The E&P sector is working to win back investors by giving them what they want—cold, hard cash.

They’re doing so with robust free cash flows, which are being returned to shareholders through a medley of dividends and stock buybacks.

But as commodity prices and oil company revenues have descended from the heights seen in 2022, the sector has lowered capital spending to keep cash flowing freely.

Experts say free cash flow through the U.S. upstream sector remains healthy. Balance sheets are nearly as clean as they’ve ever been. Debt levels are low.

The handful of publics that took on debt to make large-scale acquisitions, like Occidental Petroleum, have realistic goals for deleveraging. Some M&A buyers, like Civitas Resources, are shifting free cash flow toward debt reduction in the near term.

Oil and Gas Investor reported that E&Ps were “free cash flow utopias” in mid-2023. Today, the sector remains the most investible it’s ever been, said Doug Reynolds, managing director of energy and power investment banking at Piper Sandler.

E&Ps’ “efficiencies are making returns on just about all rock better,” Reynolds said. “Free cash flow is very significant. A huge amount of cost has come out of the business either through consolidation or efficiencies or both.”

RELATED

‘Free Cash Flow Utopias’ Offset E&Ps Hurdles to Accessing Capital

Lower spending

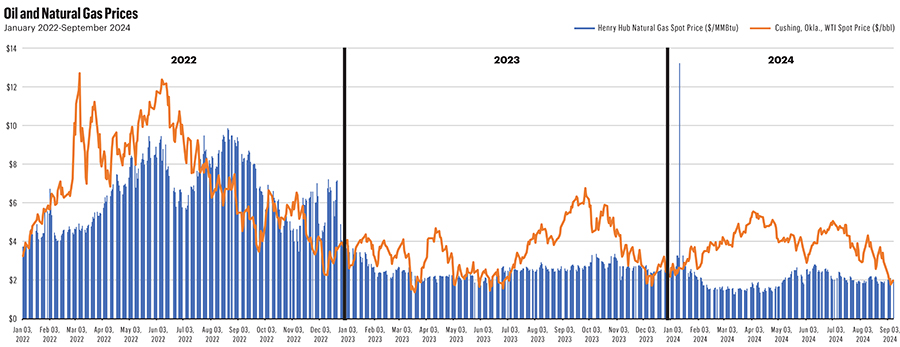

Oil and gas companies were awash with cash in 2022 as commodity prices spiked and the world emerged from the depths of the COVID-19 pandemic. U.S. supermajors Exxon Mobil and Chevron posted record profits.

“2022 was a wonderful year. Commodity prices were historically high for both oil and gas,” said BOK Financial Managing Director Cristina Stellar. “They were printing money.”

But as commodity prices have decreased over time, so have oil company revenues.

Operating cash flow—revenues from sales minus operating expenses—dropped across the upstream sector between 2022 and 2023.

Free cash flows—operating cash flows minus a company’s capital spending—also fell in 2023.

But from 2023 and into 2024, free cash flow generation has remained relatively flat. Operators are staying disciplined and keeping their spending controlled to drive healthier cash flows, according to Bernstein Research’s coverage of 42 North American E&P companies.

Second-quarter cash flow of $21/boe was up about $1/boe from the first quarter, per Bernstein data. Average oil prices were also up—WTI increased to $81.77/bbl versus $77.60/bbl in the previous quarter.

E&Ps reinvested around 58% of their cash into operations during the second quarter, down from around 61% in the first quarter.

But that’s still well below the sector’s pre-pandemic spending, when E&Ps would reinvest 90% to 100% of cash flows into growing production at nearly any cost. That cost turned out to be high: a bout of painful bankruptcies and reorganizations across the E&P sector and a flight of capital from the energy space.

Since its emergence from the 2019 price collapse and the COVID-19 pandemic lows, the name of the game for the E&P sector has been capital discipline.

Lower spending. Lower drilling costs and lease operating expenses. Cash flows driven by healthy oil prices and flattish production. Return as much cash to shareholders as possible.

By and large, E&Ps are sticking to the plan.

“At the end of the day, the returns that you’re getting from these companies are pretty consistent unless you start seeing a severe degradation in the commodity price,” said David Deckelbaum, managing director at TD Cowen. “The stocks will correct for whatever move the commodities have.”

RELATED

As Crude Markets Turn Bearish, Will OPEC Come to the Rescue?

Price check

At around $80/bbl, investors can expect “a healthy, predictable yield” from North American E&Ps, Bernstein analysts said.

But oil isn’t $80/bbl anymore—prices were hovering closer to $70/bbl in mid-September. Concerns about global oil demand and pushing prices down, and recent jobs figures data haven’t left much for optimism, said John E. Paisie, president of Stratas Advisors.

The S&P Oil and Gas Exploration & Production Select Industry index has fallen by about 13% since the end of the second quarter, alongside a similar dip in oil prices.

“Oil price fell and, with it, the ability to generate FCF and thus the share prices,” analysts at Bernstein wrote in a Sept. 16 report.

The confluence of geopolitical and economic factors has spooked the market.

“The way the futures curves of Brent and WTI collapsed on [Sept. 10] tells you that physical market actors see too much supply on offer,” Piper Sandler analysts Jan Stuart and James Noonan wrote in a recent report.

