Diamondback Energy sees power generation for data centers as a profitable avenue for its 1.17 Bcf/d of Permian natural gas production. (Source: Shutterstock.com)

With ample gas production and surface acreage, Diamondback Energy is working to lure data center operators into the Permian Basin.

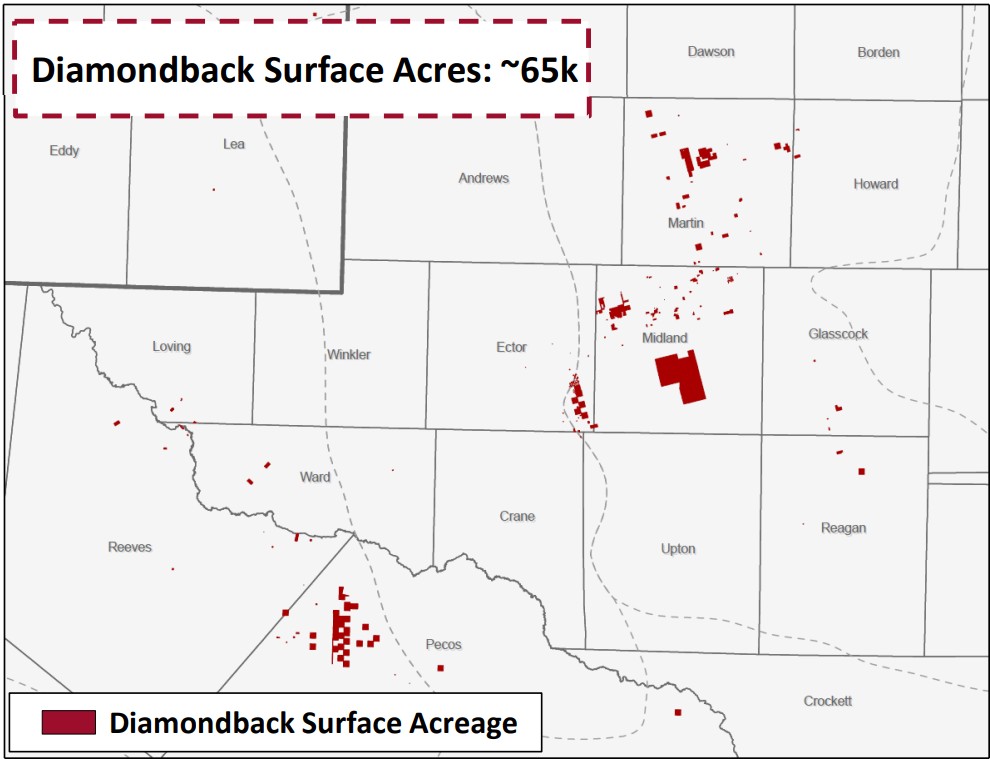

Midland-based Diamondback owns around 65,000 net acres in the Permian, the company highlighted in fourth-quarter earnings.

Diamondback can be nimble and quickly adjust to hyperscaler technology customers’ changing needs, said President Kaes Van’t Hof during Diamondback’s Feb. 25 earnings call.

The company is well positioned to be a “premier partner” for data centers looking for cheap land and cheap access to natural gas.

Diamondback can provide land to site the power generation and data center projects. It can also supply natural gas for power generation and water to cool data center operations.

Diamondback would also look to purchase a portion of the gas-fired power for its own internal operations, too.

“Obviously, we’re short power in the basin,” said Van’t Hof, who will transition to Diamondback’s CEO later this year.

Specifically, Diamondback is looking to join forces with an independent power producer (IPP) to “build a large, behind-the-meter gas power plant in the basin, using Diamondback gas,” he said.

A hyperscaler data center operator would take on the lion’s share of the power, but Diamondback would receive some, too.

“We're still confidentially discussing it with the hyperscalers, giving feedback,” Van’t Hof said.

In addition to surface acreage, Diamondback also manages a significant volume of natural gas “that needs a better market,” Van’t Hof said.

