A multi-well drilling operation for Berry Corp. in the Indian Canyon of Duchesne County, Utah. (Source: Berry Corp.)

Berry Corp.’s legacy is in California’s Central Valley, but its growth engine, CEO Fernando Araujo believes, is in Utah’s Uinta Basin.

Dallas-based Berry aims to grow in the Uinta and drill more horizontal wells through farm-ins and other partnerships, Araujo told Hart Energy.

Around 80% of Berry’s production still comes from Kern County, California, where the company was founded and first struck oil over a century ago.

It’s harder to drill for oil in California today than it was in the early 1900s. Regulation and red tape mires the fossil fuel industry in the Golden State—though Berry still finds ways to operate successfully in California, Araujo said.

But to continue growing, Berry has looked outside of California from time to time. In 2003, Berry acquired assets in Utah’s Uinta Basin, where the company manages production from roughly 1,200 vertical wells.

Berry’s Utah production averaged 4,700 boe/d during the third quarter; California output averaged 20,100 boe/d.

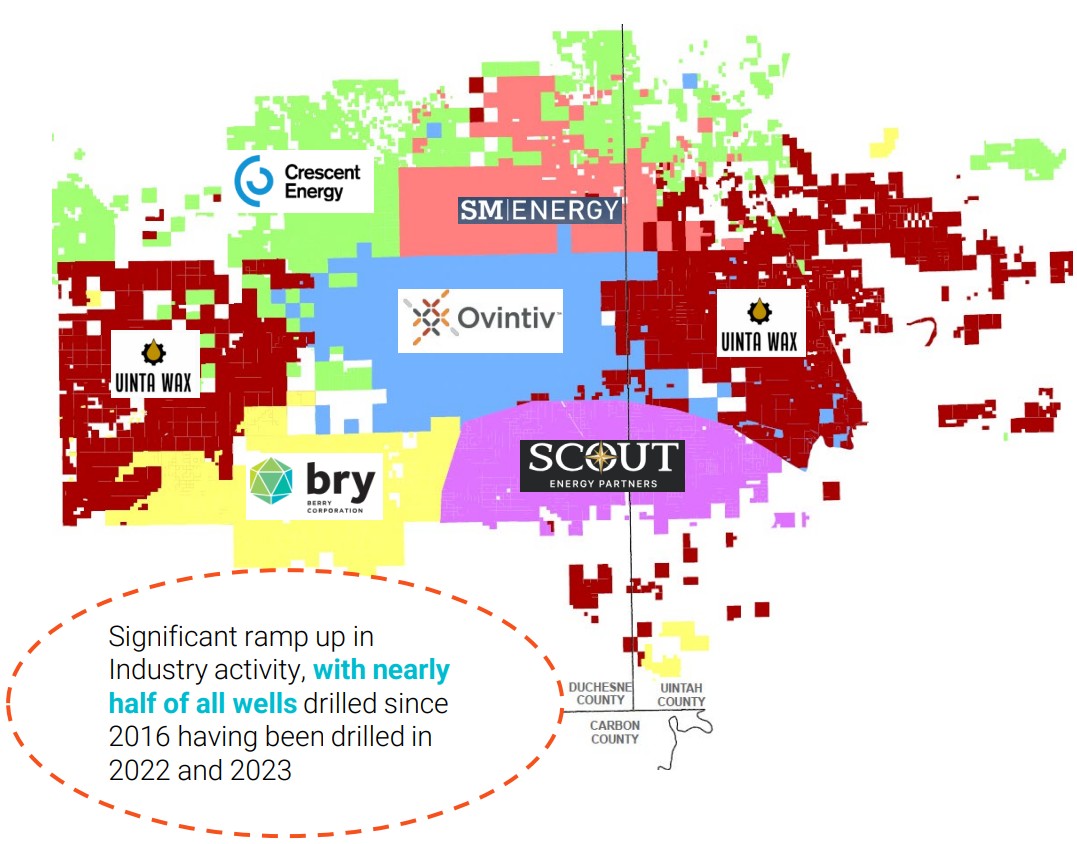

Berry is excited about the fast pace of horizontal development in the Uinta, with nearly half of drilling activity since 2016 occurring in just the past two years.

Berry sees drilling its 100,000-acre Uinta Basin asset as a transformational opportunity, Araujo said.

“We’re very excited about Utah, especially now with the potential development of our fields with horizontal wells,” he said.

