Diversified expects 2025 adjusted EBITDA of $12 million from the acquisition. (Source: Shutterstock/ Diversified Energy)

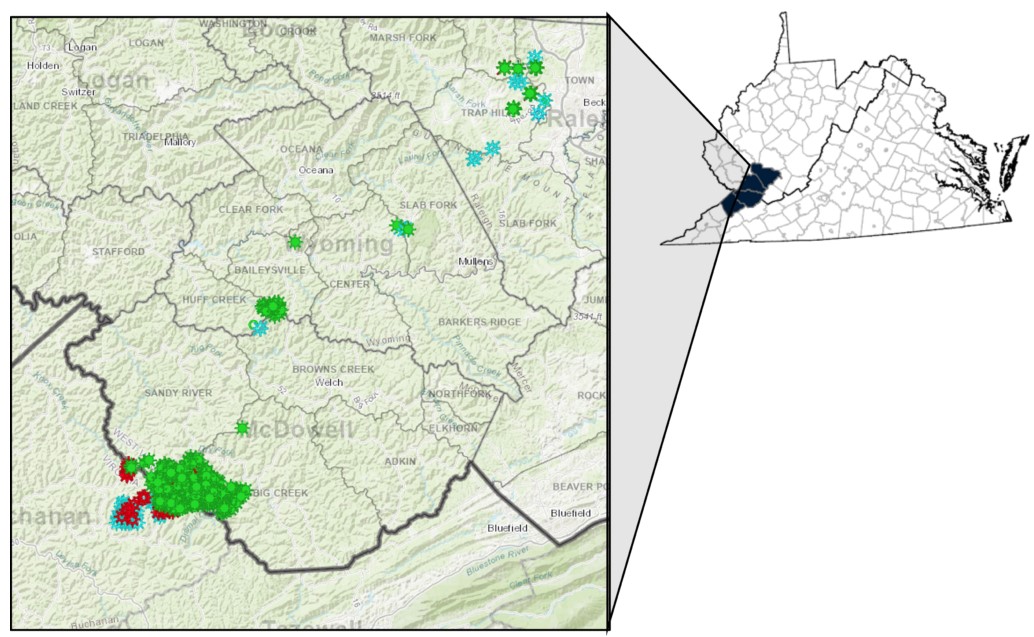

Diversified Energy has agreed to acquire operated natural gas and midstream assets in Virginia, West Virginia and Alabama in the southern Appalachian Basin for about $45 million, the company said Jan. 6.

The bolt-on from Summit Natural Resources includes 300 net producing wells in the Appalachia region, which will account for about 60% of the asset’s 12 MMcfe/d (2,000 boe/d) average production.

The deal also includes 265 net producing coal mine methane wells located within Alabama, making up 40% of production. The wells are proximate to Diversified's corporate headquarters in Birmingham, Alabama.

The acquisition from Summit marks a shift from the company’s 2024 purchases, valued at about $174 million, which were largely focused in East Texas gassy areas.

The deal additionally adds proved developed producing reserves of 65 Bcfe (11 MMboe) with a PV-10 of $55 million from Summit, Diversified said in a press release. Diversified said its paid the equivalent of PV-16.

Diversified expects 2025 adjusted EBITDA of $12 million from the acquisition. The company said the deal includes “strategic midstream pipeline growth” that will enable the company to route produced volumes to premium sales points.

Diversified’s deal comes after a pair of East Texas acquisitions last year, including a $68 million cash-and-stock bolt-on and a second cash-and-stock deal for about 170,000 acres from Crescent Pass Energy.

Commenting on the acquisition, Diversified CEO Rusty Hutson Jr. said:

"This asset package is strategically located within our existing southern Appalachia operations and is uniquely positioned to benefit from the operational expertise of our field teams,” Hutson said. “Additionally, with this strategic acquisition, we anticipate capturing additional revenue from the sale of incremental environmental credits with our growth in the production of coal mine methane.”

Hutson said the acquisition will provide additional opportunities for Diversified to drive improved margins through its Smarter Asset Management programs that continue to be a foundation and support for its cash flows.

“We continue to believe there is a sizeable backlog of organic Coal Mine Methane cash flow growth within our current Appalachian portfolio, and this acquisition highlights our ability to leverage existing capabilities, assets, and intellectual capital to grow this segment of our revenue stream inorganically,” he said. “As we kick-start 2025, we are committed to our strategic imperative of "Energy-Optimized" and our unique solutions-based approach to improving operational and emissions performance of acquired assets while expanding margins and continuing to create long-term value for our shareholders."

The acquisition is expected to close during first-quarter 2025.

Recommended Reading

Entergy, KMI Agree to Supply Golden Pass LNG with NatGas

2025-02-12 - Gas utility company Entergy will tie into Kinder Morgan’s Trident pipeline project to supply LNG terminal Golden Pass LNG.

Trinity Gas Storage Adds Texas Greenfield Gas Storage Complex

2025-01-20 - Trinity Gas Storage has opened a 24-Bcf gas storage facility in Anderson County, Texas, to support the state’s power grid.

ONEOK, Enterprise Renew Agreements with Houston’s Intercontinental Exchange

2025-01-29 - ONEOK and Enterprise Product Partners chose to continue their agreements to transfer and price crude oil with Houston-based Intercontinental Exchange.

Tidewater Sells Canadian Roadway Network for CA$24MM

2025-03-06 - Canadian midstream company Tidewater Midstream and Infrastructure plans to use proceeds to pay down debt.

WaterBridge Starts Open Season for Produced Water Pipeline

2025-04-01 - Water midstream company WaterBridge plans to develop transport capacity out of the Delaware Basin.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.