Oil and Gas Investor Magazine - July 2018

Cover Story

E&P Processing Power

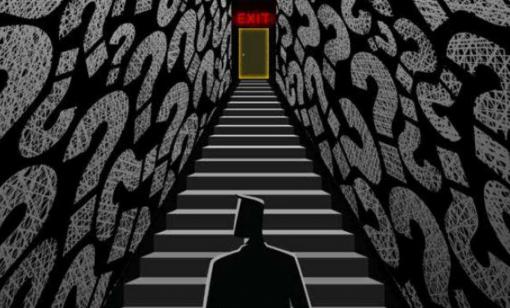

The oil and gas industry’s long flirtations with new technology—including hydraulic fracturing itself —have been romanticized, but E&Ps that lag behind in the coming digital wave of artificial intelligence may find heartbreak and ruin ahead.

Feature

Encana’s Path Forward

President and CEO Doug Suttles refocused Encana Corp. after facing what he called “inconvenient facts.”

Fieldwood Energy: Voyage From Debt To The Deep

Fieldwood entered Chapter 11 with a simultaneous deal to buy Gulf of Mexico assets from Noble Energy while taking pains to meet obligations to employees and more than 700 vendors.

Oil Prices Up, Spending Not So Much

The industry downturn that began in the second half of 2014 forced oil and gas producers to cut spending and suspend, delay or cancel upstream development projects.

PE E&P Firms: Sending Money Home

With less receptive capital markets, traditional exits for private-equity-backed portfolio companies have narrowed. Sponsors are finding new ways to make returns to investors.

Shale And The New Order

Energy markets consultant Jamie Webster discusses shale’s global role, the coming production decline and why oil might top $100 again.

The Bakken’s Edge

The Bakken Shale emerged from the downturn stronger and leaner, and producers say its economics compete with the best—particularly the Permian.

The Creditors’ Gamble

E&P debtholders converted to equity owners through a slew of reorganizations. Have the post-bankruptcy months resulted in value creation or value destruction?

A&D Trends

A&D Trends: Upstream Trade Winds

Most analysts’ data show upstream A&D activity to be flat or declining and deal values nosediving compared to last year, but lost in these stats is the underappreciated art of the acreage swaps.

At Closing

Praising Permian Pipelines

Let us come now to praise famous men—those who will build more pipelines, central processing plants and water disposal facilities in the Permian Basin.

Bright Spots

Bright Spot: Meet Twin Oaks’ Steven Patterson

Steve Patterson recently spoke with Hart Energy’s Oil and Gas Investor about his time with Chevron and what brought him to Dallas-based Twin Oaks Fund Management, where he currently serves as vice president.

E&P Momentum

The Permian Barnett Shale

The Barnett Shale is becoming new again as several E&Ps unleash plans for horizontal development of the Barnett resource play in the Permian Basin.

From the Editor-in-Chief

We Wish To Believe

You know the saying, “The cure for low natural gas prices is”—say it with conviction—“low natural gas prices.”

On the Money

Permian Takeaway Blues

An interesting aspect about energy is that there’s always something new to learn or relearn.