A multi-frac job being completed for Berry Corp. in Duchesne County, Utah, in the heart of the Uinta Basin. (Source: Berry Corp.)

Exploration of the Uinta Basin’s oily stacked pay is still in early innings, according to Utah operators and experts.

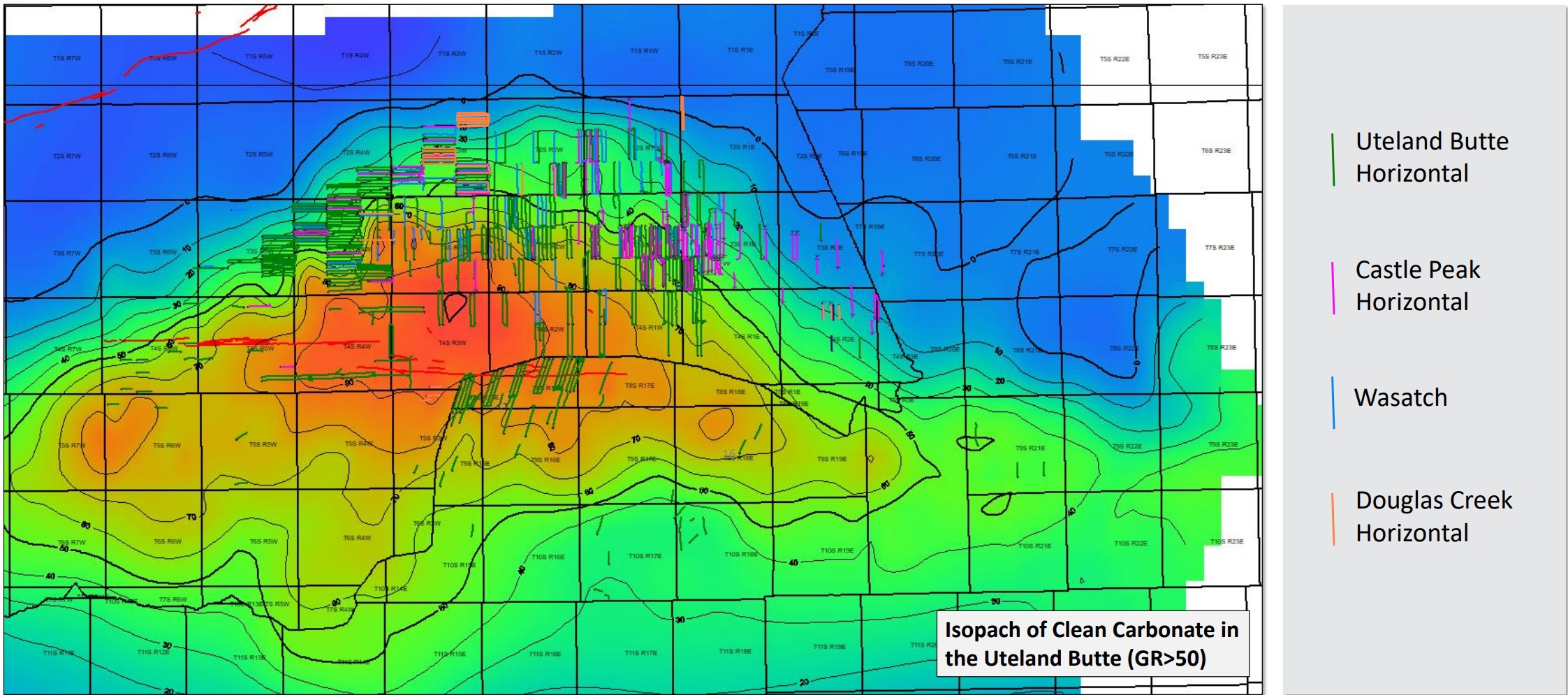

Horizontal development of the Uinta Basin oil window has focused on the Uteland Butte since the early- to mid-2010s.

But operators are increasingly landing laterals in other zones, like the Wasatch, Castle Peak and Douglas Creek benches. Some are drilling deeper into the Flagstaff and Mancos Shale zones.

