Natron Energy plans to build a $1.4 billion sodium-ion battery manufacturing gigafactory in North Carolina, a move that could boost its current production capacity by 40 times, the company said.

Located in Edgecombe County on a 437-acre site, the facility is designed to produce 24 gigawatts (GW) of the company’s sodium-ion batteries annually at full capacity. The 1.2-million-sq-ft facility is expected to be the first of its kind in the U.S. to produce sodium-ion batteries at the giga-scale, according to Natron.

“Once operational, the Edgecombe County facility will accelerate Natron’s growth trajectory, allowing us to capitalize on the growing demand for efficient, safe, and reliable sodium-ion battery energy storage,” said Wendell Brooks, co-CEO for Natron Energy.

Plans for the new sodium-ion battery manufacturing facility are taking shape as demand rises for batteries for electric vehicles and energy storage systems. It also comes as the U.S. encourages companies to boost domestic manufacturing capacity to decrease reliance on foreign countries, mainly China.

While lithium-ion batteries dominate the market, Natron’s batteries do not rely on critical materials such as lithium. Its main ingredient, sodium, is abundant, cheaper and safer, experts say. What sets Natron’s sodium-ion batteries apart from others is Prussian blue—a compound dating back to the 18th century.

The compound—the same blue pigment used in paint, blue jeans and as an antidote for heavy-metal poisoning—enables electrodes to store the sodium ions in a unique structure that results in a faster charge, faster discharge and a longer cycle life, according to Natron.

Natron said its batteries are the only UL-listed sodium-ion batteries on the market today. Earlier this year, the company began commercial-scale operations at its sodium-ion battery manufacturing facility in Holland, Michigan. The facility has an annual production capacity of 600 megawatts (MW).

The company, which has Chevron, Liberty Energy, Nabors and United among its backers, also said the project was approved by North Carolina for a 12-year grant that authorizes up to about $21.7 million in potential reimbursement for the project.

“North Carolina’s momentum in the clean energy economy reaches epic proportions with today’s news,” Gov. Roy Cooper said Aug. 15. “Natron Energy’s choice to build this large and unique battery factory in our state will help the nation reduce greenhouse gas emissions while creating good jobs in Rocky Mount, Nash and Edgecombe counties, and many other places in eastern North Carolina.”

Additional funding support is expected from a state grant program designed to prepare or upgrade qualifying industrial sites.

Here’s a look at other renewable energy news this week.

Bioenergy

Waste Management District Selects Ameresco to Build RNG Plant in Utah

Ameresco Inc. on Aug. 14 said it was selected by Wasatch Integrated Waste Management District to capture methane-filled landfill gas in Utah and convert it into renewable natural gas (RNG).

The company will design, build, own and operate an RNG plant at the Davis Landfill in Layton, Utah. The Davis RNG facility, which will be Ameresco’s second with Wasatch, is expected to replace the use of more than 8 million BTUs annually of fossil fuels when the facility is completed, Ameresco said.

“By transforming landfill gas into renewable natural gas (RNG), we’re taking a significant step toward creating a cleaner planet,” said Michael Bakas, executive vice president of Ameresco. “This approach makes sense—why drill for natural gas that is sequestered deep in the earth when we can harness what’s already in our atmosphere?”

Nathan Rich, executive director of the Wasatch Integrated Waste Management District, called the project a win-win.

“Turning an environmental liability into a renewable energy source is a great way to meet the mission of the district,” Rich said. “After commissioning the first landfill gas to energy project in Utah almost 20 years ago, we are looking forward to updating the project to a modern RNG plant to supply the current energy market.”

RELATED

Cashing in on Trash: RNG Developers Advance Projects, Some See Delays

Energy storage

Sage Selects Texas Site for Geopressured Geothermal System

Houston-based Sage Geosystems plans to locate its 3-MW geopressured geothermal system energy storage facility in Christine, Texas, having reached a land use agreement with San Miguel Electric Cooperative Inc. (SMECI).