RELATED

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

Farm-ins

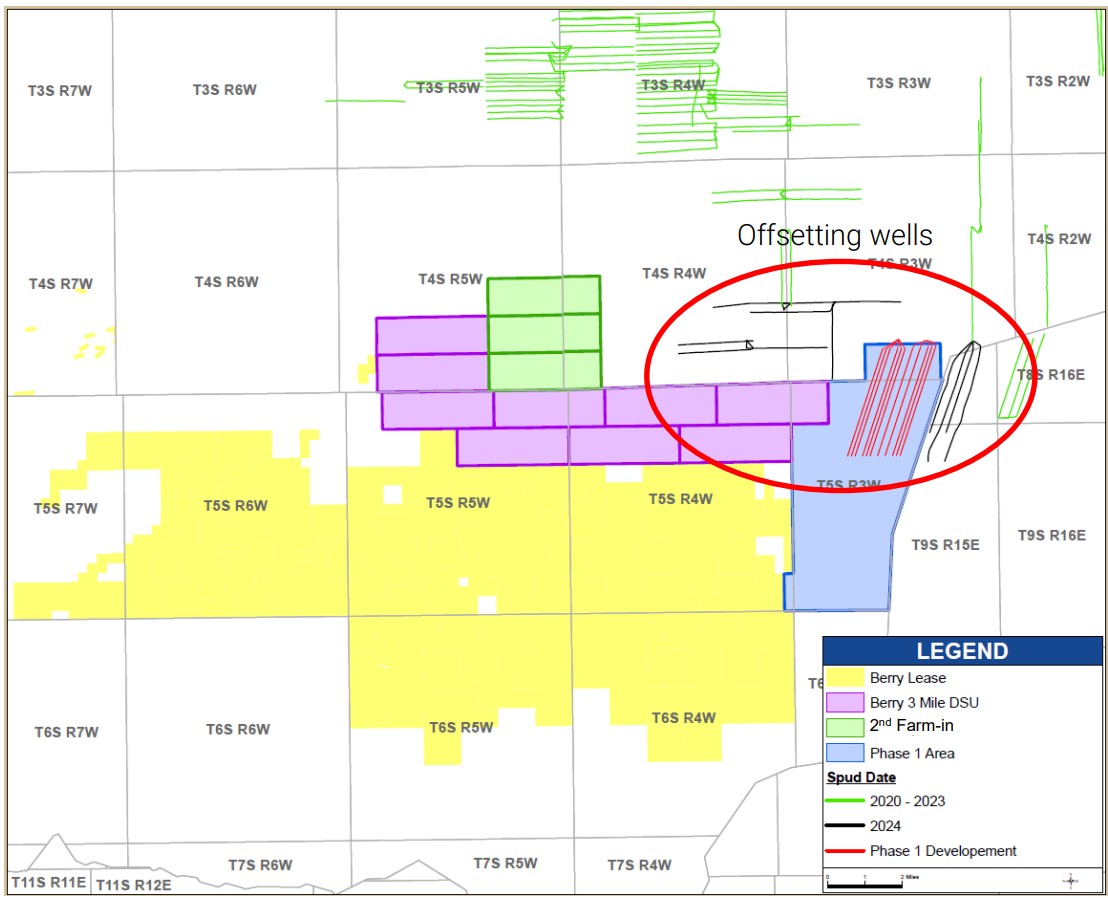

Berry made its first moves to horizontally develop in the Uinta earlier this year.

During the second quarter, Berry acquired a 21% working interest in four, 2- to 3-mile horizontal wells directly adjacent to its existing Uinta operations. The wells were landed in the Green River Formation’s Uteland Butte reservoir—the most popular bench among Uinta horizontal operators so far.

By August, the results indicated better wells than Berry’s pre-drill estimates. The wells IP’ed at 1,100 boe/d each, 90% oil.

But they were landed in a shallower end of the basin with relatively lower reservoir pressures, so IP’s are slightly lower than wells in the northern end of the deep basin, Araujo noted on an investor call.

Impressed with the early results, Berry doubled down on the Uinta. In November, Berry exchanged certain leasehold interests in Duchesne County, Utah, for that of another Duchesne County operator’s.

Berry received a 17% working interest in three, 3-mile drilling spacing units (DSUs) in exchange for a 75% working interest in one, 2-mile DSU, according to regulatory filings.

The second farm-in agreement calls for up to 12 horizontal wells; The first two Uteland Butte wells are expected to be online by early next year.

“Another six wells will be drilled in ’25 and the rest of the wells will be drilled in ’26,” Araujo said.

Most of the wells covered under the second farm-in agreement will target the Uteland Butte. But one or two wells are planned to target the deeper Wasatch Formation, Araujo said.

