Industrial gases company Air Liquide and TotalEnergies will jointly invest €150 million (US$158 million) and work together to produce renewable hydrogen at a biorefinery in France. (Source: Shutterstock, TotalEnergies, Air Liquide)

Industrial gases company Air Liquide and TotalEnergies will jointly invest €150 million (US$158 million) and work together to produce renewable hydrogen at the La Mède biorefinery in southeast France, the energy company said Nov. 25.

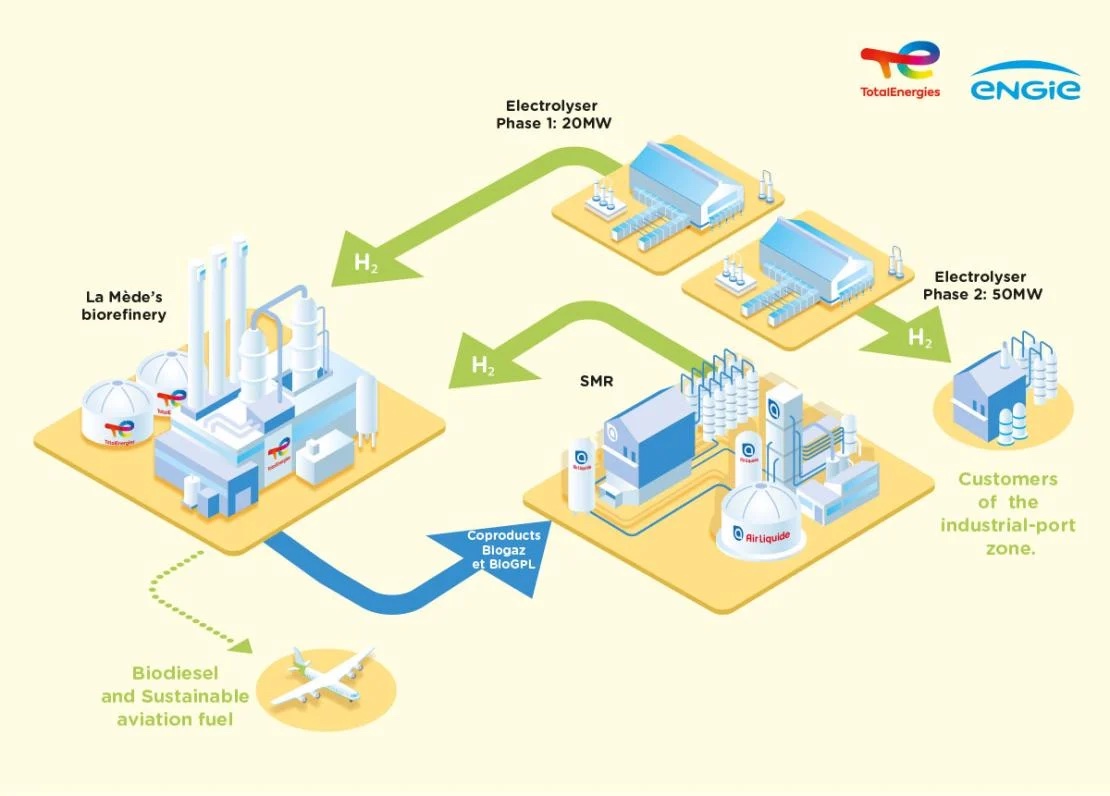

The partnership takes shape as TotalEnergies moves to decarbonize its European refineries. Plans are for Air Liquide to build and operate a hydrogen production unit, using steam methane reforming, at La Mède with an annual capacity of 25,000 tons, according to a news release. The hydrogen will be used at the biorefinery to produce biodiesel and sustainable aviation fuel.

The new unit is expected to start production in 2028, TotalEnergies said.

“This new renewable hydrogen production project, carried out with Air Liquide, allows us to accelerate the decarbonization of our La Mède platform,” said Vincent Stoquart, president of refining and chemicals for TotalEnergies. “Almost ten years after the announcement of its conversion, La Mède is continuing its transformation and is becoming a low-carbon hydrogen production center, thus contributing to the decarbonization ambition of the Provence-Alpes-Côte-D’azur region.”

The company’s efforts also include the Masshyli green hydrogen project with Engie. The companies aim to have an annual capacity of 10,000 tons per year. If subsidies are secured and the project is approved by European and French regulators, plans are to start the first 20-megawatt electrolyzer in 2029.

Recommended Reading

What's Affecting Oil Prices This Week? (March 17, 2025)

2025-03-17 - The price of Brent crude could get a boost from Trump’s threats of sanctions on Russia, Iran and Venezuela, but it is doubtful it will break $72/bbl, Stratas Advisors says.

What's Affecting Oil Prices This Week? (Feb. 24, 2025)

2025-02-24 - Net long positions of WTI have decreased by 59% since Jan. 21 and are 61% below the level seen on July 16, 2024, when the price of WTI was $80.76.

Oil Dives More Than 6%, Steepest Fall in 3 Years on Tariffs, OPEC+ Supply Boost

2025-04-03 - Oil prices swooned on April 3 to settle with their steepest percentage loss since 2022, after OPEC+ agreed to a surprise increase in output the day after U.S. President Donald Trump announced sweeping new import tariffs.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

What's Affecting Oil Prices This Week? (March 24, 2025)

2025-03-24 - Oil demand will be picking up as we move into warmer months for the northern hemisphere. For the upcoming week, Stratas Advisors think the price of Brent crude will move higher and will test $73.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.