It’s been called a unicorn, but there has been no magic involved in the Advanced Clean Energy Storage project (ACES Delta) in Utah being developed by Mitsubishi Power and Chevron.

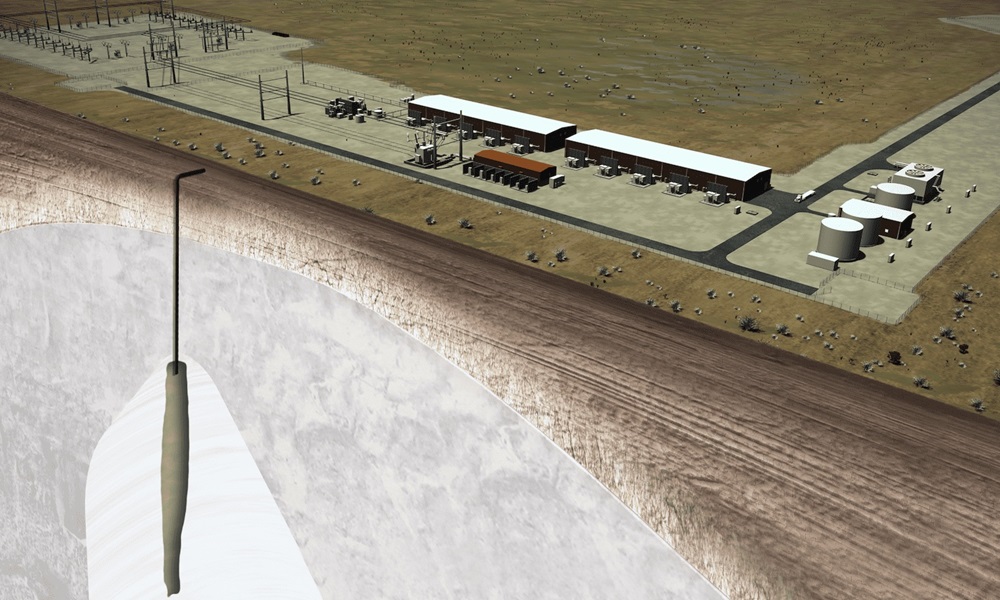

Its story is rooted in partnership, planning, proven technologies and proximity to infrastructure. The hub—which will initially convert more than 220 megawatts (MW) of renewable energy into 100 metric tonnes per day of hydrogen to be stored in two gigantic 4.5 MMbbl salt caverns—is under construction with startup expected in 2025. The project will provide long-duration energy storage to be dispatched as needed to the grid.

“Once it does go operational, we think that it will serve as a blueprint for other projects to follow. We’re already seeing it right now in the market, and we’re happy to see that,” Michael Ducker, president and CEO of MHI Hydrogen Infrastructure, told Oil and Gas Investor. “Of course, we’re looking to emulate some of what we’ve done at that project in other projects across the U.S. and globe.”

Across the world in Saudi Arabia, nearly two dozen banks and investment firms came together to clear the path for an $8.4 billion hydrogen plant. The NEOM Green Hydrogen Company JV, comprised of ACWA Power, NEOM and industrial gases company Air Products, secured an exclusive 30-year offtake agreement with Air Products for all of the ammonia that will be produced from hydrogen at the facility. When complete, the plant will produce up to 600 tonnes per day of hydrogen in the form of green ammonia by year-end 2026.

The hydrogen projects are among the few with announced commissioning dates that have made it past the final investment decision (FID) stage amid the global clean energy drive. It’s a destination that many hydrogen producers hope to reach. However, the road has been bumpy. Hydrogen is a promising decarbonization tool but it can be more expensive compared to fossil fuel-based products. Developers need to lock in buyers to move projects forward. Policy could help, but uncertainty—particularly in the U.S. regarding demand and qualifications for hydrogen production tax credits—remains.

Sluggish Investment

Insights shared in a joint report by the Hydrogen Council and McKinsey & Co. show the pipeline of hydrogen projects has surpassed 1,400 globally, representing about $570 billion worth of investments and 45 million tons per annum of clean hydrogen through 2030.

However, investment decisions are sluggish. Of the projects with a known commissioning date, only one-quarter have passed FID, accounting for 7% of the total announced investments, according to the report.

“It’s important to remember that when it comes to low-carbon hydrogen, we’re looking to build in a short few years what it took literally decades or centuries for previous energy transitions to establish,” Mark Klewpatinond, global business manager of hydrogen for Exxon Mobil Low Carbon Solutions, said during a hydrogen conference in Houston. “While the energy transition is underway, we appreciate that there’s still a tremendous amount of work to be done. This is a long-term proposition that requires no small amount of investment and effort. Now is the time to tackle these challenges.”

Klewpatinond pointed out hydrogen’s more expensive price over incumbent fuels and stressed the need of society to cover the required costs to develop infrastructure and convert customers.

“We can achieve this by enabling market-driven, technology-neutral policies that activate and build on nascent demand, coaxing these new markets to life,” he said. “At present, a lack of sufficient policy support and market uncertainty is undermining this development.”

The U.S. Bipartisan Infrastructure Law made available $7 billion to establish regional hydrogen hubs in the U.S. and $1 billion to help spur demand, while the Inflation Reduction Act’s clean hydrogen production tax credit is intended to incentivize developers.

“But at present it’s still not sufficient to activate hydrogen’s potential,” Klewpatinond said.

“What we specifically need is clarity and assurance that the Treasury [Department] will incentivize hydrogen produced from different technologies, enabling key projects like Exxon Mobil’s Baytown project, which are instrumental in building America’s economy at a cost acceptable to consumers,” he added.

The company plans to use natural gas to produce up to 1 Bcf/d of hydrogen, capturing more than 98% of the associated CO2 and storing it underground.

