Pine Run Gathering LLC, a joint venture between Energy Spectrum Partners and UGI Corp., purchased three gathering systems in Pennsylvania from Superior Midstream Appalachian LLC. (Source: Superior Midstream)

Pine Run Gathering LLC has closed a transaction to acquire Superior Midstream Appalachian LLC, which owns and operates three gathering systems in Pennsylvania—Pittsburgh Mills, Snow Shoe and Brookfield.

The deal was valued at $120 million, subject to customary adjustments.

Buyer Pine Run is a joint venture (JV) owned by a subsidiary of Stonehenge Energy Resources III LLC— a portfolio company of Energy Spectrum Partners VIII LP—and UGI Corp., a wholly owned subsidiary, UGI Energy Services LLC (UGIES). The deal was reported closed on Jan. 27.

The Pittsburgh Mills system is connected to UGIES’ Big Pine gathering system. All three have long-term acreage dedications and total combined daily flow of approximately 190 MMcf/d.

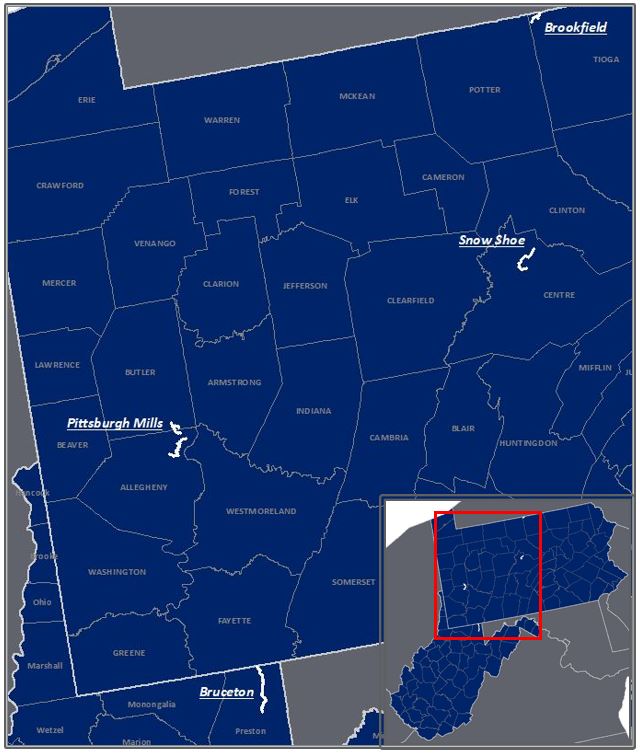

According to Superior Midstream's website, the Pennsylvania gathering systems’ assets include:

- The Pittsburgh Mills Gathering System in Allegheny and Butler counties with compression, dehydration and delivery capacity through interconnects with Dominion TL-469 and Columbia’s Big Pine System;

- The Snow Shoe Gathering System in Centre County, with a compressor site, dehydration, an interconnect to Dominion PL-1 and taps on TETCO; and

- The Brookfield Gathering System in Tioga County, with delivery to National Fuels Z20S through a third party.

Superior Midstream's Appalachian Basin gathering and processing systems in Pennsylvania. (Source: Superior Midstream)

The transaction was wholly financed by debt at Pine Run Gathering. Energy Spectrum’s Stonehenge owns a 51% interest and UGIES 49%. The acquisition is expected to be immediately accretive to the JV’s earnings, UGI said.

“Today marks an exciting day for us and our partners at UGI Energy Services,” said Patrick Redalen, president and CEO of Stonehenge. “This acquisition underscores our optimism about the future of our industry and the strength of our partnerships with UGI and Energy Spectrum.”

UGI President and CEO Bob Flexon said the assets are highly complementary to its existing midstream footprint and will extend “our reach from producers through to end-use customers, demonstrating our commitment to explore additional growth opportunities within the Midstream business.”

Baker Botts LLP and Vinson & Elkins LLP served as legal counsel to Pine Run Gathering. BOK Financial served as the administrative agent on the transaction.

Cadence Bank and Citizens Bank served as joint lead arrangers.

Recommended Reading

Camino Reportedly Seeking $2B Sale as Midcon M&A Heats Up

2025-01-30 - Oklahoma producer Camino Natural Resources—one of the Midcontinent’s largest private E&Ps—is reportedly exploring a sale in the range of $2 billion.

Elk Range Acquires Permian, Eagle Ford Minerals and Royalties

2025-01-29 - Elk Range Royalties is purchasing the mineral and royalty interests of Newton Financial Corp., Concord Oil Co. and Mission Oil Co.

After Big, Oily M&A Year, Upstream E&Ps, Majors May Chase Gas Deals

2025-01-29 - Upstream M&A hit a high of $105 billion in 2024 even as deal values declined in the fourth quarter with just $9.6 billion in announced transactions.

Chevron JV Plans 4-GW Project to Fulfill US Data Center Power Needs

2025-01-28 - Chevron U.S.A. Inc., Engine No. 1 and GE Vernova will develop the natural gas-fired power plants co-located with data centers amid President Trump’s push for AI dominance.

Oxy CEO Hollub Sees More Consolidation Coming in Permian, Globally

2024-11-21 - Occidental Petroleum CEO Vicki Hollub names emissions and water management as top challenges for Permian operators and an incentive for growth.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.