Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. (Source: Shutterstock.com)

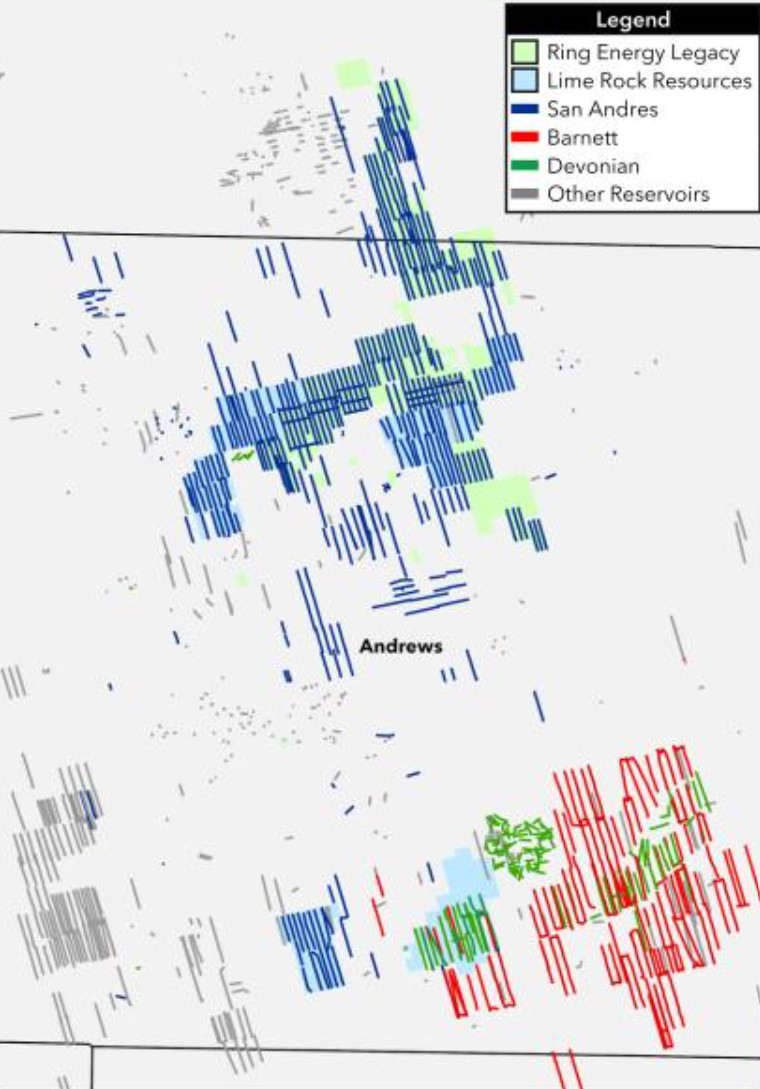

Ring Energy sees an opportunity to drill the Barnett Shale and deeper Devonian benches on the Central Basin Platform.

But Barnett and Devonian horizontal locations could also fetch a nice price should Ring pursue a sale in the future, Chairman and CEO Paul McKinney suggested during a fourth-quarter earnings call.

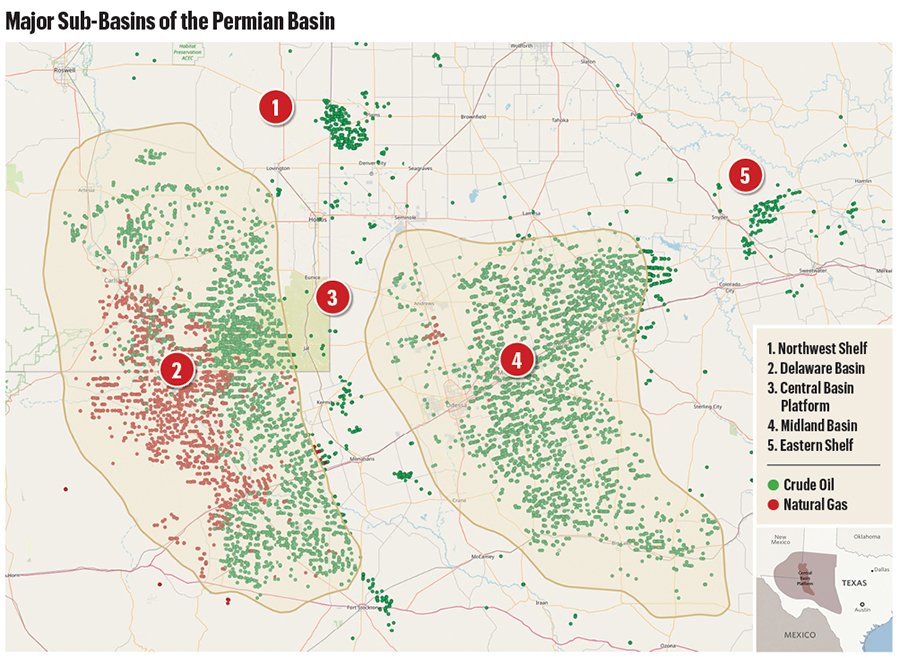

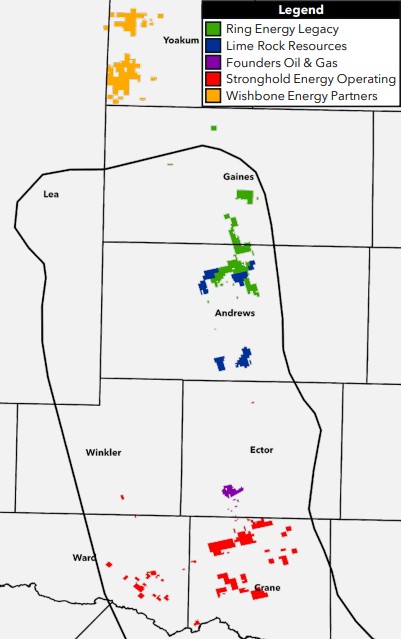

Ring primarily develops the San Andres horizontal play in the Central Basin Platform and adjacent Northwest Shelf. Developing the deeper Barnett and Devonian benches would require higher commodity prices, McKinney said.

