(Source: nikkytok/Shutterstock.com)

Memories are long in the oil patch, but thankfully, the sea has no memory. Every day on the water begins fresh and new, ripe with opportunities for those daring few willing to risk it all. The time-tested Permian Basin of Texas and New Mexico has held much of the energy industry’s focus in recent years. However, another proven basin, the Gulf of Mexico (GoM), has quietly staged a comeback in the roughly five years since the market downturn sent crude prices plummeting.

A quick check of the U.S. Energy Information Administration’s (EIA) GoM statistics shows a steady increase in production, from 1.3 MMbbl/d in January 2014 to 1.9 MMbbl/d in January 2019. The EIA expects the increased output to continue in the years ahead. According to the February 2019 update in its Short-term Energy Outlook, the EIA predicts U.S. crude oil production will average 12.4 MMbbl/d in 2019 and 13.2 MMbbl/d in 2020. The overall increases in crude oil production are, according to the EIA report, the result of continued growth in the Permian Basin as well as the expectation of 19 new projects to start in 2019 and 2020 in the GoM.

Many of those new projects were made possible through the careful combination of cost cutting, new technologies and the use of subsea tiebacks to existing infrastructure. This combo helped bring offshore breakeven costs down in response to the market downturn. The average pre-final investment decision breakeven dropped to $49/boe in 2018 compared to $78/boe in 2014, according to a November 2018 report by Wood Mackenzie.

The lower breakeven costs have made offshore competitive with shale plays. Speaking at the Marine Technology Society’s Offshore Industry Market Outlook 2019, Barry Donovan, managing director of FMI Capital Advisors, shared his thoughts with attendees on the offshore versus shale position.

“There is an amazing opportunity in the offshore market, and it should have an extra appeal to people because these wells can be prolific. Offshore wells can produce 10 times what a shale well can produce right off the bat and then—more importantly—it can hold that volume better than a shale well,” he said. “Interestingly, analysts and operators have been presenting a lot of evidence that the offshore breakeven costs have come down and are competitive.”

It is a position that John Hess, CEO of Hess Corp., also put forward in his presentation at the Scotia Howard Weil Conference held in March. According to Hess, the Liza project in Guyana’s Stabroek Block offers a breakeven superior to premier U.S. shale plays.

In his presentation Hess compared the development capex for Liza Phase 1 against that of a 50,000-net-acre development project in the Delaware Basin. The Liza project, with peak production of 120,000 boe/d from eight production wells with an average EUR of about 63 MMbbl of oil per well, is $3.7 billion. To produce 120,000 boe/d from a Delaware Basin development, it would require 1,500 production wells with an average EUR of about 0.7 MMbbl of oil per well and would ring up a development capex of $12.8 billion.

Donovan noted that, for the foeseeable future, the offshore industry has provided 30% of the global oil and gas production for the past decade. “There are many analysts out there telling us that the offshore is going to continue to provide that 30% of the world’s oil and gas production,” he said. “Offshore is important. It is not being replaced by onshore production, and I’ll go so far as saying that it can’t be.”

Adding to the appeal of lower breakevens in the GoM is current market dynamics, oil shortages and stable political climate, according to a Morningstar Commodities Research report. “The quality of Gulf crude, as well as the longer life of offshore wells, make it just as attractive as shale to large producers,” said Sandy Fielden, director of oil products research for Morningstar Commodities Research, in the report. “On top of that, in a market where OPEC cuts, Iranian sanctions, Venezuela’s meltdown and Canadian production controls have created a shortage of medium and heavy crude, Gulf of Mexico grades are valuable to both domestic and overseas refiners.”

One need only look to the results of the recent GoM regionwide lease sale that occurred in March for evidence of increased interest in the basin. The sale attracted 257 bids from 30 companies, with high bids totaling $244.3 million, a 37% increase (or about $66 million more) from the last lease sale in August 2018. The highest bid of the round came from Equinor with $24.5 million for Block 801 of the Mississippi Canyon protraction area.

“We saw a modest increase in overall spend, but it was outpaced by the increase in acreage leading to a lower amount per acre, furthering our hypothesis that it is a buyer’s market in the Gulf of Mexico,” said William Turner, senior research analyst at Wood Mackenzie, in a release.

“The number of companies participating has thinned out, with the only notable absence being Exxon Mobil. It seems those left in the Gulf of Mexico are committed to the region and taking this opportunity to quietly strengthen their prospect inventory,” Turner added.

In reviewing details of the sale, it would be difficult to miss the number of what Turner called “unique partnerships” between the majors and smaller players.

“Kosmos with Equinor, Fieldwood Energy with Chevron, LLOG with BP and Talos with EcoPetrol—this demonstrates a shrinking pool of players but also an increased willingness of the majors to partner with these more nimble players,” he said in the release.

