The concept of dilution to shareholders from equity offerings is not new. Most investors (and companies) prefer to finance acquisitions with debt, assuming that leverage remains within prudent levels. The same is true with MLPs but the dynamics of the general partner’s (GP) incentive distribution rights (IDRs) sometimes create a situation where the GP and limited partner (LP) unitholders have conflicting—or perceived conflicting—objectives.

This article highlights some of the complicating factors resulting from the MLP and IDR structure that need to be considered by conflicts committees when evaluating transactions. It also examines the implications of the current M&A market and commodity price environment with respect to these structures.

The growth treadmill

Considerations of accretion/dilution are not unique to MLPs. However, because virtually all of an MLP’s cash flow is distributed to unitholders, growth needs to be funded with new capital. Investors and MLP sponsors prefer a strong growth profile because high-growth MLPs typically trade at higher prices (resulting in a lower distribution yield). This growth can come from acquisitions or organic growth but, either way, issuance of debt and equity to fund growth is a frequent occurrence for most MLPs.

At this point in the sector’s evolution, most investors understand the basics of the IDR structure: As the LP distribution per share reaches certain hurdles, the GP gets an increasing share of distributions. What isn’t always clear is that the GP benefits from issuance of new units even if the distribution per LP unit does not increase. This is because the GP’s distribution, paid through the IDRs, is based on the level of LP distributions per share for all units outstanding. Let’s consider some examples.

Example 1: Acquisition funded 100% with LP units. Take the example of a hypothetical MLP with the following MLP IDR waterfall: The MLP has 100 million units outstanding at a market value of $10 per unit with a yield of 5%. As shown in the chart on the previous page, the current annual LP distribution is 50 cents per unit, and the GP gets an annual distribution of $25.3 million. Note that GP distributions are not generated on a per-unit basis but looking at it this way makes the calculation more intuitive.

Now, let’s assume the MLP makes an acquisition for $100 million funded entirely with an offering of LP units (10 million units) and that the incremental cash flow from the new acquisition is $7.53 million (13.3X cash flow acquisition multiple). As can be seen in the chart at top, the incremental cash flow results in neither accretion nor dilution for the LP unitholders. Of the $7.53 million in new cash flow from the acquisition, $5 million goes to pay the 50-cent-per-unit distribution on the 10 million new LP units and $2.53 million goes to the GP. The GP’s distribution goes up by 10% (in proportion with the new number of LP units) even though the per-unit distribution remains the same.

Most investors recognize that growth in the per unit distribution results in an increasing share of distributions to the GP (the waterfall). The increase in GP distributions from any LP unit offering— even non-accretive—is more subtle.

Example 2: Acquisition funded 100% with debt. If we look at the same acquisition (see chart below) but assume that it is funded with $100 million in debt with a 5% interest rate, distributable cash flow increases by $2.53 million.

Of the $7.53 million in new cash flow from the acquisition, $5 million goes to pay the 5% interest on the new debt. Because there are no new LP units, the incremental $2.53 million is split according to the waterfall at the 50% tier. The same transaction is now accretive to LP per unit distributions by 1.27 cents per unit.

At the same 5% yield, the LP units’ market value would be $10.253, an increase of 2.53%. Note that while still accretive to the GP distributions, the same transaction results in a lower distribution to the GP vs. the “all equity” funding.

Impact of IDRs over time

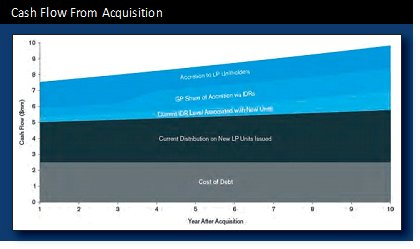

The preceding funding examples and resulting one-year accretion/dilution demonstrate why the debt-equity decision for funding acquisitions can create a perceived conflict. However, looking at a transaction over just the next year ignores the impact that the IDRs can have on the accretion/dilution of a transaction to LP unitholders over several years.

Consider the hypothetical acquisition introduced above: $100 million with incremental cash flow of $7.53 million (13.3X). One could look at the inverse of the acquisition multiple and think of the acquisition as “yielding” a 7.5% return in the first year (vs. the acquisition price of $100 million), then increasing over time due to the projected growth in cash flow of the acquisition.

