Houston-based ConocoPhillips expects to close an acquisition of Marathon Oil this quarter. (Source: Shutterstock.com)

On track to close a blockbuster $17.1 billion acquisition of Marathon Oil before year-end, ConocoPhillips reported record Lower 48 output in third-quarter 2024.

Houston-based ConocoPhillips’ third-quarter production averaged 1.147 MMboe/d across its Lower 48 footprint, the company reported Oct. 31.

That includes record production of 781,000 boe/d from the Permian and record Eagle Ford volumes of 246,000 boe/d, Nick Olds, ConocoPhillips’ Lower 48 executive vice president, said during an earnings call. Bakken volumes averaged 107,000 boe/d.

“We’ve seen more feet per day, more stages per day,” Olds said. “In fact, in 3Q in the Delaware Basin, we had a best-ever feet per day for that entire quarter within the program.”

In the Midland Basin, ConocoPhillips saw “strong performance” from several 3-mile lateral wells during the third quarter, he said.

ConocoPhillips is getting a huge lift across its Lower 48 position through the acquisition of Houston-based Marathon Oil. ConocoPhillips will also assume $5.4 billion in Marathon debt.

The companies still anticipate closing the transaction during the fourth quarter.

ConocoPhillips aims to drive significant synergies by combining the two portfolios; company guidance is to achieve over $500 million in annual synergy cost savings within a year of closing the Marathon deal.

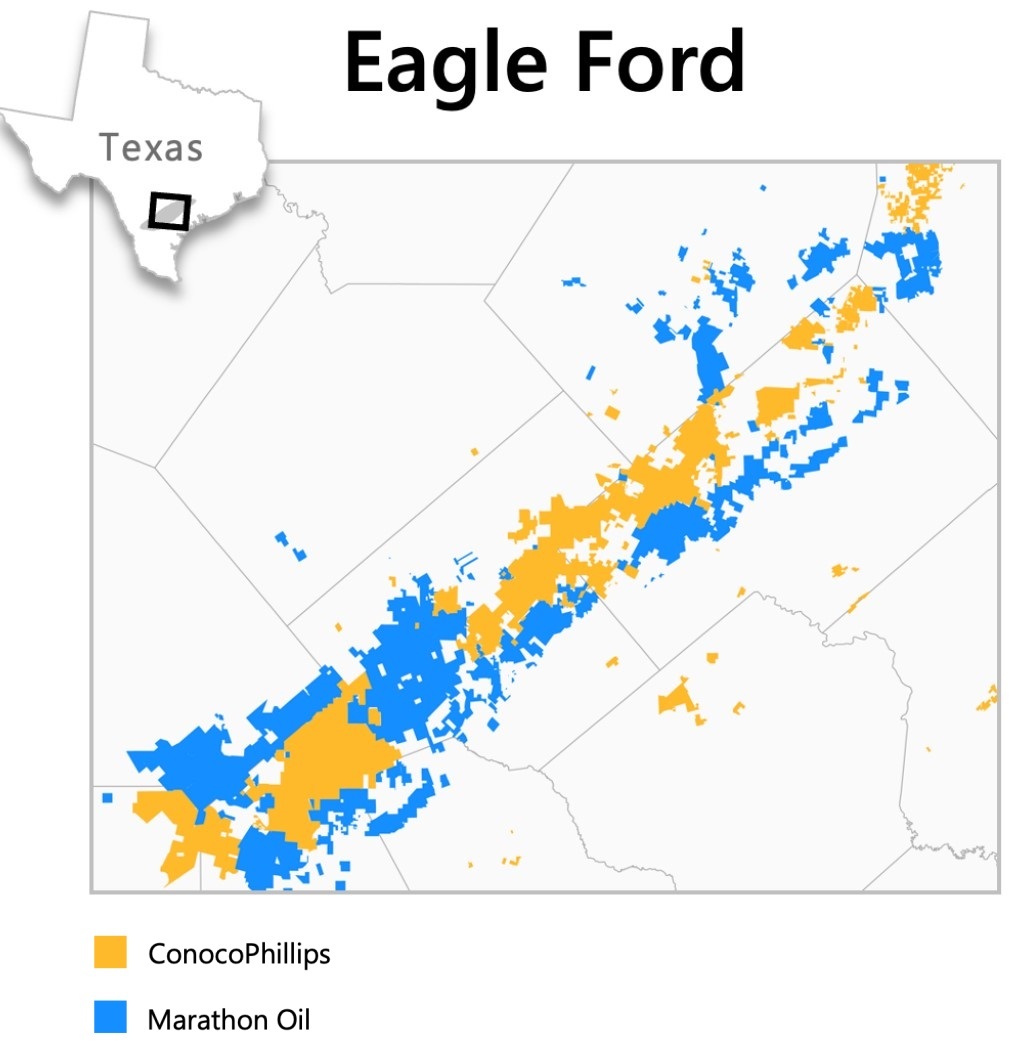

The Marathon acquisition will add another 2,000 drilling locations to the combined portfolio. Roughly half of the new inventory is in the Eagle Ford Shale of South Texas, where Marathon and ConocoPhillips are both top producers.

