The spotlight is shining on the power potential of abundant natural gas resources in the U.S. as domestic manufacturers and data centers, among others, crave more electricity.

Standing up more natural gas-fired power plants could help meet growing demand, while lowering global greenhouse-gas (GHG) emissions by further reducing reliance on coal. Power providers have an opportunity to go even further in shrinking carbon footprints by adding carbon capture and sequestration (CCS) components to their plans.

The U.S. Environmental Protection Agency’s (EPA) GHG rule, issued last year during former President Joe Biden’s administration, requires new baseload natural gas-fired power plants to install CCS technology capable of capturing 90% of CO2 emissions by 2032, or run below a 40% capacity factor. Coal plants that plan to operate beyond 2038 are also required to utilize CCS by 2032.

The rule’s impact on the CCS project outlook in the U.S. could mark a meaningful shift for the sector. With amine and other technology proven in power and other industrial applications plus the 45Q carbon sequestration tax credit on their side, CCS and midstream companies are positioning themselves to take on projects.

However, the road ahead may be bumpy. The threat of regulations being overturned, opposition from some utilities and the cost of post-combustion capture projects are among the challenges to giving CCS a boost in the U.S.

“From the coal side of things, we anticipate the [rule’s] impact to the CCS market to be minimal. Based on the age of existing infrastructure, the move towards natural gas and the cost of retrofitting facilities with capture technology, it is likely most plants choose to retire or convert the plant rather than going with CCS,” Brendan Cooke, vice president of CCUS for Rystad Energy, told Oil and Gas Investor (OGI) via email. “On the natural gas side of things, the impact would be much larger but will depend on how new plants are structured and whether they are planning to provide baseload support with a large capacity factor or act as peakers.”

The EPA says its Regulatory Impact Analysis projects reductions of 1.38 billion metric tons of CO2 systemwide through 2047 with the Greenhouse Gas Standards and Guidelines for Fossil Fuel-Fired Power Plants.

Cooke said the rule could have quite a large impact on the CCS project outlook in the U.S.

“Currently, the power sector is the largest source emissions addressable by CCS and making up 61% of emission sources addressable by CCS in the U.S., with 30% coming from coal and 31% from gas,” he said. “So, the potential for CCS in the power sector is really large.”

Chasing power

That is what Verde CO2 Chairman and CEO Charles Fridge is banking on. The Houston-based company, a private full-scale CCS developer, shifted its focus to the power generation sector.

“First and foremost, natural gas power generation is the most reliable form of power. We root for solar and onshore wind, but the wind doesn’t always blow and the sun doesn’t always shine,” Fridge told OGI. “To really make a difference in the environment, we felt like the most volumes that we could capture long term is [from] natural gas power generation.”

However, it is considered more difficult and more expensive to capture emissions from flue gas at gas-fired power plants due to low concentrations and purity of CO2.

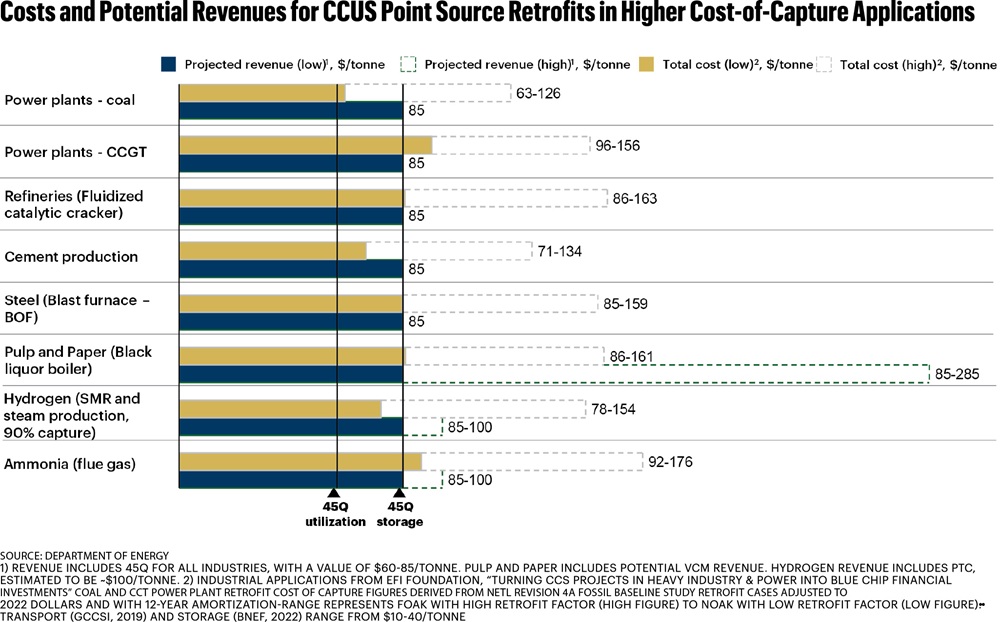

Some companies have shied away from post-combustion capture projects because of the costs. Federal incentives such as the 45Q tax credit for CCS offer up to $85/tonne; however, that is not enough to make CCS projects economic for big emitters, many say.