“Acreage valuations have greatly increased but there are still a lot of zones to be tested,” said Riley Brinkerhoff, partner of Hive Partners, CEO of Duchesne River Resources and a longtime Uinta Basin professional.

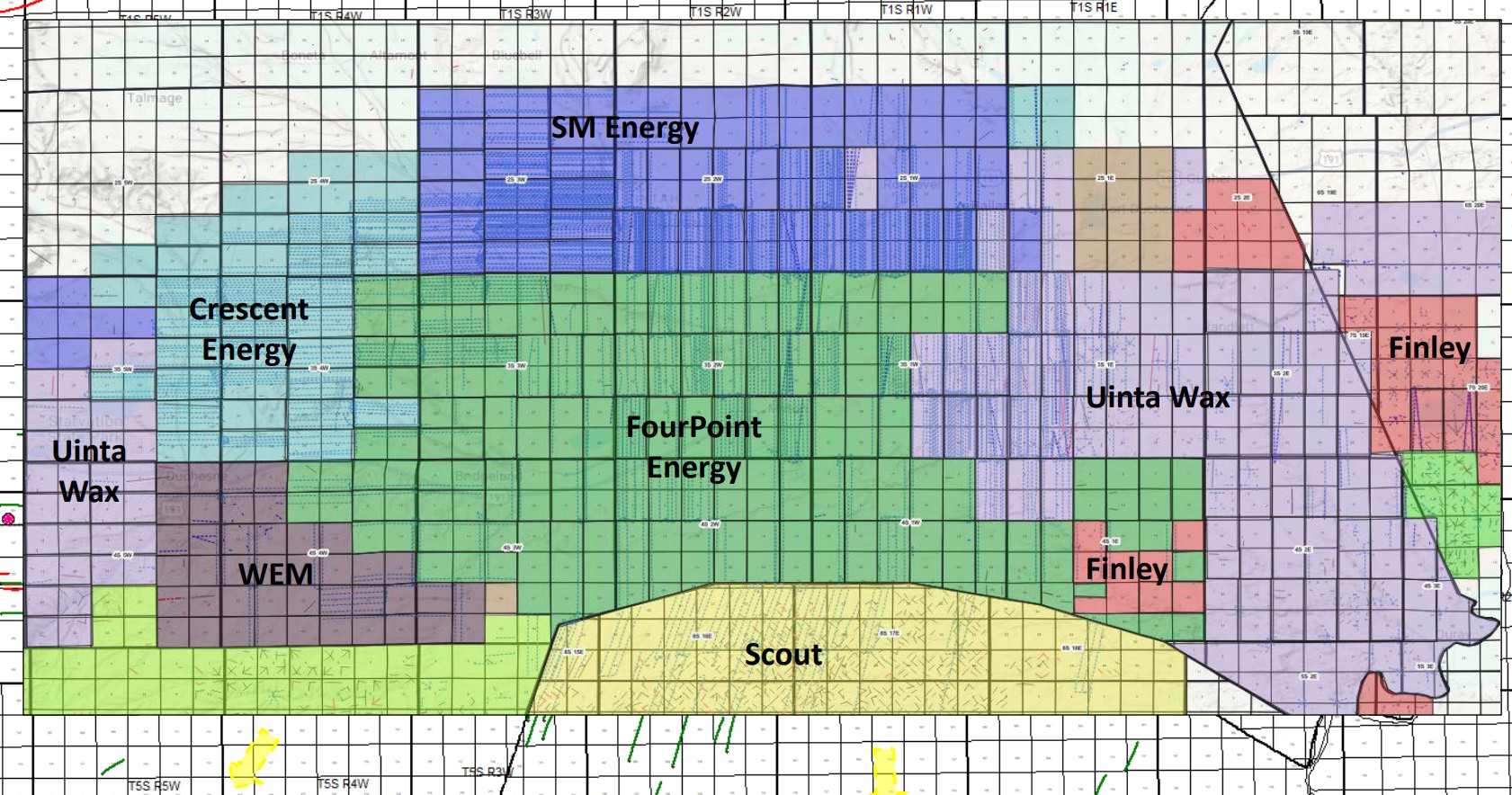

Uinta Basin M&A activity has increased significantly as operators search for affordable drilling locations outside the Permian Basin.