The company produced about 107.25 Bcf from the Permian Basin in the fourth quarter, or around 1.17 Bcf/d, Diamondback said in an earnings report.

Oil production averaged nearly 476,000 bbl/d in the fourth quarter. Total production averaged over 883,000 boe/d.

RELATED

Diamondback Touts Land, Cheap Gas to Lure Data Centers to Permian

AI fervor

Diamondback isn’t alone in courting power plant and AI technology partners.

Other large natural gas producers, including Exxon Mobil, Chevron and Expand Energy are in conversations with tech customers to supply gas to behind-the-meter power projects to feed AI data centers.

Analysts at Truist Securities estimate that Diamondback has around 2,000 surface acres in the Permian that are “well-positioned to interface with data centers,” according to a Feb. 25 report.

In late January, Chevron announced a new partnership to develop “scalable, reliable power solutions” for U.S.-based data centers running on natural gas. The partnership includes Engine No. 1 and GE Vernova.

Chevron has secured seven of GE Vernova’s largest 7HA gas-fired turbines under a slot reservation agreement on an accelerated timeline.

Exxon is fielding interest from tech customers for its integrated carbon capture, utilization and storage (CCUS) capabilities. It owns the nation’s largest CO2 transport and storage network, picked up through a $4.9 billion acquisition of CCUS and E&P company Denbury Inc. in 2023.

Expand Energy has heard forecasts ranging from 2 Bcf/d all the way to 20 Bcf/d of incremental gas demand from data centers, CFO Mohit Singh said at the 2025 NAPE Conference earlier in February.

“I think we’ll land around an incremental 5 Bcf/d of natural gas demand from data centers,” he said.

RELATED

Not Sweating DeepSeek: Exxon, Chevron Plow Ahead on Data Center Power

2025 momentum

Last year “was arguably the most transformational year” in Diamondback’s history, CEO Travis Stice wrote in a Feb. 24 letter to stockholders.

Diamondback closed a massive $26 billion acquisition of private Midland Basin E&P Endeavor Energy Resources last September, cementing it as a top Permian producer.

The company’s core Midland Basin portfolio grew to around 722,000 net acres with the Endeavor acquisition.

During the fourth quarter, Diamondback closed an acreage trade with TRP Energy, adding inventory in the southern Midland Basin.

Under terms of the TRP trade, announced last November, Diamondback traded certain Delaware Basin assets and paid $238 million in cash in exchange for TRP’s Midland Basin assets.

TRP’s Midland holdings included around 15,000 net acres in Upton and Reagan counties, Texas, 55 undeveloped locations and 18 DUCs.

Diamondback has strong momentum so far in 2025, too.

Last week, it announced a cash-and-stock acquisition of private equity-backed Double Eagle IV valued at $4.1 billion.

The incremental 400 drilling locations added through the Double Eagle acquisition are expected to be immediately slotted into Diamondback’s near-term drilling program, Stice said.

Full-year 2025 oil production is expected to average between 485,000 bbl/d and 498,000 bbl/d; total production will be between 883,000 boe/d and 909,000 boe/d.

Later this year, Stice will step down from his role as CEO of Diamondback and transition to executive chairman of the board.

Van’t Hof will succeed Stice as CEO and join the Diamondback board. The leadership transition will become effective as of Diamondback’s 2025 annual shareholder meeting.

RELATED

Diamondback, Double Eagle Form JV to Drill in Southern Midland Basin

Recommended Reading

Baker Hughes, Woodside Partner to Scale Net Power Platform

2025-03-06 - Net Power’s platform uses natural gas to generate power while capturing nearly all CO2 emissions, Baker Hughes said in a news release.

ChampionX’s Aerial Optical Gas Imaging Platform Secures EPA Approval

2025-03-05 - ChampionX Corp.’s aerial optical gas imaging platform combines optical technology with a gimbal system to detect and locate methane leaks.

Montana Renewables Closes $1.44B DOE Loan for Facility Expansion

2025-01-13 - The expansion project will lift annual production capacity to about 300 million gallons of sustainable aviation fuel (SAF) and 330 million gallons of combined SAF and renewable diesel.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.