“And because the expense with current technologies is relatively high, it’s marginally economic unless you can find just the right plant,” Fridge said.

Goldilocks conditions include being a newer plant with a long lifespan, which enables money spent to be amortized over the project’s life; having favorable geography near the sequestration site; and having enough space for capture equipment such as contact towers near exhaust stacks.

“Your sequestration site needs to be close to your capture so you don’t have to incur the significant expense of building brand new pipelines for long distances,” Fridge said. “So, most all of our projects are very focused on one emitter with one site. We’re not building big hubs right now because we are a private company.”

Power generation flue gas is similar, whether it is in located in Texas or Wyoming, and requires the same type of conditioning, Fridge said. He added that amine solvent capture technology has been around for a long time, is proven, effective and used at natural gas processing plants in oil fields.

Some companies are developing separation technologies involving membranes and looping cycles.

“We’re rooting for a lot of these new, cheaper technologies and there’s some great pilot programs out there,” Fridge said. “But there’s nothing that we can, frankly, finance around.”

Power moves

Despite the challenges, some companies in the power sector are still pursuing projects to lower emissions.

Calpine Carbon Capture is developing a capture project designed to capture 95% or more CO2 emissions from turbines and auxiliary boilers at the Baytown Energy Center, a combined heat and power generation facility in Texas. The project, which received funding from the U.S. Department of Energy, will capture and store about 2 million metric tons of CO2 emissions, according to the company’s website.

In Louisiana, Entergy is working with Crescent Midstream on a $1 billion-plus project. The Houston-based midstream company was tapped to build an integrated CCS project at Entergy’s 994-megawatt Lake Charles Power Station. The project, which includes a 30-mile pipeline, is designed to capture up to 3 million tonnes of CO2 per year and is expected to be fully operational by 2029.

They are among the projects moving forward, but economics is preventing a surge in projects.

“Currently this cost is sitting in a range that, after accounting for any required transportation and storage costs, it is difficult to operate for less than the $85 per tonne offered by 45Q,” Cooke said. “That being said, power sector mandates have the potential to force further development regardless of economics. However, we aren’t seeing the impact of this in the market at this time.”

A group of companies, municipal and state authorities and cooperatives asked the Trump administration to review the regulations enacted during the Biden administration. In a Jan. 15, 2025, letter to Lee Zeldin, who now heads the EPA, the group said the regulations—specifically the new GHG rule and coal combustion residual rules—burden the power sector without tangible benefits.

“Any new gas-fired power plants that will operate at greater than 40% of their capacity factor (i.e., the plant generates an amount of electricity that is more than 40% of what the plant was designed to generate) must install by 2032 CCS that captures 90% of the plant’s GHG emissions,” the letter states. “Because 90% CCS is infeasible and could not be put in place by 2032 even if it were feasible, the GHG Rule effectively forces any new gas-fired power plants to operate at less than 40% of their capabilities, thereby imposing unnecessary and wasteful costs on electric utilities (and the public) by requiring the construction of at least twice as many units to meet electric demand.”

Executives from Duke Energy and Talen Energy were among the signers. The EPA’s rule prompted several lawsuits.

Looking Ahead

Cooke also pointed out the timeline is tight given the scale of needed infrastructure during the next seven years. Moreover, Trump has said he plans to undo these regulations, Cooke said.

“The path to repeal is more complex than with other EPA rules he undid in his last term, as the rule for existing coal power plants and new gas-fired turbines was finalized ahead of the Congressional Review Act (CRA) 60-day lookback period,” Cooke said. “However, with a Republican-appointed head of the EPA, it is certainly still possible.”

RELATED

The Evolving Federal State of Energy Under Trump 2.0

Retrofits to existing gas power generation are also unlikely to progress, he added.

Fridge said he doesn’t think anyone knows what will happen with the regulations. He referred to executive orders unveiled during the early days of Trump’s return to office and some, including a funding freeze, that were blocked in the courts.

“I think there’s a lot of trepidation or pause right now with the investing world, which I understand,” he said. “But I think everything that has been telegraphed by the Trump administration is that they’re pro-fossil fuels, which is a good thing.… If we can capture CO2, there’s zero reason not to do it as long as there are government incentives, which 45Q gives us, and we hope that the voluntary credit markets will continue to improve.”

There is no question that CCS technology works, according to Fridge.

“I don’t think you can argue with a straight face that we can’t effectively capture. The question is, ‘Is it cost effective?’” he said. “And with the government incentives that have been out there for a while, that are out there, we certainly believe that it is effective.”

