By accepting equity in a Chapter 11 reorganization rather than cash from a forced liquidation, creditors of E&P companies during the downturn were hoping to realize a better return. They expected equity values would rise post-emergence due to an increase in commodity prices or to insightful management actions post-bankruptcy.

An assessment of 12 reorganized producers’ performance finds a mixed bag of both value creation and destruction while the price of West Texas Intermediate (WTI) has improved and natural gas has been mostly flat. These producers emerged from bankruptcy between September 2016 and August 2017. There are possible commonalities among performances, but observed correlations are relatively weak among the sample set.

The downturn

In the second half of 2014, WTI collapsed from more than $100 on July 30 to $53 by year-end. Despite several improvements during 2015, the price continued to fall, eventually to $26 in February of 2016. Dozens of producers filed for Chapter 11 bankruptcy protection to restructure their over-levered balance sheets and address liquidity issues.

In past downturns, many operators were liquidated via Section 363 sales or through debt-for-equity exchanges in which the number of debtholders was closely held. In the latter, the newly emerged E&P eliminated the costs of continuing Securities and Exchange Commission (SEC) compliance.

However, during the recent downturn, several debtors emerged from bankruptcy with outstanding common equity that was required to be registered with the SEC—either due to the number of holders or to creditors receiving the new equity requiring a liquid market for the shares, notwithstanding the cost associated with continued SEC requirements.

Each of the 12 producers whose stock performance was examined registered its shares for trading at the time of exit, or shortly thereafter, and has maintained current filings with the SEC.

At least three other E&Ps that have exited bankruptcy during the same period issued equity in exchange for debt. However, that equity is thinly traded and the companies do not file regular updates with the SEC. These companies are Berry Petroleum Co. LLC, which was spun out of the Linn Energy Inc. bankruptcy; Sabine Oil & Gas Corp.; and Blue Ridge Mountain Resources Inc., formerly known as Magnum Hunter Resources Corp.

Debt-for-equity swaps

In many cases, the rationale for the debt-for-equity swap may rest on a belief that liquidating the debtor’s assets for cash in a bankruptcy would result in a lower bid price than could be achieved in post-bankruptcy sales by the reorganized company. As an example, this strategy has worked well for Linn Energy’s holders of its post-reorganization equity. In addition, another potential source of appreciation is increased commodity prices following the exit, which has occurred for the oil-weighted operators.

To measure the change in equity value, the total common equity value of the company as included in the plan of bankruptcy—and reported in its “Fresh Start Accounting” footnote to its annual report—is compared with the equity’s market value at close on May 18, 2018.

Five of the operators have achieved an increase in their equity value following exit. Penn Virginia Corp. leads the way with a market value more than five times its exit value ($1 billion vs. $191 million at exit). The other four gainers are Goodrich Petroleum Corp. (up 183%), Linn Energy Inc. (61%), Halcón Resources Corp. (48%) and Bonanza Creek Energy Inc. (9%).

At the other end of the spectrum are Ultra Petroleum Corp. (down 89%), Vanguard Natural Resources Inc. (78%) and Energy XXI Gulf Coast Inc. (72%). These have lost well over half their equity’s exit value. Four others to have seen an erosion in equity value are Midstates Petroleum Co. Inc. (down 31%), Amplify Energy Corp. (24%), Chaparral Energy Inc. (17%) and SandRidge Energy Inc. (7%).

The average for these 12 stocks is a gain of 45%—driven by the return on Penn Virginia. However, considering the total asset value of all 12 producers at exit, the weighted average performance is an overall destruction of 22% of exit value.

As a benchmark, WTI was between $40 and $55 during the operators’ exits, and the price at close on May 18, 2018, was $71.59. All other things being equal, one would have expected the oil-weighted companies to have a greater equity value in a $70 world. For operators with material oil weightings, only Penn Virginia (70% of YE2017 PDP reserves in oil, utilizing a 6:1 equivalency, has outperformed WTI. Halcón (63% oil at YE2017) comes close with a 48% increase compared with a 58% appreciation in WTI.

For the operators heavily-weighted toward natural gas, the WTI comparison is admittedly unfair, with Henry Hub gas prices largely flat since exit for these companies. Among them with less than 25% of YE2017 PDP reserves in crude oil, Goodrich (21% oil) and Linn Energy (16%) have performed well. On the other hand, Ultra (5% oil) and Vanguard (17%), the two worse performing companies, clearly did not get any lift from the appreciation in oil prices.

Common denominators

In compiling the data for this performance set, the initial expectation was to find that operators that exited bankruptcy earlier in the cycle, which proved to be lower for longer than the market initially expected, would underperform, while the most recent exits would be more successful.

