A deep dive in the January 2025 issue of Oil and Gas Investor explores the power generation that new Lower 48 data centers and other imminent growth in demand will require. Besides compelling investment in generating the electrons, industry members and analysts report investment is needed in power-transmission infrastructure itself.

Estimates of new power demand for data centers alone in the coming few years is as much as 80 gigawatts (GW), which is the equivalent of 96 new nuclear reactors like Unit 1 at Three Mile Island.

Whatever the numbers turn out to be by 2030 or 2035, though, “I don’t think we have the infrastructure planned to meet all this,” said Rob Gramlich, president of Washington, D.C.-based consulting firm Grid Strategies.

Gramlich was among the speakers at a joint Dallas Fed and Kansas City Fed energy forum in November.

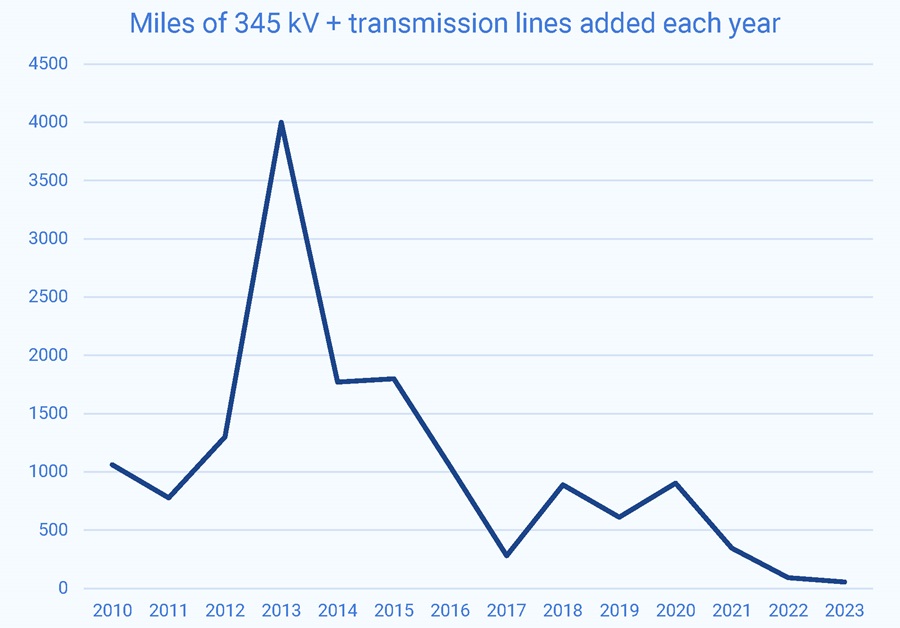

Ten years ago, some 4,000 miles of 345-kilovolt-and-greater transmission was built in the U.S., he said. “This has really trickled down to barely anything now.”

While oil and gas producers have sounded the alarm over federal, state and other permitting gridlock for decades, power companies have been finding in the past decade that this hurdle is impeding transmission growth, too.

Rick Muncrief, Devon Energy president and CEO, said reform is needed “irrespective of what part of the energy sector you’re in.”

And urgently, he added. “With energy, you can only kick a can down the road so far and you’re going to wake up one day and have a hell of a crisis on your hands.

“… When the power’s out, the power’s out and that’s when meltdowns occur.”

RELATED

Permitting Reform Stalls in Congress Despite Industry Support

Further, once clearing permitting and other impasses, when new power is ready to come online “the regional interconnection queues are all backed up,” said Kristina Lund, president of wind, solar, transmission and energy-storage developer Pattern Energy Group.

U.S. power infrastructure doubled between 1950 and 1980 as demand doubled. And it doubled again between 1980 and 2010, noted Stacey Dore, power producer Vistra Corp.’s chief strategy and sustainability officer.

Vistra projects another doubling between 2020 and 2050.

This is while also needing to replace many existing power plants, said Javier Fernandez, president and CEO of power generator Omaha Public Power District.

In Nebraska alone, “50% of the generators are 40 years old or older and 25% of them are 50 years old,” Fernandez said.

In a report in September, Evercore ISI energy analyst James West wrote that “the breadth and severity of issues facing the power sector are more likely to get larger before they get smaller.”

He estimates some $630 billion of large-power-load consumers—data centers, manufacturing plants and industrial facilities—will come online by 2035.

“Time is of the essence to address the capability and reliability of the grid to address demand growth,” he wrote.

Peak power demand will be some 38 GW greater in the next five years and peak winter demand will be some 78 GW greater in the next 10 years, he estimates.

And “the current grid infrastructure is not currently equipped to handle” this, he added.

Meanwhile, “most state public utility commissioners have little experience of regulating in a growth environment,” Chris Seiple, vice chairman of power and renewables for Wood Mackenzie, reported in October.

Tech executives who are accustomed to moving at light speed “are shocked” when they “learn about the pace at which electric utilities move,” Seiple added.

Woodmac counted 51 GW of new data-center announcements since year-end 2022. Should this grow 15% per year during the next five years, another 25 GW is needed, Seiple wrote.

Demand from manufacturers could be 15 GW for building batteries, solar wafers and cells and semiconductors.

“Lastly, the wider electrification of the economy will drive demand, with electric vehicle use continuing to grow and electrolyzers connecting to the grid potentially adding another 7 GW of demand through 2030,” Seiple reported.

Renewables alone won’t answer the call, he added. “If renewables are only able to barely match the pace of demand growth, it means we won’t be decarbonizing the power sector.”

At Evercore, West also sees more power demand coming than can be answered by alternative energy.

He concluded: It is “The Age of Natural Gas.”

Recommended Reading

Occidental to Up Drilling in Permian Secondary Benches in ‘25

2025-02-20 - Occidental Petroleum is exploring upside in the Permian’s secondary benches, including deeper Delaware Wolfcamp zones and the Barnett Shale in the Midland Basin.

Exxon Sits on Undeveloped Haynesville Assets as Peers Jockey for Inventory

2025-04-09 - Exxon Mobil still quietly holds hundreds of locations in the Haynesville Shale, where buyer interest is strong and inventory is scarce.

Early Innings: Uinta’s Oily Stacked Pay Exploration Only Just Starting

2025-03-04 - Operators are testing horizontal wells in less developed Uinta Basin zones, including the Douglas Creek, Castle Peak, Wasatch and deeper benches.

Antero Stock Up 90% YoY as NatGas, NGL Markets Improve

2025-02-14 - As the outlook for U.S. natural gas improves, investors are hot on gas-weighted stocks—in particular, Appalachia’s Antero Resources.

Oklahoma E&P Canvas Energy Explores Midcon Sale, Sources Say

2025-04-04 - Canvas Energy, formerly Chaparral Energy, holds 223,000 net acres in the Anadarko Basin, where M&A has been gathering momentum.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.