The backwardation in forward-looking strip pricing appears to have spooked members of OPEC+, too. The international cartel of producers decided to delay unwinding voluntary production cuts that it originally planned to start in September. OPEC+ now plans to start phasing out the cuts in December and continue until November 2025.

If OPEC does decide to boost output, crude prices could fall below $60/bbl in 2025, Piper Sandler predicted. Such a degradation would start to poke holes in the shareholder-focused capital discipline regime employed by E&Ps today.

But disciplined E&Ps still have some options in a lower price environment.

As commodity prices declined and flattened from 2023 and into 2024, E&Ps leaned into share buybacks over variable distributions to try to take advantages of dislocations in their stock prices, according to Gabriele Sorbara, managing director at Siebert Williams Shank & Co.

Buying back stock at depressed valuations is a way to return value to shareholders. Lowering capex is another way to drive healthier free cash flow.

E&Ps are lowering spending by drilling fewer wells with longer laterals, decreasing drilling cycle times and lowering G&A expenses through consolidation.

All these efficiencies are items that are somewhat permanent, Reynolds at Piper Sandler said.

“These efficiencies are built into the system going forward,” he said. “Frankly, the rate of change on efficiencies is, if anything, increasing.”

RELATED

Go Long: Exxon, EOG Extend Permian Laterals, Lead US Onshore Drilling

Debt reduction

Operators have pushed free cash flow toward stock buybacks and dividends, but some are allocating cash flow toward near-term debt reduction.

A handful of operators have taken on debt to make large-scale acquisitions over the past two years. But near-term debt isn’t expected to have meaningful effects on shareholder distributions.

“I’m less concerned about what I’ll call temporary debt increases to fund acquisitions,” Reynolds said.

Operators have publicly laid out plans to deleverage using proceeds from divestments and notable cash-flow boosts stemming from acquisitions.

Occidental Petroleum waded further into debt to make a $12 billion acquisition of Permian E&P CrownRock LP, a deal to significantly boost Oxy’s footprint in the Midland Basin.

But Oxy has been vocal about deleveraging since closing the CrownRock acquisition. Oxy sold non-core operated Barilla Draw assets in the southern Delaware Basin for $818 million and plans to use the proceeds for debt repayment.

The company also monetized midstream assets by selling common units of Western Midstream Partners for $700 million.

Oxy plans to reach 85% of its near-term $4.5 billion debt reduction target by the end of the third quarter.

Civitas Resources was a big M&A buyer last year in the Permian Basin, where the Colorado-based operator pumped nearly $7 billion into acquisitions.

Civitas had previously committed to returning at least 50% of its quarterly free cash flow as a variable investor return, after a $0.50 /share base dividend. And the company has been well ahead of its 50% target due to participating in selling shareholder offerings, Sorbara said.

As of the start of the third quarter, Civitas’ variable return of capital has been provided through a combination of common stock repurchases and dividends. The board determines how capital is allocated between the two buckets, but Civitas said it will stay at the 50% threshold.

The remaining 50% of free cash flow, after the base dividend, will support reducing debt on Civitas’ balance sheet, company executives said during second-quarter earnings.

As part of the updated returns framework, the Civitas board boosted the company’s share buyback authorization up to $500 million, a 75% increase over its authorization remaining under the previous program.

Civitas is prioritizing share buybacks due to the “continued disconnect” with how the company is valued and traded compared to its peers in the market, CEO Chris Doyle said during the company’s second-quarter earnings call.

The price of its shares doesn’t reflect Civitas’ value in the prolific Permian Basin, nor the value of the company’s legacy Denver-Julesburg Basin operations, Doyle argues.

“You’ve got a business here that’s executing on really high-quality assets trading at a 20% free cash flow yield,” Doyle said on the call. “That's a super compelling opportunity as we see it. That’s driving the change.”

APA Corp., parent company of Apache, is also hot on the divestment trail to repay debt after closing a $4.5 billion acquisition of Callon Petroleum in April.

“The ones that have had to issue debt of any kind, they’ve been very specific about what they are going to divest,” Stellar at BOK said.

RELATED

Oxy Nears $4.5B Debt Reduction Target Post Barilla Draw Sale

Recommended Reading

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025-02-02 - The launch of the energy-efficient DeepSeek chatbot roiled tech and power markets in late January. But supermajors Exxon Mobil and Chevron continue to field intense demand for data-center power supply, driven by AI technology customers.

Artificial Lift Firm Flowco’s Stock Surges 23% in First-Day Trading

2025-01-22 - Shares for artificial lift specialist Flowco Holdings spiked 23% in their first day of trading. Flowco CEO Joe Bob Edwards told Hart Energy that the durability of artificial lift and production optimization stands out in the OFS space.

Chevron Technology Ventures Would Like to See the Manager

2025-03-13 - Chevron Corp.’s Chevron Technology Ventures, which turns 25 this year, pays close attention to leadership teams when making investment decisions in technology startups.

BlackRock CEO: US Headed for More Inflation in Short Term

2025-03-11 - AI is likely to cause a period of deflation, Larry Fink, founder and CEO of the investment giant BlackRock, said at CERAWeek.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.