Ovintiv is adding 109,000 net acres and ~900 drilling locations in the Alberta’s (pictured) Montney shale through an acquisition from Paramount Resources. (Source: Shutterstock/ Ovintiv)

Instead of growing in the expensive Permian Basin, Ovintiv is instead putting capital to work in Alberta’s Montney Shale play.

Rumors have swirled that Denver-based Ovintiv Inc. could look to grow its holdings in the Permian Basin, where the company spent $4.28 billion acquiring three private equity-backed E&Ps last year.

Media reports suggested a potential tie-up in the works between Ovintiv and Double Eagle IV, one of the most highly coveted private producers left in the Midland Basin.

But costs to buy in the red-hot Permian Basin have risen rapidly, Ovintiv President and CEO Brendan McCracken said.

“Since we did our Permian transaction, we’ve seen the cost of acquiring core Midland Basin and Delaware Basin assets go up pretty significantly,” McCracken said during a Nov. 14 call with analysts.

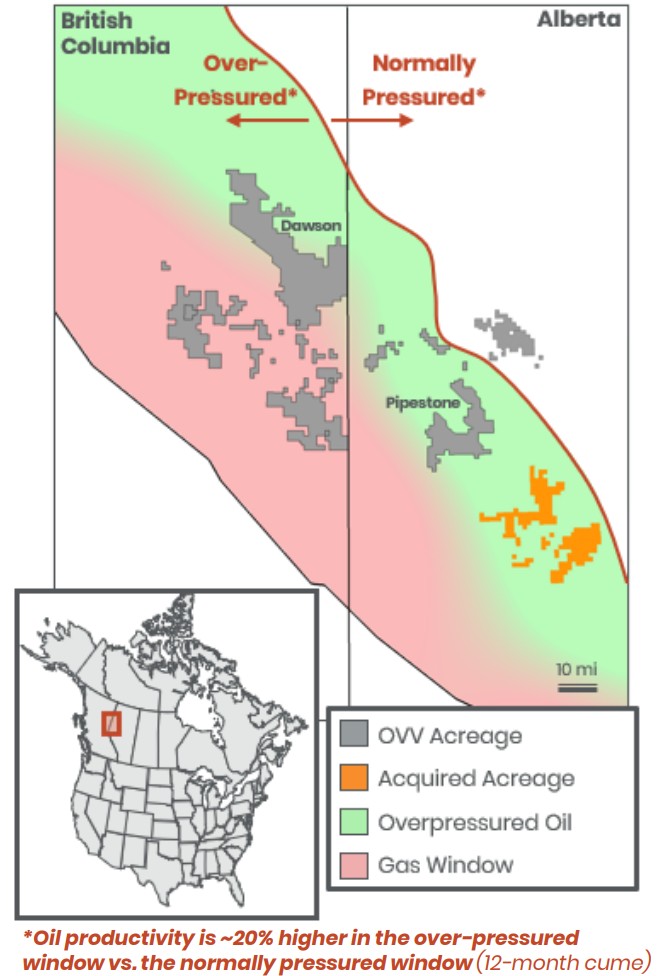

Rather than the Permian, the Canadian-born operator is growing north of the border where it already has deep roots—acquiring Montney assets from Paramount Resources Ltd. for US$2.38 billion (CA$3.33 billion) in cash.

The Paramount deal will add 109,000 net acres (80% undeveloped) and 70,000 boe/d of production (~25,000 bbl/d of oil and condensate) to Ovintiv’s Montney portfolio.

The deal adds around 900 net undeveloped drilling locations with 10,000-ft laterals, including 600 “premium return” locations capable of generating over a 35% rate of return at $55/bbl WTI oil and $2.75/MMBtu NYMEX gas.

“It’s hard not to notice the disparity here, where we’re able to acquire these undeveloped locations at under $1 million per location,” McCracken said, “which is quite unheard of in the Lower 48 today.”

Truist Securities analysts considered the deal positive “given the price paid for the Montney appears lower than recent deals,” analyst Neal Dingmann wrote in a Nov. 14 report.

The transactions are slated to close in the first quarter of 2025.

Ovintiv traces its origin back to the late 1800s, when workers for the Canadian Pacific Railway struck natural gas while drilling water wells. Formerly branded as Encana, the Calgary-based company reorganized and moved its headquarters to Denver in 2020.

RELATED

Ovintiv Swaps the Uinta for Montney in Multiple M&A Moves

Considering condensate

Paramount focused on pad development on the Montney asset, which leaves the undeveloped part of the acreage unencumbered by one-off parent wells, McCracken said.

The incremental 70,000 boe/d, including 25,000 bbl/d of condensate production, will nearly double Ovintiv’s Montney oil volumes.

“The primary driver of value in the Montney is condensate production,” McCracken said, “and since there is a structural, long-term deficit in the [Western Canadian Select] market, Montney condensate will continue to trade tightly to WTI for the foreseeable future.”

“Because of this, we refer to Montney condensate as oil,” he continued.

Montney condensate is frequently used as a diluent blended in Western Canadian Select (WCS), one of North America’s largest heavy crude oil streams.

The Paramount Montney asset is highly complementary to Ovintiv’s preferred brand of multi-bench cube development. The company will develop the acreage targeting up to three productive Montney benches, consistent with Ovintiv’s practices on adjacent acreage and practices by offset operators, McCracken said.

“Here the upside would be at three benches across the position, and the base case at a mix of two and three,” he said. “I think pretty early on you’ll see us stepping into that three-bench development and testing that.”

Ovintiv’s Montney oil and condensate production is expected to average 55,000 bbl/d after closing. The company’s Montney land position will grow to 369,000 net acres.