In an interview with E&P, Turner added that the emergence of these more nimble players has been an interesting shift to watch over the last four years. “LLOG, for example, is focused in the Gulf of Mexico and is a smaller operator, but it has turned some heads in just how quickly it is able to turn around projects. Its lead times, even on standalone facilities, are very low,” he said. “Then you have Talos, which is in the U.S. Gulf of Mexico and also on the Mexican side as well. We’re seeing the emergence of these smaller but more regionally focused players juxtaposed with those larger players that exited. These operators are stepping into the gap left from these more globally diversified independents. Kosmos is a great example of one company that has stepped in with the capability to actually operate in the region.”

Building on greatness

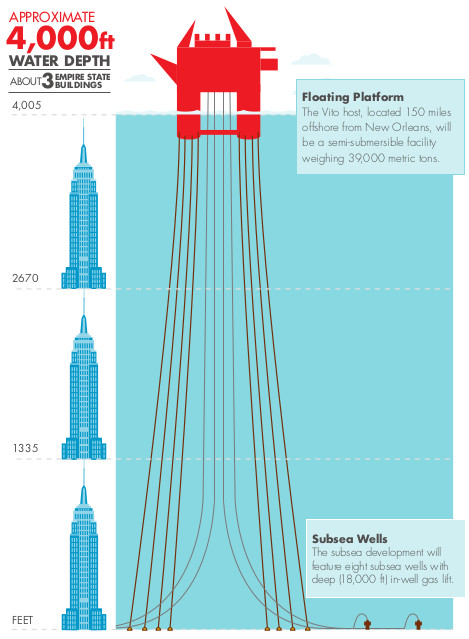

While Guyana is far removed from the GoM, the breakeven comparison still rings true in the basin. Take, for example, the final investment decision announcement by Shell regarding its Vito deepwater development in the GoM. The operator noted that the project’s forward-looking, breakeven price estimated to be less than $35/bbl. The field, located over four blocks in the Mississippi Canyon protraction area, is about 240 km (150 miles) south of New Orleans. Peak production for the Vito Field is expected to be about 100,000 boe/d, and it holds an estimated recoverable resource of 300 MMboe, according to the announcement. Production is scheduled to begin in 2021.

“With a lower cost developmental approach, the Vito project is a very competitive and attractive opportunity industrywide,” said Andy Brown, Shell Upstream director, in the release. “Our ability to advance this world-class resource is a testament to the skill and ingenuity of our development, engineering and drilling teams.”

According to the company, in 2015 the project was redesigned, resulting in cost estimate reductions of more than 70% from the original concept. The company credits the savings to a simplified design and through collaboration with the project’s vendors.

In July 2018, Subsea 7 announced that it was contracted by Shell for the project management, engineering, procurement, installation and pull-in of two 12-in. infield production flowlines with 10-in. steel catenary risers (SCRs), one gas-lift flowline and SCR, and an umbilical system at Vito. Installation activities are scheduled for 2020 and 2021, according to Subsea 7.

“We have a collaborative partnership across our management teams, where synergies and shared goals are powerful drivers in delivering a differentiated and value-added service,” said Craig Broussard, Subsea 7’s vice president for the GoM, in a release. “This award will draw on our expertise to ensure our client is given the competency, cost-efficiency and project capability they need to unlock the full potential of this significant deepwater development.”

In November 2018, the company was awarded a second construction contract for the Vito project by Enbridge Offshore Facilities for the transportation and installation of 80 km (50 miles) of 18-in. oil export pipelines, 27 km (17 miles) of 10-in. gas export pipelines and 4.8 km (3 miles) of associated SCRs and pipeline end terminations. The activities are scheduled for 2019 and 2020, according to the release.

Technology advances

Deepwater projects contribute to much of the production growth in the GoM, with advances in technology making it possible to do more with in-place infrastructure. In October 2018, BP’s Thunder Horse Northwest Expansion came online, boosting production at Thunder Horse by an estimated 30,000 boe/d at its peak, taking gross output at one of the largest oil fields in the GoM to more than 200,000 boe/d. Initially planned for startup in early 2019, the project started up four months ahead of schedule and 15% under budget, according to the company.

In January, BP announced its approval of the $1.3 billion Atlantis Phase 3 development that will significantly expand the production capabilities of the field. Advanced seismic imaging and reservoir characterization revealed an additional 400 MMbbl of oil in place, according to the company. The development will produce an additional 38,000 bbl/d when it comes online in 2020.

According to BP, an additional 1 Bbbl of oil in place at the Thunder Horse Field also was identified using the same advanced seismic imaging technology and analysis.

“Atlantis Phase 3 shows how our latest technologies and digital techniques create real value—identifying opportunities, driving efficiencies and enabling the delivery of major projects. Developments like this are building an exciting future for our business in the Gulf,” said Starlee Sykes, BP’s regional president for the GoM and Canada, in a release.

Atlantis Phase 3 will include the construction of a new subsea production system from eight new wells that will be tied into the current platform located about 240 km (150 miles) south of New Orleans.

