Denver-based Civitas Resources started production from 13 4-mile wells in Colorado’s D-J Basin this summer. (Source: Shutterstock.com)

DENVER—Civitas Resources is seeing efficiencies from drilling longer laterals in Colorado, despite a challenging regulatory and land acquisition environment.

Denver-based Civitas began flowing back production from 13 4-mile Denver-Julesburg (D-J) Basin wells in late June.

“To our knowledge, they’re the longest wells ever drilled in the state of Colorado,” said Civitas CFO and Treasurer Marianella Foschi during the 2024 EnerCom Denver conference on Aug. 19.

Results from the 13 4-mile D-J wells are still early, but Civitas has confirmed that each mile drilled is contributing meaningfully to production, Foschi said.

Being capable of drilling longer 4-mile wells in the D-J Basin gives Civitas “a massive competitive edge,” she said.

Civitas saw around a 5% reduction in per-foot drilling costs on its 4-mile wells compared to 3-mile wells.

“Obviously, that speaks to the capital efficiency,” Foschi said.

The company has gotten much more comfortable drilling longer laterals in the D-J over time. When planning its 2022 capital program with risky 3-mile laterals, Civitas wasn’t sure what kind of performance it would see from the wells.

The company was pleased to see essentially no degradation in performance for a 3-mile well compared to a 2-mile well.

“If you think about our outperformance in 2022 and 2023, it was very much underpinned by the fact that we heavily risked that third mile, relative to the two,” she said.

Going longer underground in the D-J Basin can also provide some relief to a challenging land acquisition game.

It can be difficult to find and buy surface drilling locations in Colorado, where acreage is already heavily consolidated in the portfolios of a handful of operators like Chevron , Occidental and Civitas itself.

The extra fourth mile on Civitas’ 13 4-mile D-J wells is equal to about six 2-mile wells—and well over 60,000 ft of resource recovery potential, Foschi said.

And despite Civitas’ major investment into the Permian Basin, the company still has future drilling plans in store for its foundational Colorado asset.

