Appalachia gas producer Antero Resources is poised to take advantage of the improving U.S. natural gas macro, analysts say. (Pictured): A natural gas pad near Moundsville, West Virginia. (Source: Shutterstock.com)

As the U.S. natural gas price market improves, investors are hot on gas-weighted stocks—Antero Resources, in particular.

Analysts say Denver-based Antero Resources (AR) is one of the best producers poised to take advantage of improving natural gas and NGL prices this year and into 2026.

Investors have been snapping up shares for Antero and its gassy peers at a high clip over the past year. Despite dismally low Henry Hub prices, gas-weighted stocks have generally outperformed oily names over that span.

Shares for Antero Resources (AR) are up nearly 90% year-over-year, based on AR’s closing price of $40.15 per share on Feb. 13.

AR shares easily outpaced the S&P 500 index (~22%) and the S&P’s upstream-heavy XOP index (~2.7%) over the past year.

Antero’s current market cap ($12.5 billion) values the company ahead of Ovintiv ($11.5 billion), Permian Resources ($11.4 billion) and Apache parent APA Corp. ($8.6 billion).

Other U.S. gas producers have also outpaced oily peers in the public markets.

Shares for Haynesville shale E&P Comstock Resources (CRK) are up around 155% over the past year.

Dallas Cowboys owner Jerry Jones now holds over 71% of Comstock’s outstanding common stock. Analysts question whether Jones could be making a run at taking Comstock private—in a similar fashion to Harold Hamm’s go-private buyout of Continental Resources in 2022.

Comstock and Antero are the two companies with the most torque to improving natural gas prices right now, Siebert Williams Shank & Co. Managing Director Gabriele Sorbara told Hart Energy.

Stock prices for other gassy names have grown in the past year, including EQT Corp. (62%), Expand Energy (39%), CNX Resources (57%), Gulfport Energy (44%) and Range Resources (35%).

Antero held 521,000 net acres of gas, NGL and oil properties, primarily in Ohio and West Virginia, as of year-end 2024, regulatory filings show.

RELATED

Analyst: Is Jerry Jones Making a Run to Take Comstock Private?

LNG, NGL upside

Antero is bullish on rising demand for its Appalachia gas volumes to feed U.S. LNG exports.

The company’s net production averaged 3.4 Bcfe/d in 2024, a 1% increase over 2023 levels, Antero told investors in fourth-quarter earnings on Feb. 13. Natural gas output averaged 2.2 Bcf/d in 2024.

Antero’s firm transportation portfolio sends 75% of its gas production into the Gulf Coast LNG corridor.

The startup of new LNG export facilities on the Gulf Coast should result in higher premium price realizations to NYMEX in the coming years, CFO Michael Kennedy said.

Venture Global’s Plaquemines plant—on the Mississippi River south of New Orleans—is currently pulling around 1.5 Bcf/d after exporting its first cargo in late December.

Justin Fowler, Antero’s senior vice president for natural gas marketing, said Plaquemines’ ramp up has been faster than market expectations.