As part of the deal, Ovintiv will also swap its Horn River unconventional gas assets in British Columbia with Paramount, while Ovintiv will pick up Paramount’s Zama asset in Alberta.

The Horn River properties include Ovintiv’s 50% operated interest within its current joint venture (JV) with Paramount at the Two Island Lake field, and a 50% operated interest at the Kiwigana field.

“Our partner and neighbor in the Horn River assets is Paramount, so it made sense for them to grow their working interest in that asset,” McCracken said.

Ovintiv stock closed up nearly 6% at $44.72 per share following the announcement.

RELATED

Production from Canada’s Montney, Duvernay Gains Momentum

Uinta sale

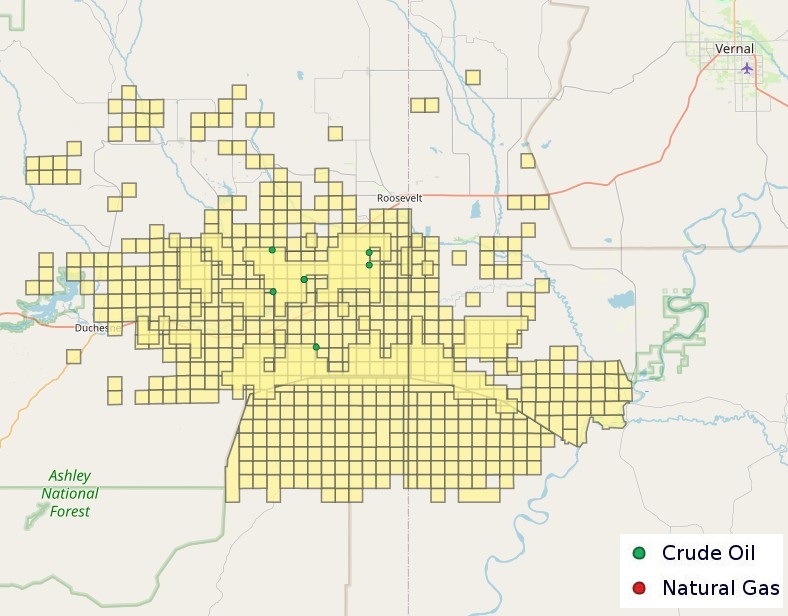

To finance part of the Montney acquisition, Ovintiv is selling assets in Utah’s emerging Uinta Basin for $2 billion to private operator FourPoint Resources LLC.

The Uinta asset includes 126,000 net acres and production of 29,000 bbl/d, FourPoint said. The assets are primarily within Duchesne and Uintah counties, Utah, according to Ovintiv’s regulatory filings.

FourPoint is backed by private equity partners Quantum Capital Group and Kayne Anderson.

FourPoint previously developed assets in the western Anadarko Basin before the company restructured and its assets were transferred to an affiliate of Maverick Natural Resources in late 2020.

The company is also active in the Permian Basin but was considering new M&A opportunities earlier this year, FourPoint executives told Hart Energy.

George Solich, chairman and CEO of FourPoint, previously led Cordillera Energy Partners, which sold to Apache Corp. for $2.85 billion in 2012.

“The opportunity to partner with Quantum and Kayne Anderson, two of the premier private equity firms in energy, will allow our team to immediately begin the work to grow production, cash flow and create value on one of the highest quality, inventory-rich assets in the Lower 48,” Solich said in a Nov. 14 statement.

The Uinta Basin has seen increasing interest lately. Utah drew the attention of public E&P SM Energy, which closed an acquisition of leading Uinta producer XCL Resources in October.

SM acquired an 80% undivided interest in XCL’s assets, while Northern Oil & Gas (NOG) picked up a 20% non-operated stake. The total purchase price was approximately $2.6 billion.

Ovintiv didn’t see the Uinta as competitive for growth capital compared to its Permian and Montney assets, said Enverus Intelligence Research Principal Analyst Andrew Dittmar.

“Trading out the Uinta for a larger asset in one of those two plays was a likely strategic move for the company,” Dittmar said. “And, given the current sky-high pricing of inventory in the Permian compared to relative discounts in the Montney, it looks like an easy decision for Ovintiv to jump on the opportunity to acquire the Paramount assets.”

RELATED

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

Recommended Reading

The Chicken or the Egg? Policy and Tech Needed to Enable Hydrogen Market

2025-04-11 - Hydrogen project developers ask themselves the famous ‘chicken or the egg’ conundrum as they lean on policy, incentives and technology to bridge cost gaps.

Nabors, Corva Expand Alliance to Boost AI-Driven Innovation at Rig Sites

2025-04-11 - Nabors Drilling Technologies and Corva AI will use the RigCloud platform to provide real-time insights to crews directly at drilling sites, the companies said.

USD Completes Final Asset Sale of Hardisty Terminal

2025-04-11 - USD Partners was obligated to sell the Hardisty Terminal, in Alberta, Canada, after entering a forbearance agreement with its lenders on June 21 2024.

ADNOC Explores $9B Acquisition of Aethon’s Haynesville Assets—Report

2025-04-11 - Abu Dhabi National Oil Co. (ADNOC) is evaluating an acquisition of natural gas assets from Aethon Energy Management valued at around $9 billion, Bloomberg reported April 11.

E&Ps Posting Big Dean Wells at Midland’s Martin-Howard Border

2025-04-11 - Diamondback Energy, SM Energy and Occidental Petroleum are adding Dean laterals to multi-well developments south of the Dean play’s hotspot in southern Dawson County, according to Texas Railroad Commission data.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.