Diversified Energy will acquire EIG’s Maverick Natural Resources, adding acreage that offsets Diversified’s core Western Anadarko position and Permian Basin assets in the northern Delaware. (Source: Shutterstock.com)

Diversified Energy Co. has agreed to acquire the liquids-rich assets of EIG-backed Maverick Natural Resources for $1.275 billion, the Birmingham, Alabama-based E&P said Jan. 27.

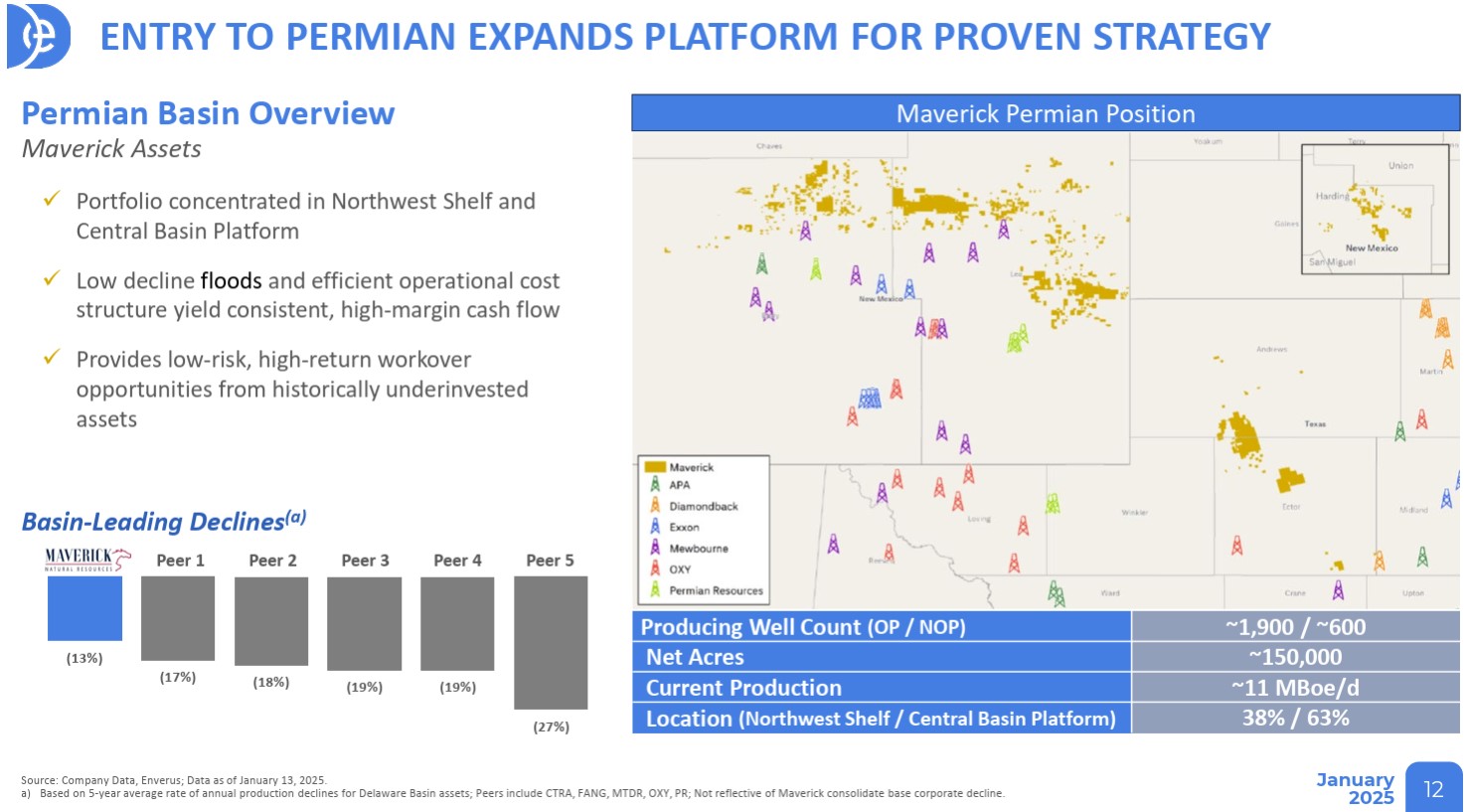

The multi-basin deal provides an entry into the Permian Basin with Maverick’s assets in multiple operating zones in the northern Delaware Basin, Northwest Shelf and Central Basin Platform.

