Devon Energy is digging deeper in the Williston Basin of North Dakota through a $5 billion deal with EnCap-backed Grayson Mill Energy. (Source: Shutterstock)

Devon Energy is the latest large-cap producer to jump into the M&A cycle, picking up Grayson Mill Energy’s Williston Basin assets in a $5 billion deal.

Oklahoma City-based Devon is a bit late to the M&A party, but not for lack of trying. The company has evaluated several potential acquisitions across its multi-basin footprint over the past year.

Devon was reportedly targeting a potential takeout of Bakken-heavy E&P Enerplus Corp. earlier this year, but Enerplus was later acquired by Chord Energy for $4 billion.

In the Permian Basin, Devon also reportedly looked at acquisitions of private producers Endeavor Energy Resources and CrownRock LP.

Endeavor was ultimately acquired by Diamondback Energy for $26 billion; CrownRock by Occidental Petroleum for $12 billion. Both deals are still pending.

Devon also has asset footprints in the Anadarko Basin, the Eagle Ford Shale of South Texas and the Powder River Basin of Wyoming.

But Devon finally landed on a $5 billion cash-and-stock acquisition from Williston Basin E&P Grayson Mill, a deal analysts say will extend Devon’s drilling runway and enhance shareholder returns.

The $5 billion Williston Basin acquisition—$3.25 billion in cash and $1.75 billion in stock—helps address Devon’s inventory concerns, creates synergies and significantly expands the company’s production base in the basin, Gabriele Sorbara, managing director of equity research at Siebert Williams Shank & Co., wrote in a July 8 report.

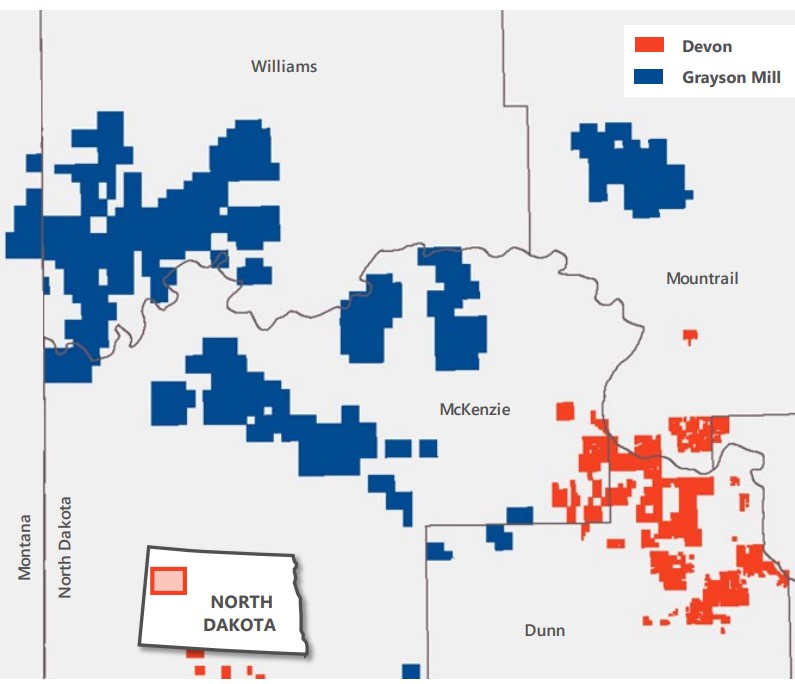

The Grayson Mill acquisition adds another 307,000 net acres (70% working interest) to Devon’s Williston Basin position.

The bolt-on is expected to boost Devon’s inventory by around 800 gross locations, including approximately 300 refrac opportunities, the company said in an investor presentation.

Once combined, Devon will have around a decade of drilling inventory in the Williston Basin at a $80/bbl WTI oil price and a three-rig development cadence.

The majority of the 500 new well locations target the Bakken shale formation, while around 20% target the Three Forks interval, the company said on a July 8 call with analysts.

Around 40% of the new locations identified are 3-mile lateral wells; the rest are 2-mile wells.

The acquired Grayson Mill assets are expected to produce 100,000 boe/d (55% oil) in 2025, growing Devon’s pro forma Williston production to approximately 150,000 boe/d (57% oil).

Devon President and CEO Rick Muncrief said the company plans to hold Williston Basin production at the 150,000 boe/d level “for the foreseeable future.”