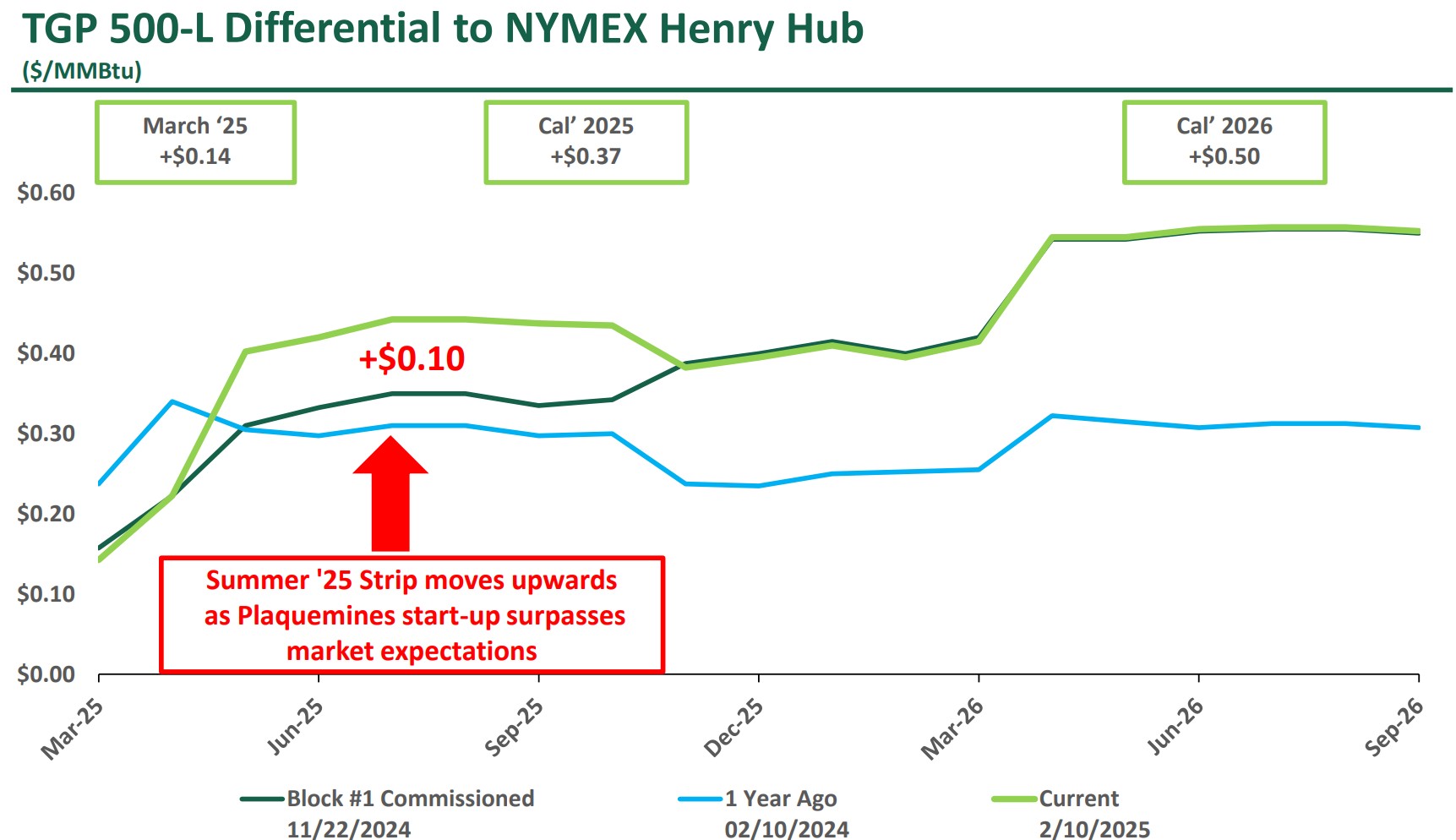

“Looking at the TGP 500-L basis—which is the basis hub with the most current exposure to Plaquemines—the quicker-than-anticipated ramp-up of the facility has already lifted summer 2025 pricing by $0.10/ MMBtu, compared to the strip pricing before the startup,” Fowler said.

For context: Every $0.25/Mcf improvement in natural gas strip pricing adds around $220 million to Antero’s incremental cash flow, Kennedy said during a Feb. 13 earnings call.

Gas producers are bullish on prices as more LNG exports tick online. Cheniere Energy’s expansion at Corpus Christi, Texas, began liquefaction in December. Full capacity from the seven-train expansion will be 1.3 Bcf/d, bringing the plant’s total output to more than 3.3 Bcf/d.

And Exxon Mobil’s long-awaited Golden Pass LNG plant is also expected to come online within the next 12 months. Golden Pass LNG has FERC approval for 2.6 Bcf/d.

Both projects “are expected to significantly increase the call on natural gas along the LNG corridor,” Fowler said.

NGLs are also a big part of Antero’s growth outlook. Antero’s liquids production averaged 209,000 bbl/d in 2024—an 8% increase year-over-year.

Last year, Antero realized a $1.41/bbl premium over Mont Belvieu prices, the best C3+ differentials in the company’s history, said Dave Cannelongo, senior vice president of liquids marketing.

Fourth-quarter realizations came in at a $3.09/bbl premium over Mont Belvieu.

Antero still expects to see high annual NGL export premiums this year.

“Those premiums, coupled with our domestic marketing efforts, are allowing us to set our guidance for 2025 at levels even higher than 2024's record year, resulting in a range for our C3+ NGLs of $1.50 to $2.50 per barrel premium to Mont Belvieu prices,” Cannelongo said.

Every $5/bbl improvement in NGL pricing adds another $200 million to Antero’s cash flow bucket.

RELATED

Recommended Reading

2025 Pinnacle Award: Christine Ehlig-Economides is a Pioneer in the Field and Classroom

2025-02-27 - University of Houston petroleum engineering professor Christine Ehlig-Economides has left an indelible mark on the industry and blazed a trail for women.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.