The company said it is targeting 6- to-10-hour storage durations. The energy storage system will be paired with renewable energy to provide baseload and dispatchable power to the Electric Reliability Council of Texas (ERCOT) grid. Sage said the first-of-its-kind project, which is expected to launch later in 2024, will use Sage’s proprietary technology called EarthStore to store energy.

“Once operational, our EarthStore facility in Christine will be the first geothermal energy storage system to store potential energy deep in the earth and supply electrons to a power grid,” said Sage Geosystems CEO Cindy Taff. “Geothermal energy storage is a viable solution for long-duration storage and an alternative for short-duration lithium-ion batteries. Electric utilities and co-ops like SMECI will be able to use our technology to complement wind and solar and stabilize the grid.”

The site will be located near SMECI’s lignite coal power plant in Christine, which is south of San Antonio, Texas. Sage said it will operate as a merchant, buying and selling electricity to ERCOT.

RELATED

Ormat Signs Tolling Agreements for Two Energy Storage Facilities in Texas

Solar

Meta Taps RWE for Solar Power in Texas, Illinois

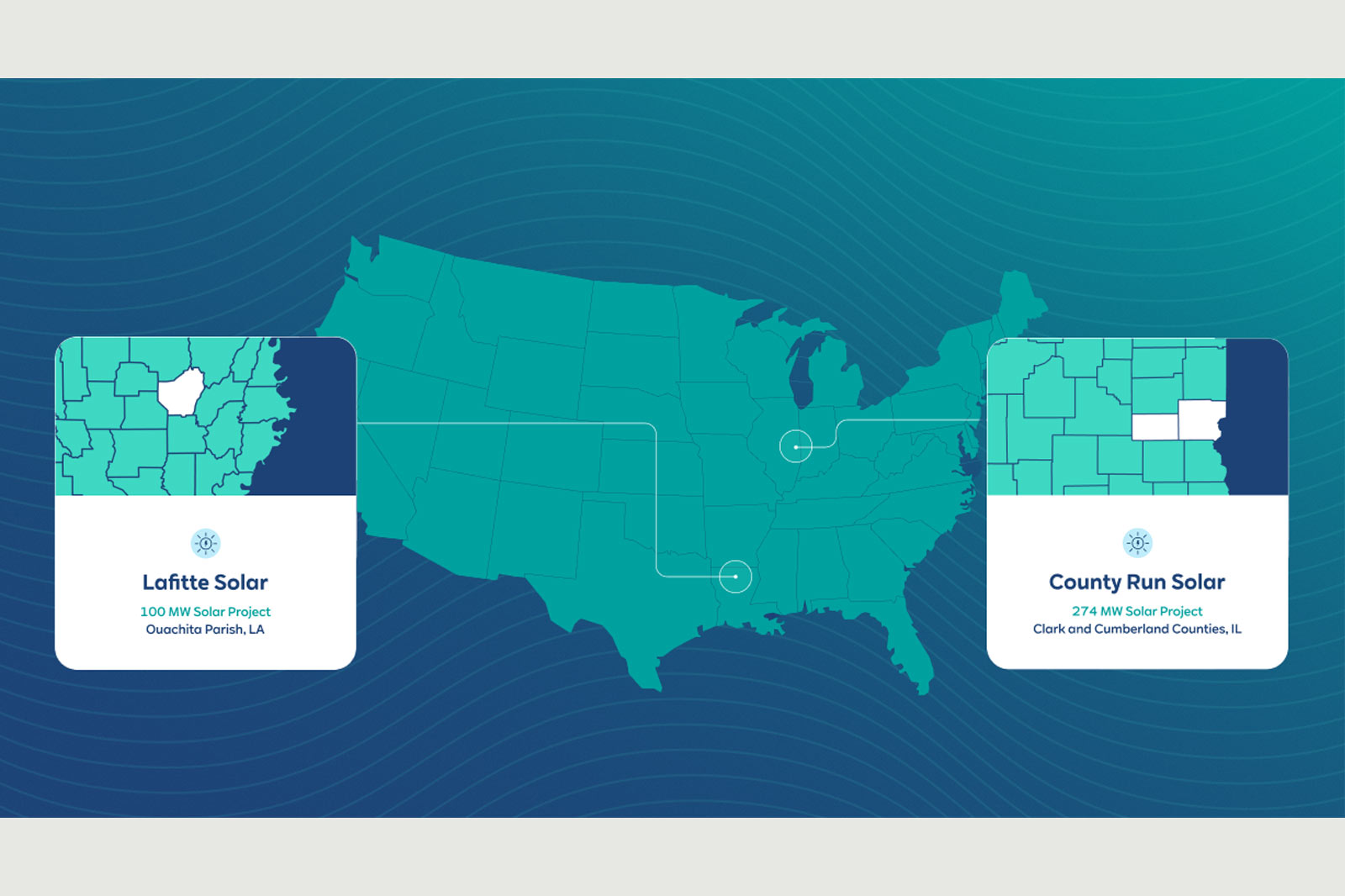

Renewable energy company RWE said on Aug. 14 it signed two long-term power purchase agreements with Meta, the tech company formerly known as Facebook, for power produced at two solar farms.

The agreements are electricity power from RWE’s 274-MW County Run Solar project in Illinois and its 100-MW Lafitte Solar project in Louisiana. Construction is underway at both sites, and commissioning at both sites is scheduled for late 2025.

“Partnering with renewable energy providers like RWE to bring new solar energy projects online is an important part of our approach to energy procurement,” said Urvi Parekh, head of renewable energy at Meta. “We are excited to scale our renewable energy contracts, and this collaboration is an important demonstration of those efforts and our commitment to match 100% of the electricity use of our data centers and offices with renewable energy.”

Meta, which is one of the largest corporate buyers of renewable energy in the U.S., is aiming for net-zero emissions across its value chain by 2030.

US Allows More Solar Cell Imports to Avoid Trump-era Tariffs

U.S. President Joe Biden on Aug. 12 more than doubled the volume of solar cells that are allowed to be imported tariff-free to help domestic panel producers relying on components made overseas.

According to a White House proclamation released late Aug. 12, the so-called tariff-rate quota on solar cells will increase to 12.5 GW from 5 GW. The tariff currently is set at 14.25%.

The tariffs were first imposed by former President Donald Trump in 2018 under section 201 of the 1974 trade act to protect the small U.S. solar manufacturing sector against competition from low-priced imports made mainly in Asia.

The Biden administration had said in May it would consider raising the quota if imports approached the 5 GW level.

Biden has pledged to revitalize American manufacturing jobs in part by producing clean energy equipment to support his climate change agenda.