Let’s assume that the acquisition is funded 50:50 with debt and units with the same assumed borrowing rate of 5% and the units yielding 5%. Let’s also assume that the MLP is currently in the 25% IDR tier but expected to reach the 50% tier (even without the acquisition) in five years. Even though the MLP is in the 25% tier, the GP’s blended share of distributions is less—in this case somewhere between about 10% and 15%. It’s just like personal income tax rates. Even if you’re in the marginal 35% bracket, your actual tax rate is lower because some of your income is taxed at the lower brackets.

In year one, incremental interest on the new debt would be $2.5 million ($50 million x 5%). Distributions on the new units at the previous distribution level would be $2.5 million ($50 million x 5% yield). The incremental cash flow to the IDRs before assuming any LP distribution increases would be $340,000 ($2.5 million existing distributions to new LP units ÷ 88% x 12% average split at current level). This would leave $2.19 million in accretive cash flow to be split among the GP and the LP unit holders. Because this is marginal cash flow at the 25% tier, it would be split $1.64 million to the LPs and $550,000 to the GP.

The chart above highlights what would happen to the incremental cash-flow once the IDRs reach the 50% level. A transaction that was substantially accretive in year one, becomes only half as accretive to LP unitholders in future years as the MLP reaches the top 50% IDR tier.

These examples highlight some of the subtle dynamics of the MLP IDR structure that can lead to confusing and sometimes counterintuitive implications for LP unitholders and the GP. How a transaction is funded and where an MLP is within its IDR split tiers can have material impacts on the attractiveness of an acquisition. To protect against these perceived conflicts of interest, an MLP board needs to explicitly and simultaneously consider a transaction from many perspectives.

Implications

M&A activity in the MLP sector continues to grow exponentially as the number of new MLPs grows. In 2014 there were 18 MLP IPOs. Between public MLPs and private midstream companies, many of which are sponsored by private equity, competition for deals is fierce.

Pressure to pay higher prices for assets puts MLPs with high IDRs at a disadvantage in comparison to their competitors with no or lower IDRs. In order to be competitive with the lower IDR MLPs, higher IDR MLPs may need to use a greater percentage of debt to maintain accretion to their LP unitholders. Assuming each MLP attempts to achieve accretive transactions, the interests of the GP and LP are more aligned at the higher IDR MLP if more debt is used. Stated differently, there is more leeway for a lower IDR MLP to fund an acquisition with new units while still maintaining accretion, resulting in higher absolute increases in cash flow to the GP vs. a greater percentage of debt funding. While these considerations are theoretical, boards of newer, lower IDR MLPs should be aware of this dynamic.

Another implication of the LP/GP dynamic on M&A transactions—especially in the current commodity price environment—is that larger, more diversified MLPs, and those with contracts and operations that are less dependent on factors like commodity prices or production declines in specific geographic areas, should trade at a lower yield to reflect the lower risk profile. In this environment, investors have shown an increased focus on a prospect’s risk profile relative to commodity price in their assessment of potential investments/acquisitions, which could have varying impacts across the MLP landscape.

Taking a step back, yield represents the market’s expectation concerning both risk and growth. (Remember the cost of equity capital formula P= D/(r-g) from Finance 101? [That is, the yield at which the stock trades reflects the dividend divided by the stock price, with the dividend determined by the required rate of return minus the growth rate.] Therefore: Yield=D/P=r-g). Historically, under normal circumstances, a larger, more mature MLP may be expected to trade at a higher yield to reflect the lower expected growth profile vs. a newer, smaller MLP.

The mature MLP is typically expected to have a lower growth profile because (a) larger and larger acquisitions are needed to achieve the same percentage growth rate and (b) the higher IDR tiers make achieving LP accretion in an acquisition harder. Lower g = higher (r-g) = higher yield. This is potentially compounded by the fact that a higher-yielding MLP has a higher cost of equity making it that much harder to compete for acquisitions.

Kinder Morgan’s MLP retreat

Kinder Morgan is an excellent case study for this phenomenon. Prior to its announcement that it planned to exit the MLP structure by having the GP sponsor, Kinder Morgan Inc. (KMI), acquire its affiliated MLP entities with a combination of shares and cash, Kinder Morgan Energy Partners LP (KMP) was trading with a yield of about 6.9%. By comparison, Tallgrass Energy Partners LP was trading at that time with a yield less than 4%. Most industry observers agreed that Kinder Morgan’s management was among the best in the industry and many pointed out that Kinder’s backlog of organic development projects still provided growth opportunities. However, with almost 50% of cash flow going to the GP, the market’s expectation of growth in LP distributions was well below its peers, resulting in a premium yield.