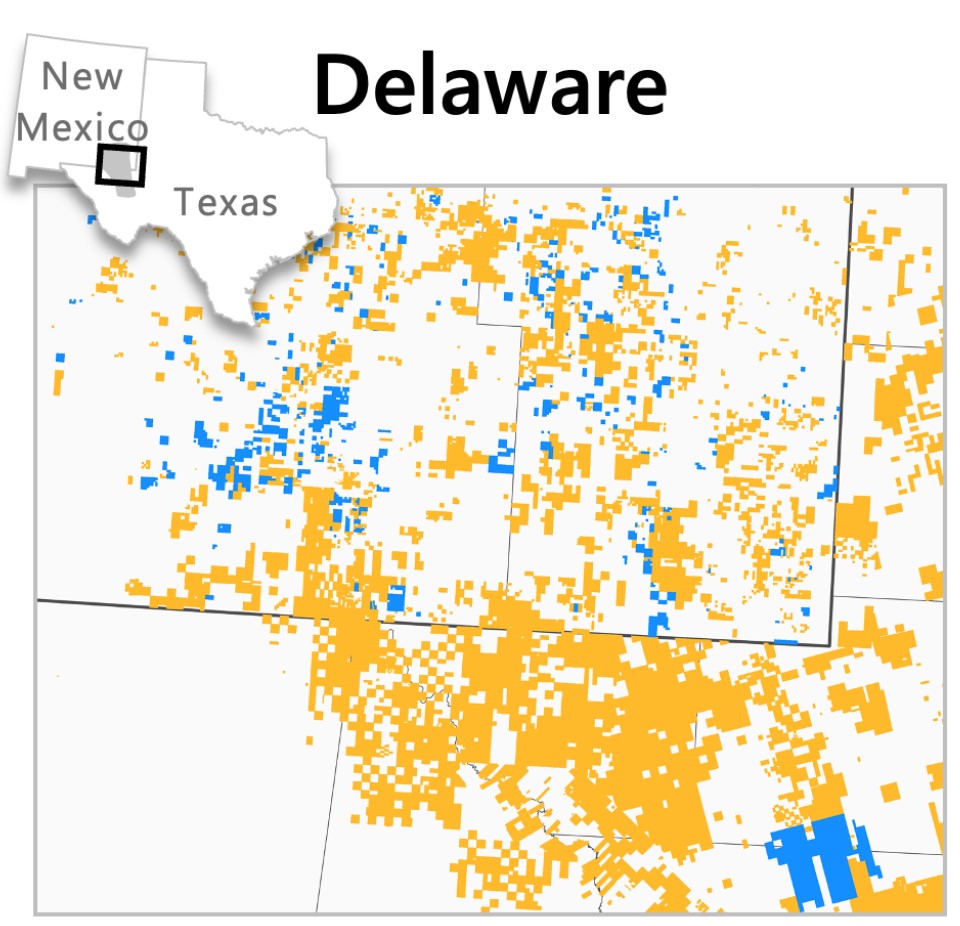

The deal will also combine the two companies’ smaller inventories in the Bakken and in the Permian’s Delaware Basin.

The companies see additional upside from reworking the combined drilling and efract programs at the asset level, said Andy O’Brien, senior vice president of strategy, commercial, sustainability and technology, for ConocoPhillips.

Compared to its 2024 capital spend, ConocoPhillips plans to reduce the combined development program by at least $500 million in 2025.

The reductions will come primarily from the Eagle Ford and the Bakken, O’Brien said.

“We're confident in our ability to achieve an optimal plateau level at lower levels of activities versus as standalone companies,” he said. “Simply put, we need fewer rigs and fewer frac crews to achieve the same outcome.”

Recompletion projects, or so-called refracs, are becoming more topical in mature basins like the Eagle Ford and Bakken, where early horizontal wells were drilled without modern technologies and a decade-plus of shale learnings.

ConocoPhillips has been using refrac techniques on its own Eagle Ford asset for some time to expand its drilling inventory.

A growing number of producers are leaning toward refracs, re-entries, recompletions and other re-do jobs underground to breathe new life into declining wells.

RELATED

Report: ConocoPhillips Shopping Delaware Basin Assets for $1B Sale

Chopping block

After acquiring Marathon’s net debt, ConocoPhillips aims to deleverage by divesting $2 billion of non-core assets over the next several years.

Rumors are swirling that the company is marketing a package of Delaware Basin assets that could fetch over $1 billion.

The package includes 55,000 net acres. Production is estimated to reach around 17,000 boe/d by year-end.

Executives declined to address the reports but said ConocoPhillips is confident it can hit the $2 billion disposition target.

“Activities are well underway on multiple disposition candidates at this stage,” O’Brien said.

In addition to reducing debt, ConocoPhillips is appeasing investors by raising its ordinary dividend by 34% to $0.78 per share.

ConocoPhillips distributed $2.1 billion to shareholders during the third quarter, including $1.2 billion in share repurchases and $900,000 through the ordinary dividend and variable return of cash.

Share buybacks will approach $2 billion in the fourth quarter, ConocoPhillips CEO Ryan Lance said.

RELATED

Marathon Oil Expects ‘Mass Layoff’ After ConocoPhillips Deal Closes

Recommended Reading

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

CNOOC Starts Production at Two Offshore Projects

2025-03-17 - The Caofeidian 6-4 Oilfield and Wenchang 19-1 Oilfield Phase II projects by CNOOC Ltd. are expected to produce more than 20,000 bbl/d of crude combined.

Equinor Begins Producing Gas at Development Offshore Norway

2025-03-17 - Equinor started production at its Halten East project, located in the Kristin-Åsgard area in the Norwegian Sea.

US Oil Rig Count Rises to Highest Since June

2025-04-04 - Baker Hughes said oil rigs rose by five to 489 this week, their highest since June, while gas rigs fell by seven, the most in a week since May 2023, to 96, their lowest since September.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.