Aaron Hunter, Delaware Basin vice president for ConocoPhillips, speaks at Hart Energy’s Executive Oil Conference & Expo in Midland, Texas, on Nov. 21, 2024. (Source: Hart Energy)

MIDLAND, Texas—ConocoPhillips is looking to extend laterals and explore secondary Permian benches after closing a blockbuster acquisition of Marathon Oil.

The companies announced closing the $17.1 billion transaction on Nov. 22.

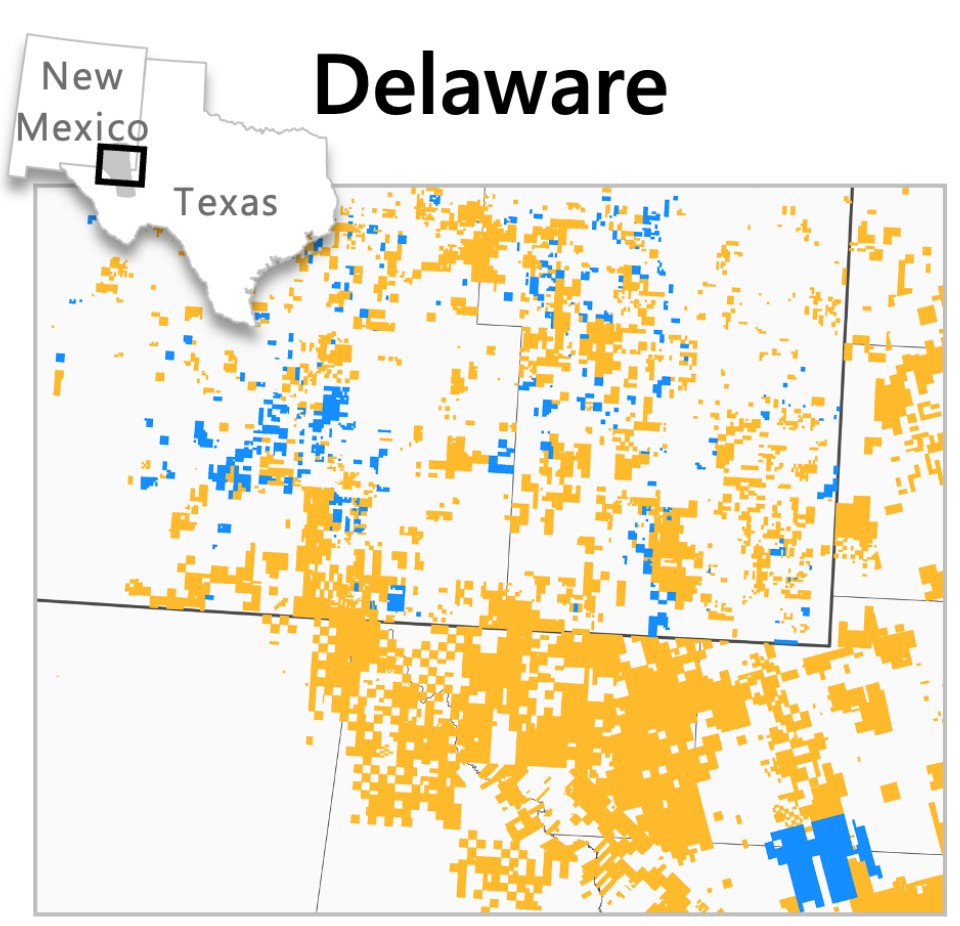

The combined company will have around 800,000 net acres in the Permian’s Delaware Basin, complementing ConocoPhillips’ existing presence in the Midland Basin.

Aaron Hunter, vice president for ConocoPhillips’ Delaware Basin business, said the company looks forward to drilling bigger projects in West Texas and New Mexico by adding in Marathon’s adjacent acreage.

“Where can I take [1.5-mile] or 1-mile sections on our acreage, or their acreage, and turn them into 3- or 4-mile laterals?” Hunter said Nov. 21 during Hart Energy’s Executive Oil Conference & Expo in Midland, Texas.

ConocoPhillips was already regularly drilling 3-mile laterals on its legacy Delaware acreage—where its land position made it possible. The company’s longest Delaware lateral was around 3.1 miles, Hunter said.

In the Midland Basin, ConocoPhillips has drilled a longer 3.6-mile well.

But after closing the Marathon deal, the company would like to optimize as many Delaware sections as possible for 3- and 4-mile laterals, Hunter said.

“We hope to have some proposals on plans next year on some 4-mile acreage on the [Delaware Basin] Texas side,” he said.

The Delaware Basin, where drilling targets are generally deeper and more expensive to tap into, has been slower to develop over time than the Midland Basin.

Based on a ConocoPhillips analysis of Enverus data, roughly 43% of the Midland Basin has been developed—compared to 25% of the Delaware Basin.

RELATED

Decoding the Delaware: How E&Ps Are Unlocking the Future

Secondary benches

In addition to drilling longer laterals, Hunter is also excited to learn about Marathon Oil’s experiences delineating the deep Woodford bench in the Texas Delaware Basin.

Marathon Oil, through wholly-owned subsidiary Bosque Texas Oil LLC, has been one of the most active operators testing the Woodford formation in Ward and Winkler counties, Texas.

“Just looking at public reported production, they look like really interesting wells,” Hunter said.

ConocoPhillips is drilling the Delaware Basin’s more primary benches: The Wolfcamp A, the third Bone Spring and the second Bone Spring in certain areas.

Hunter also sees future opportunities to drill projects in the shallower Avalon bench.

“We highly value those areas and look forward to developing them in the next five to 10 years,” he said.

RELATED

Barnett & Beyond: Marathon, Oxy, Peers Testing Deeper Permian Zones

Recommended Reading

Diamondback Energy Closes $4.1B Double Eagle IV Acquisition

2025-04-02 - Diamondback Energy Inc. closed on its approximately $4.1 billion deal to buy EnCap Investments’ Double Eagle IV, adding approximately 40,000 net acres in the Midland Basin to its portfolio.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Williams Commissions Two NatGas Projects to Expand Transco Network

2025-04-01 - Midstream company Williams Cos. added to its network capacity in the southern U.S. with the commissioning of the Southeast Energy Connector and the Texas to Louisiana Energy Pathway.

CenterPoint Energy Completes NatGas Pipeline Sale to Bernhard

2025-04-01 - CenterPoint Energy Inc. has closed on a sale of natural gas distribution utilities in Louisiana and Mississippi to Bernhard Capital Partners.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.