“It would be the largest low-carbon hydrogen project in the world. The carbon capture and storage project enabling this hydrogen plant would also be one of the largest, and it could store up to 10 million tons of CO2 annually, and double our current carbon capture and storage capacity,” he said. “The Baytown project has been designed to deliver very low carbon intensity hydrogen as a result of additional significant investments made by Exxon Mobil. For example, the project will benefit from low carbon intensity or differentiated natural gas resulting from significant investments that we have made to reduce emissions in our Permian operations.”

Pending FID, which is expected in 2024, and other conditions, the facility could start up in 2027 or 2028. The project would represent about 10% of the Biden administration’s 2030 goal for clean hydrogen supply.

Reaching FID

ACES Delta’s FID predates the Inflation Reduction Act.

During the conference, former Mitsubishi Power Americas CEO Paul Browning said the project isn’t a unicorn, as some people call it. Instead, a confluence of factors enabled ACES Delta to come together: a creditworthy offtaker plus a desirable location with access to renewable energy, water, storage and infrastructure that includes pipelines within feet—not miles—of the offtaker’s fence line.

The project will provide fuel via pipeline for Intermountain Power Agency’s (IPA) 840-MW combined cycle gas turbine power plant, which is adjacent to the ACES Delta hub. IPA’s IPP Renewed Project is set to replace a retiring 1,800-MW coal-fired power plant. Its gas turbines will run on 30% hydrogen fuel at startup in 2025, but that percentage could increase to 100% by 2045.

RELATED

Mitsubishi, Chevron Overcome Hydrogen, Storage Project Woes

In his current role as a co-founder of Energy Transition Finance, Browning helps companies navigate the U.S. Department of Energy’s Loan Programs Office (LPO) application process. He worked with Mitsubishi when the company submitted its loan application to the DOE.

Reaching bankable FID sooner requires having a debt mindset, Browning said. When seeking federal funding, realize that any government agency has rules to follow and stakeholders to satisfy. “If you try to cut corners on that, you’re just going to be delaying your project and increasing the cost,” he said.

There is no secret sauce or mystery to getting there.

“It’s hard work. It’s thoughtfulness. It’s having the right partners and putting one foot in front of another,” First Ammonia CEO Joel Moser said.

It’s Finance 101, he added, mentioning fixed price construction, firm credit off-takers and inputs/feedstock that are either fixed price or hedged.

“It’s a closed box where the entire project is de-risked the same as we’ve done historically for gas-fired generation and for any kind of projects financed. So, there’s nothing new,” Moser said. “We just have to approach it on project finance basis, de-risk everything, get to project close and start building enough of these.… We all have to succeed. This market has to get big enough that the products have their own trading market.”

At that point, the sector can evolve from the “kindergarten of project financing” one at a time to being industrial producers, he added.

First Ammonia is targeting FID in 2024 for a green ammonia project it is developing in Texas. The green ammonia will be produced from renewable hydrogen at the Victoria, Texas, port. The company has lined up an agreement to deliver green ammonia to Uniper, but the global market for the product is still developing.

“There is not at this moment in the world today commercial quantities of this product being produced. So, there’s no big surprise that there isn’t a traded market,” Moser said. “So, when it reaches the status of being a traded commodity as green ammonia separate from conventional ammonia, we can move on to financing our projects, our companies, in the way that industrial companies do.”

Like electrolytic hydrogen, the clean derivative product is more expensive than its fossil fuel counterpart but it is becoming cheaper. The story is the similar for green methanol, which is used as fuel. HIF Global combined captured CO2 with electrolytic hydrogen to create synthetic methanol, which is then refined into gasoline, at a demonstration plant in southern Chile.

“Porsche is an investor in our company, and they actually buy all the fuel that we produce from there. And it is no way economic,” HIF Global COO Brooke Vandygriff said of the demonstration plant during the conference. “It is truly a proof of concept to prove to the world that drop-in fuels can be made today. And by teaching the regulators and policy makers that we can produce these fuels, they will catalyze and incentivize them to write the policy that supports these project developments.”

At least, that is the hope.

Policy, collaboration needs

Hydrogen players are awaiting more details on the hydrogen production tax credit.

The proposed regulation, intended to incentivize low-carbon hydrogen production, offers a credit ranging from $0.60 per kilogram (kg) of hydrogen produced to $3/kg, depending on the lifecycle greenhouse gas (GHG) emissions from hydrogen production, including its power source. It is based on three pillars: additionality, regionality and time matching. Since the proposed guidance was unveiled in December 2023, industry reaction has been mixed.

Vandygriff said, “they made it very difficult to navigate and really squashed a very nascent industry from taking off. I just need them to solidify the policy so that we can move forward with our project.… Until the regulations are solidified and in law, we cannot get to FID because we don’t know how to calculate the hydrogen tax credit. And then we don’t know how to value our offtake product because of that. And then we can’t get somebody to sign a long-term contract for a cost of a product that they don’t know.”

HIF Global plans to use wind energy along the U.S. Gulf Coast to produce hydrogen, which will be used to make eFuels in Matagorda, Texas. The $6 billion project expects to produce about 1.4 million tons per year of eMethanol by 2027 and capture about 2 million tons per year of CO2.

Companies, including HIF Global, are also trying to scale to bring down costs.

“Manufacturing must scale so that the equipment cost can come down. The hydrogen production component of the plant is by far the most expensive part,” Vandygriff said. “We do really need the cost of the electrolyzers to go down over time if we want to replicate these plants and really capture some market in the green fuel space.”

As a company that has made it beyond FID, Ducker sees the value in collaboration. He called it “absolutely critical” for getting projects of this magnitude and complexity off the ground to overcome gaps and scale.

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.