In the transaction, each KMP unitholder received 2.1931 KMI shares plus $10.77 in cash. The transaction was taxable to unitholders and according to company statements, KMI estimated that the tax for the average holder would be between $13.45 and $16.41, depending on the price of KMI shares at closing. Prior to the transaction, KMP had an annualized distribution of $5.56 per LP unit. Post transaction and adjusting for taxes, holders are expected to receive about $4.20 in dividends on its new KMI shares for each LP unit during 2015.

This dividend/distribution dilution extends beyond just the first year. Even Kinder Morgan in its presentations predicted distribution dilution to existing KMP holders through 2018 and cumulative dilution past 2020.

However in this situation, accretion/dilution does not reflect the economic reality. Because the transaction removed the drag that the GP IDRs placed on growth, Kinder Morgan’s shares now reflect a superior growth profile and a premium valuation.

Prior to the transaction announcement, KMP was trading at about $80 per unit. Immediately after the announcement, the units shot up into the mid-$90s. In mid-July, even taking taxes into account, former KMP unitholders held KMI shares worth about $93, reflecting 16.26% increase, not including the added “benefit” of a stepped-up tax basis.

More importantly, the higher growth expectation results in a lower cost of capital and, in turn, should make Kinder Morgan far more competitive when bidding for acquisitions. KMI shares trade with a yield of about 4.5%.

However, in the time since Kinder Morgan’s conversion, the commodity price environment has dramatically changed. Investors are more focused on an MLP’s risk profile relative to commodity price (and volume) changes.

Certainly, this assessment is very MLP-by-MLP specific but, generally, the larger, more diversified, more mature MLPs have a better risk profile (lower “r”). One would expect this dynamic to have a beneficial effect on these MLPs’ yields. In fact, a second case study supports this hypothesis.

Narrowing yield spreads

Over the last 12 months, the spread of the average yields of the largest six MLPs (with IDRs) over the average yields of eight selected midstream MLPs that went public in 2013 narrowed significantly as commodity prices rapidly declined in the second half of 2014.

This narrowing of yield spreads may level the playing field a bit when it comes to the ability of mature MLPs to compete for acquisitions. Combine this dynamic with the fact that E&P companies under pressure may increasingly look to monetize gathering and processing assets to free up precious capital, and we may see an increase in third-party M&A among the larger, more mature MLPs that have recently been more focused on organic growth.

This could be compounded if conditions in the energy sector worsen over 2015 and access to capital becomes even harder for the smaller, newer competitors.

Finally, while most of the MLP-MLP M&A has been strategic in nature (for example, Enterprise Products Partners LP’s acquisition of Oiltanking Partners in late 2014), mid-to-late 2015 may re-veal opportunities for well capitalized, large MLPs to acquire distressed, basin-focused peers at attractive multiples.

The current turmoil in the commodity price environment potentially changes the competitive dynamics for M&A in the sector. Boards need to be aware of how these dynamics affect the potential for conflicts of interest in the financing of transactions and specifically address these issues in their deliberations.

Jim Hanson is a managing director for Duff & Phelps LLC, specializing in transaction opinions, M&A and private capital raising for the energy sector.

Recommended Reading

Hamm: Interior, DOE Leadership is a ‘Dream Team’

2025-02-06 - Harold Hamm, U.S. energy policy influencer and founder of wildcatter Continental Resources, said his top choices of Interior Secretary Doug Burgum and newly confirmed Energy Secretary Chris Wright will be a “dream team of unimaginable proportions.”

As Energy Secretary, Wright Would Remove Barriers to Projects

2025-01-15 - Liberty Energy CEO Chris Wright, Trump’s nominee to head the Department of Energy, said removing bureaucratic barriers to project development would be a top priority during a Senate confirmation hearing on Jan. 15.

Burgum: Yes to US Power Supply, Reliability; No on Sage Grouse

2025-01-16 - Interior Secretary nominee Doug Burgum said the sage grouse is neither endangered nor threatened; he'll hold federal leases as scheduled; and worries the U.S. is short of electric power and at risk of losing the “AI arms race” to China and other adversaries.

Trump Fires Off Energy Executive Orders on Alaska, LNG, EVs

2025-01-21 - President Donald Trump opened his term with a flurry of executive orders, many reversing the Biden administration’s policies on LNG permitting, the Paris Agreement and drilling in Alaska.

Analysts: DOE’s LNG Study Will Result in Few Policy Changes

2024-12-18 - However, the Department of Energy’s most recent report will likely be used in lawsuits against ongoing and future LNG export facilities.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.