Wind

BOEM Finalizes Environmental Review for Wind Leases Off Oregon

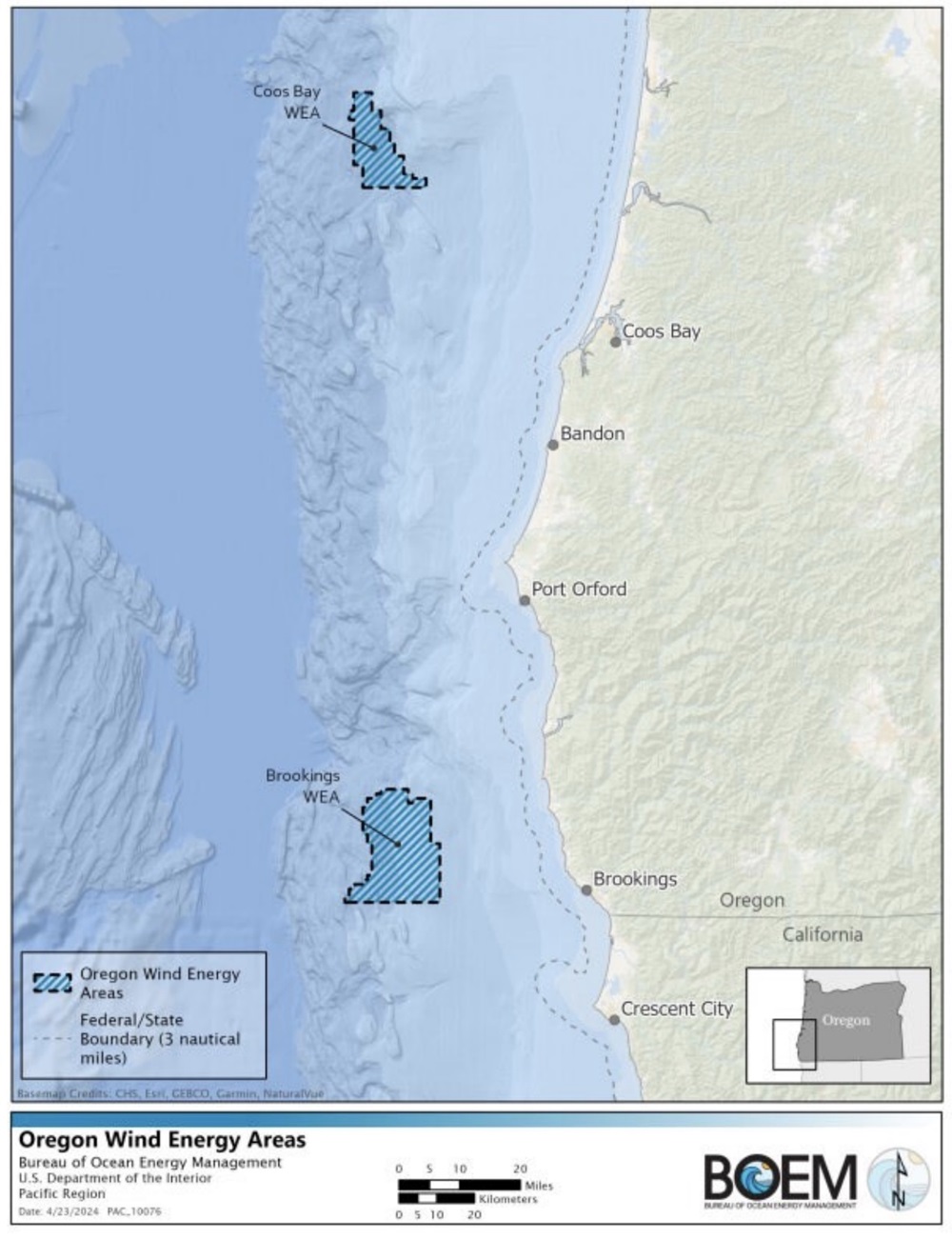

The U.S. Bureau of Ocean Energy Management said on Aug. 13 has it finalized an environmental review of wind leases offshore Oregon, finding no significant impacts to people or the environment.

The review followed a proposal announced in April for offshore wind auctions off the coasts of Oregon and in the Gulf of Maine. The proposed lease sale in Oregon includes two lease areas totaling nearly 195,000 acres. The two areas include the 61,203-acre Coos Bay area and the 133,792-acre Brookings area. Combined, they could produce enough electricity to power more than 1 million homes, according to BOEM.

“BOEM relies on the best available science and information for our decision-making regarding offshore wind activities,” said BOEM Director Elizabeth Klein. “Working with tribes, government partners, ocean users and the public, we gathered a wealth of data, diverse perspectives and valuable insights that shaped our environmental analysis. We remain committed to continuing this close coordination to ensure potential offshore wind energy leasing and any future development in Oregon is done in a way that avoids, reduces or mitigates potential impacts to ocean users and the marine environment.”