In October, SM Energy and non-operated partner Northern Oil and Gas (NOG) closed a $2.6 billion acquisition of XCL Resources, the top Uinta Basin oil producer.

In January, Ovintiv closed a $2 billion sale of its Uinta assets to private operator FourPoint Resources.

Drilling and testing of the Uinta’s stacked pay is expected to increase as operators get their hands on shiny new assets.

“We’re going to have to have a high level of activity to justify the [high] valuations,” Brinkerhoff said. “That’s just going to bring the number of rigs in the basin up significantly in the near future.”

RELATED

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

Uteland Butte: The workhorse

Historically, before around 2010, most of the Uinta’s oil production came from vertical wells in the Green River Formation, with some activity in the deeper Wasatch and Flagstaff formations, said Juan Nevarez, executive vice president for Uinta Basin E&P Scout Energy Partners.

Most recently, Uinta horizontal development has mostly focused on the Green River Formation—the Uteland Butte bench, in particular.

“Most of the production and growth in the horizontals is coming from the Uteland Butte,” Nevarez said during Hart Energy’s Uinta Basin Oil Output Unleashed virtual panel on Feb. 26.

Uteland Butte is Scout’s primary horizontal target across its acreage block, located toward the southern end of the Uinta Basin oil play.

Scout acquired the Greater Monument Butte Unit (GMBU) asset in the Uinta Basin in September 2022. The GMBU asset includes more than 85,000 net acres and production from around 1,000 existing vertical wells.

Uteland Butte is about 250 ft thick below Scout’s Uinta asset, he said. It sits at a depth of about 6,000 ft between the Green River and Wasatch.

The Uteland Butte target was left relatively untapped during GMBU’s legacy vertical development, making it an attractive horizontal target.

“It hasn’t been developed because it’s shallow,” Nevarez said. “You basically don’t have as much oil content, and you also have much [lower] temperatures.”

Pressures and temperatures tend to get higher to the north end of the basin, where operators SM Energy, Crescent Energy, FourPoint Resources and Uinta Wax Operating are active.

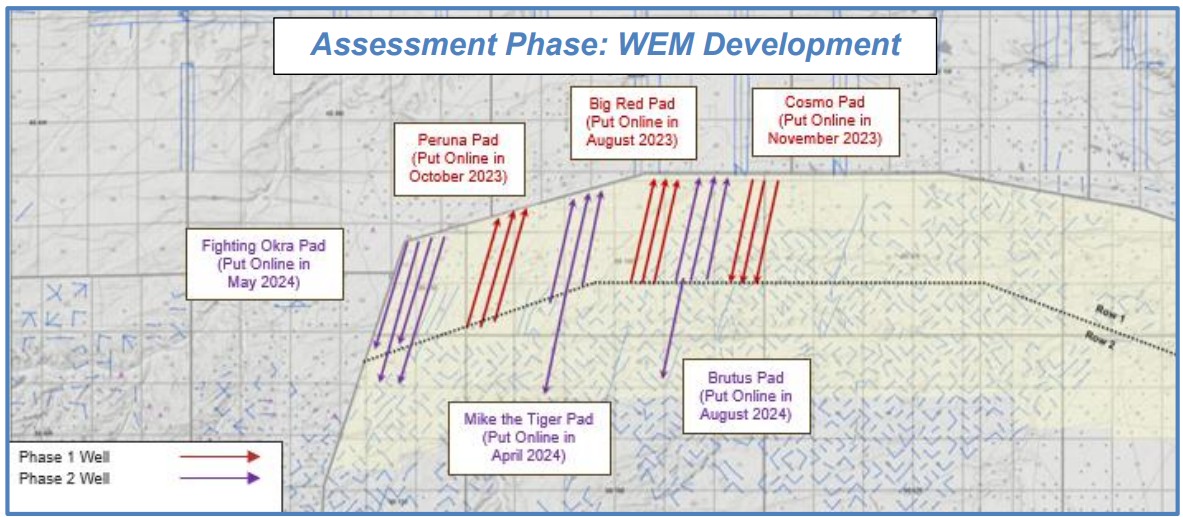

With horizontal drilling happening all around its acreage, Scout formed a joint venture with Utah operator Wasatch Energy Management (WEM) to drill 21 horizontals.

