The contract is for engineering, procurement, construction and installation (EPCI) work at TotalEnergies’ Lapa North East field in the presalt Santos Basin offshore Brazil. (Source: Shutterstock.com)

TechnipFMC Plc said TotalEnergies SE had awarded the company a “significant” subsea contract for a project in presalt Brazil.

The value of the contract was not disclosed, but for TechnipFMC a significant contract is between $75 million and $250 million, according to the company press release on Sept. 14.

“The Brazilian offshore market is becoming more diverse with regard to work scope and customer opportunity,” commented Jonathan Landes, president, subsea, at TechnipFMC.

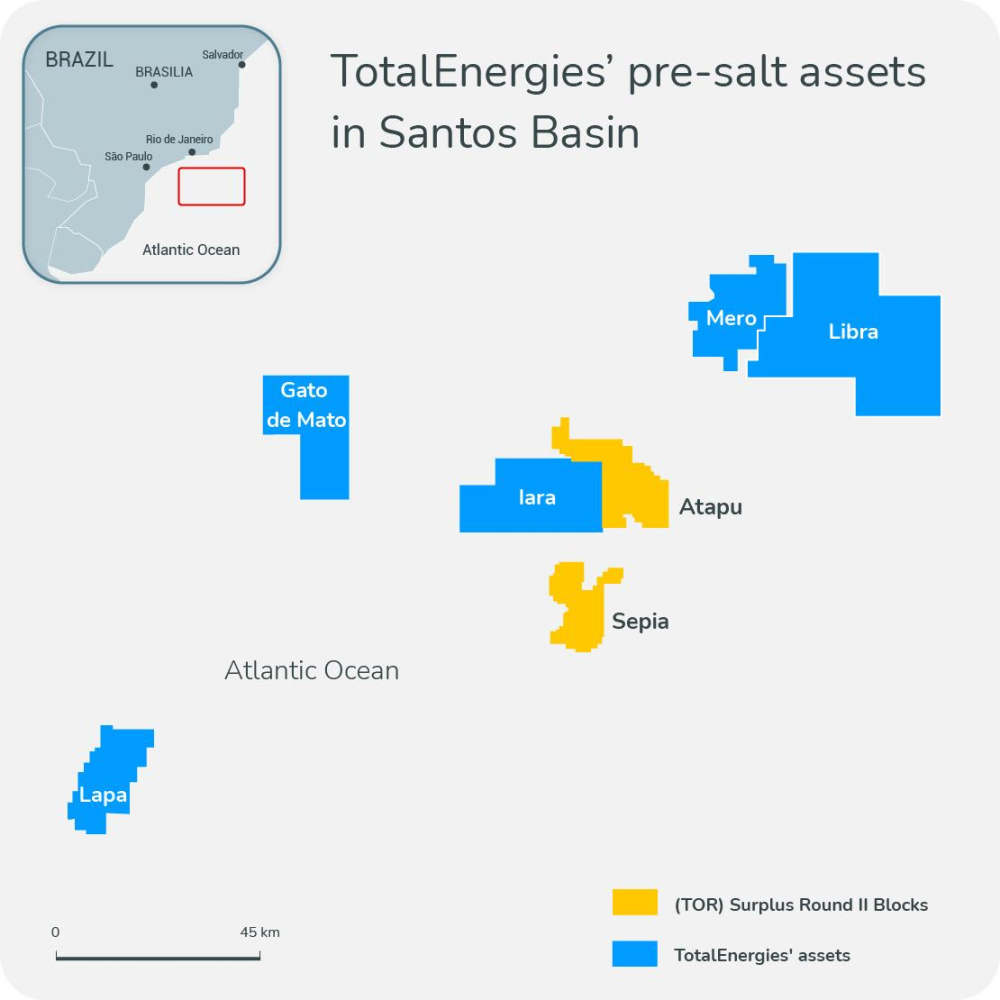

The contract is for engineering, procurement, construction and installation (EPCI) work at TotalEnergies’ Lapa North East field in the presalt Santos Basin offshore Brazil.

TotalEnergies had acquired 35% interest in the Lapa Field along with operatorship as part of a transfer of rights transaction with Petrobras in 2018. Other partners in the Lapa Field located in Block BM-S-9A include Shell Plc (30%), Repsol-Sinopec (25%) and Petrobras (10%).

“On Lapa North East,” Landes continued in his statement on Sept. 14, “we are working with a valued client with whom we have built a trusted relationship. By offering the flexibility of a phased campaign, we are helping TotalEnergies accelerate its schedule and begin production sooner.”

As part of the EPCI contract award, TechnipFMC will reconfigure and install umbilicals and flexible pipe in a new configuration that will further secure the production of the field.

Recommended Reading

Argent LNG, Baker Hughes Sign Agreement for Louisiana Project

2025-02-03 - Baker Hughes will provide infrastructure for Argent LNG’s 24 mtpa Louisiana project, which is slated to start construction in 2026.

Venture Global LNG Pares IPO Hopes by 15% to $2.2B

2025-01-22 - LNG exporter Venture Global nearly halved the price per share, while increasing the number of shares it expects to offer.

Italy's Intesa Sanpaolo Adds to List of Banks Shunning Papua LNG Project

2025-02-13 - Italy's largest banking group, Intesa Sanpaolo, is the latest in a list of banks unwilling to finance a $10 billion LNG project in Papua New Guinea being developed by France's TotalEnergies, Australia's Santos and the U.S.' Exxon Mobil.

Baker Hughes to Supply Equipment for NextDecade’s Rio Grande LNG

2025-03-11 - Baker Hughes will provide turbine and compression for NextDecade’s trains at Rio Grande LNG.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.