The step moves the U.S. closer to its ambitions to deploy 15 GW of floating wind offshore capacity. Unlike conventional fixed-bottom wind turbines attached to the seabed in shallower water, floating turbines are attached to floating structures to harness power in deeper waters such as offshore the West Coast. Deepwater off Oregon’s coast is suitable for floating wind offshore turbines, experts say.

Dominion Energy Marks Monopile Milestone

Dominion Energy installed the 50th monopile foundation for the 2.6-GW Coastal Virginia Offshore Wind project offshore Virginia, the company said Aug. 12.

The company plans to install between 70 and 100 monopile foundations for the project, which is the largest offshore wind project under construction in the U.S. The monopile foundations, manufactured by EEW SPC, are single vertical, steel cylinders installed into the seafloor to support the wind turbine generators.

Expected to be complete in late 2026, the project will consist of 176 turbines capable of generating enough renewable energy to power up to 660,000 homes.

“Our on-time, on-budget Coastal Virginia Offshore Wind project proves that regulated offshore wind works in the United States,” said Dominion Energy CEO Robert M. Blue. ‘Offshore wind is critical to our all-of-the-above approach to provide our customers with affordable, reliable and increasingly clean energy.”

Monopile installation will continue through fall 2024. Installation will resume in May 2025, the company said.

Vineyard Wind Allowed to Resume Limited Offshore Turbine Installation

Vineyard Wind and GE Vernova said on Aug. 13 that U.S. safety officials have allowed them to resume limited construction on an offshore wind farm off the Massachusetts coast where a turbine blade shattered last month.

Vineyard Wind, owned by Avangrid and Denmark’s Copenhagen Infrastructure Partners, was ordered to stop power production and construction after a blade broke apart on July 13 and sent pieces of fiberglass into the water that washed up on nearby beaches.

In a joint statement, the project developer and turbine maker said they are now able to install towers and nacelles, the portion of a turbine that houses generating components, according to a new order from the U.S. Bureau of Safety and Environmental Enforcement (BSEE).

The incident has been a blow to both Vineyard Wind, the first major U.S. offshore wind farm, and the nation’s budding offshore wind industry.

The project, located 15 miles (24 km) south of the Massachusetts island of Nantucket, is still under construction with only about a third of its planned turbines installed.

Upon completion, Vineyard Wind is projected to produce 806 MW from 62 turbines, enough electricity to power around 400,000 homes and businesses in Massachusetts.

The updated suspension order still does not allow further blade installation or power production at this time, the companies said.

A BSEE spokesperson confirmed the updated order and said the agency was still investigating the blade failure.

CK Infrastructure-led Consortium to Buy UK Onshore Wind Portfolio for $450MM

A CK Infrastructure-led consortium entered into an agreement to acquire a portfolio of onshore wind farms in the U.K. from Aviva Investors for about £350 million ($450 million), the firm said in a statement on Aug. 14.

The portfolio comprises of 32 wind farms located in England, Scotland and Wales, totaling 175 MW in installed capacity and 137 MW in net attributable capacity, according to the statement from CK Infrastructure Holdings Ltd.

The transaction is expected to be complete in late September, it added.

RELATED

Winded: Ørsted Books More Impairments, Delays US Offshore Project

Equinor, Dominion Place Winning Bids in US Offshore Wind Sale

Reuters contributed to this report.

Recommended Reading

E&P Highlights: April 7, 2025

2025-04-07 - Here’s a roundup of the latest E&P headlines, from BP’s startup of gas production in Trinidad and Tobago to a report on methane intensity in the Permian Basin.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

TGS to Conduct Ocean-Bottom Node Survey Offshore Trinidad

2025-04-07 - TGS has awarded a client a shallow water ocean bottom node contract offshore Trinidad.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

VoltaGrid to Supply Vantage Data Centers with 1 GW of Powergen Capacity

2025-02-12 - Vantage Data Centers has tapped VoltaGrid for 1 gigawatt of power generation capacity across its North American hyperscale data center portfolio.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.