Devon Energy is producing record volumes from the Delaware Basin—the company’s biggest asset. (Source: Shutterstock.com)

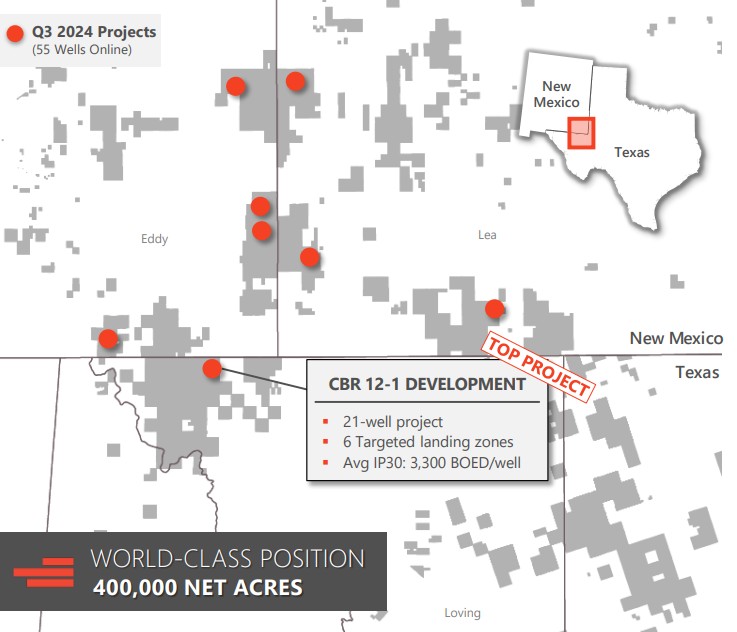

Devon Energy is producing record volumes from the Delaware Basin, where the company brought online 55 new wells in the third quarter.

That figure includes portions of a 21-well pad brought online in Loving County, Texas, during the second and third quarters, Oklahoma City-based Devon said in its third-quarter earnings released Nov. 5.

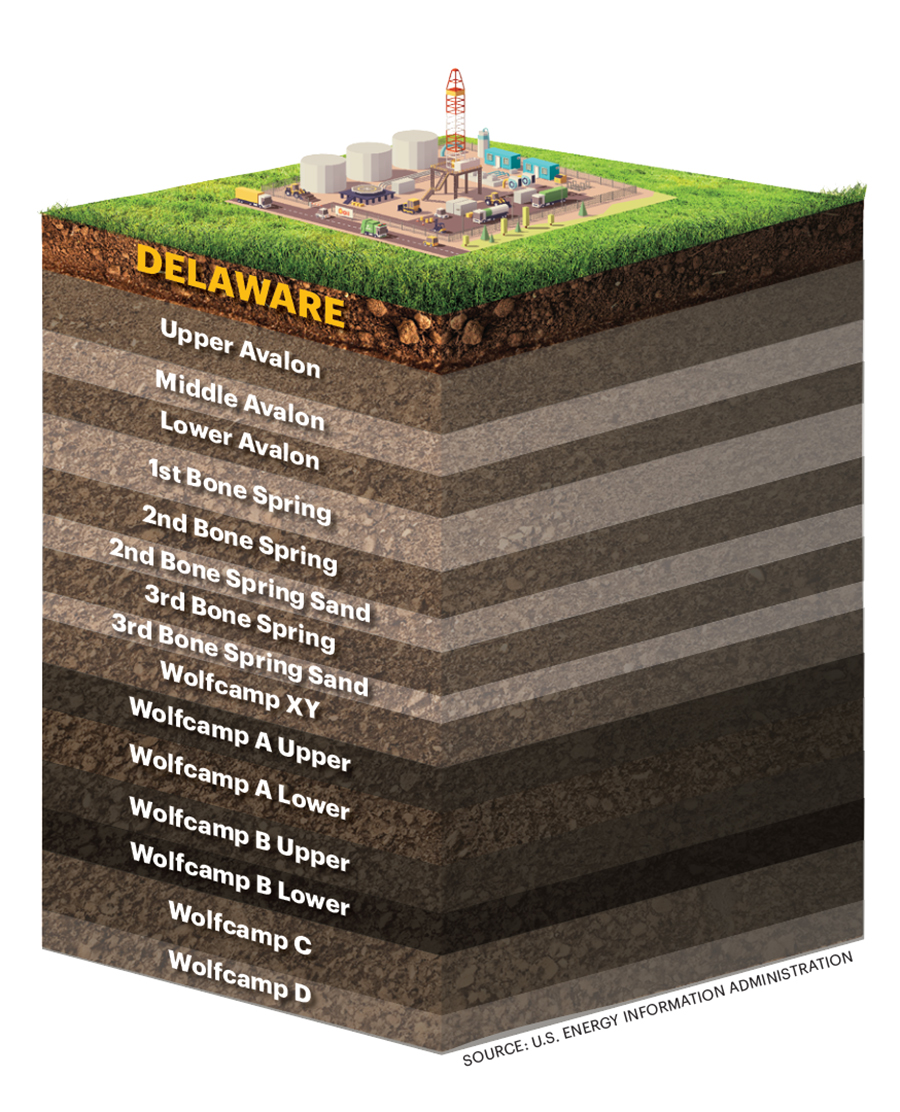

The 21-well CBR 12-1 project, sited near the Texas-New Mexico state line, targeted six different landing zones—including the Wolfcamp A, Wolfcamp B and shallower zones in the Bone Spring interval, Devon COO Clay Gaspar said.

