Since 2020, a lot of Permian Basin operators have made public commitments to reduce emissions, with electrification of field equipment a top priority.

That year, the United Nations Race to Zero campaign launched, encouraging companies and countries to pledge to make their operations neutral by 2050.

BP executives made a net-zero pledge, saying the company would eliminate all greenhouse gas (GHG) emissions from its oil and gas production and reduce the methane intensity of operations by 50%. Exxon Mobil and Chevron followed suit with similar pledges.

Since then, many in the basin’s energy industry have faced the electric vehicle owner’s nightmare: What happens if there’s no place to plug in?

Electrification is a key factor in reducing GHG emissions. Operators sub out the diesel or gas-powered engines that typically drive operations, whether at a production site, a pump station or a processing facility.

Far West Texas and southern New Mexico are among the most sparsely populated areas on the continent, and the states’ utilities built the electric grid to handle a smaller load.

Drilling for and transporting oil, however, is an energy-intensive business. A large rig may need 3,000 hp to operate. Power demands for a single production field run into the hundreds of megawatts (MW). A crude pipeline pump station can consume 15 MW a day.

While overall power demand is ramping up nationwide, the Permian’s electric utilities have started to ramp up their supply as well—though catching up is expected to take years.

In September, the Permian Basin Petroleum Association (PBPA) discussed the issue at a board meeting. Access to electricity is the biggest concern for the oil and gas industry in the area, Stephen Robertson, PBPA executive vice president, said in a local television interview.

“If you look at West Texas, we are greatly underserved by the ERCOT [Electric Reliability Council of Texas] grid with electricity delivery and where that impacts greatly is not just prices for people buying electricity for homes and for businesses, but specifically out in the oil and gas industry,” Robertson said.

Light at the site

RPower is a Houston-based power company specializing in providing on-site electricity as a back-up, prime or bridge power while the operator waits for a utility plug-in.

The company has been busy in West Texas, said Ryan Rudnitzki, senior vice president of sales for energy. The electrification of the Permian kicked into high gear with the Inflation Reduction Act of 2022, which instituted taxes on methane emissions. Much of the equipment at energy sites—drilling, gas processing and pipeline pump stations—has been powered by fossil fuels.

“The kicker is, a lot of these locations are in very remote areas and it’s hard to get grid power to them, and that’s where we step up,” Rudnitzki said.

Many oil and gas operations in the Permian faced a two-year wait for a connection to an electrical grid, according to a 2022 report from the Texas Public Utilities Commission. Rudnitzki says some clients now face twice the wait.

A common construction timeline for a gas processing plant can be about 18 months.

“It’s very common to hear (gas processing) customers say that the power company or the transmission company is telling them it might be three to four years or longer, depending on the location and how much congestion there is in the area,” he said.

The shortage of grid plug-ins has affected some of the largest players in the basin. Enbridge, one of North America’s largest midstream companies, confirmed that the region has been affected by the delays.

“Given Enbridge’s extensive transportation pipeline and export assets, as well as continued interest in new growth across Texas and the U.S. Gulf Coast, we are always vigilant about the reliability and connectivity to the grid,” spokesman Michael Barnes told Oil and Gas Investor.

“To date, some of our projects and facilities have been impacted by power availability and increased timelines for requests to connect to the electrical grid in the Permian. We have also been impacted by reliability issues at certain locations in the basin,” he said.

The company said that electrical infrastructure is a crucial part of a midstream system and will be needed especially as the Permian continues to grow at a frenetic pace.

“As we assess all risks for new infrastructure, electrical power need is part of our long-term planning,” Barnes said. “We are working with our partners and providers on connectivity but recognize that demands on the grid continue to grow, and that current constraints could likely impact some timelines and projects.”

Operators have some of the same options as they’ve always had with on-site generation: traditionally diesel-powered generators.

RPower has taken a different approach and operates typically gas-powered, long-term generation facilities that can electrify a site on its own and provide backup in future power outages after the grid connection is available. The company can also sell power to deregulated grids like ERCOT, splitting revenues with the customer.

The Behemoth Behind the Meter

The decisions made at each power plant add up to a massive homemade power supply, said Dean Foreman, chief economist with the Texas Oil and Gas Association (TXOGA).

