The world’s largest oil reserves are consolidated in three countries: Saudi Arabia, Venezuela and Canada (more specifically, Alberta). Unlike Saudi oil—which exists in liquid form—much of the petroleum deposits in Canada and Venezuela exist as highly viscous bitumen that saturates naturally occurring mixtures of sand, clay and water known as oil sands. According to research firm IHS, Canada’s oil sands production is forecast to grow by 800,000 bbl/d by 2020, keeping it among the largest sources of growth in global oil supply throughout that period.

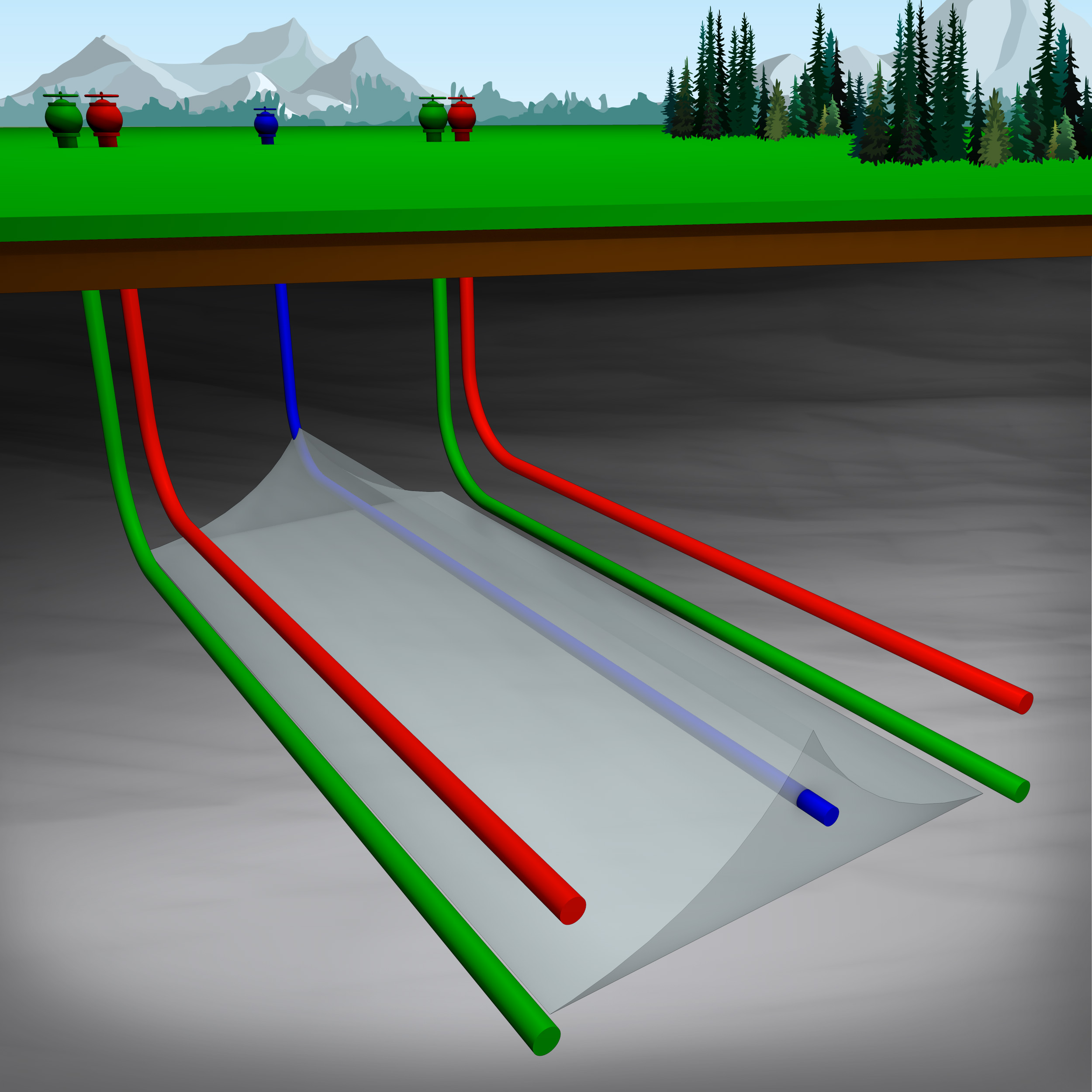

Steam-assisted gravity drainage (SAGD) has become the method of choice for producing most oil sand deposits that are too deep to mine from the surface. However, breakeven costs for new SAGD projects, which require drilling two horizontal wells—one producer and one injector—are among the highest globally. Superheated steam is pumped through the injection well into the reservoir to melt the bitumen so it can drain via gravity into the production well below.

