Chevron Corp., already drilling nearly 2.8-mile laterals at its Loma Campana Field in Argentina, wants to drill even longer horizontals, an executive told Hart Energy. (Source: Shutterstock.com)

Chevron Corp. is eyeing even longer laterals at its Loma Campana Field in Argentina’s Vaca Muerta Formation, an executive told Hart Energy during the “Shale en Argentina” event in Houston.

Chevron’s current lateral lengths extend up to 14,700 ft (2.78 miles), Jim Navratil, Chevron’s Argentina upstream general manager, said Sept. 12 during the event. Chevron also plans to continue with simul-frac and completion optimization work in Loma Campana, Navratil said.

In comparison, Tecpetrol boasted an 11,500-ft lateral this year, up from around 5,000 ft in 2017, Tecpetrol CEO Ricardo Markous said during the event.

California-based Chevron’s operations in the Vaca Muerta, or “dead cow” formation, are in the Loma Campana and El Trapial fields. The company entered Loma Campana in December 2013 and started its transition to longer laterals in 2017. In 2022, the company boasted a single day simul-frac record of 18 stages per day.

The Loma Campana and El Trapial fields produced an average 101,800 bbl/d in July, Navratil said. Narambuena and Loma del Molle Norte are Chevron’s other two assets in Argentina.

Vaca Muerta holds significant growth potential, Navratil said, but Argentina must first overcome barriers such as capital controls, market pricing and assurances that contracts will be honored. Companies want assurances that a new investment law won’t be used to pull the rug from under them they look to attract capital.

Navratil also said there was a need for improved pipelines and export infrastructure.

In terms of technically recoverable shale gas resources, Argentina ranks second in the world, according to the most recent study published by the U.S. Energy Information Administration (EIA). Argentina’s shale oil resources rank fourth, according to the EIA.

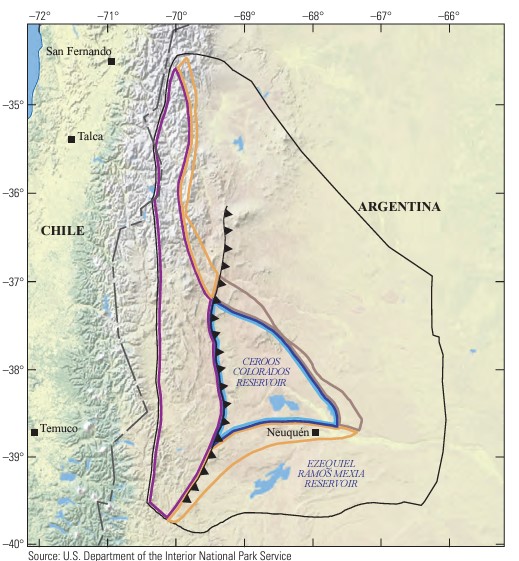

The Vaca Muerta, situated in Argentina’s Neuquén Basin, boasts technically recoverable shale gas resources of 308 Tcf—194 Tcf of which is dry gas, 91 Tcf wet gas and 23 Tcf associated gas, according to the EIA.

RELATED

Permian 2.0? The Case for Argentina’s Vaca Muerta

Vaca Muerta potential

Production from the Vaca Muerta is expected to reach around 1 MMbbl/d over the mid- to long-term compared to less than 400,000 bbl/d now, Pluspetrol Country Manager Julian Escuder said during the event.

The shale formation currently accounts for around 55% of Argentina’s oil supply. And, Vaca Muerta’s potential remains vast and growth could accelerate with the right incentives, Alex Ramos-Peon, head of shale research at Rystad Energy, said during the event.

The Vaca Muerta could produce more than 1 MMbbl/d by early 2030 with only 50% more rigs, Ramos-Peon said.

“The Vaca Muerta boasts superior oil well performance compared to U.S. peers and has some of the best-in class breakevens due to exceptional production performance,” Ramos-Peon said.

As growth companies get absorbed in the U.S., remaining E&Ps are generating cash flow while activities remain low during a high-price environment. Ramos-Peon said. “This new lack of elasticity of U.S. shale is freeing up fracking and drilling equipment [that could be sent down to Argentina],” he said.

RELATED

Achieving Energy Self-Sufficiency: Argentina’s Game Changing Vaca Muerta

Executives at the annual event stressed the need for more U.S. upstream and services companies to participate in Argentina’s energy sectors. Argentine ministers from the hydrocarbon provinces of Neuquén and Mendoza said efforts were ongoing to attract investors.

State-owned YPF President and CEO Horacio Marín and Pan American Energy Upstream Managing Director Fausto Caretta also stressed the need for investors from other countries, pointing to varied opportunities.

Marín said YPF was in discussions with Energy Transfer to take the operational reins to Argentina’s Vaca Muerta South Oil Pipeline (VMOS). The VMOS will have two tranches and span 570 km from Loma Campana to a port in Punta Colorada.

Argentina LNG awaits FID

YPF and its Malaysian counterpart Petronas continue to eye taking a final investment decision (FID) in the second half of 2025 for the South American country’s initial LNG exporting plant on its Atlantic Coast.

Engineering contracts could be signed in around two months to three months and an initial FID could be taken in either third-quarter 2025 or fourth-quarter 2025, Marín said.

“We believe in Argentina LNG … and there is a lot of interest in the project,” Marín said during the event.

Argentina’s proposed LNG facility will have a capacity of 23 million tonnes per annum (mtpa) to 30 mtpa, Marín said. The facility would be constructed in two phases.

RELATED

YPF, Petronas Target FID for Argentine LNG Facility in Late 2025

Marín said it was urgent to get the initial project up and running amid pressures from countries such as Germany and India to see Argentina cargoes by around 2030.

The first phase would consist of two floating LNG barges with the potential to produce 8 mtpa to 10 mtpa. The timeline for completion or having the barges in operation is between 2029 to 2030. Petronas is expected to bring in the first barge, analysts told Hart Energy during the shale event.

A second phase would consist of onshore modules with the potential to produce 15 mtpa to 20 mtpa, with completion expected sometime between 2030 to 2032.

Juan Martín Bulgheroni, Pan American Energy’s vice president of planning and strategy, said the gas market in Argentina was changing along with the potential to export LNG.

“LNG will be used to monetize [Argentina’s] gas resources,” Bulgheroni said during the event.

YPF will own 25% to 30% of total LNG capacity at the facility. Petronas will likely be a major owner in the project, along with other companies expected to join the project in the future, according to analysts.

“Things will be defined once the money is put in [or pledged],” Marín told Hart Energy during the event.

Recommended Reading

LNG, Data Centers, Winter Freeze Offer Promise for NatGas in ‘25

2025-02-06 - New LNG export capacity and new gas-fired power demand have prices for 2025 gas and beyond much higher than the early 2024 outlook expected. And kicking the year off: a 21-day freeze across the U.S.

Gas-Fired Power Plants Create More Demand for Haynesville Shale

2025-03-04 - Expansions and conversions of Gulf Coast power plants are taking advantage of the plentiful Haynesville Shale gas.

Kissler: Is it Time to Worry About Crude Prices?

2025-03-14 - Oil trends will hinge on China’s economy, plans to refill the SPR and how tariff threats play out.

Hirs: America Confronts Sovereign Risk with Recession on the Horizon

2025-03-21 - The risk to U.S. oil and gas production comes from within, and a recession looms on the horizon.

Segrist: American LNG Unaffected by Cut-Off of Russian Gas Supply

2025-02-24 - The last gas pipeline connecting Russia to Western Europe has shut down, but don’t expect a follow-on effect for U.S. LNG demand.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.