The 21 wells targeted Uteland Butte at a vertical depth of around 6,500 ft.

Most of the wells had 2-mile laterals, Nevarez said. But Scout and WEM drilled two 3-mile Uteland Butte wells toward the western end of its acreage.

“So far, we are seeing some additional production for the 3-mile laterals,” he said.

But going forward, Scout will “more than likely” stick with 2-mile Uteland Butte laterals.

RELATED

Scout Taps Trades, Farm-Outs, M&A for Uinta Basin Growth

‘Room to expand’

After completing the initial 21-well assessment phase with WEM, Scout aims to build on the Uinta momentum.

“We see a lot more room to expand,” Nevarez said.

Scout plans to pick up a rig this summer to begin development on the remaining farm-out area, which contains around 75 drilling locations.

The company thinks future development of its Uinta asset is significantly de-risked due to existing vertical production and the vast quantities of legacy well data at Scout’s disposal.

“They’ll be offsetting existing wells where we have plenty of information,” Nevarez said. “We have plenty of production performance.”

In addition to Uteland Butte, Scout also sees upside in the shallower Castle Peak bench and the underlying Wasatch formation.

RELATED

SM’s First 18 Uinta Wells Outproducing Industry-Wide Midland, South Texas Results

Testing and tinkering

With Uteland Butte fitting squarely within most Utah operators’ development plans, work continues to test the Uinta’s other oily zones.

“The entire Green River area is growing rapidly,” Brinkerhoff said.