A key aspect of SAGD production is the steamoil ratio, which indicates how many barrels of steam are required to produce 1 bbl of oil. This metric is important because it determines the level of emissions generated, operating costs, surface footprint size, capital efficiency, water intensity and water usage. Even after steam heating, bitumen doesn’t flow readily to the surface. Artificial lift is required to boost oil flow and reduce the steam-oil ratio.

Electric submersible pump (ESP) systems are ideal for thermal recovery, including SAGD, because they can produce at higher flow rates and can operate more reliably and economically than other artificial lift methods. However, the extreme temperatures, plus high gas-to-oil ratios and abrasives typical of SAGD production, require ESP systems specifically designed to withstand these conditions. In 2004, Baker Hughes installed a system in Canada capable of operating in fluid temperatures up to 220 C (428 F). Extending system runlife cut down on costly interventions. Additionally, reducing downtime minimized

the risk of steam chamber cooling and the associated additional steaming and higher steam-oil ratios.

Turning up the heat

As SAGD operations have matured, operators recognized that by increasing the temperature of the steam they could increase the size of the steam chamber and, therefore, the miscible oil to improve production and overall reserve recovery. However, these higher temperatures exceeded the thermal ratings of internal ESP components. Increasing the equipment temperature threshold was necessary to reduce the thermal stress encountered by the equipment to increase overall runlife.

With this in mind, the first ESP motor that was tested and validated to a bottomhole temperature rating of 250 C (482 F) was introduced in 2010. Last year Baker Hughes installed the first ESP system rated to 275 C (527 F). Achieving these higher temperature thresholds required a holistic look at the system’s mechanical and electrical geometries and materials to ensure adequate thermal expansion and chemical compatibility.

The most innovative change was a totally new robust motor specifically designed for thermal injection, including SAGD. An advanced proprietary material is used for the motor insulation. Also, traditionally, the seal sections that protect the motor use elastomeric bags. In the newer higher-temperature seal the bags are replaced with metal bellows, which can tolerate both high temperatures and temperature cycles better than elastomers to protect the motor. The overall length of the seal—and therefore, the system—is shorter, allowing the unit to pass through greater deviations with less mechanical stress on the equipment or flange connections.

Capturing stranded reserves

Like other conventional and unconventional production methods, SAGD leaves some reserves behind. When multiple well pairs are drilled from a single well pad, pockets of bitumen are unrecovered in the space between two well pairs. To maximize hydrocarbon recovery and economics, operators have begun drilling wells between the two main steam chambers to tap the stranded bitumen. These infill-type wells can increase recovery by 10% to 20% without incurring the expense of another injection wel

The stranded reserves are tapped by drilling a single horizontal well between two SAGD well pairs and pumping the oil to the surface through the additional well. The pocket formation is surrounded by steam chambers created by the existing well pairs, so significantly less water is needed for conversion to steam to soften the bitumen and pump it to surface. Less steam translates to lower water and fuel gas requirements.

ESPs are integral to the success of SAGD infill wells. Because higher temperature-rated systems were historically available only in larger diameters, this new application presented a challenge to the service industry: develop a rugged, smaller diameter ESP system that could handle high pump rates and temperatures up to 220 C.

The most recent SAGD infill ESP system has a 4.5-in. motor, a 4-in. pump and seal outer diameter and a temperature rating of 230 C (446 F)—the highest in the industry for its size. The system motor and seal make up a smaller diameter version of their larger system counterparts with the same features—including metal bellows seals and proprietary motor insulation material—and functionality. Plus, a plug-in pothead and a pre-filled seal enable faster installation to reduce rig time.

To qualify and validate the capability of the system to withstand not only extremely high temperatures but also extreme temperature swings, the infill system was subjected to strenuous tests in a robust hot loop at temperatures up to 230 C. System and component testing also included thermal cycling in 100-C (212-F) swings. These variations replicate conditions that can occur when steam facilities are cycled out for maintenance and ESPs go into low standby mode and are then expected to resume pumping.

Next steps

Next steps for ESP technology advances that will further improve SAGD production and economics include even more rigorous system and component testing, investigating pumping systems for multiphase fluids and developing systems and techniques that will allow working over live wells. In the meantime, increased ESP temperature ratings combined with infill well capabilities will allow operators to mitigate the risk associated with high-temperature applications and maximize heavy oil recovery.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.