Oklahoma E&P Camino Natural Resources is eyeing a sale that could potentially value the company around $2 billion. (Source: Shutterstock.com)

Oklahoma E&P Camino Natural Resources is exploring a sale valued at around $2 billion, according to media reports published on Jan. 30.

Camino’s private equity sponsor, NGP Energy Capital Management, has retained RBC Capital Markets to market a sales process that began earlier in January, Reuters reported.

Hart Energy has reached out to Camino, NGP and RBC for more information.

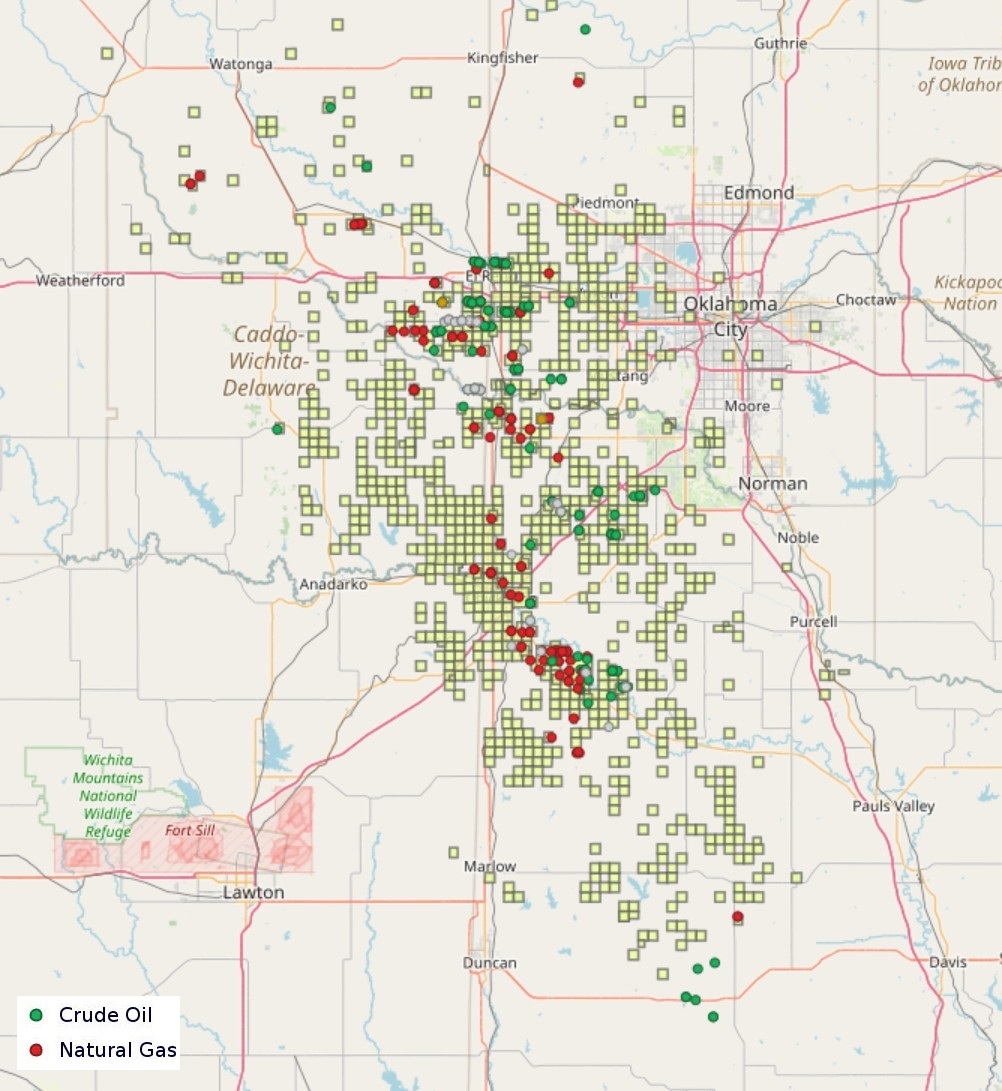

Camino is one of the top private producers in Oklahoma’s Anadarko Basin, where it holds around 135,000 net acres. The company currently manages around 360 producing wells in Oklahoma, according to state data. Production is reportedly expected to average about 81,000 boe/d (~50% natural gas) in 2025.

With asking prices for Permian Basin assets sky-high, producers have taken a harder look at M&A opportunities left in the Midcontinent.

This week, Diversified Energy announced plans to acquire EIG-backed Maverick Natural Resources for $1.275 billion. Maverick holds a large position in the western Anadarko Basin; the deal also includes Maverick’s Permian holdings.

In September 2024, private producer Validus Energy struck a deal to acquire Oklahoma E&P Citizen Energy for over $2 billion.

SandRidge Energy closed a $144 million acquisition of western Anadarko assets from Upland Exploration last fall. Upland was a leading developer in the Cherokee window of western Oklahoma.

Mach Natural Resources has also been a consolidator in the Midcontinent, closing two Oklahoma transactions last fall for $136 million. Mach is led by former Chesapeake and SandRidge executive Tom Ward.

RELATED

Recommended Reading

Enchanted Rock’s Microgrids Pull Double Duty with Both Backup, Grid Support

2025-02-21 - Enchanted Rock’s natural gas-fired generators can start up with just a few seconds of notice to easily provide support for a stressed ERCOT grid.

APA Group to Build Pipeline in Expanding Australian Gas Play

2024-12-17 - APA Group will build and operate a 12-inch, 23-mile natural gas pipeline for a proposed 40-MMcf/d pilot drilling project in Australia.

E&P Highlights: Dec. 16, 2024

2024-12-16 - Here’s a roundup of the latest E&P headlines, including a pair of contracts awarded offshore Brazil, development progress in the Tishomingo Field in Oklahoma and a partnership that will deploy advanced electric simul-frac fleets across the Permian Basin.

DNO Makes Another Norwegian North Sea Discovery

2024-12-17 - DNO ASA estimated gross recoverable resources in the range of 2 million to 13 million barrels of oil equivalent at its discovery on the Ringand prospect in the North Sea.

Baker Hughes: US Drillers Keep Oil, NatGas Rigs Unchanged for Second Week

2024-12-20 - U.S. energy firms this week kept the number of oil and natural gas rigs unchanged for the second week in a row.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.