Clay Gaspar, Devon’s executive vice president and COO, reiterated that the Grayson Mill deal won’t affect Devon’s activity in the Permian’s Delaware Basin, where the company is investing the most across its portfolio.

RELATED

Devon Energy Expands Williston Footprint With $5B Grayson Mill Deal

Dealmaking moves north

Devon’s acquisition of Grayson Mill continues a growing trend of buyers looking beyond the prolific Permian Basin for acquisition opportunities of scale, according to Andrew Dittmar, principal analyst at Enverus Intelligence Research.

Grayson Mill was one of the largest remaining private opportunities likely to come up for sale—and Grayson Mill has reportedly been shopping a sale for months.

“Among remaining private equity-sponsored E&Ps, as opposed to truly private companies like Continental Resources, Grayson Mill had the largest count of remaining undeveloped gross drilling locations,” Dittmar wrote in a July 8 report.

For the Grayson Mill assets, Enverus ascribed between 70% and 80% of the total deal value to existing production, with the remainder going to undeveloped inventory.

“That was also the case in its prior acquisitions of RimRock in the Williston and Validus in the Eagle Ford,” Dittmar wrote. “However, a more conservative outlook on deals may have prevented Devon from coming out on top in the various scrambles for core Permian opportunities.”

According to analysts at Truist Securities and Siebert Williams Shank & Co., Devon paid around $50,000 per flowing oil-equivalent barrel of production—a slight discount to Devon’s pre-deal average at $51,363/boe.

Chord Energy paid approximately $40,000/boe of production when acquiring Enerplus Corp., per Truist Securities data.

Other operators are hoping to find value and runway in the Williston Basin. TXO Partners LP, led by former XTO Energy executive Bob Simpson, recently announced entering the Williston Basin through acquisition.

TXO Partners’ two Williston transactions—one with Eagle Mountain Energy Partners and the other with an undisclosed private seller—include assets in the Elm Coulee field of Montana and the Russian Creek field of North Dakota.

A historic wave of U.S. upstream M&A transactions will set up an interesting future for the Williston Basin. Chord now finds itself in an intriguing position, Dittmar wrote.

“Grayson was a natural target for Chord with closely fitting operations. Now that Devon has committed to the basin, Chord could find itself the next acquisition target in another of the public-public company mergers that have largely dominated M&A activity,” he wrote.

Smaller M&A opportunities in the Williston could also open soon.

Exxon Mobil and its shale subsidiary, XTO Energy, maintain a legacy portfolio of Williston Basin assets. But the supermajor’s U.S. onshore efforts are much more focused on the Permian Basin, where Exxon closed a $60 billion acquisition of Pioneer Natural Resources.

Fellow U.S. supermajor Chevron Corp. is acquiring Hess Corp. for $55 billion mainly for Hess’ irreplicable position offshore Guyana—but Hess also owns a massive portfolio of assets in the Williston Basin.

Both Exxon and Chevron could look to tap the Williston Basin when considering non-core asset sales to reduce debt.

Another smaller Williston M&A opportunity is private producer Kraken Resources, Dittmar said.

ConocoPhillips’ $17.1 billion deal to buy Marathon Oil Corp. will also consolidate large swathes of the Williston Basin.

RELATED

The Shape of M&A to Come: Is Devon Up Next to Join the Spree?

Recommended Reading

E&Ps Posting Big Dean Wells at Midland’s Martin-Howard Border

2025-04-11 - Diamondback Energy, SM Energy and Occidental Petroleum are adding Dean laterals to multi-well developments south of the Dean play’s hotspot in southern Dawson County, according to Texas Railroad Commission data.

On The Market This Week (April 7, 2025)

2025-04-11 - Here is a roundup of marketed oil and gas leaseholds in the Permian, Uinta, Haynesville and Niobrara from select E&Ps for the week of April 7, 2025.

US Oil Rig Count Falls by Most in a Week Since June 2023

2025-04-11 - The oil and gas rig count fell by seven to 583 in the week to April 11. Baker Hughes said this week's decline puts the total rig count down 34 rigs, or 6% below this time last year.

IOG, Elevation Resources to Jointly Develop Permian Wells

2025-04-10 - IOG Resources and Elevation Resources’ partnership will focus on drilling 10 horizontal Barnett wells in the Permian’s Andrews County, Texas.

Saudi Aramco Discovers 14 Minor Oil, Gas Reservoirs

2025-04-10 - Saudi Aramco’s discoveries in the eastern region and Empty Quarter totaled about 8,200 bbl/d.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.