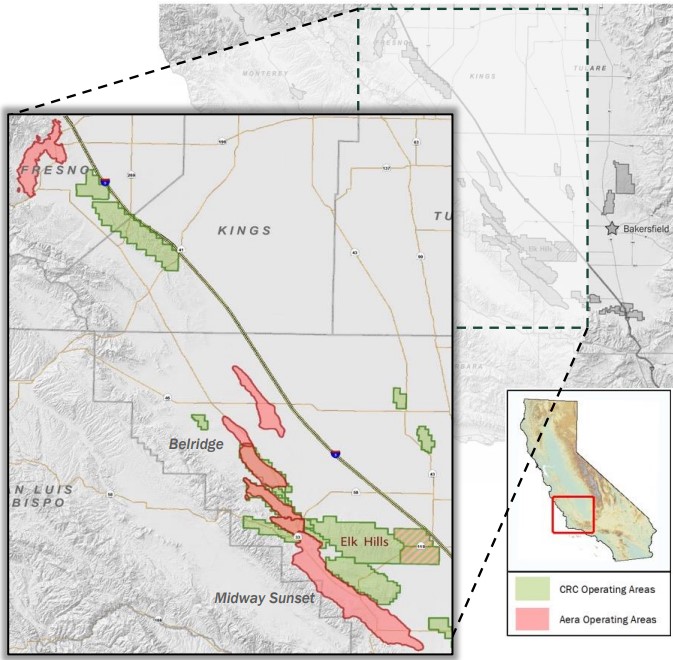

California Resources Corp. closed an acquisition of fellow California producer Aera Energy, adding conventional assets and scale in the San Joaquin Basin of Kern County, California (pictured). (Source: Shutterstock.com)

California Resources Corp. (CRC) still plans to run a one-rig program after closing a $1.1 billion combination with fellow California producer Aera Energy.

But Francisco Leon, CRC’s president and CEO, envisions a future where CRC is running eight rigs across its massive land position.

Long Beach, California-based CRC has an even larger acreage block to work with after acquiring Bakersfield, California-based Aera Energy.

Aera was previously a joint venture composed of the California assets of supermajors Exxon Mobil and Shell. International asset manager IKAV acquired ownership of Aera through separate transactions with Exxon Mobil and Shell in 2022.

CRC is a product of a 2014 spinoff of Occidental Petroleum’s California conventional and unconventional assets.

The combination—through an all-stock transaction closed July 1—cements CRC as the largest oil and gas producer in the Golden State, leapfrogging over fellow California-based rival Chevron Corp.

Including debt, the $1.13 billion all-stock deal, announced in February, is valued at $2.1 billion.

While CRC has a grand vision for expanding California oil and gas production in the future, getting to that point will involve surviving one of the most stringent permitting and regulatory regimes in the nation.

“We don’t see a line of sight this year to get back to permitting and getting to the eight rigs that we want to do,” Leon told Hart Energy in an exclusive interview. “But what we do have is an ability to grow cash flow per share.”

RELATED

California Resources Wraps $1.1B Deal, Becomes State’s Top Oil Producer

Kern County permitting pause

The permitting pain points come out of Kern County, in the heart of the prolific San Joaquin Basin in California’s Central Valley.

The bulk of California’s remaining proved onshore oil reserves are held within the San Joaquin Basin, with nearly 930 MMbbl in proved reserves remaining at the end of 2022, according to U.S. Energy Information Administration data.

“Kern County is like the Permian for us,” Leon said. “It’s the heartbeat of the industry.”

RELATED

Steamflooding Keeps California Field Producing 117 Years Later

The Kern River Oil Field has been producing oil and gas for over 125 years since the discovery well was hand-dug in the San Joaquin Valley in May 1899.

It’s not quite as easy today for Kern County operators to drill new wells or to modify existing projects in the San Joaquin Basin.

The California Geologic Energy Management Division (CalGEM), the entity regulating the state’s oil and gas drilling activity, stopped approving permits to drill new Kern County oil and gas wells since December 2022, state data shows.

