Diamondback Energy, in partnership with Kinetik, is boosting its takeaway capacity and ownership stake in the EPIC Crude pipeline after closing a $26 billion Permian Basin acquisition. (Source: Shutterstock.com)

Editor’s note: This is a breaking news article. Check back for updates.

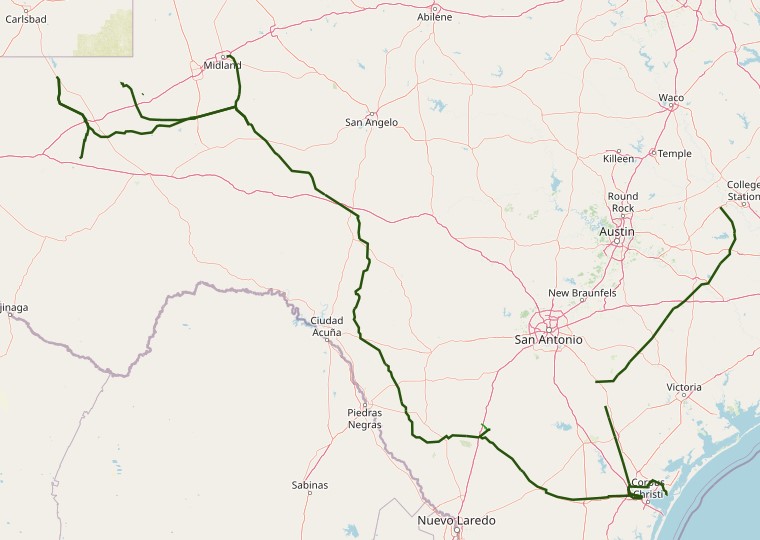

Diamondback Energy and Kinetik Holdings Inc. have acquired greater ownership stakes in the 800-mile EPIC Crude pipeline, which runs from the Permian Basin to the Gulf Coast, the companies said Sept. 24.

Diamondback and Kinetik partnered to acquire a 30% equity interest in EPIC Crude Holdings LP.

Permian producer Diamondback Energy owned a 10% equity interest in EPIC Crude as of year-end 2023, according to regulatory filings; Kinetik owned a 15% equity interest in the oil pipeline.

Each partner now owns 27.5% of the 600,000-bbl/d-pipeline system.

EPIC Midstream Holdings LP retains a 45% equity interest in and operates the system.

Chevron Corp., through its ownership of Noble Midstream Partners LP, had held a 30% stake in EPIC Crude Holdings, Chevron regulatory filings show. Chevron acquired Noble Midstream in an all-stock transaction in 2021 for $1.32 billion.

It’s unclear whether Chevron still owns the interest. Hart Energy has reached out to Chevron for comment.

The EPIC Crude pipeline transports crude from the Midland and Delaware basins and the Eagle Ford Shale to the Port of Corpus Christi in Texas.

RELATED

Diamondback Closes $26B Endeavor Deal, Forming Last Permian ‘Sandbox’

Diamondback is boosting takeaway capacity on EPIC Crude after closing a $26 billion acquisition of private Permian E&P Endeavor Energy Resources earlier this month.

Diamondback converted its existing commitment into a larger volume of 200,000 bbl/d “to accommodate additional crude barrels from Diamondback’s newly completed merger with Endeavor,” the company said.

Kinetik is also entering into a new transportation agreement with EPIC Crude with a new connection between the long-haul pipeline and Kinetik’s own crude gathering system.

The combined long-term volume commitments from Diamondback and Kinetik are expected to begin in 2025 and run through 2035. The minimum volume commitments represent over 33% of EPIC Crude’s volume capacity.

EPIC Crude has secured commitments for approximately 90% of 2025 total volumes, the company said.

"Along with our execution over the past couple of years, these transactions position EPIC Crude for continued strategic and financial success," said EPIC Midstream CEO Brian Freed. "The business continues to be transformed, and the strategic importance of this asset is supported by our Partners' long-term commitments. EPIC Crude continues to be a critical asset for Permian Basin crude production egress to the Corpus Christi market."

RELATED

Permian Takeaways: Rebuilding the Most Prolific Paradigm in the US

Recommended Reading

Shell Selects SLB for Deepwater Drilling Contracts

2025-01-08 - SLB will deliver the projects in the U.K. North Sea, Trinidad and Tobago and the Gulf of Mexico, among others regions, over the next three years.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

E&P Highlights: Feb. 24, 2025

2025-02-24 - Here’s a roundup of the latest E&P headlines, from a sale of assets in the Gulf of Mexico to new production in the Bohai Sea.

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Valeura Boosts Production, Finds New Targets in Gulf of Thailand

2025-03-03 - Valeura Energy Inc. has boosted production after drilling three development wells and two appraisal wells in the Gulf of Thailand.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.