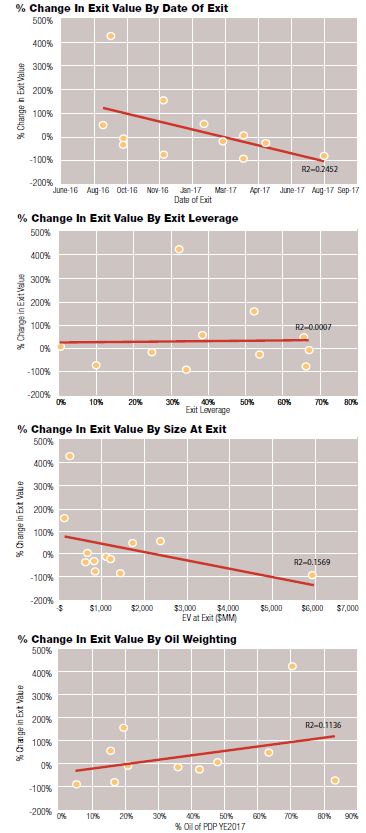

In contrast, while the correlation between the date of exit and the ratio of current value to exit value is weak with many results well off trend, the findings indicate that earlier exits have outperformed—driven by the outperformance of Penn Virginia and the underperformance of the most recent exits.

Significant debt-service obligations amidst a falling oil price and the lack of access to new capital to pay off old capital were among contributing factors to these bankruptcies. At exit, the reorganized companies had myriad capitalization structures. Several had very little debt as a percentage of the exit enterprise value. For example, Bonanza Creek had no debt and Energy XXI had only 10% of its exit enterprise value in debt. At the other extreme, SandRidge, Halcón and Vanguard had exit capital structures with approximately two-thirds debt.

When the exit leverage—the percentage of exit enterprise value comprised of debt—is plotted against the post-bankruptcy performance of the equity, the trendline tracks slightly upward for those producers with higher leverage at exit. But, again, the correlation is weak with many data points well off trend.

Some correlation appears to exist between the size of the enterprise value at exit with positive performance—but perhaps not the one expected: The smaller operators have, on average, created more value—or destroyed less value—than the larger operators. The smallest--Penn Virginia and Goodrich--lead the list of top performers; the largest, Ultra, lags near the bottom. However, not all small companies have performed well. Also, Linn and Halcón, the second- and third-largest operators at exit have created value.

In addition, the producers’ oil weighting at year-end 2018 in terms of proved developed producing (PDP) reserves was examined as a possible performance link. The initial expectation was that the oilier producers would outperform gas-weighted producers.

While the trend is slightly up for oil-weighted operators, two of the top performers (Goodrich and Linn) are predominately gas producers. Meanwhile, the operator most heavily weighted toward oil (Energy XXI) has one of the weakest results.

Warrants

In eight of these bankruptcies, the reorganized E&P issued warrants along with shares to creditors. As of this past May 18, the warrants are, in all cases, materially underwater. Three of the top-performing producers—Penn Virginia, Linn and Goodrich—did not issue warrants as part of reorganization. For the other two value-creation producers, Halcón and Bonanza Creek, the stock price was 40% and 51% of the strike price, respectfully—still a long way from being in the money.

Looking forward

Based on the performance of the 12 post-bankruptcy equities, the debtholders that received equity in the newly reorganized E&Ps have, with a couple of exceptions, largely failed to realize option value, despite material increases in the price of WTI since exit. The correlation appears relatively weak between the returns achieved to date and the quantitative factors of date of exit, exit leverage, size of company and percentage of PDP reserves in oil.

Possible changes in restructuring-plan negotiation include pushing to receive more cash in lieu of new equity; negotiating much lower warrant strike prices; increasing the percentage of newly issued debt in lieu of equity, considering the observed lack of correlation between low exit leverage and performance; and/or liquidating the newly held equity promptly at the first signs of a degradation in value. The actual performance of these equities should serve as a lesson for those creditors in on-going bankruptcies, or negotiating restructuring agreements in advance of new bankruptcies, to not necessarily rely on a post-exit bump in stock prices.

This set of companies and their post-bankruptcy performance justifies further scrutiny and additional updates may be forthcoming on this as well as on more conclusive commonalities among outperformers and underperformers.

Jay D. Squiers is a managing director in the Dallas office of Ankura, a national independent consulting firm. Squiers works with energy companies and their creditors to overcome financial and operational challenges.

Recommended Reading

Eni, PETRONAS Form Gas Development JV in Indonesia, Malaysia

2025-02-27 - Eni and PETRONAS believe the joint venture will lead to synergies that create a leading LNG player in the region.

ConocoPhillips to Sell Interests in GoM Assets to Shell for $735MM

2025-02-21 - ConocoPhillips is selling to Shell its interests in the offshore Ursa and Europa fields in the Gulf of Mexico for $735 million.

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

Woodside, Chevron Agree to Swap Oil, LNG Assets

2024-12-19 - Woodside and Chevron have entered an agreement that shifts interests in oil, LNG and carbon capture projects with Chevron also paying Woodside $400 million.

Battalion Oil Walks Away from Fury Resources Buyout

2024-12-20 - The Battalion Oil-Fury Resources merger had been in discussions for more than a year, but Battalion said Fury failed to meet financial deadlines to continue the talks.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.