Dennis Degner, president and CEO of Range Resources, speaks with Hart Energy Editorial Director Jordan Blum at the DUG Appalachia Conference & Expo in Pittsburgh, Pennsylvania, on Nov. 7, 2024. (Source: Hart Energy)

As the upstream E&P space bought, merged and consolidated at a breakneck pace, Range Resources chose to sit on the sidelines.

Fort Worth-based Range hasn’t been an active participant in the record-breaking E&P M&A cycle, President and CEO Dennis Degner admits.

“For us, it boils down to one simple driver: We didn’t have to,” Degner said Nov. 7 during Hart Energy’s DUG Appalachia Conference & Expo in Pittsburgh.

E&Ps are consolidating in basins like the Permian, Williston and Eagle Ford for several reasons, but inventory duration and the efficiencies of scale are major drivers, he said.

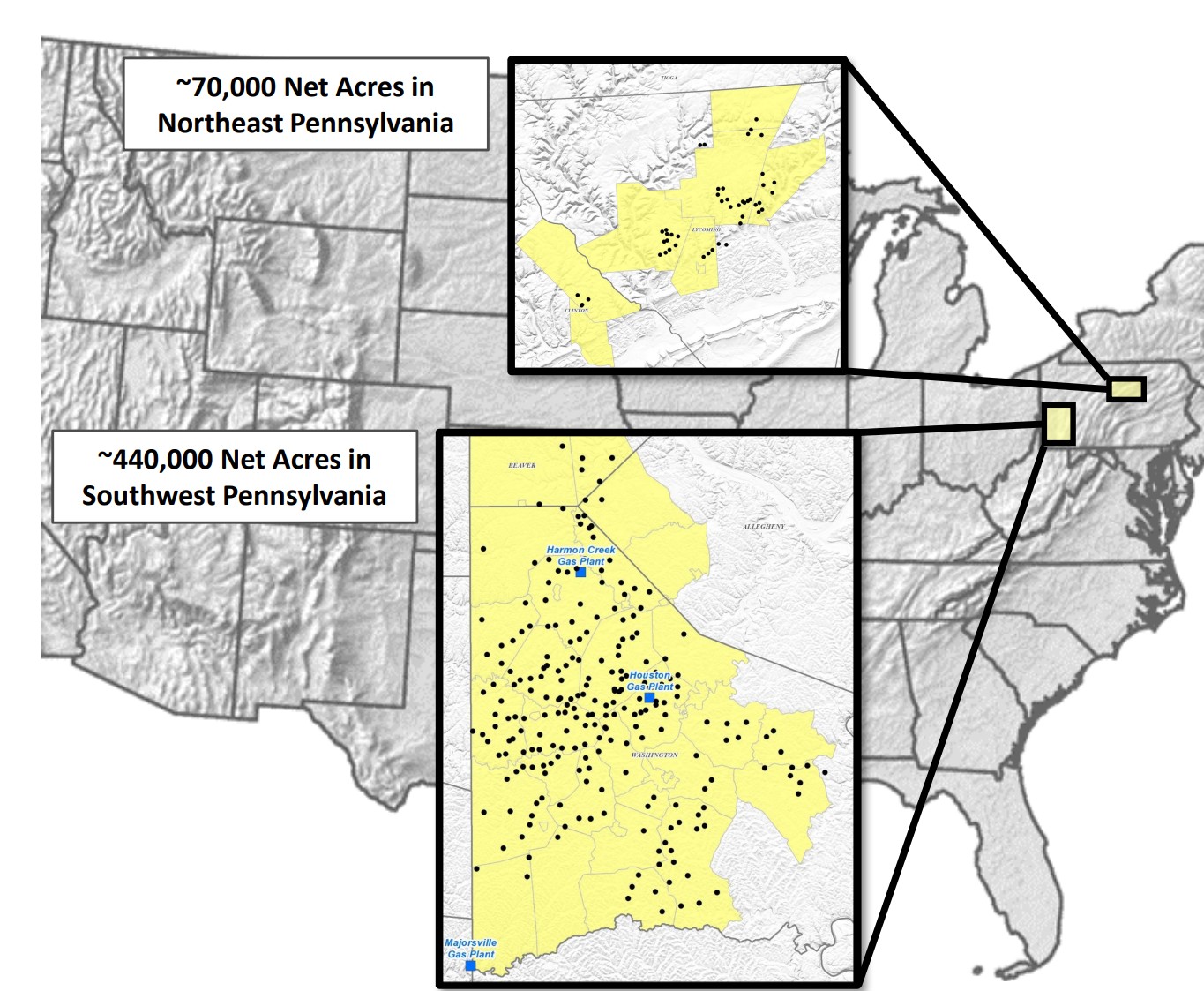

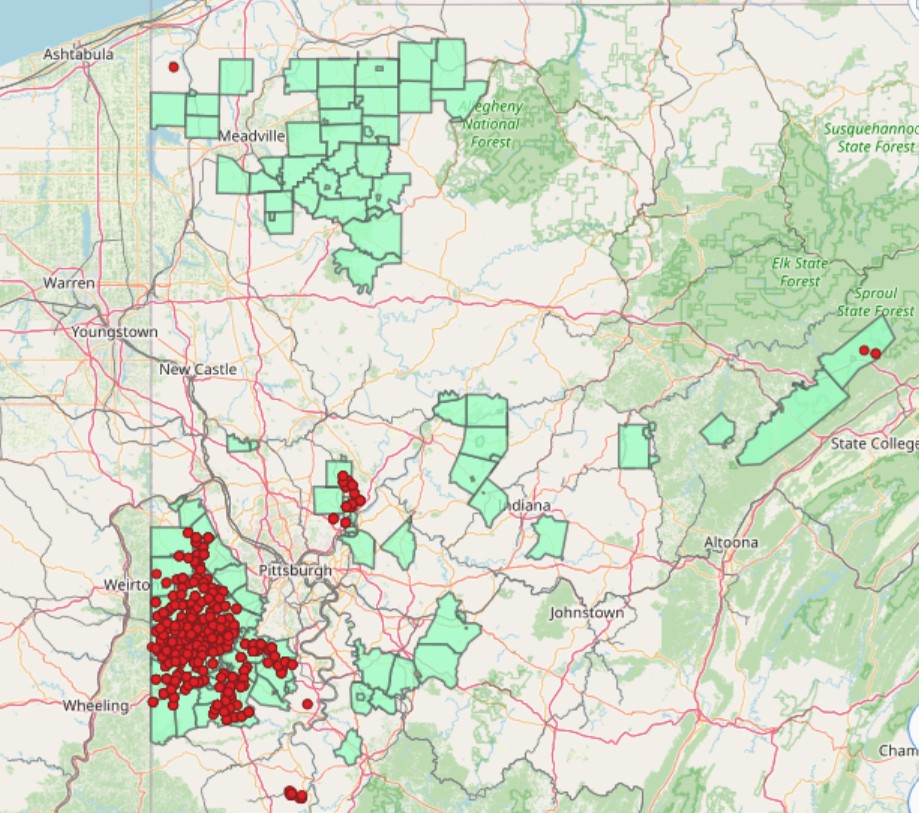

Range isn’t worried about its inventory runway in Appalachia, Degner said. The pure-play Appalachia producer holds more than 30 years of core Marcellus drilling inventory.

In the Marcellus alone, Range has around 24 million lateral ft of undrilled inventory capable of breaking even at a $2.50/MMBtu natural gas price. The company also gets a healthy uplift from higher NGL realizations.

And the core Marcellus inventory doesn’t account for additional locations in the deeper Utica and Point Pleasant intervals, or in the shallower Upper Devonian formation.

RELATED

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

“You’re talking about being able to do this for between 30 [years] and 40 years before you even get to a point where you’re needing to explore the Utica or the Upper Devonian,” Degner said.

That’s at the company’s current cadence—drilling between 60 to 70 new wells per year, with production at around 2 Bcfe/d.

“If we were to be an active player in M&A, the question would be, when do you pull that inventory into the development conversation?” Degner said. “Year 17, 25, 30? And how does it compete?”

The blocky nature of Range’s Appalachia asset also helps the company lower operating and drilling costs.

Early in Range’s exploration and development of the Marcellus shale play, the company’s horizontal wells were between 2,000 ft and 3,000 ft. That was the case when Degner joined Range as director of completions in 2010.

Today, the company is drilling laterals with average lengths of over 14,000 ft, with several exceeding 3 miles. Range drilled four laterals at 20,000 ft in 2023.

Longer lateral development allows Range to minimize its footprint, reduce the number of pad sites it needs and reuse existing infrastructure.

“This blocky acreage position that we have all just spells better management of the asset, better harvesting of it and a more efficient process,” Degner said.

