(Source: Shutterstock)

Devon Energy is deepening its foothold in the Williston Basin with a cash-and-stock acquisition from Grayson Mill Energy valued at $5 billion.

Consideration includes $3.25 billion in cash and $1.75 billion in Devon equity to the sellers, Oklahoma City-based Devon announced before markets opened July 8.

"The acquisition of Grayson Mill is an excellent strategic fit for Devon that allows us to efficiently expand our oil production and operating scale while capturing a meaningful runway of highly economic drilling inventory," said Devon President and CEO Rick Muncrief.

"This transaction also creates immediate value within our financial framework by delivering sustainable accretion to earnings and free cash flow that will result in higher distributions to shareholders over time,” he said.

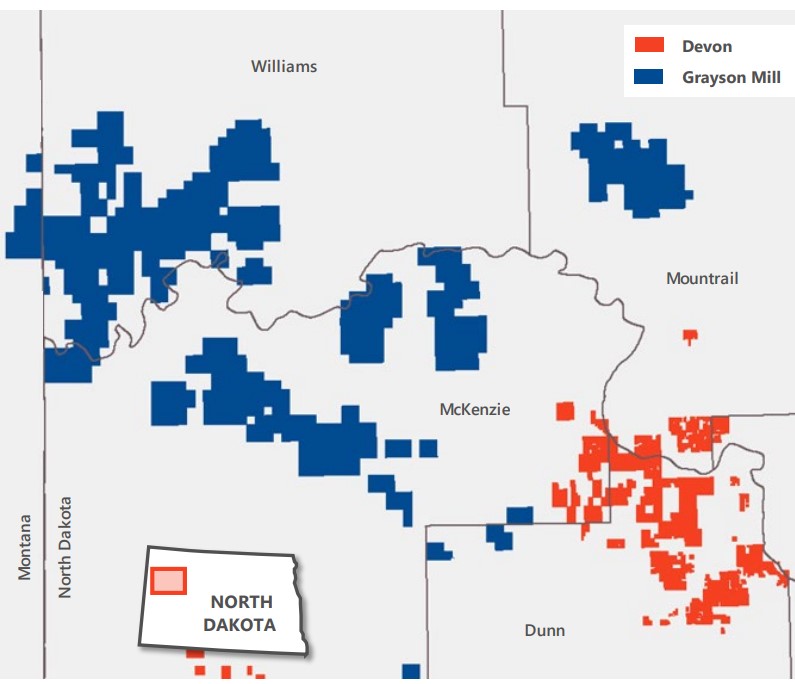

The acquisition from Grayson Mill Energy, backed by Houston-based private equity firm EnCap Investments LP, will expand Devon’s Williston Basin position with an additional 307,000 net acres (70% working interest).

Grayson Mill’s production is estimated to average around 100,000 boe/d (55% oil) in 2025.

On a pro forma basis, Devon’s company-wide oil production will average 375,000 bbl/d; total pro forma production will average approximately 765,000 boe/d.

Devon said that Grayson Mill’s “peer-leading” operating margins in the North Dakota Williston Basin benefit from midstream infrastructure ownership in 950 miles of gathering systems, crude storage terminals and disposal wells.

Grayson Mill’s midstream ownership will create a margin uplift of over $125 million in annual EBITDAX and gives the company options to capture multiple end use markets and higher pricing.

In conjunction with the Grayson Mill acquisition, Devon’s board of directors expanded the company’s share repurchase authorization by 67% to $5 billion through mid-year 2026.

Devon expects the deal to be accretive to its dividend payout in 2025 and beyond.

With the U.S. upstream E&P sector awash in corporate M&A, analysts and industry veterans wondered when—and where—Devon Energy might make a deal.

Devon reportedly looked at opportunities to expand its Permian Basin footprints through deals with Endeavor Energy Resources and CrownRock LP.

Endeavor was later acquired by Diamondback Energy for $26 billion; CrownRock by Occidental Petroleum for $12 billion. Both deals are still pending.

But the Williston Basin has attracted a notable volume of upstream dealmaking of its own. Chord Energy closed a $4 billion acquisition of Enerplus Corp. in late May, creating a top Williston oil and gas producer.

TXO Partners LP, led by former XTO Energy executive Bob Simpson, recently announced entering the Williston Basin through acquisition.

TXO Partners’ two Williston transactions—one with Eagle Mountain Energy Partners and the other with an undisclosed private seller—will deliver assets in the Elm Coulee field of Montana and the Russian Creek field of North Dakota.

RELATED

The Shape of M&A to Come: Is Devon Up Next to Join the Spree?

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Sitio Fights for its Place Atop the M&R Sector

2025-04-02 - The minerals and royalties space is primed for massive growth and consolidation with Sitio aiming for the front of the pack.

Devon, BPX to End Legacy Eagle Ford JV After 15 Years

2025-02-18 - The move to dissolve the Devon-BPX joint venture ends a 15-year drilling partnership originally structured by Petrohawk and GeoSouthern, early trailblazers in the Eagle Ford Shale.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.