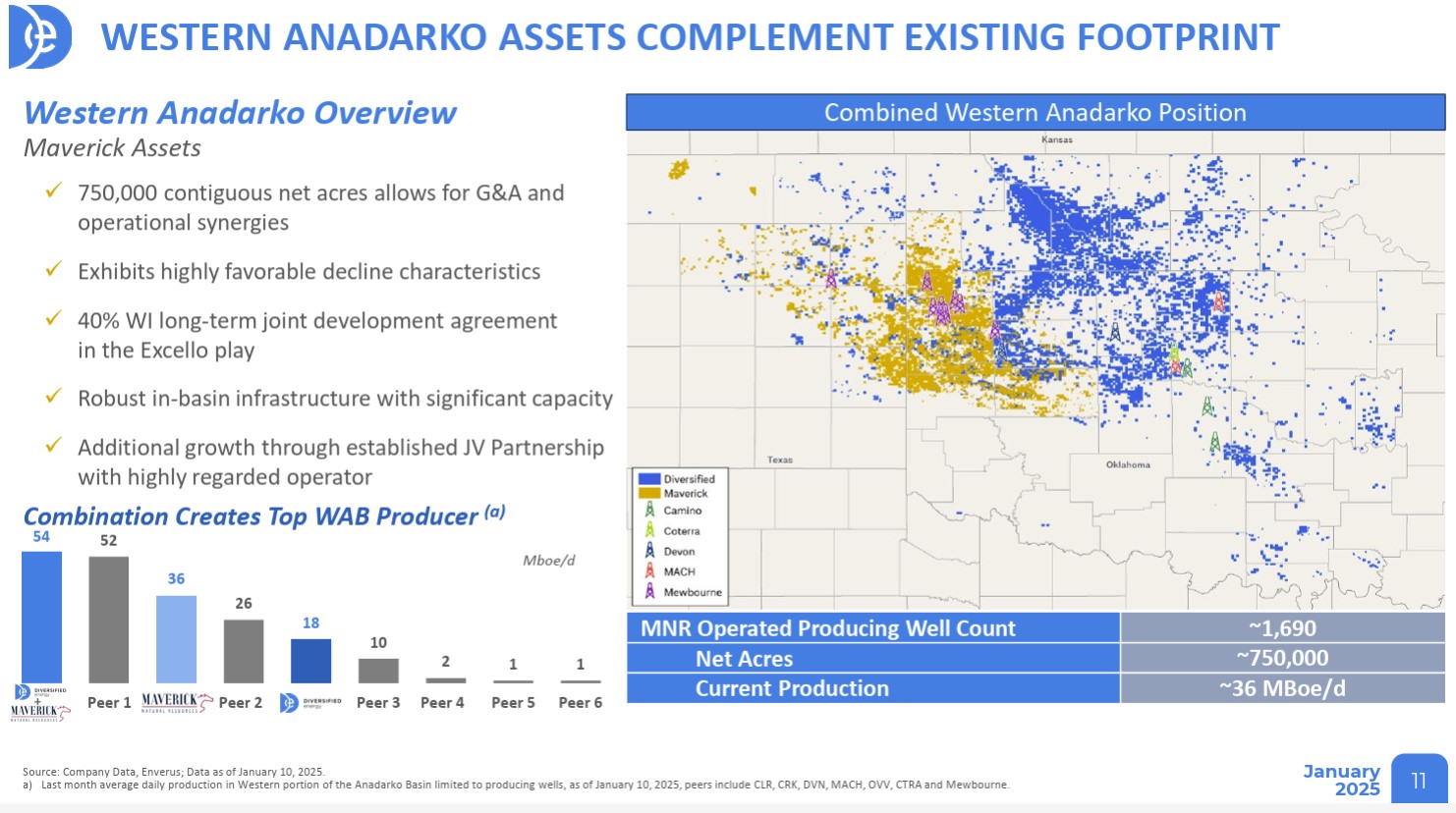

In the Western Anadarko, Maverick’s assets directly offset Diversified’s core position, where active development is ongoing in the Cherokee Play, Diversified said.

The combined company will have an enterprise value of approximately $3.8 billion and operate across five regions, Diversified said: the Appalachian, Western Anadarko and Permian basins; the Barnett Shale; and the Ark-La-Tex region.

Maverick’s production will add 350 MMcfe/d, bringing pro forma production to be approximately ~1,200 MMcfe/d (~200,000 boe/d), Diversified said.

Following the transaction, EIG will hold about 20% of all ordinary shares, including shares it already owned.

The transaction will be financed through the assumption of about $700 million of Maverick's existing debt. Diversified will issue approximately 21.2 million new ordinary shares to Maverick unit holders worth approximately $345 million and pay approximately $207 million cash.

“The Acquisition combines two complementary asset packages, pairing high-quality Proved Developed Producing weighted production assets with the lowest corporate decline and capital intensity among peers,” Diversified said in its press release.

Diversified CEO Rusty Hutson Jr. said the acquisition expands the company’s “unique and highly focused energy production company with a complementary portfolio of attractive, high-quality assets.”

“The acquired producing assets have demonstrated leading well performance and are a natural fit with our operating advantage and existing acreage,” Hutson said. “Notably, the combined footprint in Oklahoma and the Western Anadarko Basin creates one of the largest in terms of production and acreage, which includes the emerging Cherokee formation.”

After the deal closes, Diversified’s new board will comprise eight directors, with six from the current Diversified Board and two new directors designated by EIG, the company said.

Jeannie Powers, EIG’s managing director and head of domestic traditional energy, said the private equity firm will work closely with the Diversified management team and board to support the company's focus on delivering long-term value.

“Diversified is uniquely positioned in the upstream space with a differentiated business model and a history of operational excellence,” Powers said. “The combination of Maverick's assets with Diversified's existing footprint represents a strategic opportunity that we believe can support value creation for all stakeholders."

Citi is serving as financial and transaction adviser to Diversified. Truist and Stifel are serving as additional advisers to Diversified. Gibson, Dunn & Crutcher LLP and Latham & Watkins (London) LLP are serving as legal advisor to Diversified.

KeyBanc is serving as Administrative Agent and KeyBanc Capital Markets is the Lead Arranger on Diversified's debt financing in connection with the Acquisition. Jefferies Securities is serving as financial adviser and Kirkland & Ellis LLP is serving as legal adviser to Maverick and EIG.

RELATED

Energy Producer Maverick's Owner Explores Sale Valuing It at $3B, Sources Say

Recommended Reading

E&P Highlights: Feb. 18, 2025

2025-02-18 - Here’s a roundup of the latest E&P headlines, from new activity in the Búzios field offshore Brazil to new production in the Mediterranean.

E&P Highlights: Feb. 10, 2025

2025-02-10 - Here’s a roundup of the latest E&P headlines, from a Beetaloo well stimulated in Australia to new oil production in China.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.