Increased oil price volatility may have also deterred some buyers, though Enverus' Andrew Dittmar said there’s rising enthusiasm for gas and gas-weighted assets to feed burgeoning demand from LNG and data centers. (Source: Shutterstock)

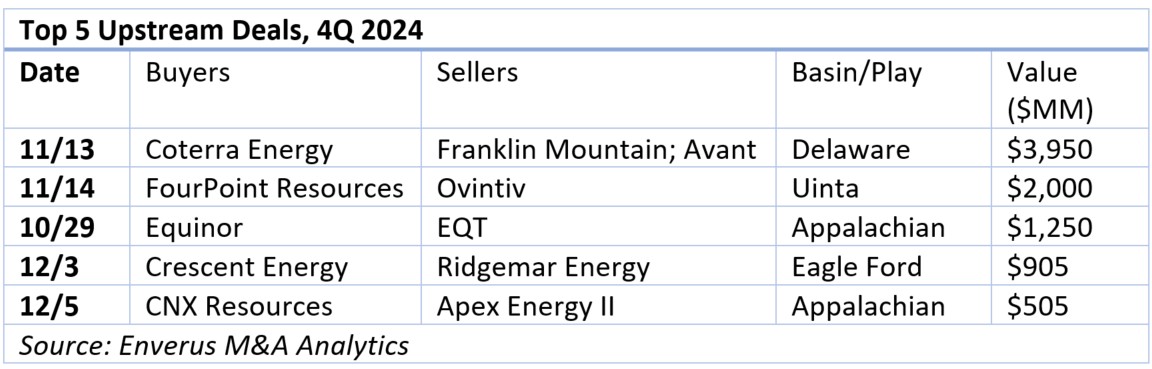

The upstream M&A party continued to wind down in the final quarter of 2024, with $9.6 billion in transactions to end an otherwise massive year for dealmaking at $105 billion.

The deal values made 2024 the third-highest year tracked by Enverus Intelligence Research (EIR), trailing 2023’s blistering $192 billion and 2014’s $108 billion haul.

The report says dealmaking, particularly among majors, may now shift more toward gas after a run of oil-heavy transactions—the largest in the Permian Basin. More mature shale plays, such as the Eagle Ford Shale and Bakken Shale, are getting an uplift by revisiting developed assets through recompletions.

However, activity tumbled in the back half of the year with a $9.6 billion showing among upstream M&A in the fourth-quarter—the fourth consecutive decline in quarterly value, Enverus said.

“Deal value and volume continued to drop in the final quarter of 2024 from its peak at the end of 2023 as buyers grappled with fewer M&A targets to pursue,” said Andrew Dittmar, principal analyst at EIR. “There are also quite a few larger E&Ps working to integrate their previous deals before returning to market to acquire more.”

Increased oil price volatility may have also deterred some buyers, though Dittmar said there’s rising enthusiasm for gas and gas-weighted assets to feed burgeoning demand from LNG and data centers.

Gas warms up

Gas-focused M&A values increased by 4x in 2024 compared to 2023, rising above $20 billion for the first time since 2016.

The Haynesville Shale, which is geographically best positioned to feed U.S. LNG export facilities, has been a key area of interest for buyers. But companies also added assets in other areas, such as the Appalachian Basin.

“International buyers, including Asian importers of LNG, are coming back to U.S. shale assets after being discouraged by poor returns a decade ago,” according to Enverus.

Non-operated gas assets are likely to be “highly desirable,” with deals similar to the position Equinor USA Onshore Properties Inc. and Equinor Natural Gas LLC purchased from EQT Corp. for $1.25 billion. The deal represented approximately 350 MMcf/d of forecasted 2025 net production. The interests are primarily operated by Expand Energy.

A shift in commodities might also be coming for majors, which have recently added oil inventory but may pursue gas deals. “There could even be a smaller oil-focused independent E&P that decides the best option to extend inventory is to pivot to gas,” Enverus said.

Permian still Permian

With corporate M&A slumping, buyers stuck with what they knew in fourth-quarter oil deals: acquiring private companies, Enverus said.

