Never mind the massive deals—E&Ps have been hard at work on small-scale ground game M&A in shale plays around the Lower 48 this year. (Source: Shutterstock.com)

Ground game A&D might not steal headlines or standout in earnings calls—but E&Ps have been hard at work on small-scale dealmaking so far this year.

The past 12 to 18 months have been dominated by large-scale transactions, like Exxon Mobil’s $60 billion Pioneer acquisition and Chevron’s $53 billion acquisition of Hess Corp.

But other E&Ps are quietly making strides on acre-by-acre deals, acreage swaps and other small-ball transactions to grow their positions.

Multi-basin operator Continental Resources spent $17 million on unbudgeted acquisitions and $19 million of minerals acquisitions attributable to Franco-Nevada during the first half of 2024, the company disclosed in an Aug. 5 regulatory filing.

Continental teamed up with mining firm Franco-Nevada in 2018 to form a minerals-focused subsidiary.

Though Continental was taken private through a $4.3 billion buyout by Harold Hamm in 2022, the company continues to file quarterly and annual reports with the Securities and Exchange Commission.

It’s not entirely clear where Continental added assets through the first half of the year. Texas Railroad Commission (RRC) data show that the company has been picking up leases in the Permian’s Midland Basin—including properties formerly held by Occidental Petroleum.

RELATED

CEO: Continental Adds Midland Basin Acreage, Explores Woodford, Barnett

Permian deals

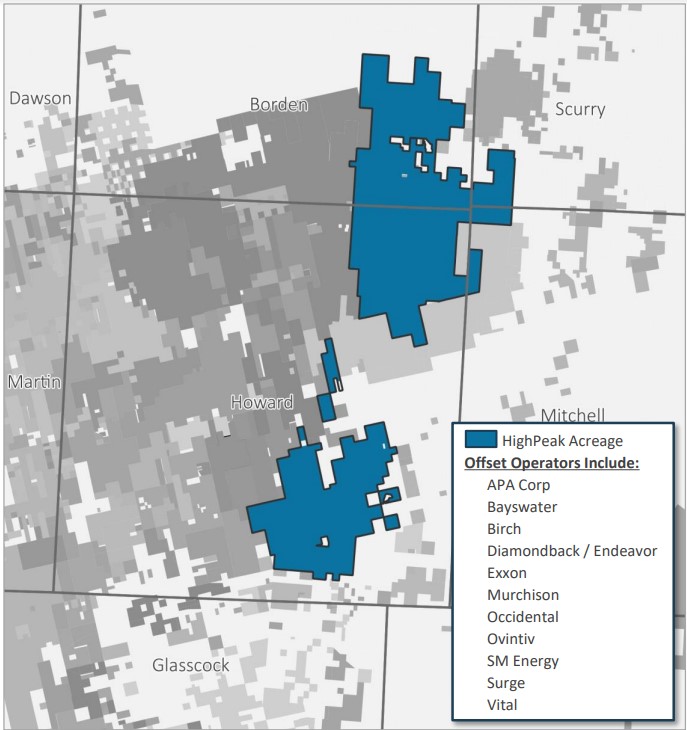

Elsewhere in the Midland Basin, public small-cap E&P HighPeak Energy spent $7.4 million through the first half of the year to acquire undeveloped crude and natural gas leases.

The acquisitions are largely contiguous with its Flat Top and Signal Peak operating areas, HighPeak said.

HighPeak has developed a position in the northern Midland Basin, primarily in Borden and Howard counties, Texas.

