Chevron holds more than 70,000 net acres in Panola County, Texas, but had only five Haynesville wells on the acreage at year-end 2023. (Source: Shutterstock.com)

TG Natural Resources is reportedly in talks to buy Chevron Corp.’s more than 70,000 mostly undeveloped Haynesville acres in Panola County, Texas, for up to $1 billion.

The Financial Times reported on the rumored discussions, citing three unnamed sources familiar with the discussions.

Neither TG Natural Resources (TGNR) nor Chevron responded to Hart Energy’s requests for comment by press time.

Houston-based TGNR is majority-owned by Japanese utility Tokyo Gas. A minority owner is Castleton Commodities, operating as CCI, that is backed by family offices, including Walmart’s Walton family.

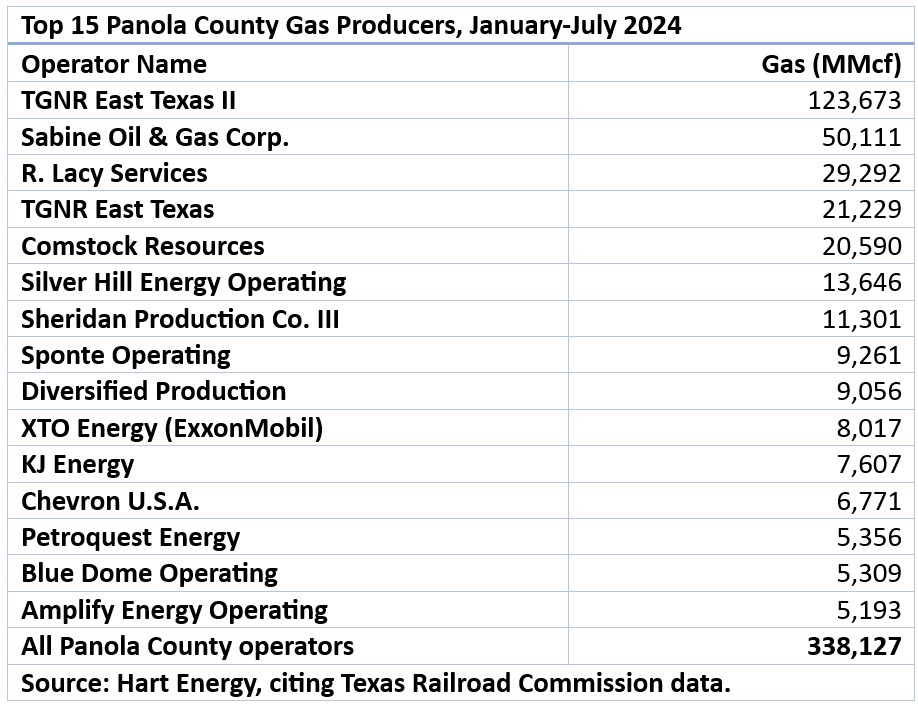

TGNR is currently the No. 1 gas producer in Panola this year, surfacing 145 Bcf from the county through July, according to Texas Railroad Commission (RRC) data.

Chevron is the county’s No. 12 producer, reporting 6.8 Bcf into sales this year through July, from its roughly 72,000 net, mostly contiguous Panola acres, primarily from legacy Cotton Valley wells.

Rumors surfaced earlier this year that Chevron had the position for sale. Outside of Panola, all of Chevron’s E&P operations onshore Texas are in the Permian Basin, according to RRC data.

“That [Panola acreage] is a position that all Haynesville operators are interested in,” Mike Winsor, CEO and COO of Haynesville operator Paloma Natural Gas, said in remarks at Hart Energy’s DUG GAS+ conference in Shreveport, Louisiana, this spring.

In 2023, Chevron had five horizontal Haynesville wells online on the property, according to the RRC.

“It's not very often you can come into an acreage position that is consolidated,” Winsor said. “You can come in with a blank slate.

“And whatever your well-spacing, whatever your design, there’s a huge amount of running room there.”

Ready for more deals

Craig Jarchow, TGNR’s CEO, said onstage in Shreveport that he was aware that the Chevron property may be sold.

TGNR was busy integrating its $2.7 billion acquisition of Haynesville neighbor Rockcliff Energy II LLC at the time. “We really have our hands full, but generally we look at everything just as a matter of discipline.”

In June, Jarchow told Reuters that he was looking for more deals. Tokyo Gas’ president similarly said the company was interested in acquiring more U.S. natural gas assets in June.

Another of Chevron’s Panola neighbors, Sabine Oil & Gas, is the county’s No. 2 gas producer, surfacing 50.1 Bcf through July this year. It is owned by Japanese utility Osaka Gas USA.

Carl Isaac, Sabine’s president and CEO, didn’t comment on the property while speaking in the Shreveport conference.

The Chevron property includes a long-term firm-volume contract with Williams Cos. that Chevron signed in 2023.

In the deal, Williams installed gas-gathering on 26,000 acres Chevron dedicated, connecting it to Williams’ Louisiana Energy Gateway (LEG) pipeline across the border.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Exxon Enlists Baker Hughes to Support Uaru, Whiptail Offshore Guyana

2025-02-03 - Baker Hughes’ will provide specialty chemicals and related services in support of the Uaru and Whiptail projects in the Stabroek Block.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

New Fortress Signs 20-Year Supply Deal for Puerto Rican Power Plant

2025-01-23 - The power plant, expected to come online in 2028, will be the first built in Puerto Rico since 1995, New Fortress said.

TGS to Conduct Ocean-Bottom Node Survey Offshore Trinidad

2025-04-07 - TGS has awarded a client a shallow water ocean bottom node contract offshore Trinidad.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.