, bring down the cost of equipment failure and deploy the right crew and tools when maintenance was needed.

SLB, an oilfield services company, saw an opportunity in the use of AI and the liberation of data to solve cross-industry global problems, like the rising cost of operations and the need to reduce carbon emissions. Digital technologies are central to solving these issues and data is central to the operation of these technologies. To help upstream players manage data complexity and make smart decisions around where to apply optimization, SLB partnered with Cognite to integrate the company’s Enterprise Data Solution for subsurface with Cognite Data Fusion.

With the current partnership, users of SLB’s subsurface Enterprise Data Solution can integrate data from reservoirs, wells and facilities into a single platform, make it accessible and use embedded AI to identify opportunities for optimization and ways to innovate at scale.

The system can help companies look beyond solving existing problems and build a foundation to solve emerging use cases.

Across all of these examples, what we see is that industrial data management, in combination with the predictive capabilities of generative AI, can play a fundamental role in streamlining intense data processes to be more effective and scalable. As we look to create a safe, secure and sustainable energy future, energy providers’ abilities to fully harness technology to create efficient and automated processes will be paramount. If 2023 was generative AI’s breakout year, 2024 is the year of putting it to work.

Recommended Reading

Glenfarne Signs on to Develop Alaska LNG Project

2025-01-09 - Glenfarne has signed a deal with a state-owned Alaskan corporation to develop a natural gas pipeline and facilities for export and utility purposes.

Overbuilt Fleet of LNG Tankers Sinking Cargo Transport Rates

2025-01-30 - LNG shipping rates are at historic lows as a flooded transport market waits for projects to come online and more cargoes to move.

Cheniere’s Corpus Christi 3 Project Sends First Commissioned LNG Cargo

2025-02-20 - Cheniere Energy executives say the Corpus Christi Stage 3 project has been ahead of schedule in commissioning its first LNG cargo.

Polar LNG Express: North American NatGas Dynamics to Change with LNG Canada

2025-02-21 - The next major natural gas export project in North America has a location advantage with Asian markets. LNG Canada opens up a new pathway that will change the price dynamics for producers.

FERC Closes Out ’24 with Rulings to Boost LNG Supply

2025-01-06 - A trio of Federal Energy Regulatory Commission authorizations in the latter half of December allowed new LNG trains to begin operations or boosted gas supplies to the facilities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.