Chevron Corp. says its planned growth in renewable fuels, hydrogen and carbon capture is expected to enable about 30 million tonnes of annual CO2 equivalent emission reductions by 2028. (Source: Shutterstock/com)

Technology adoption, policy and consumer behavior will drive energy choices, says a top sustainability executive, as companies focus on carbon management along the path to net zero.

All three factor into whether one form of energy or another is sought to supply demand created by income and population growth, according to Bruce Niemeyer, vice president of strategy and sustainability for Chevron Corp.

“Keeping supply and demand balanced through the transition is important so the transition works for all and doesn’t become a negative event for those most vulnerable,” Niemeyer said earlier this month during UT Energy Week. He added, “We’re going to need many forms of energy, which means we need to work on reducing the carbon intensity of all of them.”

Chevron is among the many companies working to lower its emissions amid a heightened focus on global warming and future energy supplies.

Like the smartphone, technologies with features that meet consumers’ needs or low-cost technologies will gain market share, he said, noting consumer preference is a strong factor. Take, for example, the automotive sector. EVs are expected to play a key role in the energy transition, giving their lower emissions, compared to vehicles with internal combustion engines.

However, “last year, our best estimate is there were 6.6 million electric vehicles sold. At the same time, there were 35 million SUVs. It doesn’t mean it will be that way forever, but consumer preferences are strongly important to how energy is demanded by the world and then the choices of whether it’s provided from one form or another.”

Most consumers do not appear willing to give up their gasoline-fueled vehicles. As Ram Chandrasekaran, head of road transport for Wood Mackenzie, explained in a November opinion piece, “The problem is that, unlike, say, a Nokia-style mobile compared to a smartphone, EVs offer nothing extra for the end user. Concerns around range anxiety, access to charging and upfront affordability were also significant barriers to uptake.” He pointed out how sentiment is changing as sales rise.

Falling electric vehicle (EV) prices with improved battery technology are contributing to an uptick in sales. Citing data from Wards Intelligence, the U.S. Energy Information Administration said in February that hybrid, plug-in hybrid, and EVs collectively accounted for 11% of light-duty vehicle sales in the United States in fourth-quarter 2021.

Several countries and automakers have set ambitions to increase EV sales, including in the U.S. where there is a target of 50% EV sales share in 2030.

Policy, Technology

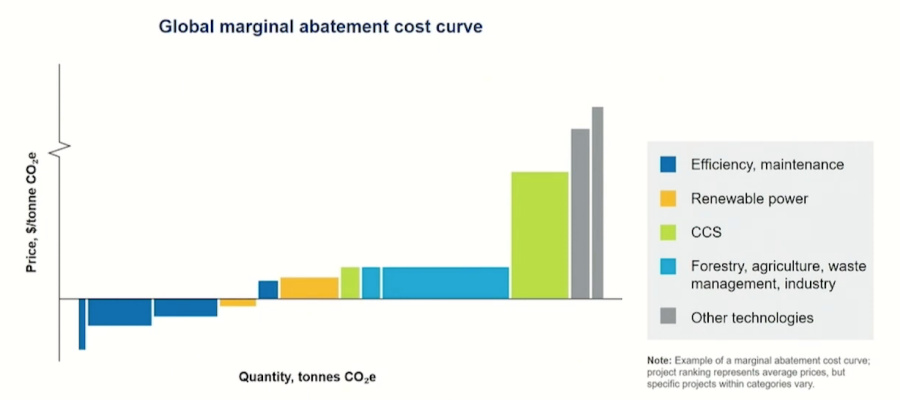

“Policy establishes the rules of the game, so to speak, for a company like Chevron and other parts of society as we work towards a lower carbon future,” Niemeyer said before turning to the global marginal abatement cost curve of different ways to reduce CO2.

Of the methods highlighted, efficiency and maintenance were the lowest cost compared to carbon capture and storage on the high end and renewables near the middle.

“Some of them actually are profitable,” Niemeyer said, adding some CO2 abatement technologies pay for themselves while reducing emissions. “They are typically related to efficiency. … There are other things that are less so, and some options are very expensive.”

Policy such as a price on carbon, however, can impact costs associated with certain technologies enabling them to become profitable for companies.

“Policy can also attempt to pick winners and losers and might pick something that’s very expensive that will abate carbon but will do so at a high cost,” Niemeyer added.

Given innovation in the energy sector, Niemeyer said he is optimistic that the world can accomplish the large task at hand—limiting global warming to well below 2 C and pursuing efforts to limit it to 1.5 C.

“But in order for the transition to work for all, it has to be done in a way [in which] all can participate. All parts of the world aren’t affluent enough to afford those kinds of solutions,” he said. “The more we can work on these sorts of solutions with the right policy support, the more success we’re going to have.”

Some parts of the economy such as aviation are not electrified easily, so using sustainable aviation fuel—instead of traditional jet fuel—may be a better option to lower carbon intensity.

“Sustainable aviation fuel is not made from a fossil feedstock. It’s made from a renewable feedstock like soybean oil or animal fats,” he said, “and its lifecycle carbon emissions is very different than that is provided by fossil-based jet fuel that’s used in airlines today.”

Chevron aims to produce 100 MMbbl/d of renewable fuels, which could be used by the aviation sector, by 2030.

Targets

Like many of its peers, Chevron is advancing technologies to reduce the carbon intensity of its operations. Its targets include a 35% reduction in upstream CO2 intensity by 2028, a more than 5% reduction in its portfolio carbon intensity by 2028 and net-zero Scope 1 and Scope 2 emissions by 2050. Chevron’s 2030 new energies targets also include producing 150 ktpa in hydrogen, which Niemeyer said could be used to decarbonize the heavy-duty transportation sector; and 25 MMtpa in carbon capture and offsets.

The company has formed several partnerships, including with Hydrogenious, a developer of liquid organic hydrogen carrier technology. Speaking during Chevron’s analyst day in March, Chief Technology Officer Eimear Bonner said the technology could deliver affordable and efficient storage and transport of hydrogen.

“Deploying and integrating technology across our assets enables us to commercialize leading solutions – for example, we’re integrating technologies from partners, such as Carbon Clean, Svante, and others as we aim to scale carbon capture capabilities at lower cost,” Bonner said.

Asked at UT energy event why Chevron isn’t pursuing renewables such as solar to scale operations given its financial status, Niemeyer said that is not what the company’s investors want.

“What they have said to us is we don’t want you to be investing in renewable power as a separate business line because we, as investors can do that ourselves. We can go buy Company X, where that’s all they do and we can create that in our portfolio if we want to,” he said.

Investors do, however, believe in and support useful technologies and their ability to reduce the carbon intensity of operations, Niemeyer added, noting it’s important that companies figure out what they do well and fulfill that role.

“We’ll use those financial resources to grow hydrogen, where we have a target to deliver 150,000 tons per annum by 2030. … Today in the world there are 40 million tons per annum of carbon capture in the world. Our target is to add 25 million tons between now and 2030. So, a substantial increase, and it’ll take all of our financial might to do that.”

The company has said its planned growth in renewable fuels, hydrogen and carbon capture is expected to enable about 30 million tonnes of annual CO2 equivalent emission reductions by 2028.

Recommended Reading

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.