On the sidelines at EnerCom Denver, Brad Gray, Diversified president and CFO, said the company likely isn’t done buying in East Texas. (Source: Shutterstock)

DENVER — Diversified Energy has entered into a joint acquisition for operated natural gas properties in East Texas from a regional operator, according to an Aug. 20 press release.

Included in the assets, Diversified will purchase “significant” proved developed producing (PDP) reserves for approximately $68 million in cash and stock, the company said.

The assets include 331 net PDP wells and are expected to add 21 MMcfe/d of production and 70 Bcfe in PDP reserves, the release said. Production is primarily gas-weighted, with about 69% gas volumes and the remainder liquids.

On the sidelines at EnerCom Denver, Brad Gray, Diversified president and CFO, said the company likely isn’t done buying in East Texas.

“We are looking to grow that,” he told Hart Energy.

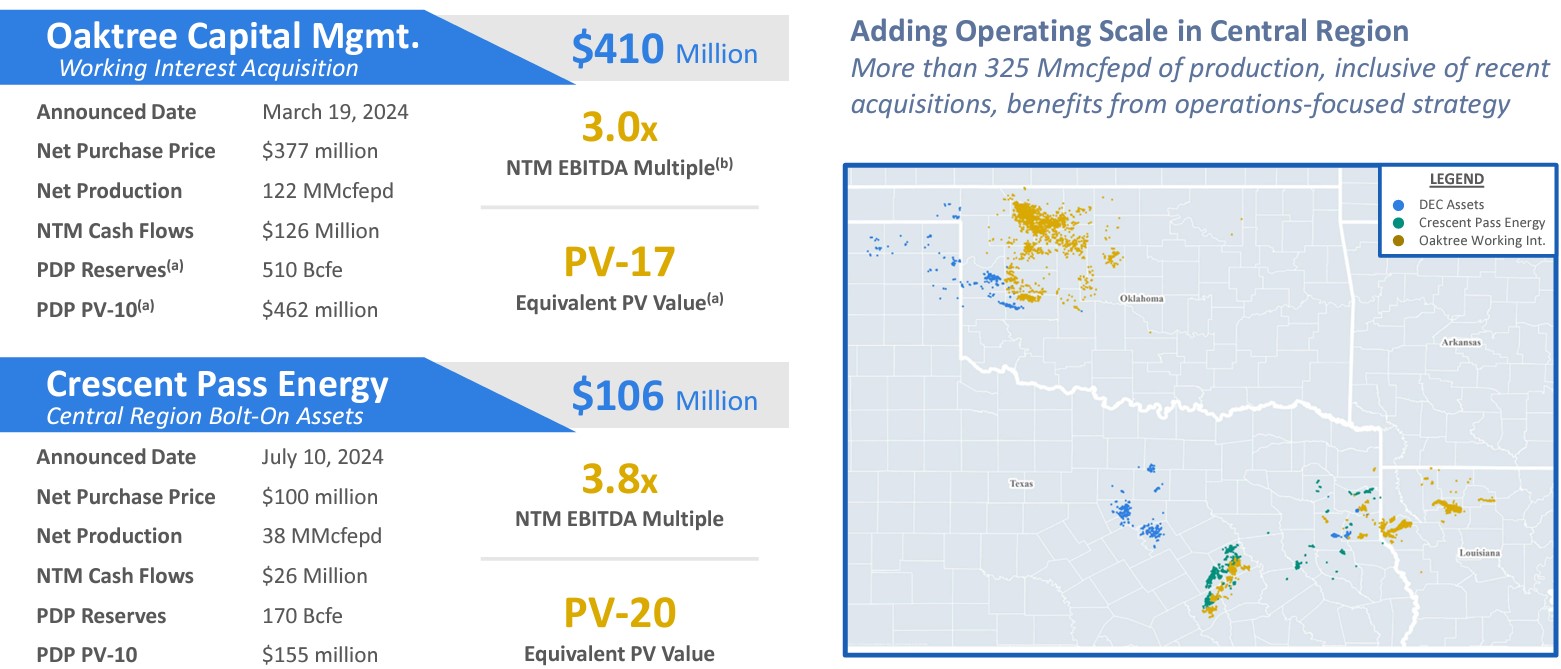

During a presentation at EnerCom, Gray said that the bolt-on follows other deals the company has been able to execute so far this year. In June, the company closed an acquisition of working interests in Oklahoma, East Texas and Louisiana from Oaktree Capital Management for $410 million.

The East Texas acquisition is Diversified’s second recent bolt-on of PDP assets in 2024. On Aug. 16, the company closed a cash-and-stock deal of about 170,000 acres of leasehold in eastern Texas from Crescent Pass Energy. For the year, the company has closed $516 million in acquisitions.

“We were able to buy them out here at the 1st of June, which actually ended up being our second largest transaction of over $410 million,” Gray said. “We also added some bolt-on assets in East Texas by acquiring assets from Crescent Pass.”

“This is a type of transaction that we like to do when we go into an area and establish a foothold. We like to bolt on, build scale, build vertical integration, drive production optimization and also drive expense efficiencies,” Gray said. “So this is a good outcome for us. And one unique or maybe different part of the Crescent Pass transaction is that we were actually able to use our U.S. listed shares as consideration for part of that.”

Gray said the use of New York Stock Exchange equity, which is also a part of the Aug. 20 deal, is a “very positive outcome and we also think it's positive for our continued U.S. growth plans.” “And we did announce a second East Texas acquisition this morning [Aug. 20] that fits right along this bolt-on type strategy,” he said.

Diversified’s new bolt-on is part of a deal with a third-party partner that will purchase an additional amount of undeveloped acreage valued at approximately $19 million. The partner will own a majority of the undeveloped acreage while Diversified will maintain a 5% interest for $1 million in consideration.

The total purchase price of the PDP assets and the undeveloped acreage is approximately $87 million, of which $18 million will be paid by the third-party developer to the seller once the deal closes, which is anticipated for fourth-quarter 2024.

Truist Securities analysts said Diversified’s transaction screens at 3.5x next 12 months EBITDA, with some of the cost funded through equity. The deal screens well compared with peer activity and prior transactions on a valuation basis, Truist said, and increased activity in the region could potentially unlock value on the company's existing undeveloped assets.

“Diversified continued its accretive march towards scale with a back-to-back bolt-on in its central region position,” Truist analysts said Aug. 20. “While individually today's announcement is on the smaller size, over the past five months the company has now quickly added >$500mm of low-cost low-decline assets. As we have previously outlined, we expect the increased US ownership and asset scale to result in rising investor interest and multiple expansion.”

Gibson, Dunn & Crutcher LLP served as legal counsel to Diversified. Opportune LLP served as sole financial advisor and Kirkland & Ellis LLP served as legal counsel to the Seller.

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.