A challenge with oilier basins is that the price outlook has been fairly stable and not attractive enough for companies to grow production but now low enough to jeopardize the profitability of Tier 1 areas. (Source: Shutterstock)

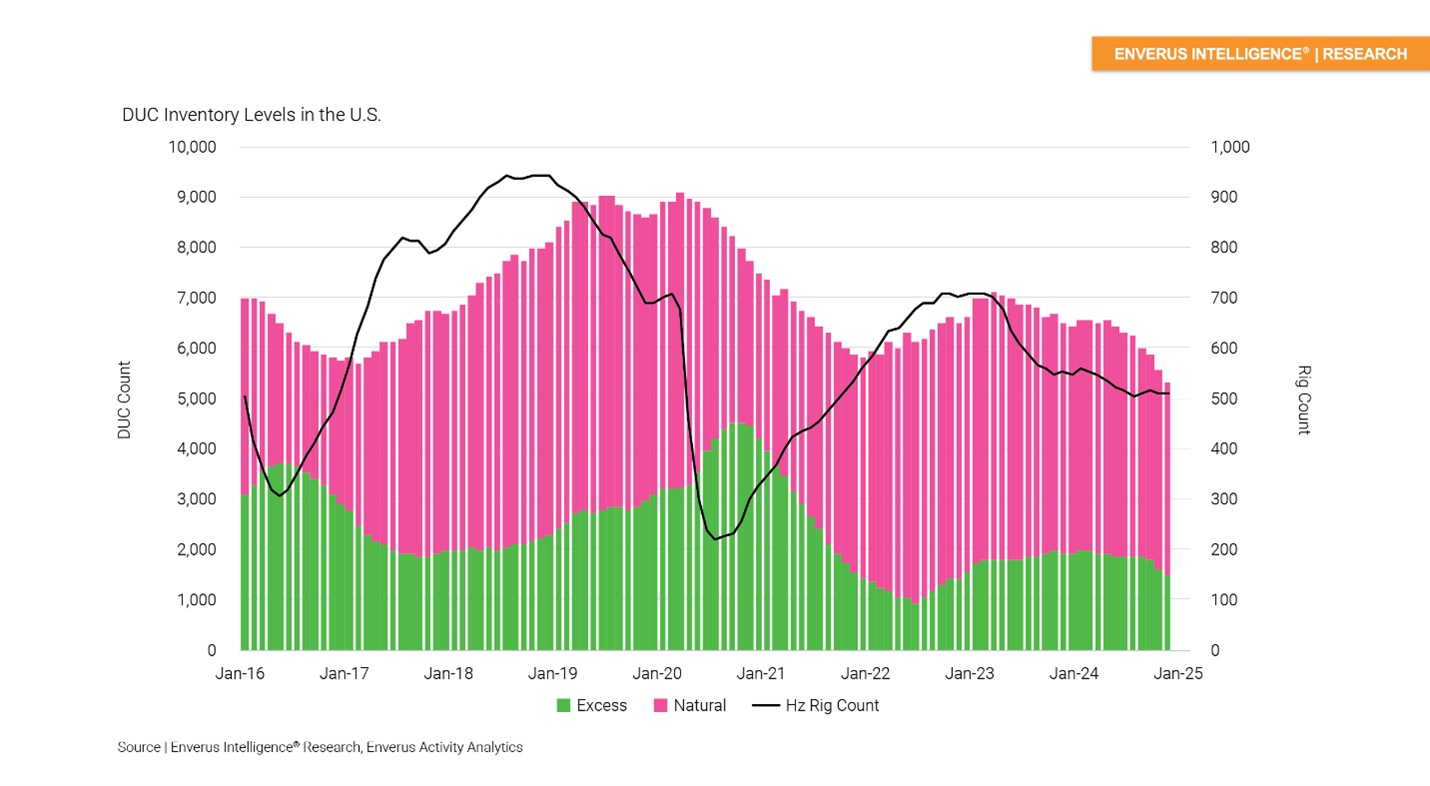

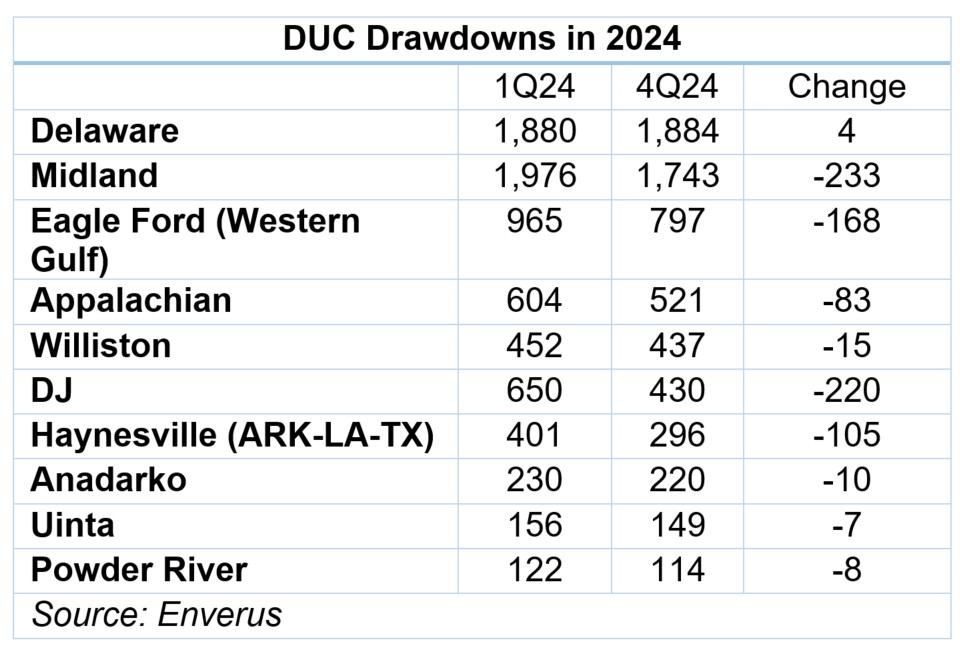

Some operators are entering in 2025 with substantially lower DUCs than last year, creating potential effects on E&Ps’ capital efficiency and production, according to a report by Enverus Intelligence Research. Nearly every shale play has seen DUCs fall, in some cases by the hundreds.

Mark Chapman, principal analyst and the report’s co-author, said DUCs in the past year fell faster than the drop in drilling rigs, which indicates the backlog of wells ready for completions has declined.

The Midland Basin saw the largest depletion of excess DUCs, with ready to complete inventory falling from two months to one. The Midland saw a drawdown of 233 rigs from the second quarter (2,022) to the fourth quarter (1,743). During the same period, the Denver-Julesburg Basin also saw 186 DUCs completed—a drop from 616 DUCs to 437.

Chapman told Hart Energy that in order to keep completion activity where it is, more wells will have to be added in the basin.

“So I think that we're already starting now to see a response in the rig count in the Midland where it's up like 10 rigs so far this year and actually it seems like it's at the expense of the Delaware,” he said. “So the Delaware is declining some while the Midland's growing.”

A challenge with oilier basins is that the price outlook has been fairly stable and not attractive enough for companies to grow production but now low enough to jeopardize the profitability of Tier 1 areas.

On a corporate basis—not basin specific— operators are maintaining several months of DUC inventories, but most also rapidly complete wells. Exxon Mobil has three to four months’ worth of DUCs—the amount of time they could complete wells without additional drilling. Exxon averages roughly 80 completions per month.

BP has a little more than five months of inventory. Midland pureplay Diamondback Energy has five months of inventory and completes about 50 wells per month.

EOG Resources completes “just north of 60, Oxy just north of 60 as well and Conoco is just north of 60. And then Exxon's the one that's up close to 80, but those are the five that are in the tier of their own,” Chapman said.