And don’t forget about the roughly 200,000 acres Range still has quietly within its portfolio, Degner said. It’s an area that’s on-trend with the delineation activity taking place across the border in the emerging Ohio Utica oil window.

There could be a chapter in Range’s future where the company looks to develop the liquids-rich, oil-bearing window in northwest Pennsylvania. But Range continues to focus on southeast Pennsylvania’s gas and NGL development for now, he said.

Energy industry M&A activity has concentrated in the prolific Permian Basin oil play. Fewer deals have been inked in Appalachia, apart from a handful of notable transactions:

- The merger between Chesapeake Energy and Southwestern Energy, yielding the newly named Expand Energy, consolidated huge swathes of land across Pennsylvania and the Louisiana Haynesville Shale.

- Appalachia gas giant EQT Corp. acquired Equitrans Midstream, the owner of the controversial Mountain Valley Pipeline, in a $5.4 billion all-stock transaction this summer.

RELATED

Marcellus Waiting to Exhale But Held Back by Regional, Economic Factors

Rising demand

Despite its abundant natural gas reserves, growing production in Appalachia has been challenged by takeaway constraints and relatively tepid in-basin demand growth.

But producers and analysts say demand for natural gas is expected to rise in the coming decades to fuel U.S. LNG exports and power demand for AI computing.

The U.S. LNG export complex has proven to be “pretty resilient,” despite interruptions from infrastructure turnarounds and storm-related issues, Degner said.

“You’re still seeing a good, quality, resilient 12, 13, 14 Bcf/d-type LNG consumption,” he said. “That just didn’t exist a handful of years ago. That number was more like 0, or less than 1.”

Producers are also excited about power demand to fuel AI computing and data center projects. But it’s not yet clear just how much natural gas hyperscalers and AI developers will need to power their operations.

“I’ve seen everything from 16 Bcf/d to more like 3 to 5 Bcf/d,” Degner said.

Range is being a bit more conservative in its AI demand outlook—the company sees consumption growing by between 3 Bcf/d to 5 Bcf/d for computing and data centers in the coming years.

Tech giants are eyeing other sources of energy to power their AI needs, too. Several are setting out to tap into existing nuclear power plants—or even restart shuttered nuclear reactors—as sources of emissions-free power.

But Big Tech’s atomic dreams face red-tape hurdles. The Federal Energy Regulatory Commission (FERC) recently rejected a bid to allow an Amazon data center to tie into power from a nearby nuclear plant in Pennsylvania.

It’s not a death blow to the nuclear co-location project, industry watchers say, but it does complicate a growing number of AI-nuclear agreements around the country.

But outside of AI-specific demand, Range also sees an upside for natural gas in broader domestic power generation.

Incremental gas consumption for power burn is up around 1.4 Bcf/d to 1.5 Bcf/d this year compared to 2023 levels, Degner said.

Coal plant retirements will also stretch thin power supply at a time when power demand is rising.

Degner pointed to PJM Interconnection’s latest capacity auction this summer, which hit record highs. Capacity prices for the 2025 to 2026 year rose to $270 per megawatt-day (MWd), a more than 800% increase from the roughly $29/MWd for the 2024 to 2025 auction.

In a report, PJM cited the significant decrease in overall supply from retirements may have impacted the results of the latest auction.

Experts say it’s still unclear exactly how much ratepayer bills will increase due to the changes. Capacity costs account for only a portion of customer electric bills.

PJM is the grid operator for all or parts of Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and Washington D.C.

“[AI demand] is still emerging, but we’re seeing that change in power pricing now,” Degner said. “What’s going to happen in the years to come?”

RELATED

Recommended Reading

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

CEO: TotalEnergies to Expand US LNG Investment Over Next Decade

2025-02-06 - TotalEnergies' investments could include expansion projects at its Cameron LNG and Rio Grande LNG facilities on the Gulf of Mexico, CEO Patrick Pouyanne said.

Paisie: How a World in Flux Impacts Oil Prices

2025-04-02 - Sanctions, tariffs and production strategies are buffeting crude markets as wild cards like tariffs and geopolitical conflicts make headlines.

Trade War! Or Maybe Not

2025-03-06 - An energy industry that prefers stability gets hit with whiplash as it attempts to adjust to the Great Disruptor taking over the White House.

The Evolving Federal State of Energy Under Trump 2.0

2025-03-04 - What happens when the Trump wrecking ball swings into the bureaucratic web of everything that touches oil and gas?

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.