The industry has amazingly good methods to quantify rocks in the subsurface, and they are constantly improving. The main ones are downhole well logs of various kinds and seismic. They measure properties on two very different scales, but both are valuable for understanding the subsurface.

The industry’s ability to relate these measurements to the actual subsurface rocks is critical for E&P. However, the physical measurements alone commonly do not give a unique answer as to what the actual rock-fluid system actually is. So the challenge is to properly interpret those data, and doing so requires a calibration of those measurements with good rock data. The rock data are usually in the form of whole cores, sidewall cores or cuttings (available for virtually every well). In some cases, nearby outcrops (as with the Eagle Ford Shale) can be very instructive. The real objective is to reduce risk.

The most common phrases used to describe this are “rock physics” or “reservoir characterization.” These words embody both the 3-D geometry of the reservoir (best with seismic) and the internal attributes of the reservoir (mostly from logs).

Historical context

The first application of rocks physics came in the ’50s and ’60s to tie downhole well logs to rock data, mostly for the conventional clastic and carbonate reservoirs the industry dealt with at that time. With the advent of true amplitude seismic data in the ’70s the industry realized there was valuable rock-fluid information encoded into amplitudes, frequencies and phase properties of the seismic, but it needed calibration with real rock data.

As the industry moves into unconventional resource plays where the reservoir is even more complicated, the need to calibrate the engineering data with rock information is more critical as the lithologies, pore systems and flow properties are more complicated. The industry also deals with mechanical properties like brittleness, which is so critical to create the fractures to make these plays economical.

A check of most any E&P office will show that most workers are fixed on screens manipulating various forms of data. Many companies have deserted the training that earlier geologists had— namely, to carefully look at and describe the rocks.

What do rocks provide?

The main items we get directly from the rocks are:

- Lithology;

- Mineral composition;

- The mix of lithology and mineral composition (i.e., the degree of heterogeneity that is being averaged by the measuring tool);

- Porosity type and value;

- Permeability;

- Brittleness;

- Cementation exponent (m);

- Specific minerals that create log anomalies that complicate normal interpretation; and

- Various special core analysis measurements that impact petrophysical models, reservoir engineering parameters and well completion designs.

Examples:

Two recent examples illustrate the value of good rock data because in each case the initial interpretations from good engineering data alone indicated noncommercial or water-wet units. When rock data were added to calibrate the log data, the units were all economical pays.

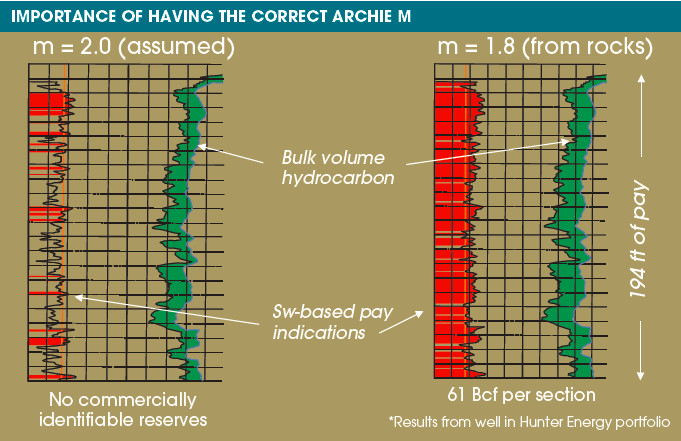

Establishing the correct m. A correct m is essential for establishing an accurate water saturation calculation and thus establishing what is pay. A value of 2.0 is commonly assumed. That value can in fact vary from 1.5 to 2.5. By looking at the rocks, the correct value for m can be established rather quickly and inexpensively. A correct m can result in testing units that would otherwise appear wet using an existing assumed value. Figure 1 shows how a marginally productive zone (left) was converted to one that has about 1.7 Bcm (61 Bcf) of recoverable gas per section (right) by obtaining a correct m from cuttings.