Among private operators, Chapman said Fasken Oil and Ranch Ltd. has “a fairly good inventory of DUCs.”

The Permian should see a small amount of production growth this year, although “not really large growth like we had in ‘23 or even last year,” Chapman said.

And companies drilling efficiencies mean the number of rigs running now—about 100 fewer than in 2023—are still able to drill about the same amount of lateral footage, he said, adding that along with fewer rigs there are between 17 and 20 fewer frac crews.

Gassy basins also saw large dips in DUC inventory despite low 2024 commodity prices. The Haynesville Shale saw a drop of 105 DUCs from first-quarter 2024 to the fourth quarter; the Appalachian Basin’s drawdown was 83, according to Enverus data. Both have less DUCs now than during the low point of inventory post-COVID.

Chapman said one impetus for the report was to examine inventory in anticipation that gas demand will increase this year—largely because of LNG, as well as the cold winter.

“Will the operators be able to respond quickly if gas prices increase during this winter time in order to meet that demand? Or is that something that they just won't have the capacity to respond quick enough? And any gas growth, will that have to wait until summer or a season when demand is lower if LNG pushes?”

A few gas producers bucked the industry trend and managed to increase their DUC inventory by more than one month since last year.

Expand Energy has highlighted in its earnings that it has a healthy backlog of DUCs, which from a capital perspective should lead to improved efficiency this year.

“They drilled and completed a number of wells in the Haynesville and a few in the Appalachia and just deferred production,” Chapman said. “So that is all sunk cost in ‘24. It's going to have very little cost to bring it online and produce it in ‘25. So that should improve Expand's capital efficiency in ‘25.”

Likewise, Range Resources added DUC inventory in 2024 and should be able to capitalize on it this year.

Chapman said he was surprised how many deferred completions remain in the Haynesville, particularly with Expand.

“That's not a common thing you do, is sink all the cash in to drill and frac the well without producing it,” he said. “They should benefit from [that] as prices have increased for gas so far this winter.”

Other operators have significantly reduced their DUC counts.

“EQT is one of them in Appalachia that's going to have to increase drilling if they want to respond just because their DUC count's fairly low,” Chapman said.

However, because of efficiencies, on a per-foot basins the overall cost to drill and frac laterals is actually going to go down, he said.

“So we still think there's pressure on pressure pumping and in drilling,” he said. “That's going to drive prices down a little bit further throughout the year.”

In demand super-spec and e-fleet rigs will see more stable prices than diesel rigs, but “at the same time, we still anticipate a 5% improvement on efficiencies for those overall.”

“But when you talk to about a whole well, we do think that laterals are getting longer. A larger percentage of laterals are three mile laterals versus two miles,” Chapman said.

Total well costs are going to be more dependent on how long operators drill.

For rig rates and pressure pumpers, price and efficiency gains could result in “somewhere like 5%, 8% cheaper per foot for them to drill these.”

Recommended Reading

Ring Sells Non-Core Vertical Wells as it Closes in on Lime Rock

2025-03-06 - Ring Energy Inc. said it sold non-core vertical wells with high operating costs as it works to close an acquisition of Lime Rock Resources IV’s Central Basin Platform assets.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

Ring Energy Bolts On Lime Rock’s Central Basin Assets for $100MM

2025-02-26 - Ring Energy Inc. is bolting on Lime Rock Resources IV LP’s Central Basin Platform assets for $100 million.

US Energy Corp. Closes Divestiture of East Texas Assets

2025-01-07 - U.S. Energy Corp. said proceeds from the divestiture will be used to fund the company’s industrial gas project in Montana.

EQT Closes $1.25B Non-Op Appalachia Divesture to Equinor

2024-12-31 - EQT Corp. said the proceeds of the sale to Equinor were used to repay outstanding borrowings under its revolving credit facility related to its acquisition of Equitrans Midstream Corp.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.