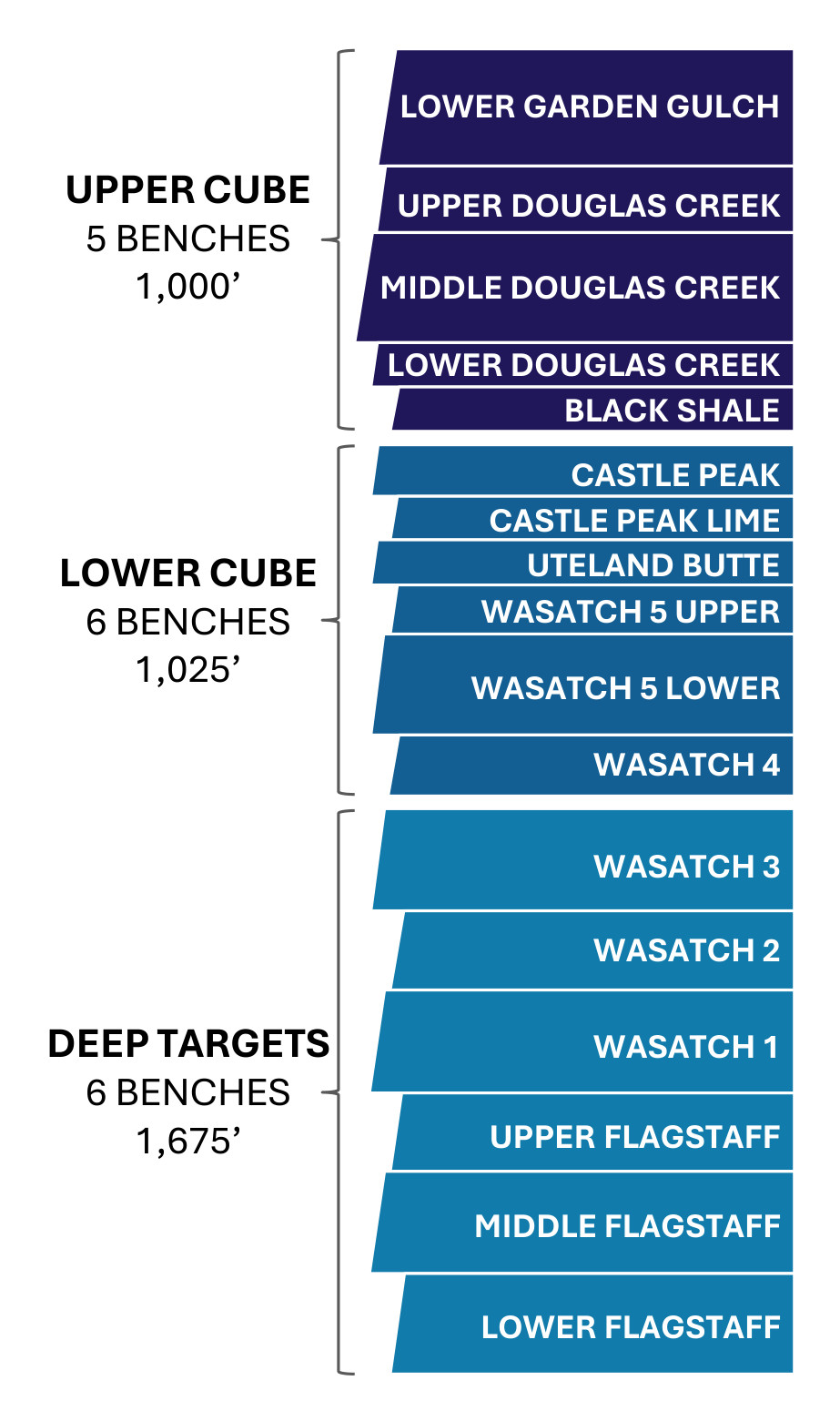

SM has tests spread across the Uinta’s “upper cube” and “lower cube,” the company reported in fourth-quarter earnings last month.

SM’s upper cube includes the lower Garden Gulch, three Douglas Creek benches and an underlying, unnamed black shale, ranging from 9,000 ft to 10,000 ft in depth.

Testing in the shallow Douglas Creek benches has expanded predominately to the north and northwest of the oil play by SM and Crescent.

The even shallower Garden Gulch intervals are “rapidly becoming economic” too, Brinkerhoff said.

The lower cube consists of the Castle Peak, the Castle Peak limestone, Uteland Butte, the Wasatch 5 upper and lower and the Wasatch 4 between 10,000 ft and 11,500 ft.

Uinta Wax Operating, led by Fort Worth-based operator Jim Finley, has led development in the Castle Peak benches to the east.

Uinta Wax has worked hard to get more of the Castle Peak lime play into the Uinta’s economic window, Brinkerhoff said.

“They either space it in the Castle Peak lime or in the overlying Long Point,” he said. “I would expect that more of what Uinta Wax has been doing to be tried in the other operators’ positions.”

Looking even deeper, SM landed a horizontal in the deep Flagstaff bench that came online recently, Brinkerhoff noted.

Experts anticipate operators will keep pushing the boundaries of the Uinta oil play further and further.

New plays are expected to crop up outside of the currently defined organic porosity window.

Significant volumes exist south of the better organic porosity window in dolomite, sandstone and limestone formations. The southern portion of Scout’s acreage has exposure to those zones, Brinkerhoff said.

Berry Corp., a longtime California producer, also holds acreage to the southern end of the Uinta oil play. Berry is planning to drill new horizontal wells on the asset, CEO Fernando Araujo told Hart Energy in December.

Fringier Uinta wells might be less productive than wells in the core, but “there’s still a lot of oil in place,” Brinkerhoff said.

RELATED

Anschutz Explores Utah Mancos Shale Near Red-Hot Uinta Basin

Recommended Reading

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

TGS to Conduct Ocean-Bottom Node Survey Offshore Trinidad

2025-04-07 - TGS has awarded a client a shallow water ocean bottom node contract offshore Trinidad.

E&Ps Posting Big Dean Wells at Midland’s Martin-Howard Border

2025-04-11 - Diamondback Energy, SM Energy and Occidental Petroleum are adding Dean laterals to multi-well developments south of the Dean play’s hotspot in southern Dawson County, according to Texas Railroad Commission data.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.