Longer distance tieback and greater water depth present increased flow assurance challenges. Subsea 7’s electrically heat-traced flowline (EHTF) technology ensures the right temperature within the flowline is maintained to reduce the risk of blockages from hydrates or wax.

In December 2018, Subsea 7 announced the award of a subsea umbilicals, risers and flowlines (SURF) contract by BP for the Manuel project in the GoM. The Subsea Integration Alliance (SIA), the partnership between Subsea 7 and OneSubsea, a Schlumberger company, will deliver a fully integrated solution to the project, according to a release. The Manuel project is a two-well development tieback to the Na Kika production facility and will be the first in the U.S. to use the

EHTF technology.

“The award of the Manuel project is a clear demonstration of the power of collaboration between all stakeholders. Together with our SIA partner, OneSubsea, and the BP team, we have produced an optimized solution that will see the deployment of EHTF technology,” Broussard said in a release. “This has enabled us to reduce the total cost of the project, while accelerating the first oil target date to just 24 months from discovery. SIA has been able to deliver this accelerated schedule by removing critical path challenges through early engagement, on both SPS [subsea production system] and SURF scopes of work. This has ultimately allowed us to achieve a solution that creates sustainable value for all parties despite a challenging cost environment.”

Another challenge operators face in the GoM is the need to isolate multiple hydrocarbon-bearing sands across the drilling and production liners. At Hess’ Stampede deepwater development project, Halliburton installed 37 XtremeGrip expandable liner hangers across seven wells as of September 2018, with no liner-top leaks or remedial work required, according to a press release.

The Stampede Field is located 185 km (115 miles) south of Fourchon, La., in Green Canyon blocks 468, 511 and 512 in about 1,067 m (3,500 ft) of water. Hess achieved first oil in January 2018, just over three years after project sanction.

The liner hangers were installed to a depth of 9,425 m (30,924 ft), setting a record depth for the XtremeGrip system. The system provides an unrestricted flow path prior to setting, and its ability to rotate while cementing provided effective and reliable isolation without costly cement remediation. Each Stampede well includes up to five XtremeGrip liner installations, making the consecutive liner runs a major part of the well construction process, according to the release.

The installations began with hanging a 137⁄8-in. drilling liner inside a 16-in. casing. The subsequent hangers support another drilling liner, followed by two production liners, through multiple reservoirs. Each well then had a production liner tied back with a scab liner for structural integrity, according to the release.

“In technically challenging offshore environments, safe and flawless execution is vital to the ultimate success of the project,” said Mark Dawson, vice president of Halliburton Completion Tools, in the release. “We are very pleased with the reliability of the XtremeGrip system in ultradeep wells. Supported by Hess’ highly collaborative work environment, we delivered the excellent results achieved on the Stampede wells. The overall scope of these projects cumulated in hanging over 143,000 ft [43.6 km] of liner casing over 27 miles [43.4 km] at a total buoyed weight of 9.3 million pounds. Halliburton provided these impressive results without any costly liner top remediation for our customer.”

After five long years, it is good to see operators step back into the GoM spotlight. While the sea has no memory, the persistent poking and prodding by humans into the seafloor have provided plenty of surface and subsurface landmarks to guide future operations.

________________________________________________________________________________________________

This story first appeared in E&P magazine's "2019 Offshore Technology Yearbook" issue, which published in May. Read the other "2019 Offshore Technology Yearbook" articles:

OVERVIEWS:

Back to Deep Water (story above)

Mexico Finding Its Place in Offshore Landscape

Middle East Offshore Market Treads Recovery Path

KEY PLAYERS:

Operators Foresee Vast Potential

TECHNOLOGY:

New Generation of Offshore Drilling Tools Targets Safety, Wellbore Conditions

Platforms Enter a New Cycle

Subsea Sector Recovery Underway

Evolving ROVs

CASE STUDIES:

Advanced Flowmetering

Composites Gain Ground

PRODUCTION FORECAST:

Americas and Middle East Put Offshore Back on the Map

Recommended Reading

Diamondback Energy Closes $4.1B Double Eagle IV Acquisition

2025-04-02 - Diamondback Energy Inc. closed on its approximately $4.1 billion deal to buy EnCap Investments’ Double Eagle IV, adding approximately 40,000 net acres in the Midland Basin to its portfolio.

CenterPoint Energy Completes NatGas Pipeline Sale to Bernhard

2025-04-01 - CenterPoint Energy Inc. has closed on a sale of natural gas distribution utilities in Louisiana and Mississippi to Bernhard Capital Partners.

Ring Energy Closes Central Basin Platform M&A from Lime Rock

2025-04-01 - Ring Energy added 17,700 net acres and 2,300 boe/d of production in the Central Basin Platform through an acquisition from Lime Rock Resources IV.

Boaz Energy Completes Sale of PermRock Properties to T2S

2025-04-01 - Boaz Energy II has completed the sale of PermRock Royalty Trust’s underlying oil and gas properties to T2S Permian Acquisition II LLC.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.