Permian Basin operators were self-producing more than twice the electricity than they were getting from the grid, according to an S&P Global study in 2022. Today, the ratio is about the same, with operators producing about 12 GW on their own. One GW is enough to power about 750,000 homes.

“A lot of these were temporary solutions, diesel generators behind the meter,” Foreman said. “They were meant to be put in place until ERCOT could expand both generation and transmission within the region, and months have become quarters, quarters have become years.”

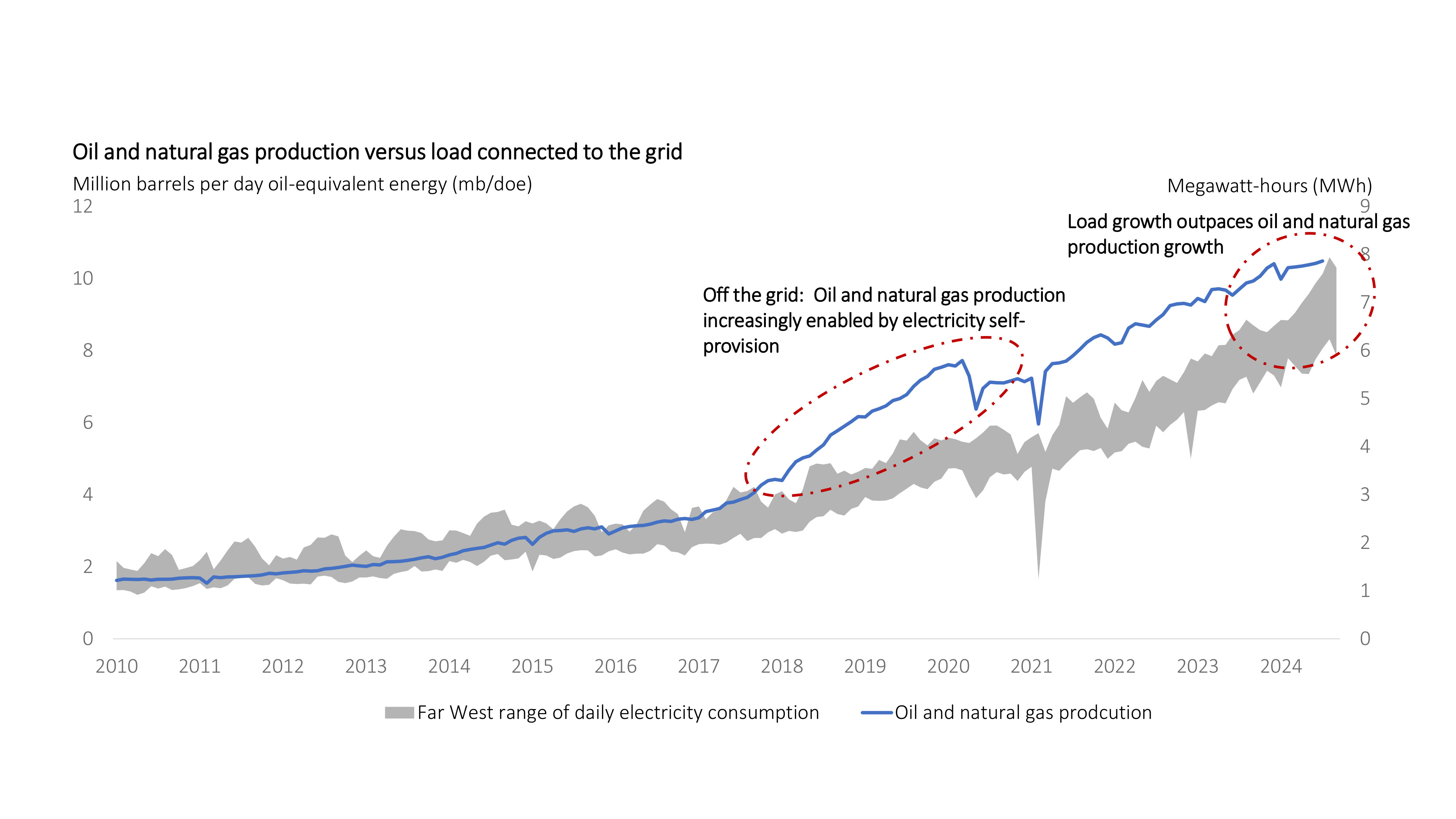

Historically, ERCOT has been able to keep pace with the demand for growth, Foreman said. ERCOT is responsible for the Texas part of the Permian; the Southwest Power Pool (SPP) oversees New Mexico. However, once the basin’s production jumped in 2018, utilities started falling behind.