“The 30-day rates from this 21-well package averaged 3,300 boe/d per well, and estimated recoveries exceed 2 MMboe per well,” Gaspar said during Devon’s Nov. 6 earnings call.

RELATED

Decoding the Delaware: How E&Ps Are Unlocking the Future

Gaspar said Devon brought online wells landed in the shallower Avalon interval during the third quarter. The company plans to continue testing secondary Permian zones going forward, he said.

CBR 12-1 gives Devon confidence in its ability to execute big Permian Basin projects, Gaspar said. But the company still needs to balance projects by returns, net present value (NPV) and overall inventory preservation.

“If you just want to maximize the return of a well, there's one way to do that, and it's probably not going to maximize the NPV of the productivity of the overall pad,” Gaspar said. “If you want to maximize the NPV of the pad, you may sacrifice things like some of the overall inventory.”

And, Devon’s ability to co-develop the zones targeted in the CBR 12-1 project is somewhat of a rarity in the Delaware Basin. In some Delaware development areas, Devon finds itself filling in wells around an initial well.

“Objectively, there's just not very many blank canvases to work with,” Gaspar said.

But Devon has gained a better understanding of the depletion effects from the previous development, mitigating downside from the old well while maximizing upside from the newer zones being drilled.

“I would say we tend towards larger pad development where applicable,” he said. “It does provide efficiencies on drilling and completions.”

Devon’s third-quarter Delaware Basin output averaged a record 488,000 boe/d, a 6% increase over last quarter—including 227,000 bbl/d of oil (46.5%), 134,000 bbl/d of NGL (27.5%) and 764 MMcf/d of natural gas (26%).

Devon is reporting strong operating efficiencies from the Delaware Basin, where the company allocates 60% of its spending.

Compared to 2023, Devon has seen a 14% improvement in drilled feet per day in the Delaware through the first three quarters of 2024.

Adopting simulfrac across the Delaware has also boosted Devon’s completed feet per day by 12% year to date.

Because of the D&C efficiencies Devon is seeing, the company is reducing drilling activity from 16 rigs to 15 rigs this quarter. And, Devon plans to drop an additional Delaware rig in the first quarter of 2025.

“At the current pace, we expect to duplicate 2024’s 16-rig output with 14 rigs in 2025,” Gaspar said.

RELATED

Avant Natural Resources Steps Out with North Delaware Avalon Tests

Williston rising

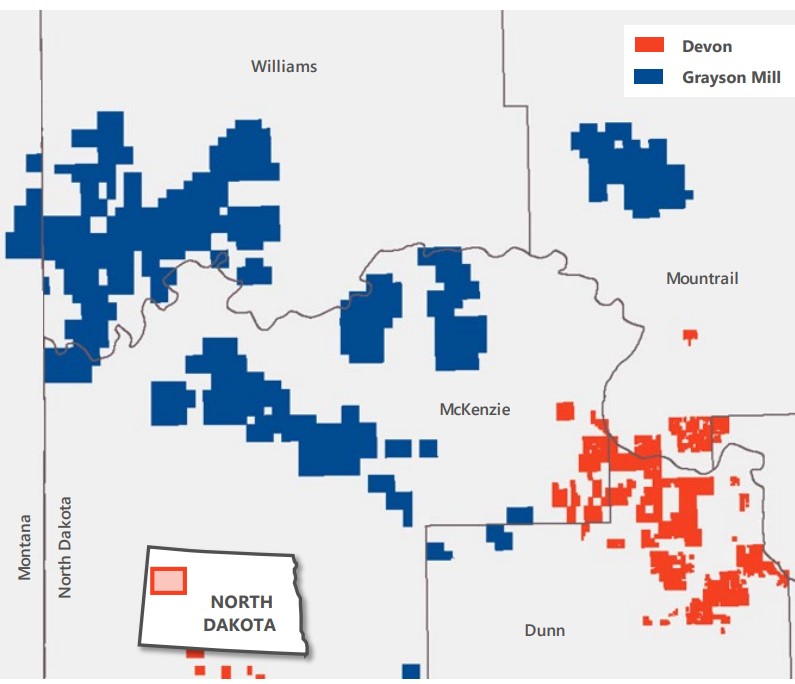

The Delaware Basin is Devon’s most productive and capital-intensive asset. But Devon’s footprint in the Williston Basin of North Dakota got a lot bigger through a $5 billion acquisition of Grayson Mill Energy.

Devon closed the acquisition of Grayson Mill—backed by private equity firm EnCap Investments LP—in September.

The deal added over 300,000 net acres, 500 gross undrilled locations and 300 refrac candidates. Around 80% of the new locations are in the Bakken Shale, and around 20% are in the Three Forks interval.

Devon now plans to allocate greater spending into the Williston with a larger footprint at its disposal, Gaspar said.

“The overall pie will shift a little bit,” he said. “You’ll see Delaware Basin drop from about 60% of the portfolio to 50%.”

Devon aims to sustain the acquired Grayson Mill assets at approximately 100,000 boe/d next year through a mix of 2- and 3-mile laterals and “tactical refracs to supplement the base production,” Gaspar said.

Combined with Devon’s legacy production, total Williston output is expected to average 165,000 boe/d (55% oil) in the fourth quarter.

RELATED

CEO: Devon Eyes 3-Mile Williston Wells With $5B Grayson Mill Deal

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.