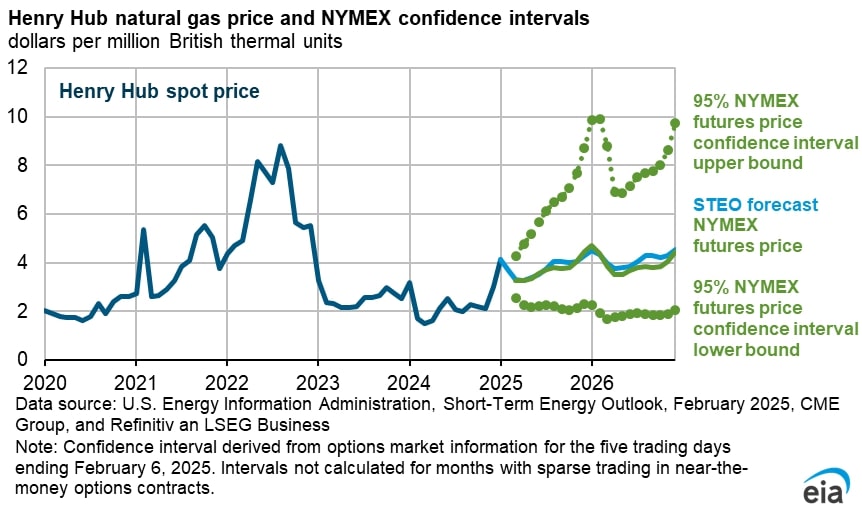

The Henry Hub spot price for natural gas averaged $4.13/MMBtu in January and reached a daily high of $9.86/MMBtu on Jan. 17. (Source: Shutterstock)

The U.S. Energy Information Administration (EIA) said Feb. 11 that the agency had seen enough bullish news to raise its 2025 forecast for the average natural spot gas by $0.65 to $3.80/MMBtu at the Henry Hub — an increase of nearly 21%.

The move follows a colder-than-average January, jumps in natural gas demand as two LNG liquefication projects ramp up production and the announcement of several AI developments.

The Henry Hub spot price for natural gas averaged $4.13/MMBtu in January and reached a daily high of $9.86/MMBtu on Jan. 17, immediately before an arctic cold snap blew through much of the U.S.

“Higher natural gas consumption led to above-average inventory withdrawals, and EIA now expects the benchmark Henry Hub spot price to average $3.80 per million British thermal units in 2025, about 20% higher than previously forecast,” the agency said on its website. The forecast for 2026 is $4.20/MMBtu.

The EIA forecast for other commodities, such as crude oil, remained largely unchanged.

Besides the cold weather, other factors affected the natural gas marketplace.

Venture Global’s Plaquemines LNG project in Louisiana received permission from the FERC in January to commission its seventh block. The plant began LNG production in November and has brought more trains online since. The FERC approved the start of Block 8 on Feb. 10. Each block has two trains and draws 150 MMcf/d of natural gas at capacity.

AI projects lining up

At the start of 2025, the predicted growth in natural gas demand to power AI data centers also started to take a solid form, thanks to three announcements.

“New natural gas demand is coming into focus to feed AI and data centers, and the Permian Basin looks to play a leading role,” said Ethan Warrick, the data center analyst for East Daley Analytics.

After taking office, President Donald Trump announced the $500 billion Stargate Project to build AI infrastructure across the U.S., starting with a center in Abilene, Texas. The site is located near natural gas pipelines stretching from the Permian Basin to networks near the Dallas-Fort Worth area.

“Stargate’s Abilene data center project is expected to scale from 1.2 GW [gigawatts] to 5 GW, making it one of the largest power-intensive AI clusters in the world,” Warrick said.

On Jan. 28, Chevron (CVX) revealed plans for a partnership with Engine No. 1 and GE Vernova to build up to 4 GW of gas-fired generation to power AI throughout the U.S.

While site locations have not been released, it’s likely that Chevron’s plans will help support the Stargate project, according to East Daley.

Warrick said Energy Transfer (ET) will most likely also provide natural gas to the StarGate project. Its most recently announced pipeline, the Hugh Brinson line, will follow a route from the Permian Basin through a corridor close to Abilene.

Energy Transfer also announced an AI-power partnership with CloudBurst Data Centers Inc. on Feb. 10. CloudBurst is building a data center development near San Marcos, Texas, located between Austin and San Antonio. ET is contracted to provide up to 450 MMBtu/d to the project.

Recommended Reading

Bloom Energy, Chart Industries Form CCUS Partnership for Low-Emissions NatGas

2025-02-14 - Bloom Energy and Chart Industries aim to use natural gas and fuel cells to generate power through their carbon capture partnership.

Gevo Completes $210MM Red Trail Assets Deal for Ethanol Plant

2025-02-05 - Gevo has renamed an ethanol production plant and CCS assets acquired from Red Trail Energy as “Net-Zero North.”

Chevron JV Plans 4-GW Project to Fulfill US Data Center Power Needs

2025-01-28 - Chevron U.S.A. Inc., Engine No. 1 and GE Vernova will develop the natural gas-fired power plants co-located with data centers amid President Trump’s push for AI dominance.

New Era Helium Signs NatGas Deal to Supply Permian Data Center Campus

2025-03-02 - The AI data center project will be developed on 200 acres of land the Texas Critical Data Centers joint venture will be acquiring. The project is expected to be online by the end of 2026.

Constellation Bets Big on NatGas in $16.4B Deal for Calpine

2025-01-10 - Constellation Energy will acquire Calpine Corp. in a $26.6 billion deal, including debt, that will give the pure-play nuclear company the largest natural gas power generation fleet.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.