(Source: Shutterstock.com)

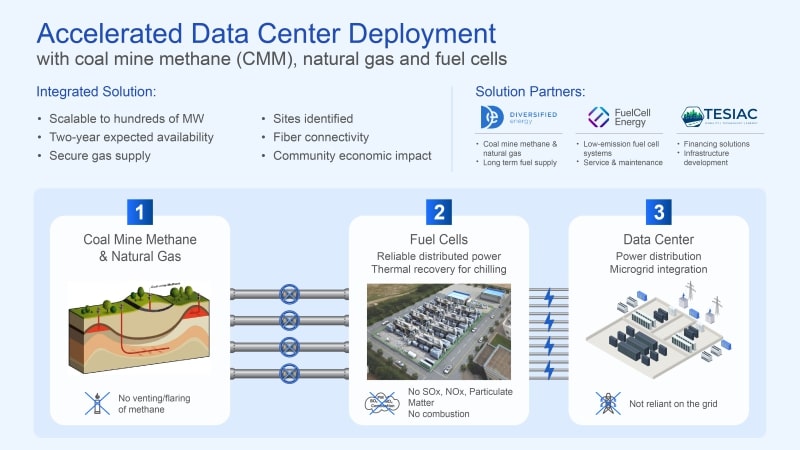

Diversified Energy Co., FuelCell Energy Inc. and TESIAC have partnered to supply up to 360 megawatts of electricity to three data centers in Virginia, West Virginia and Kentucky, the companies announced March 10.

The partnership will create an acquisition and development company (ADC) focused on delivering reliable, cost efficient, net-zero power from natural gas and captured coal mine methane (CMM).

The ADC is expected to leverage Appalachian Basin natural gas production, advanced energy generation via fuel cell technology and infrastructure financing to meet expanding data center power capacity requirements, the collaboration said.

Under the agreement, Diversified will provide natural gas and captured methane from coal mines in the basin as base fuel to be delivered via pipeline to fuel cells. The gas and CMM would generate power through the electrochemical conversion of methane to hydrogen and then to electricity, the companies said.

FuelCell will deploy its fuel cell platforms to generate efficient power, emissions management and thermal energy solutions including cooling for data centers.

TESIAC said it will secure “highly competitive” financing options to accelerate deployment, ensuring the project is profitable and can grow over time.

"The market demand for the type of reliable, quickly dispatchable power that only natural gas can deliver is incredibly strong, and we're excited about the potential of this partnership to deploy Diversified Energy-produced natural gas and coal mine methane (CMM) and pair it with Fuel Cell's advanced industrial-scale technology to create an efficient, cost-effective, environmentally sound solution for the next generation power needs of data centers,” said Brad Gray, president and CFO of Diversified Energy.

Recommended Reading

Follow the Rigs: Minerals M&A Could Top $11B in ’25—Trauber

2025-04-15 - Minerals dealmaking could surpass $11 billion in 2025, fueled by deals in the Permian and in natural gas shale plays, says M&A expert Stephen Trauber.

Haynesville Horsepower: Rigs Needed to Crest the Coming ‘Wall of Demand’

2025-04-01 - How many drilling rigs are needed in the Haynesville Shale to meet growing natural gas demand for LNG exports? Keybanc ran the numbers.

Aethon: Haynesville E&Ps Hesitate to Drill Without Sustained $5 NatGas Prices

2025-03-12 - Operators are looking to the Haynesville to fill rising natural gas demand for U.S. LNG exports. Haynesville E&P Aethon Energy says producers need sustained higher prices to step up drilling.

Exxon Sits on Undeveloped Haynesville Assets as Peers Jockey for Inventory

2025-04-09 - Exxon Mobil still quietly holds hundreds of locations in the Haynesville Shale, where buyer interest is strong and inventory is scarce.

Aethon Dishes on Western Haynesville Costs as Gas Output Roars On

2025-01-22 - Aethon Energy’s western Haynesville gas wells produced nearly 34 Bcf in the first 11 months of 2024, according to the latest Texas Railroad Commission data.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.