Coterra Energy Inc.’s acquisition of Delaware Basin E&Ps Avant Natural Resources and Franklin Mountain Energy tallied a combined $3.95 billion. The pair of deals—the largest in the fourth quarter—drove the Permian Basin to account for more than 40% of total quarterly deal value, “returning the prolific region to its central position in M&A markets,” Enverus said. Coterra closed the acquisitions in January.

“The Permian remains at the top of the list for where buyers would prefer to add assets, but it’s also the most challenging market to buy into from the perspective of available targets and sellers’ expectations on pricing,” Dittmar said.

Avant and Franklin Mountain were two of the last remaining Delaware Basin private opportunities. The Midland Basin still holds a few notable remaining private equity portfolio companies, Enverus said. Frequently speculated about is Double Eagle IV, led by co-CEOs Cody Campbell and John Sellers. The company is reportedly seeking an offer of $6 billion.

RELATED

M&A Target Double Eagle Ups Midland Oil Output 114% YOY

“For buyers considering acquiring one of the remaining Permian targets, the question will be if the quality and resource expansion upside is worth the price of admission. For many companies, particularly smaller sized E&Ps that have modest valuations on their own stock, the decision is likely to be to look elsewhere,” Dittmar said.

The elsewhere: Williston, Eagle Ford

The Eagle Ford and Williston Basin may be older plays, but they’re still luring in buyers. The emerging liquids window of the Utica Shale has also attracted attention.

Buyers are also more likely to look at extensional areas of these plays where well economics are higher on the cost curve, but assets are available at more reasonable prices, Enverus said. That strategy has been pursued by Eagle Ford consolidator Crescent Energy, which in December signed an agreement to buy Ridgemar Energy for $905 million.

“The set of remaining acquisition opportunities is largely smaller, higher up the cost curve, or both,” Dittmar said. “However, the need for scale and replacing drilled inventory means smaller E&Ps can’t simply sit out of the market. They will need to acquire these assets and have a credible plan for investors to generate returns that allow them to continue to fund dividend and buyback programs.”

The lack of acquisition opportunities may eventually push smaller E&Ps to sell, further consolidating the industry.

Enverus counted 11 mergers between public companies that exceeded $1 billion in 2023 and 2024 combined—more than double the count of the previous two years.

The last major public M&A was ConocoPhillips' May 2024 acquisition of Marathon Oil Corp. for 17.1 billion, excluding debt. The deal closed in November.

“Public company M&A can provide compelling valuations for a buyer compared to private assets given the valuation on smaller sized E&Ps,” said Dittmar. “However, finding a good strategic fit between assets and getting management team alignment has gotten more challenging. The industry will continue to consolidate, but likely not at the same breakneck pace seen during the last two years.”

Private equity reloads

Private equity (PE) firms are also likely to accelerate buying activity to reload portfolios after multiple successful exits to public companies, Enverus said.

“A track record of successful recent exits plus an administration that is favorable toward domestic oil and gas production may boost investment interest from private capital. Private firms may also be more willing to invest in growing volumes compared to public counterparts,” Dittmar said.

RELATED

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

Enverus: M&A Set to Cool with Smaller Deals, Higher Breakevens

PE portfolio companies are likely to look to plays in the Rockies or Midcontinent to find attractively priced deals and avoid competition from public operators.

In November, FourPoint Resources made one of the largest recent private acquisitions by acquiring Ovintiv Inc.’s Uinta Basin assets in Utah for $2 billion. The deal closed in January.

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

The New Minerals Frontier Expands Beyond Oil, Gas

2025-04-09 - How to navigate the minerals sector in the era of competition, alternative investments and the AI-powered boom.

Expand Energy Joins EQT in Triple-Investment-Grade Credit-Rating Club

2025-04-16 - The trifecta of endorsements assures Expand Energy, the largest gas producer in the U.S., a seat alongside EQT Corp. at the LNG and AI data center gas-supply negotiating tables.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.