Verde CO2 has entered agreements with companies in the power sector, Fridge said, but he couldn’t share information about the projects due to confidentiality provisions. “We have several million tons of CO2 under contract of existing power generation, and we are moving forward with our FEL (front-end loading) Level 3 FEED study, which will lower the cone of uncertainty as to what the actual costs are going to be.”

The pipeline of U.S. commercial capture projects tracked by Rystad have about a combined 385 million tonnes per annum (mtpa) of capture capacity by 2035. When factoring in risks, the firm put the number at roughly 225 mtpa.

“This takes into account the risk of delays or cancellations to projects that would push their operational date out past what had been communicated by project developers thus far,” Cooke said. “In terms of scale, this represents a ~9x growth compared to the capacity of active projects today of roughly 25 mtpa.”

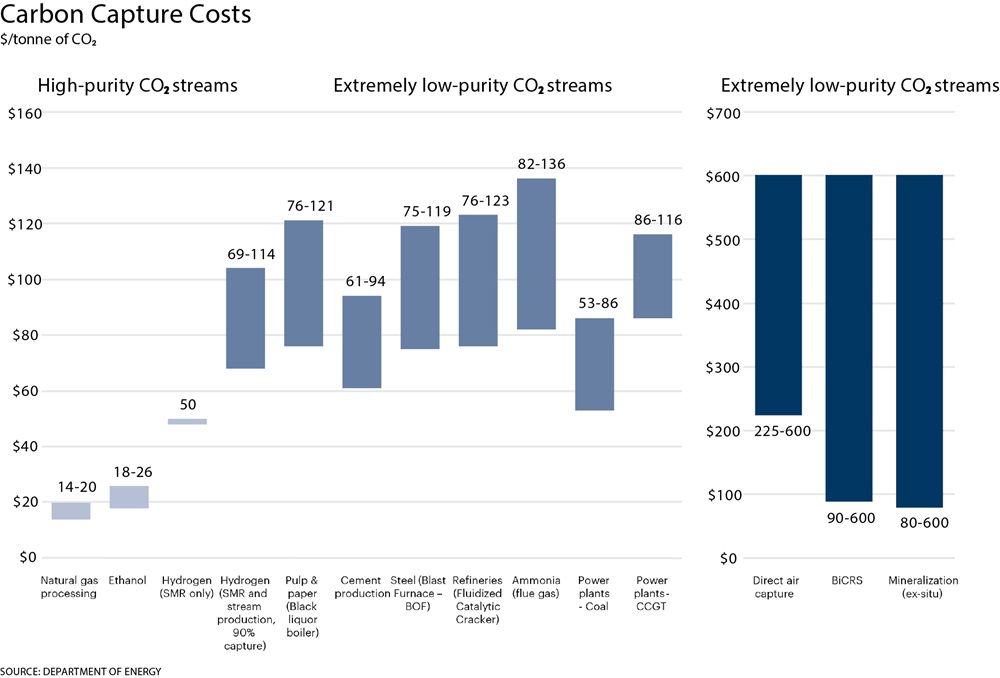

The types of CCS projects likely to see the most near-term growth are natural gas processing, ethanol, and blue hydrogen and ammonia, according to Rystad. The reason: project economics.

“The project types, especially gas processing and ethanol, have low costs of capture, which, when combined with the additional costs of transportation and sequestration, still offer a line of sight to revenue generation under the current programs,” Cooke said. “Hydrogen and ammonia also have the added potential benefit of capitalizing on blue premiums for low-carbon fuels compared to traditional products. There has been little realization of these blue premiums as of yet; however, they contribute to the business case for CCS in that sector.”

Recommended Reading

Energy Transfer Requests More Time to Build Lake Charles LNG Plant

2025-04-15 - Lake Charles LNG project was impacted by the Biden administration's refusal to grant an extension to Energy Transfer's license to export to countries other than those that have free trade agreements with the U.S.

South Bow Cleared to Restart Keystone Following North Dakota Oil Spill

2025-04-14 - Canada’s South Bow is expected to restart flows on the Keystone Pipeline as soon as weather permits.

ONEOK, MPLX’s ‘Wellhead-to-Water’ Deal Dominates Permian NGL Race

2025-04-10 - The $1.75 billion ONEOK-MPLX deal reflects how midstream companies are going big in the petrochemicals sector.

South Bow Shuts Down Keystone Pipeline After Oil Release

2025-04-09 - South Bow Corp. reported a release of approximately 3,500 bbl near Fort Ransom, North Dakota, and it is evaluating the return-to-service plans.

Segrist: Permitting Outreach Efforts Land in Unusual Hands

2025-04-09 - Natural Allies group seeks to convince blue state citizens to embrace the natural gas infrastructure that they need. Some of the country’s largest natural gas and midstream companies back the group.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.