RELATED

Life on the Edge: Surge of Activity Ignites the Northern Midland Basin

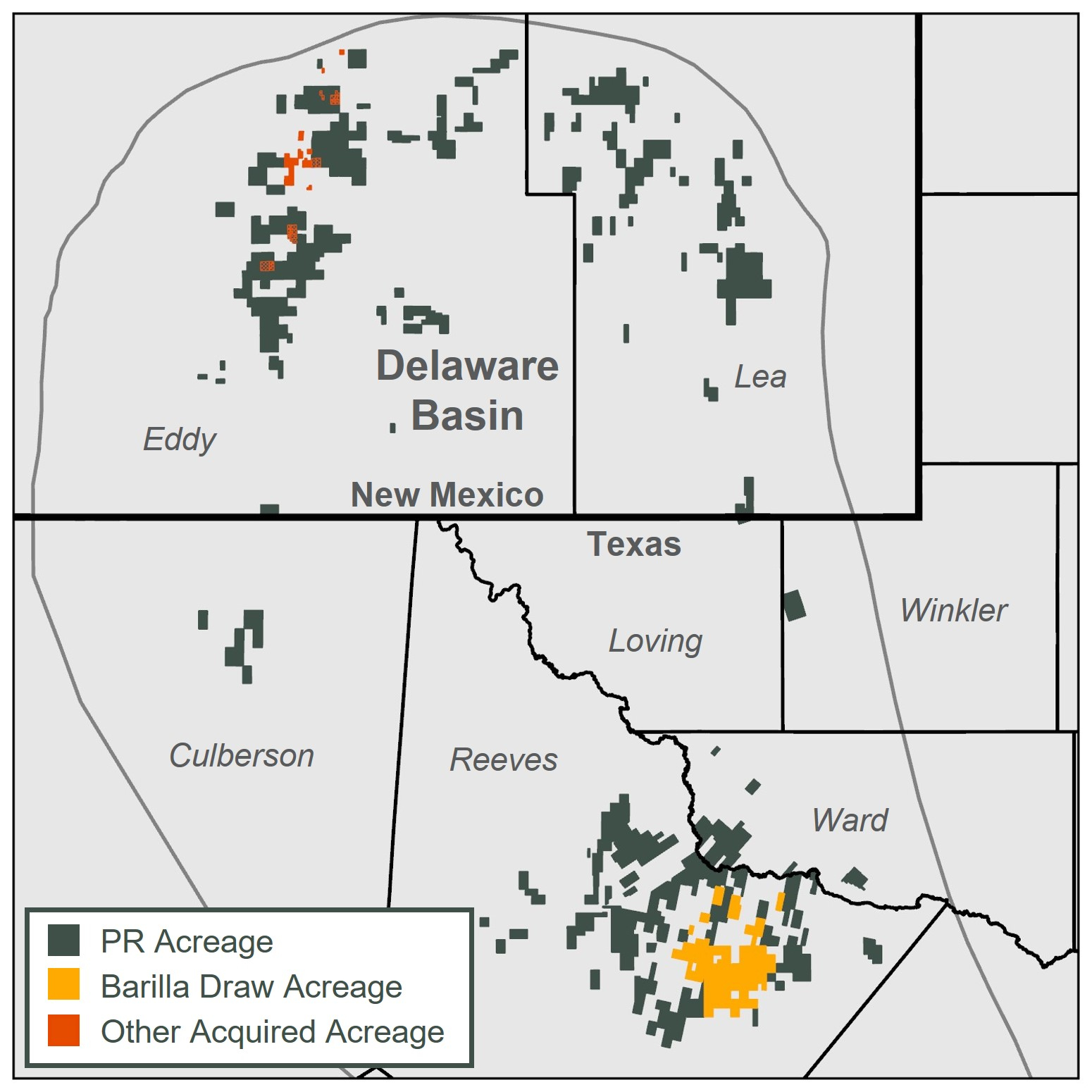

Permian Resources closed a larger $817.5 million acquisition of a Delaware Basin package from Occidental Petroleum, which included approximately 29,500 net acres and 9,900 net royalty acres in Reeves County, Texas.

But Permian Resources also bolted-on a smaller, 2,000-acre position in Eddy County, New Mexico, through the acquisition.

RELATED

Permian Resources Bolts-on Oxy’s Delaware Basin Assets for $820MM

Appalachia movement

Appalachia-focused E&P Antero Resources also made headway on organic M&A during the second quarter, allocating $21 million toward land acquisitions.

The company added approximately 3,500 net acres, representing 13 additional drilling locations at an average cost of around $750,000 per location, Antero said in second-quarter results.

The newly acquired locations more than offset the wells Antero turned to sales during the quarter. Antero plans to deploy between $75 million and $100 million on land acquisitions this year.

Antero placed 11 Marcellus Shale wells to sales during the second quarter; lateral lengths averaged 16,750 ft.

Meanwhile, Appalachia E&Ps EQT Corp. and BKV have raised capital through sales of non-operated Marcellus assets this year.

RELATED

NatGas A&D Warms Up as BKV Sells Marcellus Assets for $132MM

Recommended Reading

Aris CEO Brock Foresees Consolidation as Need for Water Management Grows

2025-02-14 - As E&Ps get more efficient and operators drill longer laterals, the sheer amount of produced water continues to grow. Aris Water Solutions CEO Amanda Brock says consolidation is likely to handle the needed infrastructure expansions.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

How DeepSeek Made Jevons Trend Again

2025-03-21 - As tech and energy investors began scrambling to revise stock valuations after the news broke, Microsoft Corp.’s CEO called it before markets open: “Jevons paradox strikes again!”

Pair of Large Quakes Rattle Texas Oil Patch, Putting Spotlight on Water Disposal

2025-02-19 - Two large earthquakes that hit the Permian Basin, the top U.S. oilfield, this week have rattled the Texas oil industry and put a fresh spotlight on the water disposal practices that can lead to increases in seismic activity, industry consultants said on Feb. 18.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.