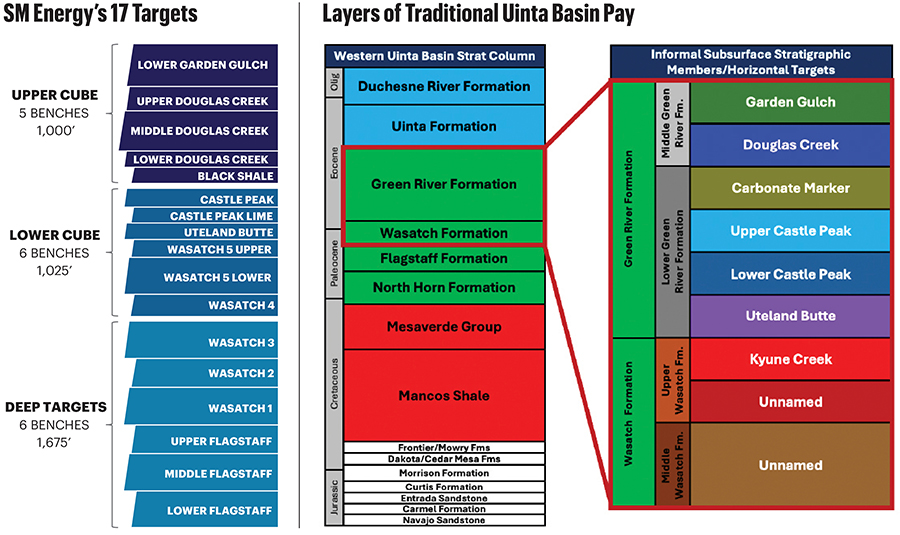

Exploration of the Uinta’s stacked pay is still in its earliest stages. On the Uinta asset that SM Energy acquired from XCL Resources in a $2.6 billion transaction this summer, SM has identified 17 productive benches.

Secondary Uinta benches include the Castle Peak, Douglas Creek and Wasatch intervals.

“We’re exposed to the Castle Peak, as well,” Araujo said. “We’ve got the Uteland Butte, and we’ve got the Wasatch in a couple different places.”

Some operators are exploring even deeper underground. Private operator Anschutz Exploration landed two laterals in Mancos Shale outside of the Uinta’s core oil play, state records show.

The Mancos underlies the Wasatch and Green River formations.

RELATED

Anschutz Explores Utah Mancos Shale Near Red-Hot Uinta Basin

Joint ventures

Farm-ins are one way to accelerate the appraisal phase of Berry’s Uinta asset. Another way is a drilling joint venture (JV).

Berry is seeking a JV partner for its 2025 and 2026 drilling campaign, Araujo said.

“This will allow us to not only mitigate the capital exposure,” he said, “but also bring in partners with additional technical resources.”

Berry is in the midst of a formal process to look for an ideal JV partner in Utah. The company aims to announce a partnership early next year.

Araujo said most conversations about a potential JV have been with existing Uinta Basin operators.

By “no later than” second-quarter 2025, Berry aims to be drilling its own horizontal wells on its own Utah acreage, Araujo said.

“The potential that we have, again, is huge,” he said.

The Uinta Basin has attracted a considerable volume of M&A this year as operators searched for drilling runway outside of the expensive Permian Basin.

SM partnered with non-operated player Northern Oil & Gas (NOG) to acquire leading Uinta producer XCL this summer. SM acquired an 80% undivided interest in XCL’s assets for $2.1 billion, while NOG picked up the remaining 20% for $500 million.

Following on the momentum, Ovintiv recently agreed to sell its Uinta asset for $2 billion to private E&P FourPoint Resources.

RELATED

Recommended Reading

E&Ps Posting Big Dean Wells at Midland’s Martin-Howard Border

2025-04-11 - Diamondback Energy, SM Energy and Occidental Petroleum are adding Dean laterals to multi-well developments south of the Dean play’s hotspot in southern Dawson County, according to Texas Railroad Commission data.

On The Market This Week (April 7, 2025)

2025-04-11 - Here is a roundup of marketed oil and gas leaseholds in the Permian, Uinta, Haynesville and Niobrara from select E&Ps for the week of April 7, 2025.

US Oil Rig Count Falls by Most in a Week Since June 2023

2025-04-11 - The oil and gas rig count fell by seven to 583 in the week to April 11. Baker Hughes said this week's decline puts the total rig count down 34 rigs, or 6% below this time last year.

IOG, Elevation Resources to Jointly Develop Permian Wells

2025-04-10 - IOG Resources and Elevation Resources’ partnership will focus on drilling 10 horizontal Barnett wells in the Permian’s Andrews County, Texas.

Saudi Aramco Discovers 14 Minor Oil, Gas Reservoirs

2025-04-10 - Saudi Aramco’s discoveries in the eastern region and Empty Quarter totaled about 8,200 bbl/d.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.