Marathon Oil, also headquartered in Houston, Texas, will add complementary acreage to ConocoPhillips’ Lower 48 portfolio with more than 2 Bbbl of resource. (Source: Shutterstock)

Houston, Texas-based ConocoPhillips is acquiring Marathon Oil Corp. in an all-stock transaction for approximately $17.1 billion—$22.5 billion including $5.4 billion of net debt, the companies announced May 29.

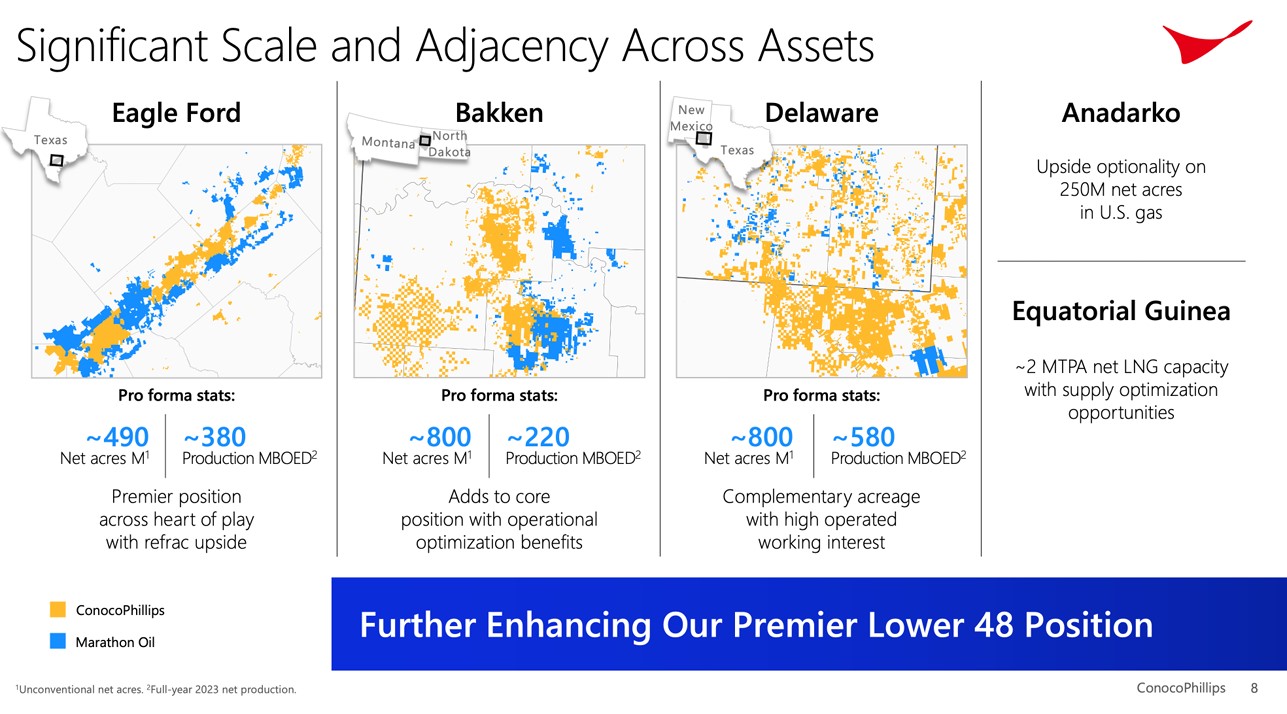

The deal adds complementary acreage to ConocoPhillips’ Lower 48 portfolio with more than 2 Bbbl of resource and an estimated average point forward cost of supply of less than $30/bbl West Texas Intermediate.

"We built a top performing portfolio with a multi-year track record of peer-leading operational execution, strong financial results and compelling return of capital to our shareholders—all while holding true to our core values of safety and environmental excellence," said Lee Tillman, Marathon Oil chairman, president and CEO. “ConocoPhillips is the right home to build on that legacy, offering a truly unique combination of added scale, resilience and long-term durability.”

ConocoPhillips expects to deliver at least $500 million of run rate cost and capital savings in the first year once the transaction closes.

"Importantly, we share similar values and cultures with a focus on operating safely and responsibly to create long-term value for our shareholders," said Ryan Lance, ConocoPhillips chairman and CEO. “The transaction is immediately accretive to earnings, cash flows and distributions per share, and we see significant synergy potential."

Marathon Oil shareholders will receive 0.2550 shares of ConocoPhillips common stock for each share of Marathon Oil common stock, a 14.7% premium to the closing share price of Marathon Oil on May 28.

ConocoPhillips plans to also repurchase $7 billion in shares in the first full year following the transaction’s close and over $20 billion in shares in the first three years.

Expected to close in the fourth quarter, the deal remains subject to the approval of Marathon Oil shareholders, regulatory clearance and customary closing conditions.

Evercore is serving as ConocoPhillips’ financial adviser and Wachtell, Lipton, Rosen & Katz is serving as ConocoPhillips' legal adviser. Morgan Stanley & Co. LLC is serving as Marathon Oil's financial adviser and Kirkland & Ellis LLP is serving as Marathon Oil's legal adviser for the transaction.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.