Exposure to the Barnett and Devonian zones “present really nice optionality” for Ring—especially with WTI prices at $75/bbl or higher, he said.

“But they are not as economically attractive as the San Andres horizontal opportunities that we have offsetting our Shafter Lake operations,” McKinney said on Ring’s March 6 earnings call.

Ring is getting deeper in the Central Basin Platform through a $100 million bolt-on acquisition from Lime Rock Resources IV LP. The deal is expected to close in the first quarter.

Announced in late February, the Lime Rock deal adds 17,700 net acres and 40 gross horizontal locations contiguous to Ring’s existing portfolio. Most of the locations are in the San Andres Formation.

Production from the assets in Andrews County, Texas, averaged 2,300 boe/d (80% oil) in the third quarter.

Ring has grown its Central Basin Platform position through several M&A transactions, including:

- A $300 million acquisition from Wishbone Energy Partners in 2019;

- A $465 million acquisition from Stronghold Energy II in 2022; and

- A $75 million acquisition from Founders Oil & Gas in 2023.

Most of Ring’s Central Basin Platform horizontal wells produce from the San Andres, according to regulatory filings.

Ring drilled 22 horizontal wells during 2024—all in the San Andres—including 17 in the Central Basin Platform.

Ring drilled five horizontal San Andres wells in the Northwest Shelf in nearby Yoakum County, Texas.

The company’s 2024 net sales hit a record 19,648 boe/d, including 4.86 MMbbl of oil, 6.42 Bcf of gas and 1.26 MMbbl of NGL.

RELATED

Classic Rock, New Wells: Permian Conventional Zones Gain Momentum

To Barnett and beyond

Barnett Shale development by other operators is happening near Lime Rock’s acreage in southern Andrews County.

Permian Barnett Shale development has focused on the western edges of the Midland Basin and the eastern flanks of the Central Basin Platform.

Several public operators are active in the Permian Barnett, including Occidental Petroleum, Diamondback Energy and ConocoPhillips, according to Texas Railroad Commission data.

Private E&Ps developing the Permian Barnett include Continental Resources, Elevation Resources and Fasken Oil & Ranch.

“On the eastern side of the Central Basin Platform, the Barnett play is a very successful play,” McKinney said. “Several companies are still spending money trying to acquire acreage in it.”

But deeper drilling would be uneconomic for the company under lower oil prices.

“At $65 oil, I don’t believe we’d be able to allocate capital to those opportunities,” McKinney said.

WTI oil prices have dropped below $70/bbl in early March due to tariff uncertainty and OPEC’s announcement that it plans to increase output by 138,000 bbl/d in April—the cartel’s first increase since 2022.

WTI strip prices average around $65/bbl through the end of 2025, according to CME Group data.

San Andres savings

Ring’s San Andres horizontals can be drilled and completed for between $350/ft and $450/ft.

D&C costs for Barnett and Devonian horizontals average between $1,100/ft and $1,200/ft, according to Ring estimates.

Using technology advances, the company has also learned to develop higher recoveries from San Andres wells with the same lateral lengths as legacy projects.

Ring’s legacy Shafter Lake wells produced six-month cumulative volumes of around 27,000 boe—compared to 38,000 boe for recent Shafter Lake wells, according to company filings.

“We've found a better way to drill the wells, stay more in zone, optimize the frac,” said Alex Dyes, Ring’s executive vice president of engineering and corporate strategy. “Our cost structure has dropped about 15% to 20% over the last couple of years.”

Ring is also looking to apply horizontal techniques further south on the Central Basin Platform in Crane and Ector counties, Texas, where Ring has historically drilled vertical wells.

RELATED

Ring Energy Bolts On Lime Rock’s Central Basin Assets for $100MM

Central Basin Platform A&D

Ring said it sold around $5.5 million in non-core vertical assets and paid down $7 million in debt during the fourth quarter.

For the year, Ring reduced its debt by $40 million.

The company aims to continue reducing debt and shoring up its balance sheet in order to enter the M&A marketplace again, McKinney said.

Lower commodity prices could challenge the outlook.

“If you’re in a sustainably lower price environment, we’re going to protect our balance sheet,” he said.

Ring currently doesn’t have much more to monetize from its portfolio, McKinney said.

But the Barnett and Devonian exposure to the south does present “really high cash-generating capacity” and optionality for Ring in the future, he said.

Dealmaking on the Central Basin Platform and Northwest Shelf picked up last year.

In September, APA Corp., parent company of Apache, announced a $950 million sale of conventional assets on the CBP and Northwest Shelf to an undisclosed private buyer—reportedly Hilcorp Energy.

Exxon Mobil also sold select conventional assets in the area to Hilcorp Energy for roughly $1 billion.

RELATED

Occidental to Up Drilling in Permian Secondary Benches in ‘25

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

More Players, More Dry Powder—So Where are the Deals?

2025-03-24 - Bankers are back and ready to invest in the oil and gas space, but assets for sale remain few and far between, lenders say.

Confirmed: Liberty Energy’s Chris Wright is 17th US Energy Secretary

2025-02-03 - Liberty Energy Founder Chris Wright, who was confirmed with bipartisan support on Feb. 3, aims to accelerate all forms of energy sources out of regulatory gridlock.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.