Overall U.S. consumption of electricity had been flat since 2010. The Permian Basin, thanks to the rapid development of the shale plays, bucked the trend. By 2022, S&P Global noted an 8.3-GW gap between the electric load demand and available grid power.

Congress passed the Inflation Reduction Act the same year, making electrification a priority. As users sought to meet the new GHG targets, the demand on the grid immediately rose by 50%, S&P reported.

In August, ERCOT’s Far West Texas region, which includes the Permian, saw its peak load rise by 20% from 2023, hitting 7.94 GW. Total demand is estimated to be more than double the available load, Foreman said.

Higher voltage

The utilities in Texas and New Mexico are working overtime to catch up.

“We’re seeing now, in the last year, load growth really ramping up. …And it represents oil and gas getting rid of those temporary solutions and coming back to the grid as more is available,” Foreman said.

The basin has seen several electrification success stories. BPX Energy reported in early 2023 that a successful hook-up to the grid allowed the company to reduce flaring on BPX’s Permian assets from 16% to less than 1%. BPX is spending about $1.4 billion in infrastructure costs to update its production to almost complete electrification.

The energy industry and electric providers in New Mexico have both come forward with plans that will allow other companies to replicate BPX’s success.

In New Mexico, the SPP approved a $7.7 billion transmission plan to meet what the agency called “generational challenges” on its electrical grid. Among the list of projects is a 765-kilovolt power line connecting the southeast part of the state to available infrastructure in the Texas panhandle for “uniquely sharp load increases in New Mexico.”

Last year, the Texas legislature approved House Bill 5066 to study the issue. In September, the Public Utilities Commission (PUC) of Texas passed a regional electric reliability plan estimated to cost $13.8 billion over the next 13 years.

ERCOT will direct the building of new and upgraded transmission lines for the region to bring in power from other regions of the state. The buildout will attempt to meet the region’s demands up to 2038, when the PUC expects an additional 26 GW will be needed in the area.

While oil and gas are the primary drivers of the grid expansion, commissioners have also taken into account the growing needs of artificial intelligence data centers and cryptocurrency operations, according to the plan.

Todd Staples, TXOGA president, said in October that he hoped the public understood the immediate need to ship more electricity to the Permian.

“A lot of times, folks hear things that are speculative, and what might happen; an ‘if-you-build-it-they-will-come’ type of thing,” Staples said. In the case of the Permian oil and gas industry, however, “they’re here.”

Recommended Reading

Exxon CEO Darren Woods: Hydrogen Incentives ‘Critical’ for Now

2025-02-03 - Exxon Mobil CEO Darren Woods said the end goal for energy policy should be a system in which no fuel source remains dependent on government subsidies.

CEO: TotalEnergies to Expand US LNG Investment Over Next Decade

2025-02-06 - TotalEnergies' investments could include expansion projects at its Cameron LNG and Rio Grande LNG facilities on the Gulf of Mexico, CEO Patrick Pouyanne said.

Trump to Host Top US Oil Chief Executives as Trade Wars Loom

2025-03-19 - U.S. President Donald Trump will host top oil executives at the White House on March 19 as he charts plans to boost domestic energy production in the midst of falling crude prices and looming trade wars.

US Tariffs on Canada, Mexico Hit an Interconnected Crude System

2025-03-04 - Canadian producers and U.S. refiners are likely to continue at current business levels despite a brewing trade war, analysts say.

Belcher: Trump’s Policies Could Impact Global Energy Markets

2025-01-24 - At their worst, Trump’s new energy policies could restrict the movement of global commerce and at their best increase interest rates and costs.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.