Last year, Enbridge transported record volumes from Canada over its Mainline system, despite the completed expansion of the Trans Mountain Pipeline, which terminates on the country’s west coast. (Source: Shutterstock)

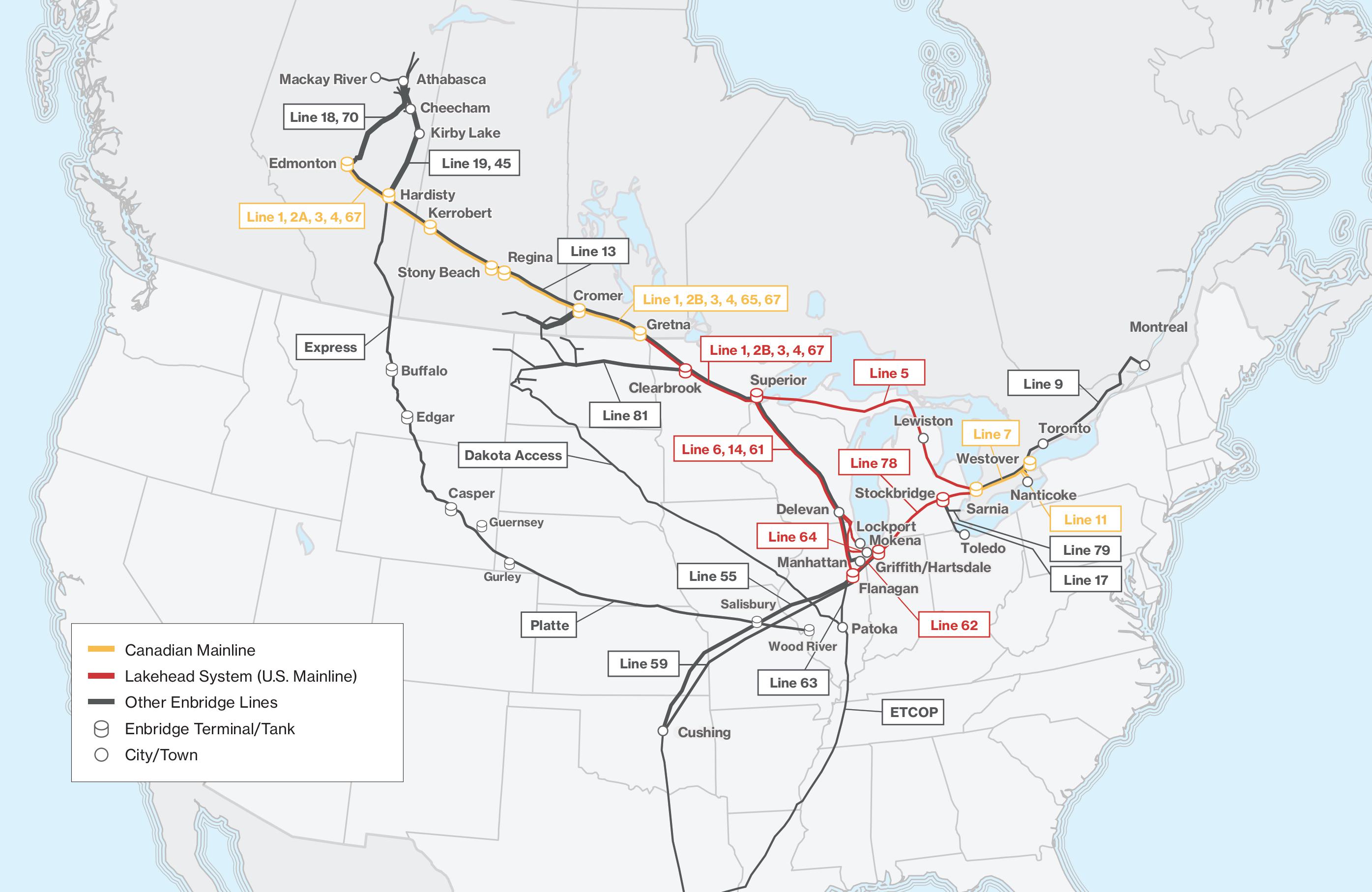

Canada’s Enbridge plans to spend $2 billion on upgrades to Mainline, the largest crude pipeline network in North America, the company said March 4—the same day the U.S. implemented a 10% tariff on oil and gas imported from its northern neighbor.

Regardless of the political climate, Enbridge CEO Greg Ebel said the investment in the Mainline and other company segments is needed to keep up with growing demand on the system.

“From a fundamentals perspective, you're really trying to take the emotions out of it and go to what is the economic reality and the interconnection between the two countries,” Ebel said. “And I think on any basis you would have to still say it is tight, it is difficult to break, and it is strong—current unpleasantries aside.”

Last year, the company transported record volumes from Canada over its Mainline system, despite the completed expansion of the Trans Mountain Pipeline, which terminates on the country’s west coast.

More than 3 MMbbl/d went through the Mainline network— about 75% of Canada’s total crude exports to America, according to the Canada Energy Regulator.

Further investment is needed as the Western Canadian Sedimentary Basin (WCSB) will require about 1 MMbbl/d of additional egress by 2035, and the Mainline will be fully utilized starting in 2026, according to Enbridge estimates.

The company expects to spend $2 billion on operational efficiencies and system reliability, with the improvements coming online by 2028. Enbridge predicted a return on equity between 11% and 14.5%.

“People underestimate the utilization of the main line,” Ebel said. “Demand continues to go up, production continues to go up, and therefore the need for energy infrastructure goes up.”

President Donald Trump implemented a 10% tariff on Canadian oil and gas, while charging all other Canadian imports a 25% fee starting at midnight, March 4. A 25% fee was also levied against Mexico, with no exception for oil and gas.

RELATED

US Tariffs on Canada, Mexico Hit an Interconnected Crude System

Trump says he implemented the tariffs to force the countries to do more to curb illegal immigration and drug trafficking, though he has previously defended tariffs as an economic good.

Canadian Prime Minister Justin Trudeau said the tariffs were a “dumb” thing to do and implemented a 25% tariff on U.S. goods the same day.

Enbridge has significant investments throughout the U.S., including gas utility companies and the Ingleside Energy Center near Corpus Christi, Texas, which exported more than 1.2 MMbbl/d of crude in the second half of 2024. The company announced plans to expand the center in 2024.

In February, Enbridge also announced plans for $100 million capacity expansion project for a natural gas line that feeds Duke Energy’s Roxboro plant.

Ebel said the tariffs would most likely not affect Enbridge in the short term, as the crude produced in Canada has few other export and refining options and the company’s lines would therefore continue running at the same volumes.

Recommended Reading

E&P Highlights: March 10, 2025

2025-03-10 - Here’s a roundup of the latest E&P headlines, from a new discovery by Equinor to several new technology announcements.

Petrobras to Deploy Baker Hughes Completion Technology Offshore Brazil

2025-03-20 - Baker Hughes will be combining its completions technologies with conventional upper and lower completions solutions at Petrobras’ offshore developments.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Baker Hughes: US Drillers Add Oil, Gas Rigs for Third Week in a Row

2025-02-14 - U.S. energy firms added oil and natural gas rigs for a third week in a row for the first time since December 2023.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.