The freeze in permitting stems from a long-running challenge to Kern County’s ability to rely on an existing environmental impact report to meet the county’s obligations under California environmental regulations.

Operators have sought out alternatives; CRC said it submitted applications for conditional use permits from Kern County for projects in its Elk Hills, Kern Front and Buena Vista fields.

“As a result of these issues and current lack of permits with respect to our Kern County properties, we plan to operate one active rig within Kern County in the first half of 2024 and have the requisite number of permits in hand to keep that rig active throughout 2024,” CRC wrote in its most recent annual report.

But the permitting freeze is showing signs of thawing. In May, CalGEM approved 10 permits submitted by Berry Corp. to drill new wells in Kern County’s Midway-Sunset field (Dallas-based Berry has also been an active consolidator in Kern County, closing a $70 million takeover of private E&P Macpherson Energy last fall).

The approvals by CalGEM drew condemnation from environmental advocacy groups, according to media reports.

For CRC, permitting in Kern County remains a challenge. The last permit CRC received to drill a new well in the county was approved in late December 2022, CalGEM data show.

The company reported experiencing “significant delays” in obtaining permits for sidetrack, deepening or rework projects throughout 2023, per investor filings. CalGEM approved around 100 rework permits for CRC in Kern County last year.

But CRC sees a resolution on the horizon. Leon said he thinks the permitting issues will get resolved by next year.

“So, we’ll go back to drilling,” Leon said. “We want to get to about eight rigs combined to offset the combined company decline.”

CRC’s production volume fell by 5,000 boe/d, or 5%, to 86,000 boe/d in 2023 from 91,000 boe/d in 2022, “predominantly as a result of natural decline,” the company wrote in regulatory filings.

Leon said CRC can protect a lot of its base decline through water injection and steamflooding, which has been the “nuts and bolts” of CRC’s activity today. Capital workovers and sidetracks are the most cost-effective, highest-return activities it can tap right now, he said.

CRC is also open to growing inorganically, like it did through the Aera acquisition. The pro forma net daily production of CRC and Aera averaged 146,000 boe/d (79% oil) during April and May of 2024. That’s up from CRC’s first-quarter average net production of 76,000 boe/d.

Moving forward, CRC is still open to making accretive acquisitions, bolt-ons and carve-outs inside California.

The Golden State obviously remains CRC’s top focus, but there’s also nothing stopping the company from evaluating potential M&A outside of California, Leon said.

He doesn’t see CRC entering the tight shale arena, but conventional assets with CO2-flooding opportunities could be attractive down the road.

“Eventually, we could look outside of the state if we have assets that are similar to ours,” he said.

RELATED

Berry Bolts On More California Assets as Kern County M&A Continues

Moving needles

As CRC waits to receive new drilling permits, the company is working to make strides where possible—like on cash flow per share, investor returns and other key financial metrics.

The Aera acquisition is expected to be immediately accretive to operating cash flow per share (45% improvement) and free cash flow per share (90% improvement).

Pro forma free cash flow is anticipated to more than double upon closing, allowing CRC to allocate greater volumes toward shareholder returns, paying down debt and developing its carbon management business.

The company has also identified around $150 million in annual synergistic cost savings by merging with Aera.

CRC wants to be a pioneer in the carbon capture and storage (CCS) space in Kern County. In 2022, CRC subsidiary Carbon TerraVault entered a joint venture with Brookfield to explore opportunities to develop carbon management projects in California.

Carbon TerraVault expects the U.S. Environmental Protection Agency (EPA) to approve its applications for Class VI CO2-injection wells later this year.

They would be the first injection wells for permanent CO2 storage approved in California. Leon said CRC has worked with the EPA and Kern County for over two years on the permitting process.

“This is a high bar. It’s difficult to get those permits,” Leon said, “but it’s a competitive advantage once you’re able to go through the process and do this.”

RELATED

Carbon Terravault’s CCS Plans Progress with Release of Draft Well Permits

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.