Oilfield operators continue to search for new technologies to decrease costs and reduce pollution. Drivers for this search include falling oil prices and tightening air quality regulations. Several technologies are now in industrial practice to reduce mono-nitrogen oxide (NOx) emissions from industrial sources.

Early solutions

First developed in the 1960s and seeing widespread application in the decades thereafter, selective catalytic-reduction (SCR) systems involve the injection of an ammoniacal reagent such as ammonia, aqueous ammonia or urea in the presence of a catalyst to convert NOx back to nitrogen and oxygen. Catalyst costs have steadily decreased since the introduction of SCR, which is able to reduce NOx to less than 5 parts per million (ppm).

SCR remains the most costly of all NOx reduction strategies and has other well-known issues. For example, for NOx to reach sub-5-ppm levels, excess reagent is usually required. Some of the excess reagent can slip by the catalyst unreacted as is and is called ammonia slip. Some districts now have limits not only for NOx but also for ammonia slip, further complicating the use of SCR as an abatement strategy.

If higher NOx emissions are acceptable (5 ppm to 20 ppm), flue gas recirculation (FGR) is another well-attested pollution-reducing technology. FGR strategies typically redirect a portion of the flue gases produced during the combustion process back to the fresh air inlet of the burner. The addition of inert gases to the air cools the flame and dilutes reactive species, thereby reducing the formation of NOx.

The recirculation of flue gas requires additional energy in the form of increased fan power. Today’s lowest NOx burners currently recirculate as much as 40% of the flue gas. Pushing all that flue gas around in a circle requires considerable additional fan horsepower, increasing electrical energy costs. To minimize additional electrical demand from utilities, certain air quality districts have contemplated an upper limit on the amount of flue gases that may be recirculated. SCR and FGR reduce air pollution, but they also require additional operating costs. In addition, SCR can require potentially expensive system redesign to integrate the catalyst bed with the combustion source. FGR requires some system

modification for keeping ducting and downtime to a minimum. Additionally, the added complexity of these systems often brings new issues to the table such as increased corrosion, additional parasitic power and increased maintenance. Chemicals required in some systems pose potential environmental threats and safety hazards that must be mitigated. The

expense of these systems continues to be an issue.

Low-NOx burners

Low-NOx burners (LNBs) and ultralow NOx burners (ULNBs) typically use some variant of staged combustion, often in conjunction with FGR, for the purpose of lowering NOx formation. In cases requiring more modest NOx reduction, LNBs and UNLBs can operate without FGR. LNBs are more expensive than the conventional burners they replace and usually require a larger operating footprint. This last point is significant because to modify the burner floor or wall, the furnace must be shut down and allowed to cool. For production units, the downtime required to install UNLBs greatly exceeds the cost of the burners. Additionally, these systems tend to create less stiff flames that are more prone to wandering and impingement than conventional flames. Flame impingement on process or boiler tubes represents a safety issue. In addition to the potential for explosion and loss of life, flame impingement accelerates scaling, fouling or coking inside boiler tubes, requiring increased maintenance and outage for tube replacement, descaling or decoking. LNBs typically operate over a smaller ratio of maximum to minimum firing rate (known as the turndown ratio). Lower turndown ratios mean less flexibility in meeting demand swings.