FIGURE 1. An assumed m of 2.0 gave a marginally productive pay zone (left). Once calibrated with rock data, the new m of 1.8 gave 59 m (194 ft) of pay (right) and large recoverable reserves. (Source: L. Meckel & Co., courtesy of K. Stolper, personal communication)

Identifying low resistivity, low contrast pays. Low resistivity, low contrast zones are commonly overlooked or considered wet due to their low resistivity values. This is because 1) there is usually a mineral or lithology that supresses the resistivity enough to indicate the unit is wet, 2) the reservoir may be thinly shale-laminated, which cannot be resolved with the available log suite, and 3) the grain size and pore throat distribution may be small enough that nonproductive water is trapped.

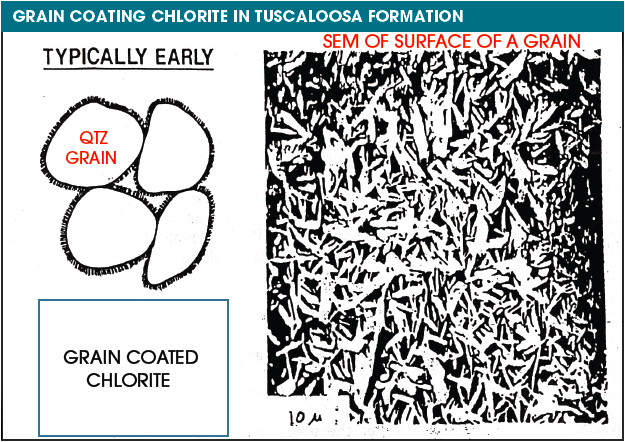

For example, in part of the Gulf Coast Tuscaloosa trend one can get water-free oil production at less than 2 ohm-meters, a resistivity value normally considered wet. Available cores (cuttings will work fine) show that where this occurs, the quartz grains are coated with a diagenetic bladed chlorite that contains lots of micropores filled with water (Figure 2). Therefore, the electrical current goes through these thin wet rims on the grains and bypasses the resistive hydrocarbons in the main pore system. The units thus have a low resistivity indicative of being wet, when in fact they will produce water-free oil.

FIGURE 2. This unit had very low resistivity and was considered wet. When calibrated with rock data (right image), it was realized that the sand was a low resistivity, low contrast pay and was not water-wet. The low resistivity was due to the pore lining chlorite that had abundant micropores filled with nonmovable water. (Source: L. Meckel & Co.)

If maximizing the value received from well-acquired and expensive engineering tools like logs and seismic is desired, it is critical that the data be calibrated with real rock data. Good rock physics data provide a better interpretation of the subsurface, thereby reducing the risk associated with this business.

References available. Contact Rhonda Duey at rduey@hartenergy.com.

Recommended Reading

Permian to Drive Output Growth as Other Basins Flatten, Decline–EIA

2025-01-14 - Lower 48 oil production from outside the Permian Basin—namely, the Bakken and Eagle Ford shales—is expected to flatten and decline in coming years, per new EIA forecasts.

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

Shale Outlook Eagle Ford: Sustaining the Long Plateau in South Texas

2025-01-08 - The Eagle Ford lacks the growth profile of the Permian Basin, but thoughtful M&A and refrac projects are extending operator inventories.

CEO: Berry Gears Up for Horizontal Drilling in Uinta Stacked Pay

2024-12-13 - Berry Corp.’s legacy roots are in California’s Central Valley—but its growth engine is in Utah’s emerging Uinta Basin, CEO Fernando Araujo told Hart Energy.

Anschutz Explores Utah Mancos Shale Near Red-Hot Uinta Basin

2024-12-10 - Outside of the Uinta Basin’s core oil play, private E&P Anschutz Exploration is wildcatting in Utah’s deeper, liquids-rich Mancos shale bench, according to a Hart Energy analysis.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.