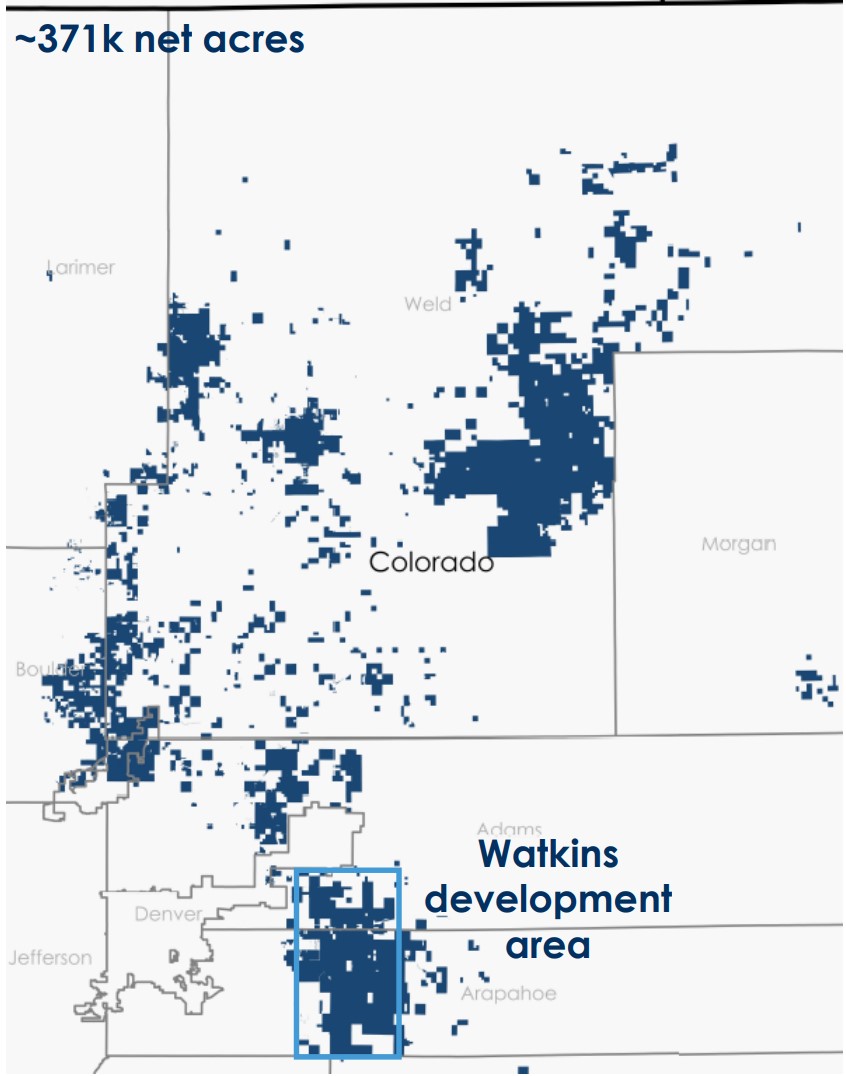

Earlier this month, the Colorado Energy and Carbon Management Commission (ECMC) approved a comprehensive area plan (CAP) for Civitas to develop the Lowry Ranch project in the southern D-J Basin.

The Lowry Ranch CAP calls for up to 166 wells on 10 new or expanded well pads in Arapahoe County, Colorado.

Foschi said Civitas aims to have an additional CAP approved by state regulators early next year.

RELATED

Civitas’ 4-Mile D-J Basin Wells See ‘Quite Compelling’ Returns

Permian prowl

Despite Civitas’ drilling runway in the D-J Basin, the company’s hunt for inventory led it to allocate nearly $7 billion of M&A into the Permian in the past year.

Civitas closed its first two Permian acquisitions in August 2023, scooping up Hibernia Energy III in the Midland Basin for $2.2 billion and Tap Rock Resources in the Delaware Basin for $2.5 billion.

In early January, Civitas closed a $2 billion acquisition of Vencer Energy, a Midland Basin E&P backed by international commodities trading house Vitol.

Foschi said Civitas is glad the company dove into the Permian when it did.

“We’re grateful and fortunate that we were able to enter the Permian when we did,” Foschi said. “According to the best we can tell, there was a meaningful, meaningful step-up in prices of assets in the Permian Basin shortly after we bought in.”

When Civitas bought in the Permian, it paid around 3x debt-to-EBIDTA and around $1 million to $2 million per net drilling location.

Today, Civitas is seeing Permian assets trade for closer to 4x debt-to-EBIDTA and around $2 million to $4 million per location.

“The current market is tough,” Foschi said. “You have to pay for capital efficiencies ahead. You have to pay up for upside zones that perhaps haven’t been proven to be repeatable.”

While Permian prices are high, Civitas still has boots on the ground in the Midland and Delaware basins scouring for acreage trades, swaps and other small-ball M&A.

Civitas produced approximately 186,000 boe/d from the Permian Basin in the second quarter.

RELATED

Civitas, Prioritizing Permian, Jettisons Non-core Colorado Assets

Recommended Reading

Diamondback Energy Closes $4.1B Double Eagle IV Acquisition

2025-04-02 - Diamondback Energy Inc. closed on its approximately $4.1 billion deal to buy EnCap Investments’ Double Eagle IV, adding approximately 40,000 net acres in the Midland Basin to its portfolio.

CenterPoint Energy Completes NatGas Pipeline Sale to Bernhard

2025-04-01 - CenterPoint Energy Inc. has closed on a sale of natural gas distribution utilities in Louisiana and Mississippi to Bernhard Capital Partners.

Ring Energy Closes Central Basin Platform M&A from Lime Rock

2025-04-01 - Ring Energy added 17,700 net acres and 2,300 boe/d of production in the Central Basin Platform through an acquisition from Lime Rock Resources IV.

Boaz Energy Completes Sale of PermRock Properties to T2S

2025-04-01 - Boaz Energy II has completed the sale of PermRock Royalty Trust’s underlying oil and gas properties to T2S Permian Acquisition II LLC.

TG Natural Resources Wins Chevron’s Haynesville Assets for $525MM

2025-04-01 - Marketed by Chevron Corp. for more than a year, the 71,000-contiguous-net-undeveloped-acreage sold to TG Natural Resources is valued by the supermajor at $1.2 billion at current Henry Hub futures.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.