Distal flame architecture

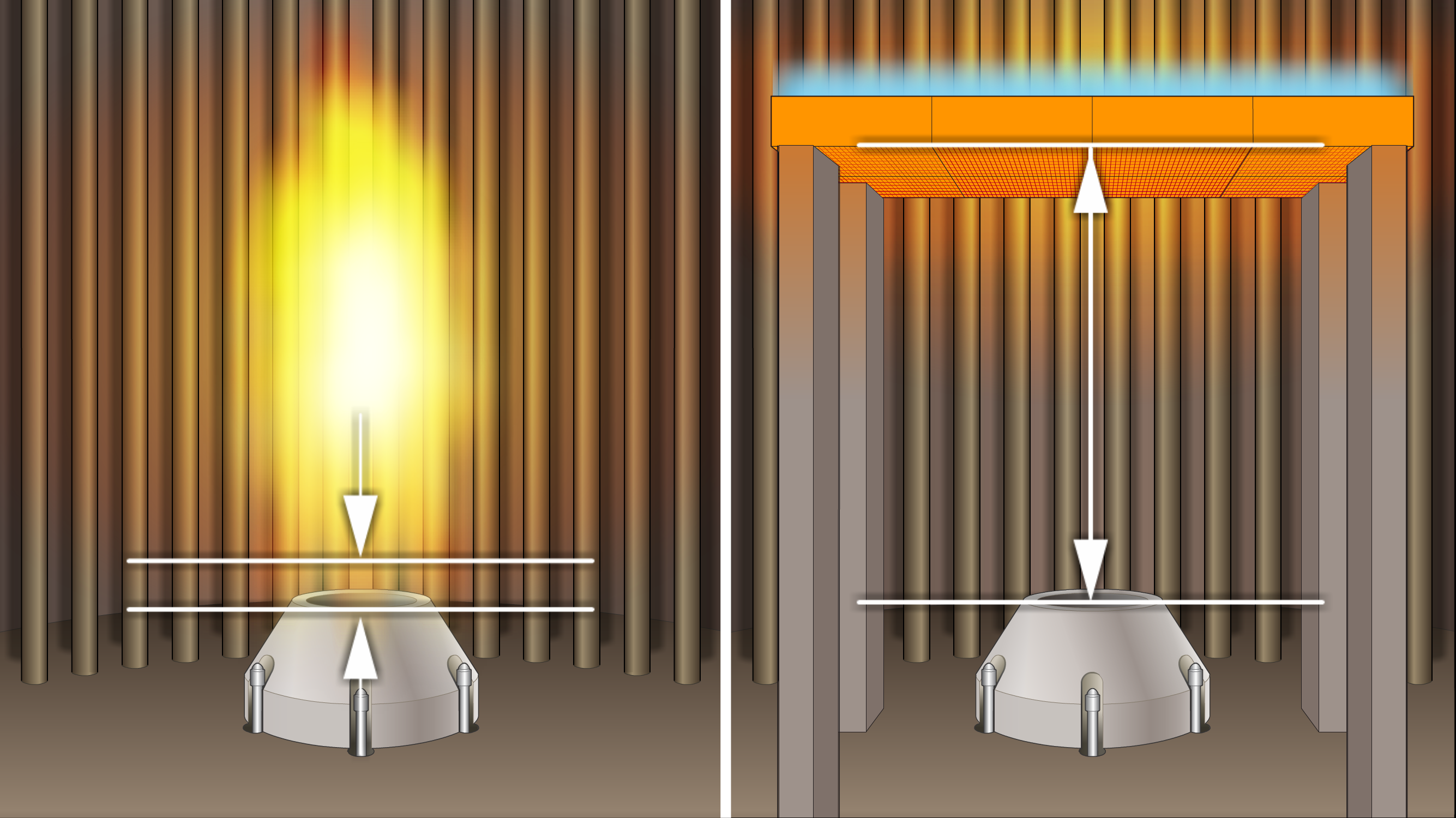

ClearSign’s DUPLEX Technology provides distal flame architecture that is a different approach to combustion, resulting in unprecedented NOx emissions reduction and ultrashort flames. Because flame chemistry is fast, flame length is generally determined by the time required for fuel and air to mix (Figure 1), and the combustion process can actually impede that mixing.

Rather than simultaneously mixing and combusting as traditional LNBs and UNLBs do, this new technology operates by supplying a downstream combustion surface (Figure 2) for combustion. The surface is located beyond the burner’s mixing length, so the combustion process can occur in inches (rather than feet) and is usually confined to the dimensions of the porous ceramic surface, eliminating the possibility of flame impingement on surrounding tubes.

Because the combustion occurs in inches rather than feet, the time for NOx formation is greatly reduced. The technology’s surface also has a much higher emissivity than the flame itself, resulting in better thermal efficiency in the radiant section and lower combustion temperatures—another contributing factor to sub-5-ppm NOx (Figure 3).

Reduction in flame impingement can lower tube failure rates, enhance tube lifetimes, reduce the need for decoking and reduce maintenance.

FIGURE 1. Flame length is predominantly determined by the distance required to fully mix the fuel and air. (Source: ClearSign Combustion Corp.)

FIGURE 2. With DUPLEX technology, the combustion reaction takes place in a porous ceramic matrix beyond the traditional mixing length of the burner. This results in short flames that are largely confined to the dimensions of the ceramic matrix itself, resulting in very little time for NOx formation and eliminating the possibility of flame impingement. (Source: ClearSign Combustion Corp.)

FIGURE 3. The figure shows a conventional burner operating in the 100 ppm NOx range. Subsequent operation on the DUPLEX surface shows a precipitous drop in NOx emissions to a steady state of about 3 ppm. Final NOx emissions are independent of starting NOx levels. DUPLEX Technology can be retrofitted to systems using conventional burners, LNBs or ULNBs. (Source: ClearSign Combustion Corp.)

Recommended Reading

AI-Shale Synergy: Experts Detail Transformational Ops Improvements

2025-01-17 - An abundance of data enables automation that saves time, cuts waste, speeds decision-making and sweetens the bottom line. Of course, there are challenges.

Understanding the Impact of AI and Machine Learning on Operations

2024-12-24 - Advanced digital technologies are irrevocably changing the oil and gas industry.

Then and Now: 4D Seismic Surveys Cut Costs, Increase Production

2025-03-14 - 4D seismic surveys allow operators to monitor changes in reservoirs over extended periods for more informed well placement decisions. Companies including SLB and MicroSeismic Inc. are already seeing the benefits of the tech.

Digital Twins ‘Fad’ Takes on New Life as Tool to Advance Long-Term Goals

2025-02-13 - As top E&P players such as BP, Chevron and Shell adopt the use of digital twins, the technology has gone from what engineers thought of as a ‘fad’ to a useful tool to solve business problems and hit long-term goals.

Small Steps: The Continuous Journey of Drilling Automation

2024-12-26 - Incremental improvements in drilling technology lead to significant advancements.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.